Eurozone Debt Crisis Deepens Sending Euro Lower and Gold to New Record at EUR 1,080/oz

Commodities / Gold and Silver 2011 May 23, 2011 - 08:34 AM GMTBy: GoldCore

The euro, global equities and bonds in peripheral Eurozone countries are all lower this morning on heightened concerns about the debt crisis in the Eurozone. The euro has fallen against all currencies and is now at a record low against gold at EUR 1,080.21/oz. Silver is lower against most currencies but is higher against the Australian dollar and the euro ( EUR 24.80/oz).

The euro, global equities and bonds in peripheral Eurozone countries are all lower this morning on heightened concerns about the debt crisis in the Eurozone. The euro has fallen against all currencies and is now at a record low against gold at EUR 1,080.21/oz. Silver is lower against most currencies but is higher against the Australian dollar and the euro ( EUR 24.80/oz).

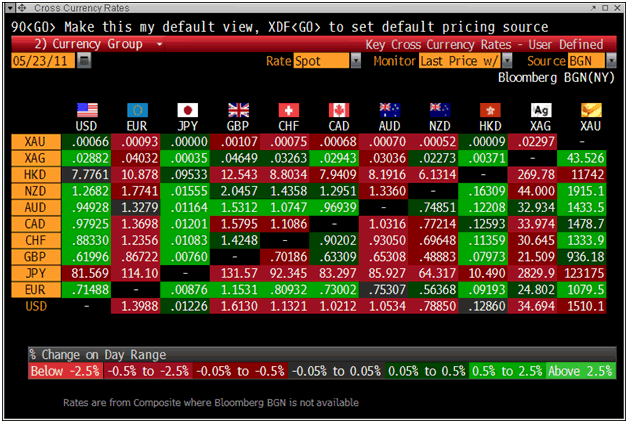

Cross Currency Rates

Greece’s 10 year government debt has surged to 16.98%, Portugal’s to 9.6% and Ireland’s to a new record at 10.76%. The yield on Italian 10-year government debt is up 9bp to 4.85% after S&P cuts its rating outlook on Italy’s sovereign debt to “negative” from “stable”. The Spanish 10 year bond has risen 11 basis points to 5.57%.

Equity markets in Europe have followed their Asian counterparts lower. Asian equities fell due to Eurozone debt concerns but also inflation concerns and the risk that the US economic recovery is faltering. Italy’s stock market (FTSE MIB) is down 3% while Spain’s IBEX is down 1.7%.

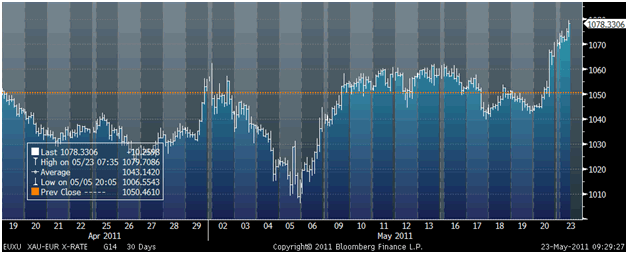

Gold in Euros – 30 Day (Tick)

Besides sovereign debt risk, gold is also being supported by geopolitical risk as seen in the increasingly unstable nuclear armed Pakistan where armed militants attempted to take over Pakistan’s naval air force headquarters.

There is increasing tension between the U.S. and Pakistan after what the U.S regards as Pakistan’s failure or collusion regarding Osama Bin Laden.

China has increasing economic and military ties and interests in Pakistan and has vowed to standby Pakistan and has called on the world to respect Pakistan’s sovereignty.

Separately, in an interview with the Financial Times on Saturday, Henry Kissinger has warned of a world war involving Pakistan and India.

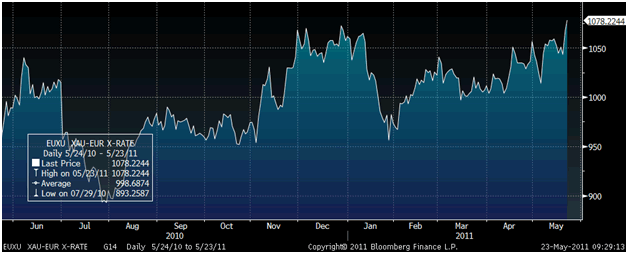

Gold in Euros – 1 Year (Daily)

The eruption of Iceland’s Grimsvotn volcano is leading to concerns about the economic impacts on the aviation industry and wider impacts on consumer confidence on an already fragile European economy.

SILVER

Demand for silver bullion in China remains robust with Chinese silver imports in April at 339.4 metric tonnes, according to data released by the Chinese customs agency today.

This compares to 302.09 metric tonnes in April 2010 or an increase of over 12% from the same month last year. It compares with silver imports of just 132.5 and 127.3 metric tonnes in April 2009 and April 2008 respectively.

This shows that the record Chinese demand for silver bullion seen in 2010 is continuing in 2011 and higher silver prices are not deterring Chinese buyers.

China imported 3475.4 tonnes of silver bullion in 2010 up a massive fourfold from 2009 when imports were just 876.8 tonnes. Importantly, China was a net exporter of silver bullion up until 2007.

Gold

Gold is trading at $1,508.80/oz, €1,078.64/oz and £935.81oz.

Silver

Silver is trading at $34.64/oz, €24.76/oz and £21.48/oz.

Platinum Group Metals

Platinum is trading at $1,747oz, palladium at $720/oz and rhodium at $1875/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.