Investors Finally Fear the Inflation Precipice

Stock-Markets / Inflation Feb 10, 2011 - 10:28 AM GMTBy: Robert_Murphy

Well it's about time. The headline on Monday's CNBC article announces: "Investors Starting to Believe That Inflation Threat is Real."

Well it's about time. The headline on Monday's CNBC article announces: "Investors Starting to Believe That Inflation Threat is Real."

For some time, I have been a proud member of the fuddy duddies who have been predicting the return of serious stagflation. Thus far, our prognostications have clearly been half-right — the "real economy" is indeed caught in a terrible rut, far worse than most of the Keynesian economists recognized even in late 2008.

However, on the (price) inflation front, things are not as clear-cut. Although asset prices and producer prices have surged in response to Bernanke's monetary pumping, retail consumer prices (at least as officially reported by the Bureau of Labor Statistics) have not been rising at alarming rates.

However, on the (price) inflation front, things are not as clear-cut. Although asset prices and producer prices have surged in response to Bernanke's monetary pumping, retail consumer prices (at least as officially reported by the Bureau of Labor Statistics) have not been rising at alarming rates.

I am not the first economist to explain this apparent anomaly by reference to Wile E. Coyote: The serious inflation won't hit until everyone thinks it is going to hit. And although the "fundamentals" of serious price inflation have been in place since late 2008, we are seeing more and more signs that Bernanke's dam of obfuscation is starting to crack.

A Simple Picture

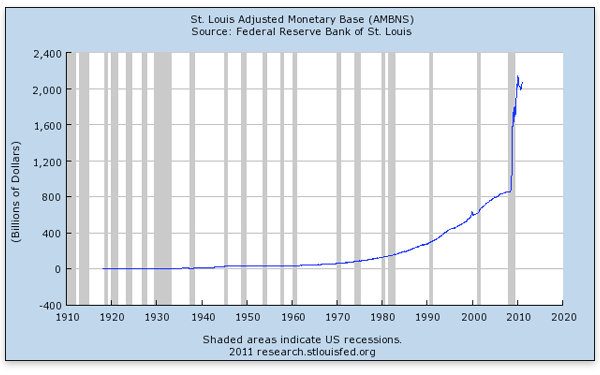

Simplistic as it may seem, I still cannot shake the feeling that the below chart is all we really need to know that eventually, we will experience large price hikes:

Yes, yes, there are all sorts of sophisticated arguments for why there's nothing to see here, just keep moving along, the dollar will be fine. In particular, there are arguments about the demand for holding "base" money totally offsetting Bernanke's injections, and the huge increase in excess reserves means that the new money isn't "leaking out" into the broader economy.

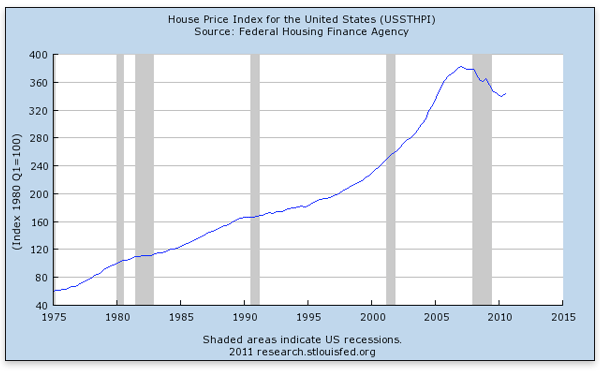

However, when the serious price inflation comes — as I still believe it will — I think we will all look back at the above chart and be shocked that people were worried about deflation in 2008-2010. And there is precedent for this sort of thing; remember that in 2005 and 2006 plenty of really smart people (including Ben Bernanke) denied that there was a housing bubble[1]:

In Bernanke I Don't Trust

It is true that Bernanke could reverse course before things are too late, as far as the purchasing power of the dollar is concerned. But this would entail devastating pain to the banking sector, since the Fed would have to reverse the policies that bailed out the overleveraged titans in the first place. If Bernanke has to choose between saving rich bankers or the dollar, I am confident he will choose the former.

When Bernanke made his infamous appearance on 60 Minutes, most analysts understandably focused on his absurd claim that he wasn't printing money. But the thing that most alarmed me was this exchange (starting at about 7:20 in this video):

BERNANKE: There really is no problem with raising rates, tightening monetary policy, slowing the economy, reducing inflation at the appropriate time. …

Q: You have what degree of confidence in your ability to control this?

BERNANKE: A hundred percent.

Now that should be terrifying. Realistically, Bernanke shouldn't have 100 percent confidence that he can control his toaster. I mean, he might turn the dial up too high, or someone might spill water on it. It could happen.

By the same token, there are all sorts of scenarios where the natural "unwinding" of the Fed's extraordinary policies won't work as planned. In particular, if even official CPI inflation starts creeping above 4 and 5 percent on an annual basis, while unemployment remains above (say) 8 percent, then it will become apparent that Bernanke's "exit strategy" leads into a brick wall.

"Well, If the Fed Started Monetizing the Debt, Then I'd Worry About Inflation …"

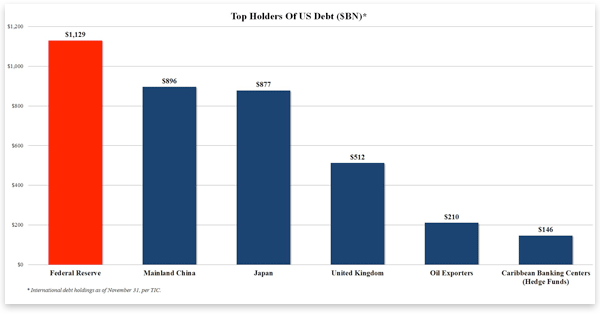

One of the more absurd stances rejecting the inflationist warnings comes from people who think Federal Reserve policy is completely divorced from the Treasury's fiscal position. Such naïve analysts think that Bernanke's decision to soak up more than one trillion in government debt had nothing to do with the massive deficits that the government has been and will continue to run.

Those pooh-poohing our current situation will concede that interwar Germany or modern Zimbabwe got into trouble all right, but those were situations where the central bank "monetized the debt." This supposedly stands in sharp contrast to the scientific monetary policies of the "independent" Federal Reserve.

To put these claims in context, note that in the 2nd quarter of 2009, the Fed's absorption of Treasury debt amounted to 48 percent of the new debt issued in that period. And ZeroHedge posted the following chart showing that the Fed is currently the world's largest single holder of Treasury securities, surpassing China:

Conclusion

No one knows the future for certain. But given the economic and political realities, I still remain confident that prices quoted in US dollars will continue to escalate, not only in commodities and certain asset classes, but eventually in most consumer goods. At some point it will be so obvious that not even Ben Bernanke will be able to deny it.

When will the breakout occur? Again, no one can know such things for sure, but there are growing signs that "the market" will soon recognize that Bernanke & Co. have painted us into a very tight corner.

Robert Murphy, an adjunct scholar of the Mises Institute and a faculty member of the Mises University, runs the blog Free Advice and is the author of The Politically Incorrect Guide to Capitalism, the Study Guide to Man, Economy, and State with Power and Market, the Human Action Study Guide, and The Politically Incorrect Guide to the Great Depression and the New Deal. Send him mail. See Robert P. Murphy's article archives. Comment on the blog.![]()

© 2011 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.