COMEX Gold Default Risk Triggers Pension Fund to Take Delivery of $1 Billion of Bullion

Commodities / Gold and Silver 2011 Apr 18, 2011 - 04:22 AM GMTBy: GoldCore

Concerns that the sovereign debt crisis may be entering a new phase and the risk of contagion has seen peripheral eurozone bonds fall sharply and the euro fall against major currencies and gold today.

Concerns that the sovereign debt crisis may be entering a new phase and the risk of contagion has seen peripheral eurozone bonds fall sharply and the euro fall against major currencies and gold today.

Sovereign debt risk, global inflation concerns, geopolitical risk, disappointing European earnings and concerns about Japan's coming reporting season have seen equities weaken and new record nominal highs for gold and silver (all time and 31-year).

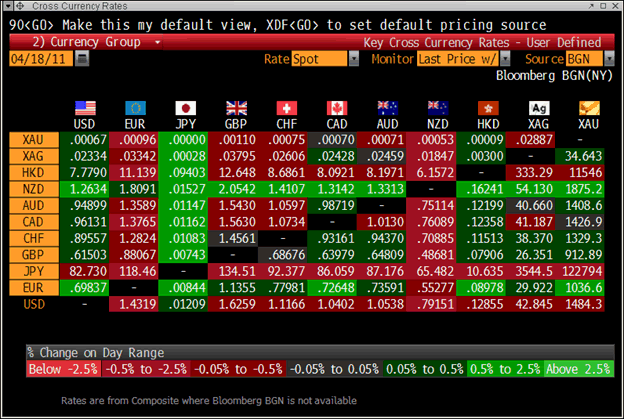

Cross Currency Table

Free Storage on PMCP Unallocated Silver

Free storage on PMCP Unallocated Silver is set to end with the discontinuation of PMCP Unallocated Silver in 7 working days on May 1st, 2011.

Existing or new clients wishing to secure free storage on silver (for as long as it is owned) should call GoldCore as soon as possible.

Greek bond yields have continued their relentless march higher and have risen above 14.07% (10-year) and Portuguese debt (10-year) has risen to a euro era record over 9.27%. Spanish and Irish debts are also under pressure this morning.

Gold in EUR - 1 Year (Daily)

Euro gold has been in a range between €900/oz and €1,070/oz for nearly a year (since last May - see chart) and this period of consolidation looks set to come to an end as gold pushes higher. Once the technical resistance at the record high of €1,072/oz (12/28/10) is breached, gold will challenge €1,100/oz.

In the current bull market, euro gold has seen many long periods of correction and consolidation prior to rapid gains and sharp moves upwards. The length of the recent correction (almost a year) suggests that the coming move could be very sharp and see gold rise to €1,200/oz in the coming weeks.

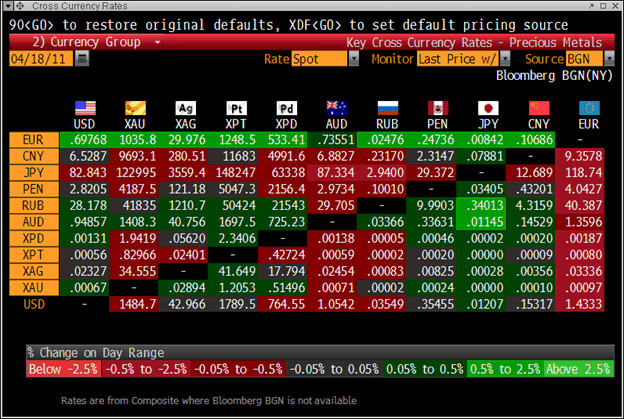

Cross Currency Table and Precious Metals

Gold is increasingly being seen as the superior currency in a world of trillion dollar and euro deficits and bailouts. Indeed, the printing and electronic creation of billions and trillions of the major paper currencies is increasingly making gold and silver the currencies of last resort.

Governments and central banks are debasing currencies through bailouts, deficit spending and quantitative easing that is leading to a massive increase in the supply of fiat currencies. Precious metals are rare and finite and this is why major currencies are falling in value versus gold and silver.

One of the largest pension funds in the world, the University of Texas Investment Management Co (which manages the endowment for the Texas teachers pension fund), has realised this and has put 5% of the pension fund into gold bullion (see news).

Unusually, but likely to be seen more frequently in the coming weeks and months, the pension fund has opted to own physical bars worth nearly $1 billion dollars in allocated accounts.

The fund has previously expressed concerns about the counterparty risk in ETFs. However, the reason given for opting for taking delivery of 100 oz gold bars in a warehouse was that if the holders of just 5 percent of COMEX futures contracts opted to take delivery of the metal, there wouldn’t be enough to cover the demand leading to a COMEX default.

The risk of a COMEX default increases by the day and appears to be moving from the realms of a “conspiracy theory” to that of “of course we knew it would happen, it stands to reason and was inevitable”.

A COMEX default would have serious ramifications for the dollar and all fiat currencies as it would further erode trust in central banks, fiat currencies and today’s monetary system.

Gold

Gold is trading at $1,482.65/oz, €1,035.43/oz and £910.80/oz.

Silver

Silver is trading at $42.81/oz, €29.91/oz and £26.31/oz.

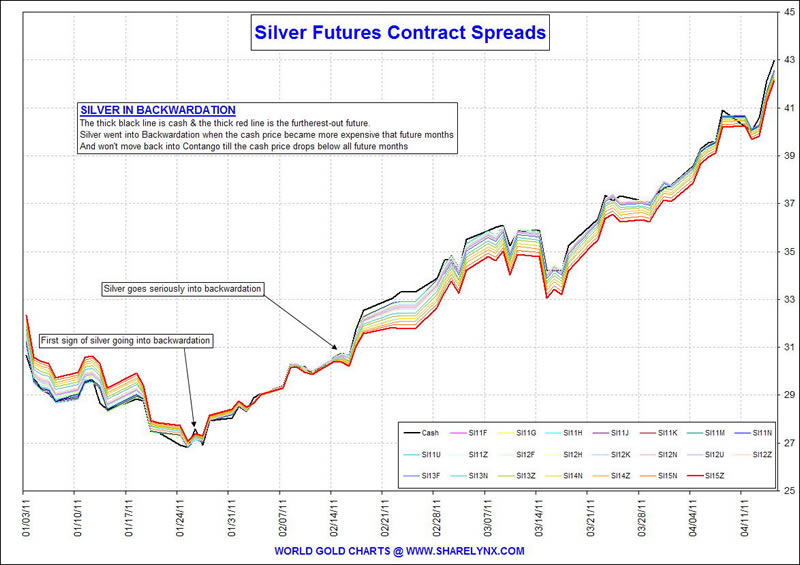

While silver is overbought in the short term, the fact that silver remains in backwardation even after the recent sharp move up suggests that higher prices may be imminent and the 1980 nominal high of $50/oz may be reached sooner that most expect.

Platinum Group Metals

Platinum is trading at $1,783.50/oz, palladium at $755/oz and rhodium at $2,300/oz.

News

(Financial Times) -- Euro slides on sovereign debt fears

Reports that Greece had asked for a debt restructuring – subsequently denied by Athens – have rattled the euro and the continent’s bourses.

Markets were initially proving stoic in adjusting to a tighter monetary environment, with traders betting that the global economy can absorb central banks’ moves to drain excess liquidity.

The People’s Bank of China increased its reserve ratio for the country’s banks by half a point to 20.5 per cent over the weekend – the fourth time this year it has used the tool to tighten liquidity – following a 5.4 per cent rise in March consumer prices.

But shortly after European markets opened, Reuters reported a Greek newspaper as saying that Athens had asked the International Monetary Fund and European Union to restructure its sovereign debt.

The euro was already weaker after an anti-euro party gained ground in the Finnish general election, raising questions about whether the bloc will be able to agree a bail-out for Portugal.

The Greek newsflash saw the single currency shed nearly 1 per cent to $1.43, while the FTSE Eurofirst 300 index stumbled as investors sold those banks with high sovereign debt exposure.

Factors to Watch

It’s a light week for US macroeconomic data, so the market is likely to be more focused on the ongoing first-quarter earnings season. On Monday, the highlights include Citigroup, Halliburton and Texas Instruments.

An unattributed official denial of the Greek restructuring story helped brake the slide, and the euro is now down 0.6 per cent to $1.4334, with the Eurofirst off 0.4 per cent. The S&P 500 futures contract points to a 0.3 per cent fall when Wall Street opens and Treasury yields are slightly softer as risk aversion rises a touch.

Nevertheless, the FTSE All-World equity index is lower by just 0.3 per cent, helped by a belief that Beijing’s attempts to rein in lending and cool inflationary pressures is not so aggressive that it will derail growth in the world’s second-biggest economy. Shanghai’s Composite index rose 0.2 per cent.

In keeping with this underlying optimism about the global economy, industrial metals are firmer – copper is up 0.4 per cent to $4.27 a pound. This in spite of the dollar bouncing off last week’s 16-month lows with a 0.4 per cent advance, a move that would usually be considered commodity-negative.

Investors are having to come to terms with the end of the ultra-loose monetary era in big developed economies following the European Central Bank’s move to raise interest rates from 1 per cent to 1.25 per cent earlier this month and amid increasing acceptance that the US Federal Reserve’s quantitative easing programme will finish on time in June.

Major stock benchmarks are close to cyclical highs, suggesting traders feel corporate profitability will not be too severely affected by the economic impact of this policy shift.

However, some investors seem to believe that central banks are not doing enough to combat inflationary pressures and they are continuing to snap up precious metals to hedge against price rises. Worries about the eurozone are also boosting gold’s haven cachet.

Gold has hit a record high of $1,489 an ounce and is currently up 0.1 per cent at $1,486, while silver has hit a fresh 31-year record of $4.35 an ounce, and is now up 0.4 per cent at $43.17.

The additional support for bullion comes despite a small pullback in oil prices, a commodity that has carried the most inflationary concern for analysts. Brent crude is down 0.5 per cent to $122.88 a barrel as Saudi Arabia challenges the bulls with its contention that the market is oversupplied and it has consequently cut output by 800,000 barrels a day.

Another currency move of note is the yen, which has recaptured the sub-Y83 level relative to the dollar as the post-earthquake intervention impact wanes. With the Bank of Japan staying relatively looser-for-longer, because of the need for increased largesse as the country recovers from the tremor and tsunami, the yen’s interest rate differentials are likely to deteriorate.

This would normally put pressure on the yen, so the currency’s current strength may revive talk that it reflects the much muted repatriation of funds – a trend that if continued could call into question the resumption of the yen carry trade.

This is turn could affect some higher yielding or riskier assets, favourite destination of yen carry trade funds. There is little sign of this so far on Monday, however. The only clear casualty of the yen’s strength is the Tokyo stock market, which has slipped 0.4 per cent as the firmer currency hurts the country’s exporters.

(Bloomberg) -- Gold Climbs to Record as Investors Fret Over Rising Inflation

Gold advanced to record as investors seek the metal as a hedge against inflation. Gold for immediate delivery gained 0.1 percent to $1,488.35 an ounce, while bullion futures for June delivery rose 0.2 percent to $1,489.40 an ounce.

(Bloomberg) -- World Gold Council Says Position Limits Could Impair Liquidity

The World Gold Council said in a letter that proposed position limits in the gold market could “reduce or impair liquidity and trade.” The council published the March 28 letter to the Commodity Futures Trading Commision on its website today.

(Bloomberg) -- Shortage Threat Drives Texas Schools Hoarding Bullion at HSBC

Dallas hedge-fund manager J. Kyle Bass helped advise the University of Texas Investment Management Co. on taking delivery of 6,643 gold bars, worth $987 million on April 15, now stored in a bank warehouse in New York.

Bass, who made $500 million with 2006 bets on a U.S. subprime-mortgage market collapse, said managers of the endowment, known as UTIMCO, sought board approval to convert its gold investments into bullion this year. A board member, Bass, 41, said he was asked to help with that process.

While Bass, a managing partner at Hayman Capital Management LP, said in an April 16 e-mail that “the decision to purchase and take delivery of the physical gold” was made by endowment staff members, “I helped where I could.” Gold futures touched a record $1,489.10 an ounce April 15 in New York before closing at $1,486.

The Texas fund’s $19.9 billion in assets ranked it behind only Harvard University’s endowment as of August, according to the National Association of College and University Business Officers. Last year, UTIMCO added about $500 million in gold investments to an existing stake, said Bruce Zimmerman, the endowment’s chief executive officer. The fund’s managers sought to take delivery of bullion to protect against demand for the metal overwhelming supply, according to Bass.

Open interest in gold futures and options traded on the Comex typically exceeds supplies held in its warehouses. If the holders of just 5 percent of those contracts opted to take delivery of the metal, there wouldn’t be enough to cover the demand, Bass said.

Printing Money

“If you own a paper contract where they can only deliver you 10 cents on the dollar or less, you should probably convert it to physical,” said Bass, who isn’t related to Fort Worth’s billionaire Bass family. He said holding cash wasn’t a better choice because the rate of inflation exceeds money-market rates by 2.5 percent to 3 percent, eroding the value of cash.

“Central banks are printing more money than they ever have, so what’s the value of money in terms of purchases of goods and services,” Bass said April 15 in a telephone interview. “I look at gold as just another currency that they can’t print any more of.”

Sovereign-debt concerns also boosted demand for the metal on April 15, driving Comex futures to an all-time high. The price has climbed 28 percent in the past year.

Gold’s 10-year rally has attracted billionaire investors such as George Soros and John Paulson, who seek a store of value as record-low interest rates erode returns on currencies.

Wealthy Buyers

Few investors take physical delivery of bullion. As of April 14, 2,860 contracts this month, about 0.5 percent of total open interest, had been converted to metal, exchange data show.

Physical deliveries have slowed as gold topped records this year, said Blake Robben, a senior market strategist who handles deliveries of Comex metals for clients at Chicago-based broker Lind-Waldock.

“It’s usually wealthy individuals with net worths over $1 million who want to take delivery to diversify away from the dollar,” Robben said. “Generally, it’s a big hassle and not worth it to take delivery.”

Investors can own 100 ounces of gold futures with Lind- Waldock by paying a $100 fee and putting up $6,571 in a margin account to purchase one contract. To take delivery of a 100- ounce bar, investors have to pay the full price of the contract.

Bass, a Texas Christian University graduate who was named to the endowment’s board in August, is a former salesman with Bear Stearns Cos. and Legg Mason Inc. He said about 5 percent of his hedge fund is invested in gold.

The endowment, which oversees funds held by the University of Texas System and Texas A&M University, has 664,300 ounces of bullion in a Comex-registered vault in New York owned by HSBC Holdings Plc, the London-based bank, according to a report distributed at a meeting in Austin.

“I simply voted as a board member to approve the storage facility and concurred with their decisions,” Bass said.

(Bloomberg) -- Texas University Endowment Storing About $1 Billion in Gold Bars

The University of Texas Investment Management Co., the second-largest U.S. academic endowment, took delivery of almost $1 billion in gold bullion and is storing the bars in a New York vault, according to the fund’s board.

The fund, whose $19.9 billion in assets ranked it behind Harvard University’s endowment as of August, according to the National Association of College and University Business Officers, added about $500 million in gold investments to an existing stake last year, said Bruce Zimmerman, the endowment’s chief executive officer. The holdings are worth about $987 million, based on yesterday’s closing price of $1,486 an ounce for Comex futures.

The decision to turn the fund’s investment into gold bars was influenced by Kyle Bass, a Dallas hedge fund manager and member of the endowment’s board, Zimmerman said at its annual meeting on April 14. Bass made $500 million on the U.S. subprime-mortgage collapse.

“Central banks are printing more money than they ever have, so what’s the value of money in terms of purchases of goods and services,” Bass said yesterday in a telephone interview. “I look at gold as just another currency that they can’t print any more of.”

Gold reached an all-time high of $1,489.10 an ounce yesterday in New York as sovereign debt concerns boosted demand for the metal as a store of value. Gold has climbed 28 percent in the past year on Comex.

The endowment, which oversees funds held by the University of Texas System and Texas A&M University, has 6,643 bars of bullion, or 664,300 ounces, in a Comex-registered vault in New York owned by HSBC Holdings Plc, the London-based bank, according to a report distributed at the meeting in Austin.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Francis Bart Bertholic

18 Apr 11, 17:46 |

silver

I'm so glad to see silver on the rise and doing so well |