The Vigilante's View on the Markets, Gold & Gold Stocks

Stock-Markets / Financial Markets 2011 Sep 23, 2011 - 03:23 AM GMTBy: Jeff_Berwick

Times like these are why we are dollar vigilantes. Talk is incessant about a possible collapse of the European Union - something which we consider to be a certainty. They can let it collapse now or paper it over again and see if they can keep that dead man walking a little longer.

Times like these are why we are dollar vigilantes. Talk is incessant about a possible collapse of the European Union - something which we consider to be a certainty. They can let it collapse now or paper it over again and see if they can keep that dead man walking a little longer.

Meanwhile, in the US, the talking heads in mass media look dazed and bewildered that, perhaps, the US is entering "back into recession". Almost all of them have been brainwashed at the Keynesian alter and actually think the US economy has been "growing". The truth of the matter is that the US has been in a depression since 2000. It's an highly inflationary depression, however, and it has managed to fool the great majority. They still listen to government statistics that are fallacious, such as the GDP (see The GDP is a Fallacy). But if they just opened their eyes and could see through the fog of decades of brainwashing and propaganda, they'd see that the true US unemployment rate is probably closer to 23%, over 45 million people are in today's version of soup lines (now called food stamps) and the US stock markets, in real terms (gold), are down 90% from their highs in 2000.

The scary part, for everyone, is that this depression is just getting started and the more they try to "stimulate" the economy, the worse it will get.

The great bearded one, the one who centrally plans the US economy, Ben Bernanke, added one word into his speech (the word "significant") when talking about downside risks and the lemmings all rushed off the edge of the cliff. It's confusing as to why they would listen to anything Bernanke says. Besides the fact that he is the leader of a criminal money counterfeiting cartel he also has been almost shockingly wrong on every prediction or forecast he has ever made.

Almost everything sold off today... even taking down gold and gold stocks with it. Let's take a look at what kind of damage was done to the assets in our portfolio.

Gold is now down to where it was about a month ago. Nothing too serious. Although if it goes much lower it could break support and could see a return to the $1500s. Perhaps even $1450. If that happens we will be shouting from the rooftops to buy. However, we hold gold bullion mainly for safety and as a hedge and so it doesn't matter if gold does go down another $150 or up $150... it doesn't mean we'd be selling now in either case. All it means is that we'd be collecting pop bottles on the side of the road to buy more gold at $1500.

Now, the thing we hold with hopes of significant profits is gold stocks. Let's take a look at them today. First, the majors:

A noticeable swan dive. Yes, that's for sure. But, just like gold, it just takes us to where we were a month ago after a nice rally that lasted all summer. Could it go down to 500? Sure. Anything is possible. And, again, if it does, we'll be borrowing money from relatives to put into the market. But, we think the gold stocks can rise from here even if gold sits around $1600... they are still very undervalued.

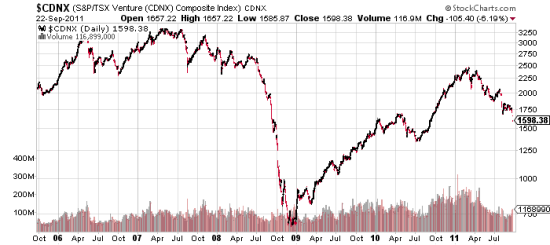

And, finally? Everyone is eyeing the juniors. We received a lot of email today saying how this is starting to feel a lot like 2008. Let's look at the TSX Venture Exchange (CDNX) which is a reasonable proxy for mining juniors. First, let's look at its chart since 2005.

The junior mining markets are the most volatile in the world and that is why we rarely have more than 15% of our entire portfolio in them... they can go up 1,000% but many of the stocks can also go to zero. This chart shows that as well as anything.

During the 2008 segment of the crisis, the TSX-V index fell from over 3,000 to under 700 in a span of a few months. It then more than tripled by March of this year and is off more than 30% since then. The question everyone is asking is if we are headed for that massive dive-bomb again this time around.

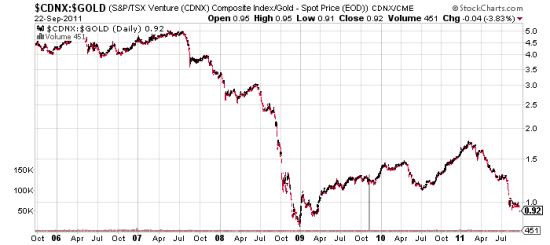

TDV subscribers know all of TDV Senior Analyst, Ed Bugos' past thoughts and research on this question and know that he is not expecting that. To add to Ed's analysis I submit this chart. This is a chart of the TSX Venture Index in terms of gold, not dollars.

This chart shows that in terms of gold, we are already near the 2008 bottom. And this at a time when gold has doubled in price in the same time frame, from $800 to over $1600. Can they still go lower? Sure. Anything can happen.

But, its more likely that they we will see 100%+ type gains over the next few months on the juniors. And, if the general public wakes up to what is going on, 1,000% and 10,000% gains aren't out of the question for certain juniors. Even just a return to where juniors were in 2007, versus gold, would entail a 500% pop.

Obviously we aren't yet at that point. But every day that central bankers try to paper over the obvious structural issues in their artificial, non-free market financial system we draw closer to a true gold stock mania.

This weekend Ed Bugos will have a full update to subscribers on what the action of this week portends and will look at opportunities to scoop up some gold mining stocks cheap. Subscribe to TDV today to keep abreast of all the action in the gold and gold mining shares and receive actionable info on how to take advantage of opportunities in the sector

Subscribe to TDV today (90 day moneyback guarantee) to access our Special Report on How to Own Gold as well as get complete access to our newsletter and portfolio selections.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.