The S&P Goes - So Goes SPXU and UPRO

Stock-Markets / Stock Markets 2011 Oct 24, 2011 - 12:00 PM GMTBy: George_Maniere

Above my desk I have a big sign that says “the market will always do what the market has always done, misdirect, confuse and confound.” The way the S&P has been behaving since August is proof perfect that this slogan is as true as ever.

Above my desk I have a big sign that says “the market will always do what the market has always done, misdirect, confuse and confound.” The way the S&P has been behaving since August is proof perfect that this slogan is as true as ever.

For those of you not conversant with the Ultra Pro Shares ETFs Pro Shares Ultra Pro S&P 500 (UPRO) is a triple leveraged fund that seeks a 300% return on the performance of the S&P for a single day. Conversely, The Pro Shares Ultra Pro Short S&P 500 (SPXU) seeks a triple leverage or 300% return on the inverse performance of the S&P 500.

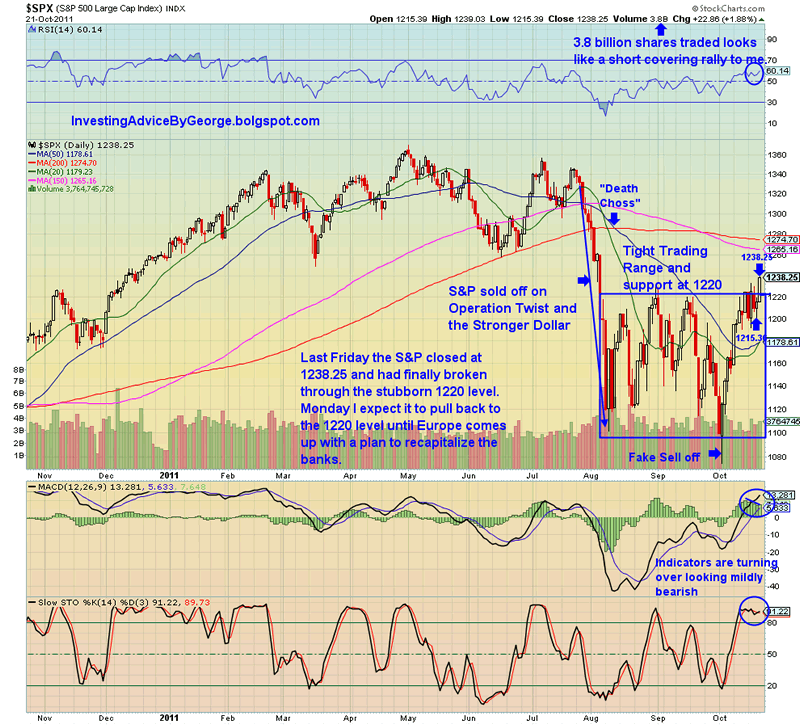

For those of you that read me on a regular basis you know that I was certain back in August that the S&P would break the support line of 1100 and from there would go to 1050 / 1020 and if things got very tight it would go to 960. On October 3rd I was sure that I would be right as I watched the S&P break the 1100 support and hit an intraday low of 1078 before closing at 1100. One or two more days of trading below 1100 would confirm my thesis and I would add to my already overweight position of SPXU. Well I was wrong. Two days at 1100 on the S&P and it began its march up and I was forced to sell at about 1140 and admit that I had been fooled again. Let’s take a look at the chart below.

As this chart will show the S&P kept its march up and about two weeks ago it formed a consolidation area between 1200 and 1220. There it remained for several weeks. The S&P attempted to continue to consolidate last week as it traded sideways in the $1200-$1220 range. On Friday the S&P 500 closed the week out at the highest prices it has seen since the decline that began in August. Buyers, however, remained impatient and only allowed a week or two of rest. This is a good show of strength as the S&P could have easily experienced a deeper pullback and still remained healthy. While I believe the S&P will need to take a more extended breather, (especially with the uncertainty from Europe) it may make a run towards $1260-$1270. This is a key level to watch in the near term as it marks a prior support level from June and the approximate area of the 200-day moving average. If it breaks through the 200 DMA we will rally to the end of the year. While S&P still has plenty of overhead resistance, the rally from its recent lows has been staggering.

In conclusion, I think that Fridays rally to 1138 was less of a rally and more of a short covering. I expect to see a pullback to the 1220 level today but there are other factors involved.

According to the Wall Street Journal, European leaders are nearing agreement on a plan that would see the region's banks raise around €100 billion ($139 billion) in fresh capital, said three people familiar with marathon talks taking place here on Sunday.

I must interject that the great Jesse Livermore taught us that it is not the news that means anything it is how the market reacts to the news that is important.

The bank-recapitalization plan is the easiest piece of a three-pronged bargain that the 17 euro-zone nations are hoping to reach during meetings that began Sunday and will continue through at least Wednesday. There remain disagreements on the other two measures—steps to boost the firepower of the bloc's €440 billion bailout fund and, critically, to deal with Greece's spiraling public debt through a complex restructuring.

German Chancellor Angela Merkel, left, walks with IMF Managing Director Christine Lagarde, center, and ECB President Jean-Claude Trichet during a roundtable meeting of euro-zone members at an EU summit in Brussels on Sunday.

European Union finance ministers discussed the bank plan during a 10-hour session on Saturday. Swedish Finance Minister Anders Borg said on his way out of the meeting they had agreed to the foundations of a plan. Today will be a very interesting day.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.