Gold, Silver, Dollar, Stocks and Crude Oil Trend Forecasts

Stock-Markets / Financial Markets 2011 Dec 15, 2011 - 05:59 AM GMTBy: Chris_Vermeulen

It’s that time of year again and I’m not talking about the holiday season… What I am talking about is another major market correction which has been starting to unfold over the past couple weeks.

It’s that time of year again and I’m not talking about the holiday season… What I am talking about is another major market correction which has been starting to unfold over the past couple weeks.

I have a much different outlook on the markets than everyone else and likely you as well. However, before you stop reading what I have to say hear me out. My outlook and opinion is based strictly on price, volume, inter-market analysis, and crowd behavior and you should put some thought as to what I am saying into your current positions.

My fundamental thinking is also a contrarian one. I feel that gold and silver have risen because of obvious reasons being printing of money but also fears that fiat currenecies will become obsolete in the next 5 years.

The problem with that thinking is that most or all the bad news has come out with Europe and we know there are still major issues to resolve but the end of the world did not happen. Looking forward 5 years countries will have stopped acting like teenagers spending more money they they have on their credicards and start creating budgets which they will abide by.

What does this mean? It means the global economy as a whole will be stronger than ever before. We may have a few bumps along the way but I feel countries and individuals will be better than ever 5 years from now

Two weeks ago I sent my big picture outlook to my subscribers, followers, and financial websites warning of a major pullback. You can take a quick look at what the charts looked like 2 weeks ago: The Currency War Big Picture Analysis for Gold, Silver & Stocks

Since my warning we have seen the financial markets fall:

SP500 down 2.6%

Crude Oil down 4.4%

Gold down 9.6%

and Silver down 12.2%

If you applied any leverage to these then you could double or triple these returns through the use of leveraged exchange traded funds. The amount of followers cashing in on these pullbacks has been very exciting to hear. The exciting part about trading is the fact that moves like this happen all the time so if you missed this one, don’t worry because there is another opportunity just around the corner.

While my negative view on stocks and precious metals will rub the gold and silver bugs the wrong way, I just want to point out what is unfolding so everyone sees both sides of the trade. I also would like to mention that this analysis can, and likely will change on a weekly basis as the financial markets and global economy evolves over time. The point I am trying to get across is that I am not a “Gloom and Doom” kind of guy and I don’t always favor the down side. Rather, I am a technical trader simply providing my analysis and odds for what to expect next.

Let’s take a look at some charts and dig right in…

Dollar Index Daily Chart:

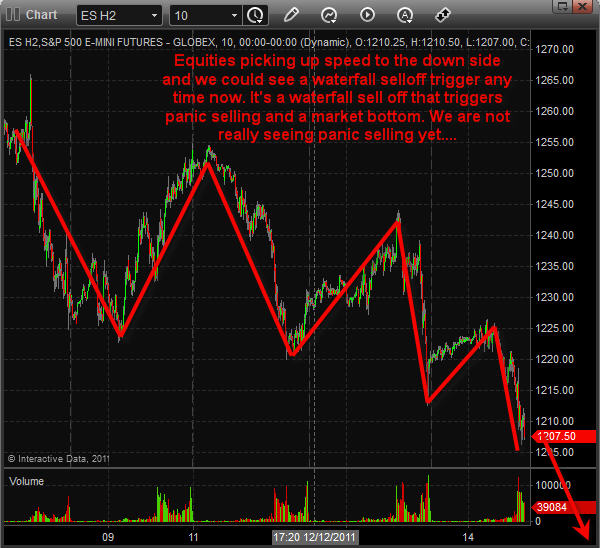

SP500 Futures Index Daily Chart:

Silver Futures Daily Chart:

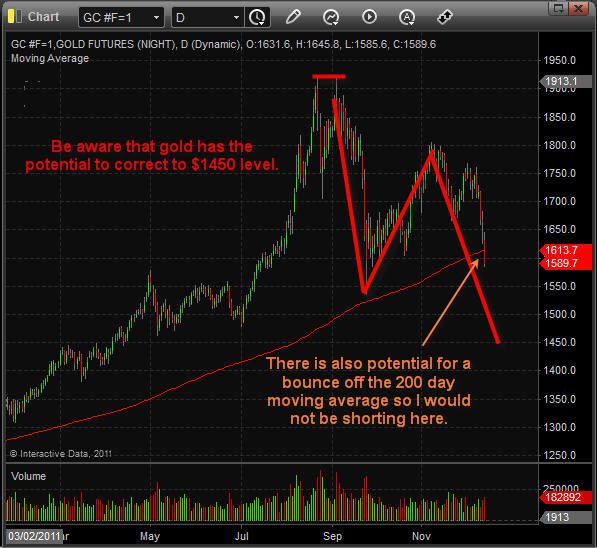

Gold Futures Daily Chart:

Crude Oil Futures Daily Chart:

Mid-Week Market Madness Trend Analysis Conclusion:

In short, stocks and commodities are under pressure from the rising dollar. We have already seen a sizable pullback but there may be more to come in the next few trading sessions.

Overall, the charts are starting to look very negative which the majority of traders/investors around the world are starting to notice. With any luck they will fuel the market with more selling pressure pushing positions that my subscribers and I are holding deeper into the money.

Now that the masses are starting to get nervous and are beginning to sell out of their positions, I am on high alert for a panic washout selling day. This occurs when everyone around the world panics at the same time and bails out of their long positions. Prices drop sharply, volume shoots through the roof, and my custom indicators for spotting extreme sentiment levels sends me an alert to start covering my shorts and tightening our stops.

Hold on tight as this could be a crazy few trading sessions….

I hope this report helped shed some light on the current market condition for you. Remember you can Get my daily pre-market trading videos, intraday updates , and trade alerts with my premium newsletter: www.TheGoldAndOilGuy.com

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.