Road to Apathy, Catching Out the Knee-Jerk Stock Buyers of 2008/2009…

Stock-Markets / Stock Markets 2011 Aug 16, 2011 - 11:53 AM GMTBy: Aftab_Singh

If we had to choose to indulge in just one form of pseudo financial mysticism, we would undoubtedly go for the view that financial assets tend to move in generational cycles. In short, we believe that nothing is more conducive to action than good old muscle memory. Here, I explain why the recent crash in the array of ‘risk assets’ is corroborating our hunch about the generational nature of trends in financial assets. Moreover, I consider one way in which widespread apathy towards speculation may come to pass.

If we had to choose to indulge in just one form of pseudo financial mysticism, we would undoubtedly go for the view that financial assets tend to move in generational cycles. In short, we believe that nothing is more conducive to action than good old muscle memory. Here, I explain why the recent crash in the array of ‘risk assets’ is corroborating our hunch about the generational nature of trends in financial assets. Moreover, I consider one way in which widespread apathy towards speculation may come to pass.

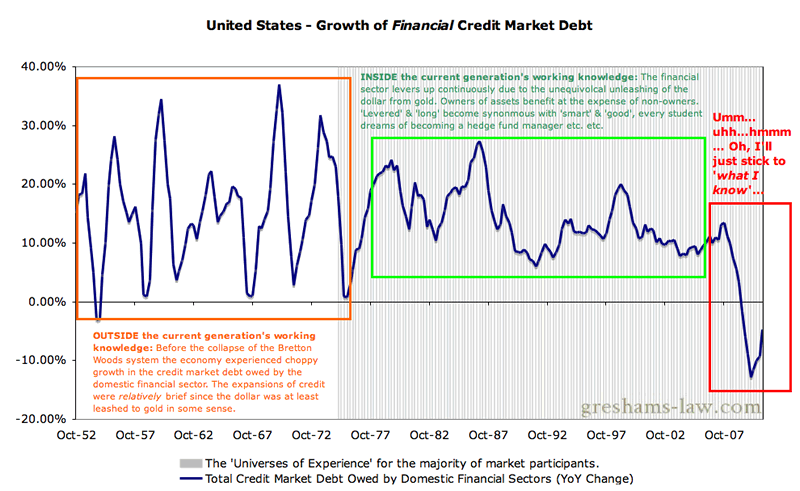

A Generation Accustomed to Leverage:

As mentioned in our recent article about the possible timing of a mania in the gold market, the investment professionals at the helms of the major speculative portfolios of the world probably began their careers between the years of 1975 and 1995:

Ok, so if we’re to deal with timing in terms of generations, then let’s quickly think about whom we’re dealing with. With the assumption that the prime of a person’s career spans from around 25 years old to 60 years old, we can assume that the majority of people in the investment business were born between the years 1950 and 1985. Moreover, most of the guys that are managing portfolios of assets (35-55 year olds) probably began their careers between the years of 1975 and 1995.

So, the environment in which these people have been operating has been distinctly friendly to asset prices. After all, the trend from 1980 to 2007 was towards progressively larger doses of leverage. Their ‘universes of experience’ — if you will — have been distinctly intertwined with a levering economy. [See chart below for details.]

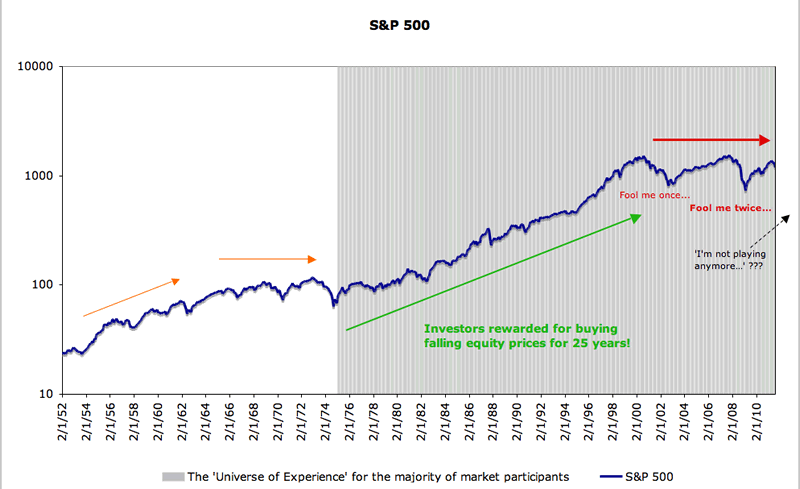

The Knee-Jerk Reaction to Falling Equity Prices:

It should be no wonder that the majority of investors have become accustomed to buying falling equity prices! Looking at the course of stock prices since the mid-1970s, one can imagine that the strategy of buying falling equity prices would have paid off handsomely. It is only recently that the ‘buy the dip’ mentality has been thrown into question (with the collapse of the TMT bubble and the 2008/2009 crisis).

Most people know (at least nominally) that they should be ‘contrarian’ – but it seems that they’ve mistakenly associated opposing the price trend with opposing the herd. A contrary position is not guaranteed if you buy falling prices or sell rising prices! As mentioned in a recent article, the contrarian philosophy involves consideration of a future that the majority is unwilling and/or unable to consider (let alone prepare for). At market tops, this involves proper consideration of unfortunate happenings and at market bottoms; this involves proper consideration of positive things.

What will get the consensus to abandon the notion that one should always buy falling prices? Well, our hunch is that we’ll have to see price action that gets the knee-jerk buyers of 2008/2009 to quit. Whatever price action that may be (a crash or a slow grind), we need to see an investment community that changes its habits drastically. If this were to come to pass, the result would be profound apathy towards speculation (particularly on the stock exchanges). As Russell Napier articulated in a recent(ish) interview with the FT, stock market bottoms are characterized by apathy rather than despair:

Apathy towards Speculation A.K.A. A love for cash…

Apathy towards speculation in stocks can also be articulated as an unshakable commitment towards the ownership of cash (to the exclusion of everything else). The contrarian principle applies both ways. Although a widespread love for cash may seem less foolish than a widespread love for equities, it still represents a dogmatic conviction about the future. Since the future remains closed to man, regardless of his particular propensity to speculate, such a dogmatic conviction would breed contrarian asymmetry on the long side. As much as people will feel like they’re being ‘safe’, the reality will be that they will be in danger – safety is simply not an option for consensual market participants. Man acts, and uncertainty about the future is a permanent and integral feature of his acting. So, ironically, the perceived bastions of safety (‘cash’ etc.) become precisely the opposite as soon as the status quo becomes dependent on that property of safeness holding through time.

As can be seen from the chart above, one possible scenario for this could be if the knee-jerk buyers of 2008/2009 were to see their positions go from barely in the black to deep in the red. To be sure, we’ve been surprised by the enduring nature of consensual market participants’ willingness to invest & speculate (just turn on CNBC for 5 seconds!). However, it may be that the ‘fool me thrice‘-move will prove the final straw for a tired investment community. The consensus may finally throw in the towel and embrace supposedly non-speculative endeavors. At this time, we may see scorn thrown upon people who have the audacity to participate at all (let alone participate on the long-side). Ironically, that will be precisely the time (and the reason) to buy.

Conclusion:

The enduring willingness to speculate has continued to surprise us over the past several years. One possible scenario over the coming years is that the 2008/2009 buyers could get caught out again (and make the emotional move into cash with intent on staying there ‘forever’). At that time, there may arise a ferocious contempt for those who speculate (indeed, this trend is already clear). Once the consensus becomes convinced that buying falling prices ‘doesn’t work’, it will — of course — ‘work’.

Aftab Singh is an independent analyst. He writes about markets & political economy at http://greshams-law.com .

© 2011 Copyright Aftab Singh - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.