Silver Action a Reminder of the Risks of the Paper Market

Commodities / Gold and Silver 2011 May 13, 2011 - 03:56 AM GMTBy: Jeff_Berwick

Gold and silver are strange things. They have been used for centuries as money and only in the last 40 years have they been shoved aside by the financial communists - yet they still exist as a free market monetary asset despite the force of all the government's guns.

Gold and silver are strange things. They have been used for centuries as money and only in the last 40 years have they been shoved aside by the financial communists - yet they still exist as a free market monetary asset despite the force of all the government's guns.

The strange thing about gold & silver, however, is that while they are the last vestige of a money that is not in and of itself able to be manipulated by the political criminal class many people still trade instruments in gold and silver which are easily manipulated by the aforementioned.

We can't speak for the marketplace but we, here at The Dollar Vigilante, buy gold and silver as a way to protect ourselves from the easily foreseeable collapse of the current non-free market monetary system. To us, to try to protect ourselves from the collapse of the monetary system by buying instruments (futures) which are a part & parcel with the current monetary system makes as much sense as buying shares of Enron in late 2001 because you had inside knowledge it was a fraud.

We suppose at this point there are probably two types of precious metals investors. Those that are blissfully unaware of the reasons to own the metals and are just bandwagon jumping the bull market and those that understand what is going on and who are buying gold and silver as protection and a way of preserving their assets through TEOMSAWKI (The End Of The Monetary System As We Know It) to come.

We live in a literal financial house of cards. It is all paper. That house of cards has been in the process of collapsing since 2008. Astute market participants realize this and are buying bullion, one of the only financial assets with no counterparty risk, as a way to protect themselves from the coming storm.

Those who think this is just a bull market to trade likely buy highly leveraged futures that have little or no direct connection to actual gold or silver bullion.

So, what happened with silver? It more than doubled since Ben Bernanke began his high level terrorist attacks against the US dollar with "Quantitative Easing II" announced in August of last year, rising from $18 to just below $50.

The rise in gold and silver was likely making Bernanke feel a bit uncomfortable about his "there is no inflation" story and a phone call was likely put into the COMEX. Five margin increases in rapid succession later and the COMEX had increased initial margin requirements by a substantial 84%.

Anyone who had bought silver futures using leverage and without a substantial cash holding was forced to immediately sell their silver futures. The result was a drop in silver futures prices from near $49 to below $34 in a matter of hours.

So, what's the first moral of the story? If you are buying gold and silver to distance yourself from the highly manipulated and rapidly failing monetary system then don't buy gold and silver in forms that are under the control of the central planners.

Silver Bubble?

The action in silver has most of the world saying that silver was in a bubble and now that bubble has popped. Those who say this don't know what a bubble is and have been blinded by the inflated dollar nominal prices.

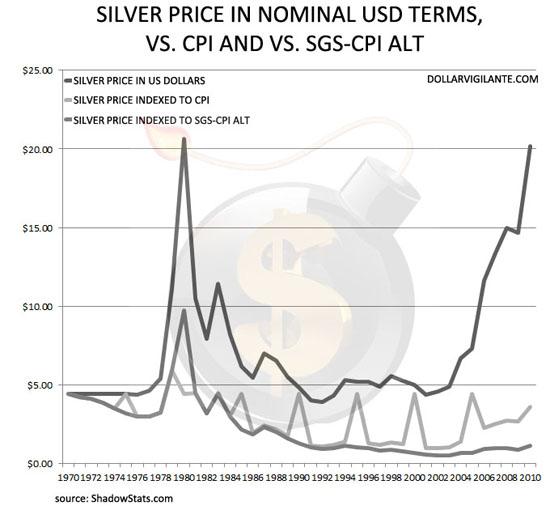

If you look at the silver price in US dollar terms it does look like quite a parabolic, bubble-like rise. However, when you just discount the silver price by the US Government's own CPI Index - which they say is a proxy for inflation - the silver price looks like it has not done much at all. And when you take Shadowstats.com's CPI - which just calculates the Government's CPI the way they used to calculate it in the 1980s before they learned how to hedonistically remove the inflation - silver has been in a long bear market since 1979.

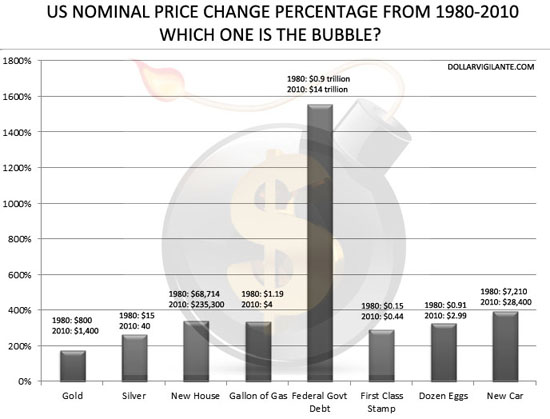

This jives with the following chart as well, taken from the May issue of The Dollar Vigilante, where we looked at the price of a number of disparate items in 1980 and in 2010. Can you spot which one of these items is in a bubble?

What's the second moral of the story? You take your investment life into your own hands if you pay attention to the price of your investments in US dollar terms. In nominal dollar terms silver looks like it has been on a ludicrous rocket ride. When looked at discounted to 'inflation' as defined by the US Government's CPI or when compared to other assets over the last thirty years, silver has been a long bear market and has done relatively nothing compared to any other assets.

And compared to the growth in US Federal Government debt, silver has underperformed by a factor of five. One bubble is about to pop... and it isn't silver.

Subscribe to TDV today (90 day moneyback guarantee) to access our Special Report on How to Own Gold as well as get complete access to our newsletter and portfolio selections.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.