The Greek Debt Market Theater

Stock-Markets / Financial Markets 2011 Jun 20, 2011 - 02:33 AM GMTBy: PhilStockWorld

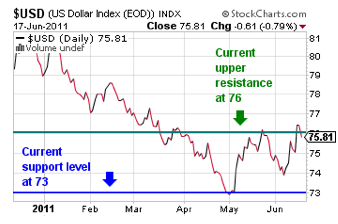

In spite of all the turmoil in the Eurozone this week, no matter how bad the situation in Greece seemed to be, or how badly the Euro was battered, none of this was enough to catapult the Dollar above its current upper resistance level of 76. Unless or until patterns change (when the Dollar pops, stocks drop), if the Dollar cannot move above this level, we don’t expect to see stocks to fall significantly.

In spite of all the turmoil in the Eurozone this week, no matter how bad the situation in Greece seemed to be, or how badly the Euro was battered, none of this was enough to catapult the Dollar above its current upper resistance level of 76. Unless or until patterns change (when the Dollar pops, stocks drop), if the Dollar cannot move above this level, we don’t expect to see stocks to fall significantly.

The stock market is largely at the mercy of the money flows between the Fed, the Treasury, Primary Dealers, foreign central banks, the banking system, and the markets. Lee Adler of the Wall Street Examiner closely follows these money flows and reports on the trends he sees and how he expects them to affect the markets. Looking ahead, Lee writes, “Short term indicators have mostly turned up and while there’s no real sign of strength, the odds of an extended selloff are reduced for the time being. My best guess continues to be that the market will churn sideways without materially breaking support for the next week or two as the 13 week cycle enters a weak up phase supported by POMO [permanent open market operations] and light Treasury supply until the end of the month.

“Next week’s calendar is light, with another paydown on Thursday and plenty of POMO, so if ever stocks had an excuse to rally, this would be it. The Federal Government would probably be happy to see stocks rally at the expense of a selloff in Treasuries since the government is not selling notes and bonds this week. Likewise, their cohorts the Primary Dealers have a little problem with a massive Treasury short position. Those guys desperately need a Treasury market selloff, but Europe isn’t cooperating. That situation spinning out of control has put Treasury yields on a downward track again after a false trend break this week. Crazy but true. So here we go again, the Primary Dealers are gonna need another bailout if this keeps up.

At the same time, the dollar’s 18 month cycle has turned up. That’s perverse given the problems with the debt ceiling and the Federal debt, but currency values are all relative to one another. In a race to the bottom some currencies will pull ahead at times. Right now the dollar is just a little less sick than its competitors and it could stay that way for a few weeks or a few months, but eventually this too shall pass and it will head lower.

Month to date data from the daily Treasury statement now confirms the evidence of an economic stall, with tax receipts currently about level with last year in June, after months of year to year gains. At the same time, outlays are falling behind last year reducing economic stimulus. This could lead to a vicious cycle where tax receipts fall faster than outlays, causing the Treasury’s borrowing needs to balloon. At the very least, they will be greater than forecast based on the Treasury’s overly rosy economic assumptions as recently as the beginning of May. [See also: Federal Tax Receipts Show Economy Grinding To A Halt]

The final POMO schedule calls for $62 billion to be added from June 13 to July 11 to end the program. Next week’s schedule calls for $17-21.5 billion. That’s down from an average of $22 billion a week over the past month. No net new Treasury supply will settle next week, and a $9 billion paydown of T-bills will settle Thursday, adding to the impact of POMO.

Since only a small TIPS issue will be sold in addition to the regular weekly bills, the government would be quite content to see bonds sell off a little so that stocks can get a little POMO love. It wouldn’t do anything in the futures markets overnight to see that that happens, would it?

Why, yes... yes it would. The fact that the government’s Primary Dealer partners in crime are positioned totally the wrong way in the Treasury market and are getting killed in their positions is another factor. They need a selloff in the Treasury market. The only question is whether events in Europe might spin out of control enough to supersede that. The panic over European sovereign debt is running counter to the needs and expectations of the PDs and causing panic IN to Treasuries. This is part of the tension we see in the market in recent days.

Tensions are pulling in all directions, just like in any good, classical Greek drama. Tyler Durden of Zero Hedge reported “Just in time for the end of QE2, when the US needs every possible foreign buyer of US debt to step up to the plate, we get confirmation that yet another major foreign central bank has decided to not only not add to its US debt holdings, but to actively sell US Treasuries.” Arkady Dvorkovich, chief economic aide to the Russian President said on Saturday “The share of our portfolio in U.S. instruments has gone down and probably will go down further.” (After Dumping 30% Of Its Treasury Holdings In Half A Year, Russia Warns It Will Continue Selling US Debt)

Furthermore, according to Zero Hedge, U.S. households sold Treasuries to the Fed at an annualized rate of $1.1Tn and China is contemplating dumping two-thirds of its $3Tn in USD reserves. With the scheduled end of QE2, the Federal Reserve will no longer be actively buying Treasuries in an emergency measure to pump liquidity into the financial system. The critical question remains, “who is going to buy U.S. Treasuries?” With private households and foreign investors being potential candidates, we would hope to see signs that they are getting ready to step up to the plate and buy large quantities of Treasuries. Instead, we see the opposite happening.

Meanwhile, on the political front, Republicans have been pushing for spending cuts and austerity measures. Notwithstanding stiff opposition from Democrats, on Friday, the House passed a $126Bn Agricultural Appropriations bill. Democrats objected to the deep cuts to both a nutrition program for low-income women and children, and additional cuts to food safety programs.

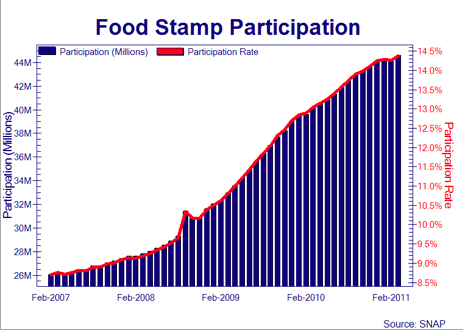

Labor’s share of US national income is lower than at any point in the last 60 years. There are now 44 million people in the US participating in the Supplemental Nutrition Assistance Program (SNAP) aka “food stamp” program, up from 27 million in October 2007. That’s an increase of nearly 63% in less than four years. Factor in high unemployment rates and inflation in food, energy and medical services, and we can only wonder what good can come from slashing spending even further. If the objective is to grow the economy so that tax receipts increase, thereby making it possible to repay debt, then the wisdom of slashing programs that put money directly into the economy (low-income people spend what they get in aid) seems misguided at best.

As Michael Hudson observed, “The economy is still suffering from the Obama administration’s failure to alleviate the debt overhead. He should be making banks write down junk mortgages to reflect actual market values and the capacity to pay. Foreclosures are still throwing homes onto the market, pushing real estate further into negative equity territory while wealth concentrates at the top of the economic pyramid. No wonder Republicans are able to shed crocodile tears for debtors and attack President Obama for representing Wall Street (as if this is not equally true of the Republicans). He is simply continuing the Bush Administration’s policies.” (How a $13 Trillion Cover Story was Written)

Try out PSW's Stock World Weekly, free, here >

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.