Stock Market Important Juncture Looming?

Stock-Markets / Stock Markets 2011 Oct 02, 2011 - 03:38 AM GMT They ended pretty much flat for the week, although I was expecting a move towards the 55 or 63ES, area, the actual bounce was far stronger than I initially thought.

They ended pretty much flat for the week, although I was expecting a move towards the 55 or 63ES, area, the actual bounce was far stronger than I initially thought.

Another crazy week of whipsaw, this particular week just gone was some of toughest price action I have seen in a while, loads of crazy wild swings, made trading the range treacherous to say the least, a tough week.

With short squeezes and overnight gap ups, the tape is starting to resemble the 2008 analogy, a very dangerous market.

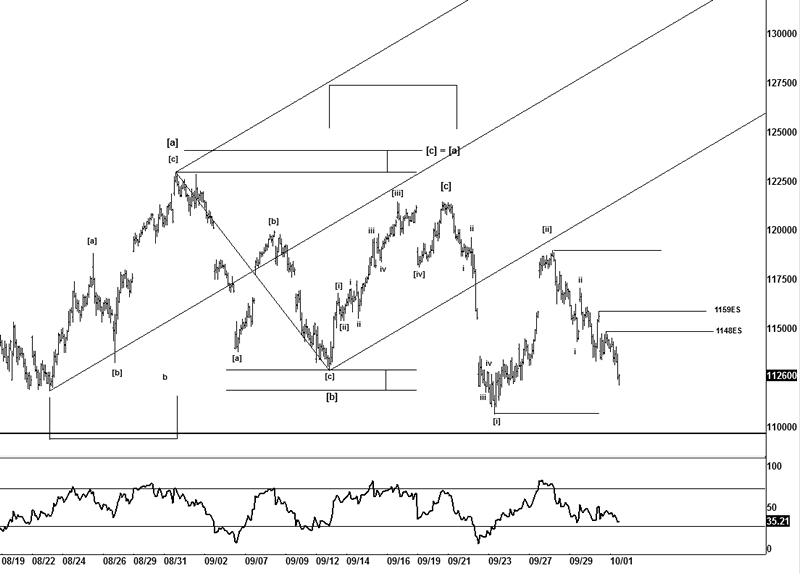

That being said, if you pull away from the whipsaw, you can see that this is a real battle ground, but slowly the bounces are still putting in lower highs against the down trend, so the down trend is still in force, and the bulls are slowly loosing the fight.

With the range the markets are stuck in, the whipsaw is making ideas change on a daily basis, although we still do have a couple of tricks up our sleeve, should the market want to pull a rabbit out of the hat going into next week.

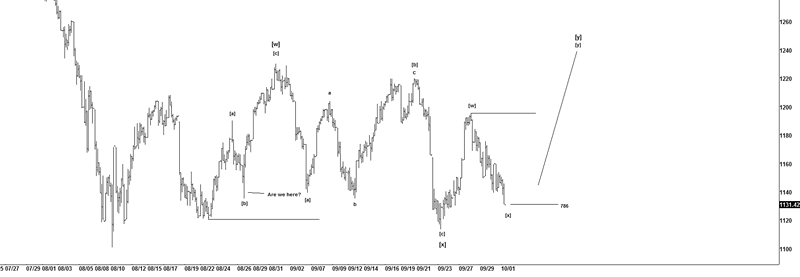

One such idea is that the market makes a short term low early next week around the 1120SPX area, and sets up for an aggressive move higher, although it feels like it wants to puke next week, I am reminded of the previous short squeezes that we saw, and they literally came from nowhere, although we had been expecting a bounce on all 3 rallies, the strength and speed still blows me away.

That being said, this idea will need to put in a low early next week ideally Monday.

Now the alternate is something I think many won't be prepared for and the markets go into a selling spiral that will likely take many by surprise, but we have some key areas, that if the market can't find its way above, we will be getting short, as the potential result could be a move like we saw in the fall of 2008, and huge decline.

So we eagerly wait next week to see which of our ideas get confirmed next week, so we can jump on the trend.

The decline this week has been anything but impulsive looking, hence we are keeping some options open for a vicious short squeeze that could see the 1230SPX highs tested again, although if the market can't get itself back above our key #47ES area, the market can be in trouble real fast.

Sundays open likely to be a valid clue, if the market starts to get itself under the 1113ES area. That can open the trap door for an extensive rout of selling, especially if Asian and European markets follow through with the US move on Friday.

However there are some important clues that I have noticed and could be potentially signaling the markets intentions to rally.

Risk markets

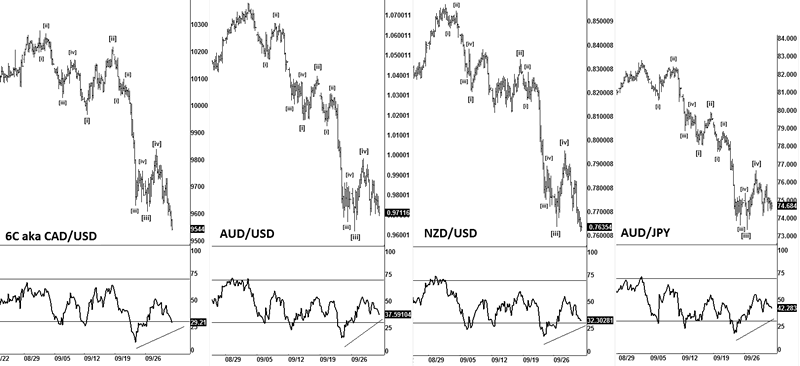

Readers of my articles will likely be aware of the term I have used called risk markets, you have probably even heard the term risk on risk off etc.

Well I follow a selection of FX markets that track the ES mini futures; I call this group the FX risk markets. Basically it's a set of FX markets that we track that offer edges to the ES mini futures and US markets.

I have mentioned it many times in these articles; traders that are not following the FX markets are missing out in a huge area of the markets that can offer a substantial edge in the current markets.

Not only can they offer great looking setups, they also can offer clues to the stocks markets.

Although this was posted to members a few hours before the close on Friday, the point of this chart is to show that from the beginning of September, we have what appears to be a 5 wave sequence potentially coming to an end.

Note: price has pushed a little lower than what is shown here, but the idea is that we are looking at a potential trend change short term, as I think we are nearing to a 5 wave decline.

So if the risk FX markets that I track are suggesting a potential end to the current trend and exhaustion nearing, that paves the way for a rally in "risk"

If we have some markets that suggest a rally in risk, then we can expect the ES and stock markets to rally as well.

With sentiment fearing the worst on the Greece news, the conditions are there for another short squeeze, although there is a lot of news coming out this week.

In order for the bears to really see a substantial sell off, the FX markets will need to kill off these ideas shown here.

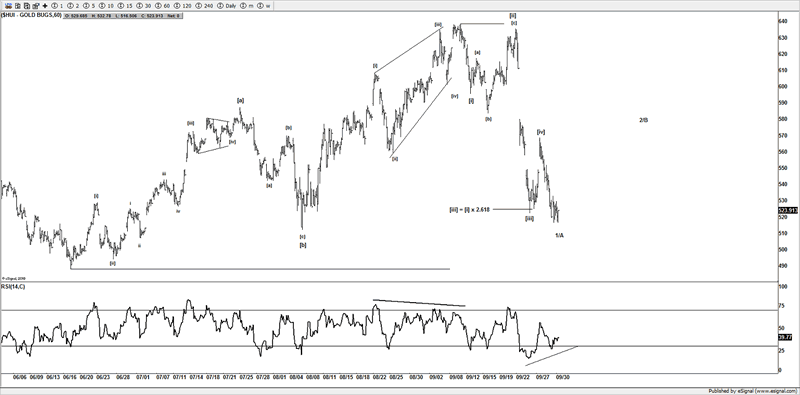

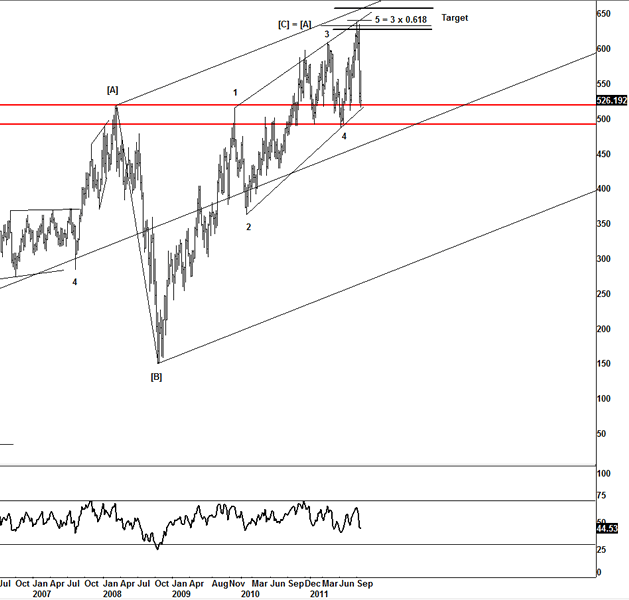

HUI

Once such market that suggests a low could be near is the HUI, with what I think is a 5 wave decline near completed or even in place, a bounce could see back to the 580 area.

What's the importance of the 5 wave decline?

Well for Elliotticians we look for a 5 wave move after a trend has exhausted, in the case of the HUI, a 5 wave move off a completed wave count helps us confirm that the trend may have indeed turned, so we could see a bounce potentially towards the 580 area, with the 1st touch of the red line support, I do suspect a bounce could be seen, if that bounce is corrective looking, then it sets up a larger move lower than will likely take out the red support around 500.

Conclusion

Although there is a very real risk of a substantial sell off in the US markets, it will need to see some heavy price downside to confirm that idea and see weak bounces, we are monitoring a potential trap to see if the market pulls a rabbit out of hat again, as the sentiment is back to where it has seen substantial short squeezes, if our areas above get eclipsed on the upside, I again suspect the shorts will need to cover having got squeezed numerous times before, that will be the fuel for higher prices.

It should be a great week next, and I am sure the media will be bring out the crash talk being October and all, crash or no crash, we don't care as long as it makes sense and we can count it we will trade it.

Until next time.

Have a profitable week ahead.

Click here to become a member

You can also follow us on twitter

What do we offer?

Short and long term analysis on US and European markets, various major FX pairs, commodities from Gold and silver to markets like natural gas.

Daily analysis on where I think the market is going with key support and resistance areas, we move and adjust as the market adjusts.

A chat room where members can discuss ideas with me or other members.

Members get to know who is moving the markets in the S&P pits*

*I have permission to post comments from the audio I hear from the S&P pits.

If you looking for quality analysis from someone that actually looks at multiple charts and works hard at providing members information to stay on the right side of the trends and making $$$, why not give the site a trial.

If any of the readers want to see this article in a PDF format.

Please send an e-mail to Enquires@wavepatterntraders.com

Please put in the header PDF, or make it known that you want to be added to the mailing list for any future articles.

Or if you have any questions about becoming a member, please use the email address above.

If you like what you see, or want to see more of my work, then please sign up for the 4 week trial.

This article is just a small portion of the markets I follow.

I cover many markets, from FX to US equities, right the way through to commodities.

If I have the data I am more than willing to offer requests to members.

Currently new members can sign up for a 4 week free trial to test drive the site, and see if my work can help in your trading and if it meets your requirements.

If you don't like what you see, then drop me an email within the 1st 4 weeks from when you join, and ask for a no questions refund.

You simply have nothing to lose.

By Jason Soni AKA Nouf

© 2011 Copyright Jason Soni AKA Nouf - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.