Turkey Economy Now Growing Faster than China

Economics / Emerging Markets Jul 04, 2011 - 12:26 PM GMTBy: Trader_Mark

While all the focus is usually on the big emerging (or emerged) markets such as those who are members of BRIC, there are quite a few other interesting stories out there such as Chile, Indonesia, and Turkey. [July 6, 2010: Turkey - Where East Meets West, and Prospects are Improving] While there are relatively limited choices to invest in these countries, they are certainly part of a secondary group of locales that are helping to boost the fortunes of U.S. multinationals.

While all the focus is usually on the big emerging (or emerged) markets such as those who are members of BRIC, there are quite a few other interesting stories out there such as Chile, Indonesia, and Turkey. [July 6, 2010: Turkey - Where East Meets West, and Prospects are Improving] While there are relatively limited choices to invest in these countries, they are certainly part of a secondary group of locales that are helping to boost the fortunes of U.S. multinationals.

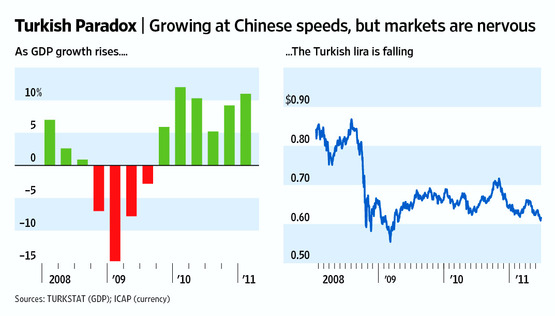

Turkey just reported a 11% GDP figure, outpacing that if China*

*how accurate these figures are, are of course up for debate but directionally they do mean something.

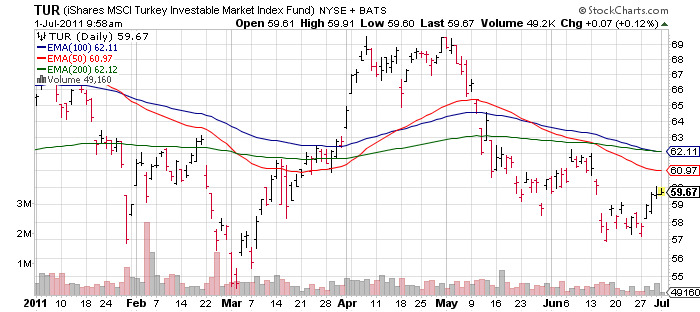

Despite this strong GDP growth, Turkey's market is struggling with fears of a growing current account deficit.

Via WSJ- The Turkish economy grew by 11% in the first quarter, outstripping China and confirming Turkey as Eurasia's rising tiger. Thursday's official growth figure, compared with the year-earlier period, easily beat market expectations, at a time when many of Turkey's neighbors in the Middle East and Europe struggle with political turmoil and bailouts.

- But in what is fast emerging as a Turkish paradox, foreign investors aren't rushing to snap up assets. A key concern in markets, economists say, is what action the new government will take to control a ballooning current-account deficit that is above 8% of gross domestic product and rising quickly—an imbalance seen as a sign of overheating, despite relatively benign inflation numbers.

- Thursday's statistics also included trade figures for May, which saw the trade deficit double from the same month last year, adding to the current-account imbalance. Imports to Turkey expanded by 42.6%, almost four times as fast as its exports at 11.7%, according to Turkstat, the state statistics agency.

- Turkey's growth until now has been dominated by expansion in the financial, retail and construction sectors, driven by rapid demand and credit growth, said Mr. Alkin. Turkey's banking sector is solid, but the country's consumption-driven model, as with Spain and China, no longer looks sustainable in the long term. Turkey, he said, has to lower costs, produce more, import less and move up the value chain.

- One sign of investor nervousness is that the Istanbul Stock Exchange has been one of the worst performers among emerging markets this year, down by 9.75% since early May. Currency traders, meanwhile, have been selling off the lira, which has fallen nearly 19% since November.

- The central bank has tried to squeeze bank lending and consumption by raising reserve requirements for commercial banks. But at the same time, it has put its foot on the gas, cutting interest rates as it tried to deter volatile short-term investment inflows that are financing the current-account deficit. That unorthodox policy is increasingly controversial and hasn't worked. The central bank says that more time is needed to see effects and that inflation, though ticking up, is only just off record lows.

- Still, many economists and bankers believe monetary policy can't fix what ails Turkey. Turkey produces minimal quantities of oil and gas. Meanwhile, manufacturers face high costs relative to competitors, economists say, and so tend to use imported semi-finished goods rather than produce their own components. As a result, as Turkey produces more, it imports more—85% of Turkish imports are commodities and semi-finished products, according to Mr. Alkin.

By Trader Mark

http://www.fundmymutualfund.com

Mark is a self taught private investor who operates the website Fund My Mutual Fund (http://www.fundmymutualfund.com); a daily mix of market, economic, and stock specific commentary.

See our story as told in Barron's Magazine [A New Kind of Fund Manager] (July 28, 2008)

© 2011 Copyright Fund My Mutual Fund - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

gerald langelier

04 Jul 11, 17:49 |

Financial market

SP500 buy any pullback until august 17 2011! |