Does Anyone Care about the U.S. Jobs Data?

Stock-Markets / Stock Markets 2010 Nov 05, 2010 - 03:52 AM GMTBy: Trader_Mark

I've already figured out tomorrow's analysis on the monthly jobs data

I've already figured out tomorrow's analysis on the monthly jobs data

If it's worst than expected, we have QE2

If it's better than expected, we have QE2

(again I am counting on better than expected because ADP report said 43,000 and birth death model says small business is booming in America so we could clear 100K easily - but it is all moot since it doesn't really matter anymore. Data is old fashioned)

Hence no need to wake up before 9:29 AM to analyze the news. This morning weekly claims jumped some 20,000+, back over 450K but that was just a bothersome footnote.

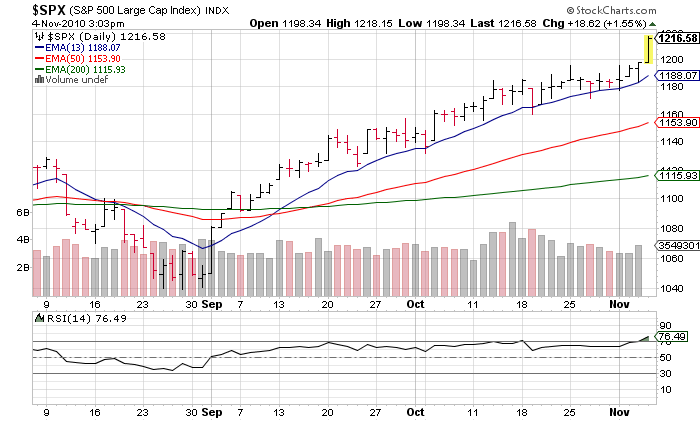

Turning to the S&P 500 the Relative Strength index has burst into major overbought for the first time during this melt up from the August lows. Using the 'rubber band theory', in which the market generally stalls when the index is 2.5%ish away from the 13 day moving average [Oct 13, 2010: Pulling the Rubber Band] we are also right at the full extension level.... 2.5% above the 13 day. (the range has been 2 to 3%) Hence if we gap up tomorrow it might be an excellent time to put some short position on (that can only last for a few hours due to Monday morning gap up)

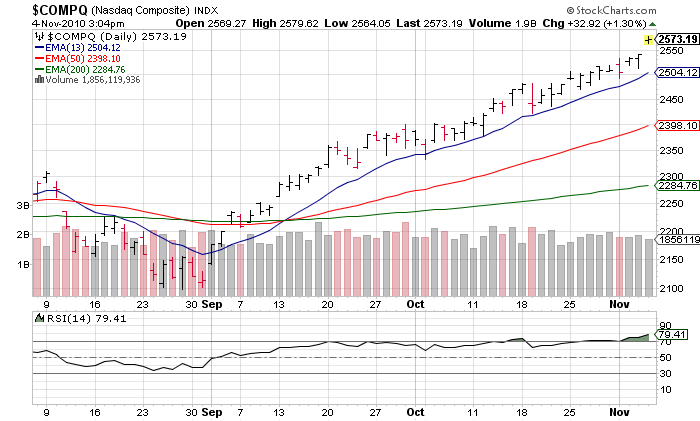

NASDAQ has already been here (again only one >-1% loss on that one in approaching 2.5 months)

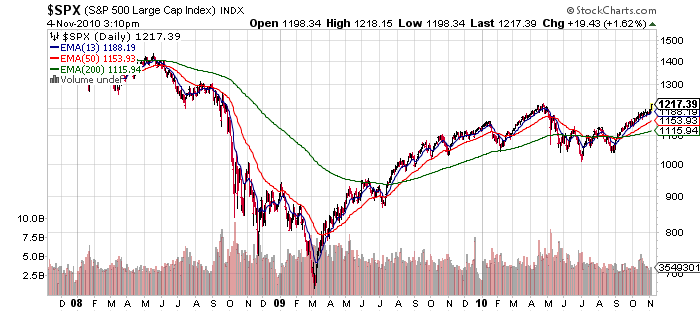

Pulling out farther, April highs in the S&P 500 are 1219.80 (April 26th). We always seem to have trouble breaking key resistance levels during market hours, so that's why we have premarket. Tomorrow's job report looks like a great way to ramp up futures in light trading to get over that level if we can't do it in this last hour. Then what? (NASDAQ already cleared yearly highs today)

3 year chart

Best I can tell something in the S&P 1250-1300 area aka 2 more gap ups aka next week. Gap up tomorrow on whatever the news is on employment. Then gap up Monday because it's a Monday. Then we can start gapping on POMO days... 1300 easy. Then 1500 in the next 6 weeks. All time highs by Valentine's Day 2011. POMO/QE2. All day, every (other) day.

I am contemplating taking some profits today, and then buying back on a move over S&P 1220, but that move should come in 16 hours right? Hmmmm

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2010 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.