Libya Unrest Boosts Crude Oil, Gold and Silver Prices

Commodities / Gold and Silver 2011 Feb 22, 2011 - 05:30 AM GMTBy: Bob_Kirtley

As unrest escalated today in Libya the pressure was felt in the oil world with WTI up $2.17 to $97.50, Brent Crude up $2.26 to $108.00. Gold prices gained $17.50 to close in London at $1406.60/oz, with silver prices adding a huge $1.25 to close at $33.91.

Libya is one of the worlds major oil exporters so the concern about the outcome of the current civil unrest is most certainly warranted. As the news comes in a number of oil companies operating in Libya are starting to evacuate some of their staff as a safety precaution. We can only imagine that essential services will be maintained and that the ability to load oil tankers can continue, however, this is not a given. Libya produces about 2 per cent of the world's oil production with exports running at approximately 1.1 million barrels per day and has reserves estimated to be 44 billion barrels.

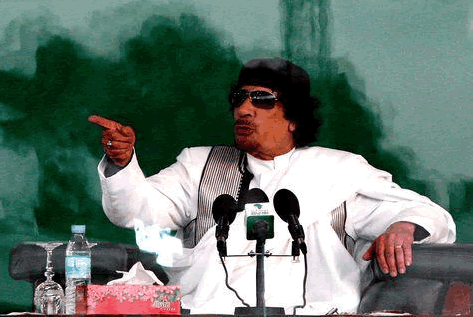

From what we can gather from various news reports it looks as though the days of Muammar Gaddafi ruling Libya are about to come to a close.

Now, as the stock markets in north America are closed for holidays the only action has been in Asia and Europe, especially on the London Stock Exchange which was down today by 68 points. A guide as to how the mining stocks reacted to today's price rises, we can see that for gold, Randgold Resources which was up 3.97% and for silver we have Fresnillo which was up 2.85%.

As we write all eyes are on the Sydney Stock Exchange and then the Singapore Stock Exchange to see if this upward move has any momentum, after we have published this article we will try and add any changes to the 'norm' via the comments section as we go through the day and into London once again.

In the mean time you can sleep tight!

Now we pop over to King World News where Eric King has, as per usual, a couple of cracking interviews, this is a taster for you:

With silver trading at a new multi-decade high trading above $34 and gold up almost $20 breaking above $1,400, King World News today interviewed John Hathaway, Senior Managing Director of the Tocqueville Gold Fund. Hathaway stated,

"What I strongly believe is that the amount of paper we are seeing traded in both gold and silver on the Comex and in the derivatives market is nonsense. It has to be something in the order of 100 to 1. The fact that the market is moving today when the Comex is closed tells me it is not New York that is doing this, it is physical demand."

For those interested in silver they have this from James Turk:

"The backwardation that we have been talking about has now blown out to 73 cents, that is unprecedented. I find that number to be completely astounding! Where are the arbitrageurs? They could make a fortune. This suggests to me that the arbitrageurs are out of the market because they don't have the physical metal to sell to deal with the imbalance."

These recent events could be the ignition that drives both gold to a new record high and silver prices to yet more triple decade highs. If you are short please tread very carefully indeed as the outcome of this current destabilization is still unknown, casting a dark cloud of uncertainty over all us.

We can only hope and pray that these conflicts are resolved with the minimum of violence and that peace returns in short order.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.