U.S. August Jobs Report Means Odds of Additional Fed Policy Action Have Increased

Economics / Employment Sep 03, 2011 - 03:39 PM GMTBy: Asha_Bangalore

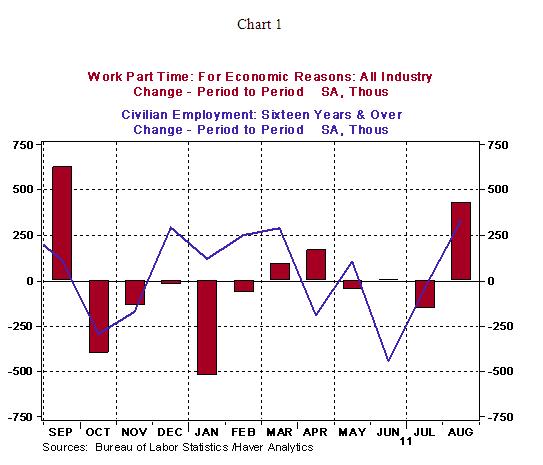

Civilian Unemployment Rate: 9.1% in August, unchanged from July. Cycle high jobless rate for recession is 10.1% in October 2009.

Civilian Unemployment Rate: 9.1% in August, unchanged from July. Cycle high jobless rate for recession is 10.1% in October 2009.

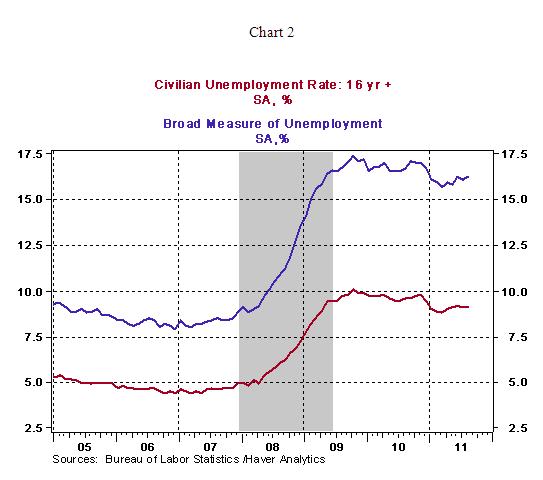

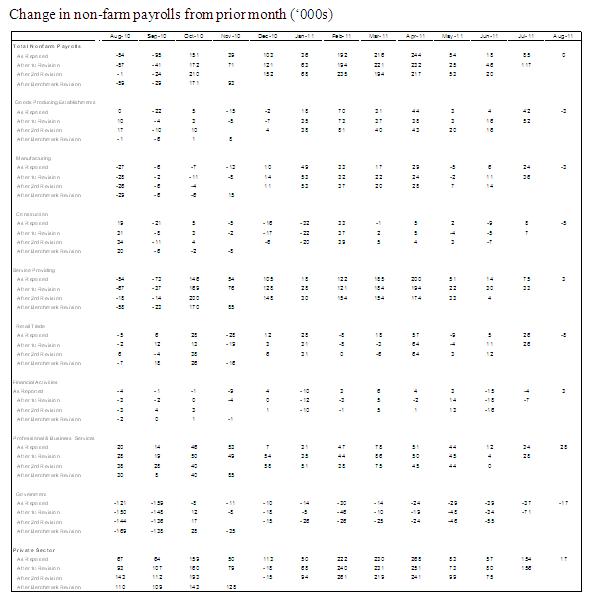

Payroll Employment: No change in August vs. +85,000 in July. Private sector jobs increased only 17,000 after a gain of 156,000 in July. Loss of 58,000 after revisions to payroll estimates of June and July.

Private Sector Hourly Earnings: $23.09 in August vs. $23.12 in July; 1.9% yoy increase in August vs. 2.3% gain in July.

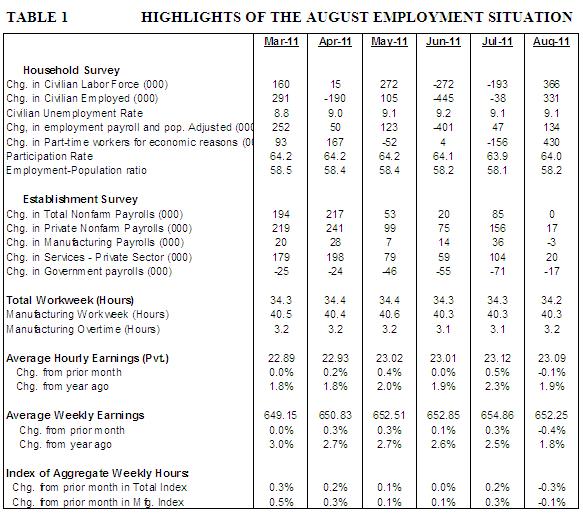

Household Survey – The unemployment rate held steady at 9.1% in August. As per the household survey, the number employed increased 331,000 in August, with part-time employment (+430,000) accounting for the entire increase in employment (see Chart 1). Effectively, if part-time employment is excluded from the count, the jobless rate would have increased.

In fact, the increase in the broad measure of unemployment (includes those working part-time because they cannot find full-time jobs and those not looking for work but want to work and are available in addition to those included in the tally of unemployed in the headline jobless rate) to 16.2% in August from 16.1% in July indicates this.

Establishment Survey – Payroll employment was unchanged in August and earlier estimates of payrolls in June (+20,000) and July (+85,000) were revised down to result in a net loss of 58,000 jobs. Private sector employment grew only 17,000 in August vs. an increase of 156,000 in July. The loss of 48,000 jobs in the information processing sector partly explains this. This loss reflects 45,000 striking Verizon workers. These employees have since returned to work and it will be reflected in the September tally of payroll employment.

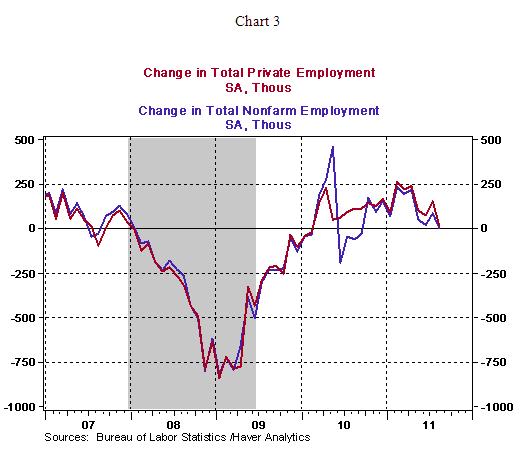

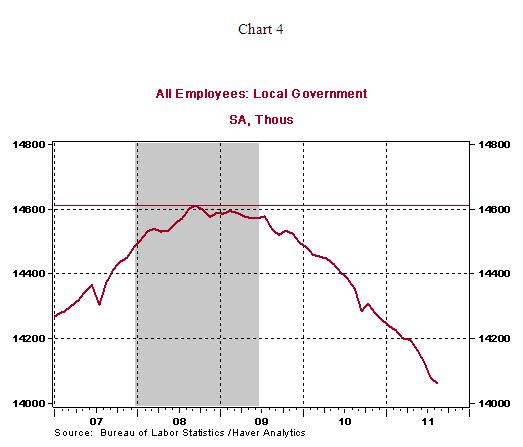

Health care employment continues to post strong gains, with the increase of nearly 30,000 jobs in August taking the twelve month gain to 305,900. Factory employment fell in August (-3,000) but the factory sector has added 206,000 jobs in the last twelve months. Federal, state, and local government employment ranks have shrunk significantly in the past three years. Of the three levels of government, local government jobs have taken the biggest hit. A total of 550,000 jobs have been lost since local government employment peak in September 2008 (14.611 million, see Chart 4). Budgetary pressures will continue to prevent government payroll gains in the near term.

Highlights of changes in payrolls during August 2011:

Construction: -5,000 vs. +7,000 in July

Manufacturing: -3,000 vs. 36,000 in July

Private sector service employment: +17,000 vs. +156,000 in July

Retail employment: -3,000 vs. +26,000 in July

Professional and business services: +28,000 vs. +28,000 in July

Temporary help: +1,200 vs. +4,700 in July

Financial activities: +3,000 vs. -7,000 in July

Health care: +29,700 vs. +29,800 in July

Government: -17,000 vs. -71,000 in July

Hourly earnings declined 3 cents in August to $23.09 after an 11-cent jump in July. This combined without any increase in jobs points to a reduction in personal income during August. The manufacturing man-hours index edged down 0.1% and bodes poorly for industrial production in August.

Conclusion – The tone of the August employment report is that of downright weakness – stalled hiring in August, downward revisions of June and July payrolls, an unemployment rate holding steady due to an increase in only part-time jobs, drop in hourly earnings, a shorter workweek and the list grows. Essentially, labor market conditions are significantly weak after almost nine quarters of economic growth. Auto sales posted a small decline in August and the ISM manufacturing survey shows stagnant new orders and a decline in production during August. In addition, the near absence of real GDP growth in the first-half of the year makes it difficult to consider these setbacks as temporary. Therefore, there is a strong probability of the Fed announcing additional monetary policy easing through purchases of securities (QE3) or more likely a lengthening of the maturity structure of the Fed’s balance sheet at the September 20-21 FOMC.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.