Silver Wheaton Triples Dividends Despite Lower Than Expected Earnings

Commodities / Gold & Silver Stocks Nov 10, 2011 - 02:02 AM GMTBy: Bob_Kirtley

Silver Wheaton Corporation (SLW) has released its financial results for the third quarter, however, earnings of $0.38 per share missed the consensus of $0.50 by $0.12 of the 9 analysts covering this company. To deliver lower than expected results is rarely received well by the investment community and so the expectation now is for SLW to sold off to some extent. However, this aberration, if we may call it that, is being viewed in isolation and creates an impression that Silver Wheaton has somehow lost its way.

Silver Wheaton Corporation (SLW) has released its financial results for the third quarter, however, earnings of $0.38 per share missed the consensus of $0.50 by $0.12 of the 9 analysts covering this company. To deliver lower than expected results is rarely received well by the investment community and so the expectation now is for SLW to sold off to some extent. However, this aberration, if we may call it that, is being viewed in isolation and creates an impression that Silver Wheaton has somehow lost its way.

We will now suggest the 'unthinkable' what if this group of analysts have got it wrong!

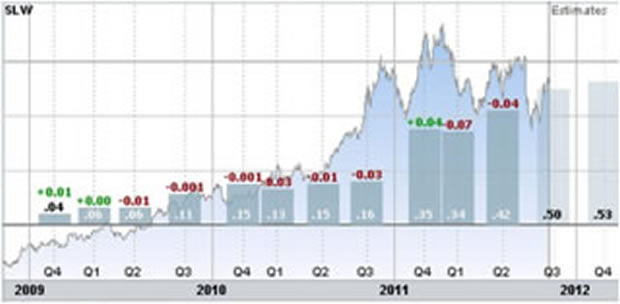

If we stand back and take a look at their estimates since the first quarter of 2009, we can see that they have over estimated earnings on 9 out of 11 attempts and have only been correct once. As retail investors we should learn to view these estimates for what they are, opinions of mere mortals, just like you and I. There is no substitute for doing your own 'due diligence' in order to raise your own comfort and confidence levels when undertaking any investment. If we take a look at the table below we can see that the estimates for the next quarter are standing at $0.50.

Given what we now know, it might be more appropriate to lower our expectations to around the $0.40 mark, in order not to be too disappointed if the analysts estimates are missed once again.

And now for some good news: Dividends!

Silver Wheaton has announced that it has adopted a new dividend policy that links quarterly dividend payments to operating cash flows in the prior quarter.

Commencing immediately, the quarterly dividend per common share will be equal to 20% of the cash generated by operating activities in the previous quarter divided by the Company's outstanding common shares at the time the dividend is approved, all rounded to the nearest cent.

Based on the new policy, its fourth quarterly cash dividend for 2011 will be US$0.09per common share. The quarterly dividend will be paid to holders of record of its common shares as of the close of business on November 23, 2011, and will be distributed on or about December 5, 2011.

We see this move as a step in the right direction and hope that the Board of Directors continues to improve the rewards for loyal investors.

The Highlights for the Third quarter are as follows:

Attributable silver equivalent production increased slightly compared with Q3 2010, to 6.1 million ounces (5.9 million ounces of silver and 5,100 ounces of gold).

- Revenue doubled compared with Q3 2010, to US$185.2 million, on silver equivalent sales of 5.1 million ounces (4.8 million ounces of silver and 6,300 ounces of gold).

- Net earnings increased 96% compared with Q3 2010 (on an adjusted basis1), to US$135.0 million (US$0.38 per share).

- Operating cash flows more than doubled compared with Q3 2010, to US$167.2 million (US$0.47 per share1).

- Cash operating margin1 more than doubled compared with Q3 2010, to US$32.11 per silver equivalent ounce, demonstrating Silver Wheaton's leverage to increasing silver prices.

- Average cash costs of US$4.121 per silver equivalent ounce.

- Quarter-end cash balance of US$715.6 million, with a net cash position of US$629.9 million.

- Third quarterly dividend for 2011 of US$0.03 per common share was paid.

"Another quarter of increased silver equivalent sales, along with strong silver prices, produced solid financial results," said Randy Smallwood, Silver Wheaton's President and Chief Executive Officer. "During the quarter, several of our partners' mines continued their focus on ramping up silver production, including Goldcorp's Peñasquito mine, which had record throughput levels in the month of September. As a result, we remain confident of achieving our 2011 production guidance of between 25 and 26 million silver equivalent ounces."

"The Company's operating cash flows more than doubled, despite sales continuing to lag production, which was primarily the result of concentrate inventory build-up at Glencore's Yauliyacu mine in Peru. However, in 2012, Glencore anticipates a more consistent schedule of concentrate deliveries, which should result in more regular silver deliveries to Silver Wheaton."

"Our Company's ability to consistently deliver amongst the highest cash operating margins in the precious metals industry, a direct result of our model of essentially fixed operating cash costs, continues to result in significant cash flow generation, particularly in the current environment of strong silver prices. Cash flows will be used to continue making accretive silver stream acquisitions and to return capital to our shareholders in the form of sustainable dividend growth. To this end, we are pleased to have recently amended our dividend policy, which now links to operating cash flows, and has resulted in a tripling of our current dividend."

"In recent months, the resurgence in global economic turmoil has resulted in tighter debt and equity markets, negatively impacting advanced exploration and development stage mining companies' access to project financing. Silver Wheaton is in a unique position to assist these companies with their growth goals by providing a value-enhancing source of capital through silver stream transactions. As such, our Corporate Development team continues to aggressively pursue high-quality and low-risk silver stream opportunities from around the globe, in order to further expand our sector leading production growth profile."

Our opinion is that the above suggests that more deals are in the pipeline, so it will be interesting to see if their management team can complete deals on favourable terms, we will watch this with great interest.

Revenue was US$185.2 million in the third quarter of 2011, on silver equivalent sales of 5.1 million ounces (4.8 million ounces of silver and 6,300 ounces of gold). This represents a 100% increase from the US$92.8 million in revenue generated in the third quarter of 2010, due primarily to increases in the average realized selling price of silver and gold of 87% and 26%, respectively.

Average cash costs in the third quarter of 2011 were US$4.12per silver equivalent ounce, compared with US$4.09 during the comparable period of 2010. This resulted in cash operating margins of US$32.11 per silver equivalent ounce, a 104% increase compared with the third quarter of 2010, demonstrating Silver Wheaton's leverage to increasing silver prices. (Average cash cost of silver and gold on a per ounce basis is calculated by dividing the cost of sales by the ounces sold. In the precious metals mining industry, this is a common performance measure but does not have any standardized meaning. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance and ability to generate cash flow.)

Silver Wheaton is the largest silver streaming company in the world. Based upon its current agreements, forecast 2011 attributable production is 25 to 26 million silver equivalent ounces, including 15,000 ounces of gold. By 2015, annual attributable production is anticipated to increase significantly to approximately 43 million silver equivalent ounces, including 35,000 ounces of gold. This growth is driven by the Company's portfolio of world-class assets, including silver streams on Goldcorp's Peñasquito mine and Barrick's Pascua-Lama project.

Our price target for Silver Wheaton Corporation has been $100.00 for some time now and we see no reason to change it.

Silver Wheaton Corporation has a market capitalization of $12.78Bln, a 52 week low of $25.84 and a high of $47.60, average volume of shares traded is between 6.78Mln and 7.96Mln, so the liquidity is good, it also has an EPS of $1.01.

Silver Wheaton Corporation trades on both the NYSE and the TSX under the symbol of SLW.

For disclosure purposes we do own this stock and it currently forms the largest part of our core position in the silver market, so we do have a bias towards them which you should bear in mind.

In terms of expectations in general, volatility is about to be turbo-driven as the mess in Europe starts to unravel, so take great care of yourselves.

Chin up and have a good one.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.