Oil Slick and Euro Debt Catastrophe

Stock-Markets / Financial Markets 2011 Jun 16, 2011 - 04:14 PM GMTBy: PhilStockWorld

Good golly what a mess!

Good golly what a mess!

I hate to say I told you so but... Oh wait, no, I'm actually loving this... I TOLD YOU SO! Look at July 2008 and look at June 2011. Now, look at July 2008 and look at June 2011. Now, look at where oil USUALLY trades. Is it over $100 or under $80? You don't want to go back further because then the case could be made for under $60.

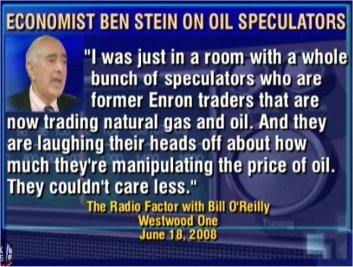

Wages have not gone up (adjusted for inflation, since 1973), home prices have not gone up (since 1985), stocks have not gone up (since 2006) - just oil and gold and silver and other stuff that people like to hoard in hopes of making themselves even richer - even though it comes at the expense of EVERYONE ELSE IN THE WORLD.

One of the protesters in Greece had a sign that said Prime Minister George Papandreou was "Goldman Sach's employee of the month" - now THAT's a good insult! At least it indicates that the Greek people UNDERSTAND how they are being screwed over while it's the Americans who are bending over and taking it from the Banksters without complaint.

I'm not going to get into it again but WHO pays that extra $30 a barrel for oil? The bottom 99.9%, that's who. Sure The Donald also pays $4 a gallon when he gasses up the limo and he also pays double to heat his gigantic homes but a full tank in the limo is $120 while the prix fixe at Masa is $450 per person for Donald's lunch so I doubt he's as worried as you are about a tank of gas. The American people are having $1.5Bn PER DAY extracted from their wallets at $4 per gallon, which is $547Bn a year and Globally that's $2Tn spent on gasoline alone. All that money is/was disposable income that is being directed AWAY from other parts of the economy.

Add in the heating oil, natural gas, oil products (rubber etc.) and all the pass-through energy costs from manufactures and we're up to about $5Tn, nearly 10% of the global economy going up in flames to enrich perhaps 1,000 oil men (and some of those men fund terrorism with their profits) and the speculators who shove the prices higher. THEY ARE DESTROYING THE WORLD! And it shouldn't be the people who rally against these bastards - it should be the other businesses, whose customers are being robbed of their disposable income before they can even drive to the store.

Sure Exxon, for example, spends $30M a year lobbying to make sure this game continues to be played their way and they should - because XOM sold $400Bn of that $5Tn last year, so what's $30M to make sure oil stays as high as possible for as long as possible? WMT took in $104Bn in revenues and it could have been $120Bn if their customers didn't leave it at the gas station on the way to the store - why don't they wake up, get together with other consumer companies and hire their own lobbyists to help end commodity speculation and put a stop to this National disgrace? Just a thought (and one I encourage you to pass along by sharing this article with others)...

Now, getting back to my own evil speculator mode - we hit oil futures for a nice $1 worth of gains in this morning's Member Chat and, at $10 per penny per contract - that's pays for our gas money AND lunch at Masa so we're all set for the day. As I've mentioned, I really hate going long on oil as we become part of the problem but at least we concentrated our firepower on breaking the backs of the speculators last week and, guess what - IT WORKED!

Just like any bully, it really just takes a few of the other kids to stand up to them and they run away crying. We began picking off oil at $103 on June 1st and on June 2nd I detailed our results and we kept at it since then, relentlessly calling the bluff of the speculators whenever they pretended they actually wanted to buy a barrel of oil for over $100.

Just like any bully, it really just takes a few of the other kids to stand up to them and they run away crying. We began picking off oil at $103 on June 1st and on June 2nd I detailed our results and we kept at it since then, relentlessly calling the bluff of the speculators whenever they pretended they actually wanted to buy a barrel of oil for over $100.

Oil bottomed out at $94 yesterday but may go lower still if Europe keeps spiraling downward (back to $94.50 at 8:25 and we are no longer playing for the bounce other than some fun USO calls we took yesterday). That's a 900 penny drop at $10 per penny per contract and we started out with 376,000 contracts on the NYMEX when I called the short play so that's $3,384,000,000 made on the NYMEX by shorts in just 15 days - that's nice!

Do you want to know something funny about this? When a hedge fund manager makes $3.4Bn betting on the market or speculating on commodities - he becomes a national hero but when a humble blogger tells thousands of other people how to make $3.4Bn, it pretty much passes unnoticed. I'm not complaining (much) as I enjoy what I do and our Members are pretty happy with the results but it shows you how screwed up our values are when we reward the greedy behavior and ignore the altruistic tendencies.

8:30 Update: 414,000 Americans lost their jobs last week. That's "normal" these days and does not bode too well for the next Non-Farm Payroll Report but bad news is GOOD for the market as it keeps the Fed on the table so I popped into Member Chat just now and called for long futures plays on oil (yes, I am a shameful slut) at $94.50 and on the Russell at 775. I am also expecting a softening by the EU (mainly the Germans) on the Greek situation as threatening Greece is clearly not working so now it's time to be the good cop and JUST GIVE THEM THE FREAKIN' MONEY!

I know that's not "fiscally responsible" and I know they'll "never learn their lesson that way" and it may even encourage bad behavior from the other kids but, at this point - they are burning down the EU House so Germany has to decide if they are willing to let the whole thing burn to the ground in order to punish one bad kid or if they want to pull $100 (Billion, that is) out of their wallet and buy themselves a little peace - until the next time, of course.

We went more bullish yesterday - taking disaster hedges, of course but we went back to the well on our 12 DIA short put ideas, which held up so well during the downturn yesterday that it improved my overall outlook. As I said yesterday, when I reposted them with adjusted prices near the close: "PLEASE compare these with our original entries. Virtually NO CHANGE despite the sell-off. This strengthens my belief that these are good picks and have gone down far enough. I think the most any of these lost was $150 (the VZ puts). That’s why this is a great way to pair a hedge!"

It's all going to be up to the EU today and tomorrow. Greek Prime Minister George Papandreou, in an attempt to "quell a growing revolt within his Socialist government, called on party lawmakers Thursday to support his unpopular austerity measures." He said, "Now is not the time to quit, now is the time for us to continue. Now is the time to say 'yes' to the big changes." Two Socialist party members withdrew their support for the government's austerity plan, bringing to four the number of Socialist party members who defected this week. Greece's Finance Minister, George Papaconstantinou, resigned last night and they are still looking for someone to take responsibility for the VERY UNPOPULAR austerity program in his place. "Papandreou's goal with this reshuffle is to defuse tensions within the party and the anger among the population," a senior party official said. "He is under a lot pressure to replace Papaconstantinou, but he also has problems finding a replacement. It's a job that few know how to do and even fewer want."

"Underscoring that difficulty, earlier Thursday Socialist party deputy George Floridis—a former public order minister and a mooted candidate for the job of finance minister—resigned his seat in parliament, citing objections to the reform program... As a precondition for receiving the next tranche of its existing loan—or any further aid package—Greece must pass a promised five-year, €28 billion austerity plan" by the end of this month. If it doesn't, Greece may run out of money by mid-July, which might precipitate a new euro zone crisis.

In May last year, Greece narrowly avoided default with the help of a €110 billion bailout from its fellow euro-zone partners and the International Monetary Fund, and is now seeking at least another €60 billion in aid to cover its borrowing needs..." But it's not like this will all explode tomorrow - we still have 4 weeks! So, just maybe, the markets are overreacting a bit at the moment. (Greek PM Scrambles To Reshuffle Cabinet Amid Flagging Support)

Maybe.

Try out PSW's Stock World Weekly, free, here >

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.