Diversify Out of Gold, Silver Developing a Serious Problem

Commodities / Gold and Silver 2011 Sep 23, 2011 - 03:28 AM GMTBy: Ned_W_Schmidt

Captain of the ship spoke sternly to the Chief Steward, "Red chairs on the port side, and blue ones on starboard." Such started a typical, icy cold morning on the Titanic. We imagine that the Chairman of the Federal Reserve likewise spoke sternly this week to the committee, "We will buy some blue ones and sell some red ones."

Captain of the ship spoke sternly to the Chief Steward, "Red chairs on the port side, and blue ones on starboard." Such started a typical, icy cold morning on the Titanic. We imagine that the Chairman of the Federal Reserve likewise spoke sternly this week to the committee, "We will buy some blue ones and sell some red ones."

Operation Twist, the buying of long blue ones and selling short red ones, is both a frivolous academic plan of little practical value and an admission by the Keynesian-Elitist academics running the Federal Reserve that QE-1 and QE-2 were failures. Operation Twist also demonstrates that Keynesianism is indeed a dead ideology as it totally ignores the fundamental problem of the U.S. economy, over regulation by the tsarist government in Washington.

However, a significantly positive event did occur with the meeting of the U.S. FOMC. Four elected leaders of Congress put in writing to the Federal Reserve a stern warning against more irresponsible monetary policy. We should be "shouting from the rooftops" to celebrate such a glorious event. The time has arrived for a pragmatic look at the near mystic maneuvers of the Federal Reserve. We thank these individuals for being some of the few in Washington with a full measure of testosterone. However, they need to take some further steps.

The Sun should shine in on all meetings of the Federal Reserve. Those meetings should be held in public. The Federal Reserve should no longer be the secret and private preserve of the Keynesian-Elitists.

Second, membership on both Board of Governors and the FOMC should be limited to no more than two academics. Clearly, given the dismal performance over 20 years, we can no longer tolerate U.S. monetary policy being determined by intellectually inbred academics that think the world can be represented by simple, and naive, chalk board models.

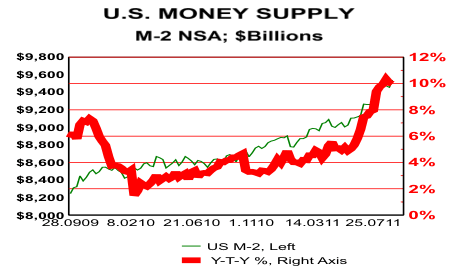

Ramifications of the past misjudgements of the Federal Reserve may now be evident, as shown in the above chart. In that chart is plotted, in red using right axis, the year-to-year percentage change of the U.S. money supply, M-2 NSA.

Clearly, the massive liquidity irresponsibly injected into the U.S. financial system by the Federal Reserve is now manifesting itself in far too rapid money supply growth. Monetary inflation in the U.S. is now running at 10%. How much higher it will rise we do not know. However, the massive liquidity remaining in the U.S. financial system is that proverbial "pig in a (monetary)python." Such is the longer term case for owning Gold. However, we must live in the short-term. As we have recently relearned, that can be painful.

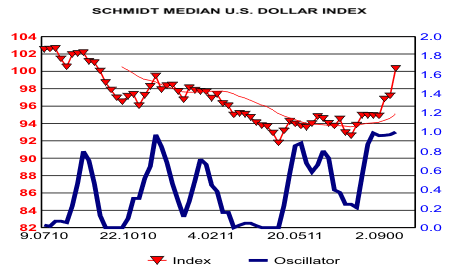

That difficulties exist in the financial system of the EU is well known. A consequence of that development has been a fear driven withdrawal of dollars from EU banks. Those withdrawals have caused both hoarding of dollars and a shortage of dollars. Rally in the value of the U.S. dollar caused by that shortage of dollars is self evident in the graph above. Gold, as a currency, is doing such as others during this dollar rally.

Some had not yet covered their dollar shorts as they were convinced that QE-3 was imminent, and would certainly arrive on 21 September. On Wednesday they discovered that QE-3 was not going to be their savior, and they covered. Now the rampage will feed on itself for a while

As the structural faults of the Federal Reserve, and most central banks, remain, retaining Gold positions can be well justified. We should though throw out those frivolous forecasts of $2,500 or $5,000 Gold. Latter might happen, but not in a time frame relevant if one has any grey hair. Diversifying that Gold portfolio with Chinese Renminbi denominated assets, perhaps some Rhodium, or agricultural land might be wise. On the latter see 5th Annual U.S. Agricultural Land As An Investment Consideration - 2011.

Silver is developing a serious problem. 200-day moving average is ~$36.50. A move through that level has happened as we write. 200-day moving average should now be converted from a floor to a ceiling. Silver remains a sale candidate when above our sell price. Price of Silver should ultimately bottom next year in the teens. Sale proceeds should be directed to Rhodium or Chinese Renminbi denominated deposit accounts.

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.