Google and the Death of Privacy

Politics / Social Issues Mar 02, 2012 - 08:21 AM GMTBy: Jeff_Berwick

You may or may not be surprised to hear this but I am not a big "privacy buff". You've probably noticed this as I've regularly detailed the minutiea of my personal life here for a number of years. I'm certainly not one of those who would protest against Google StreetView for taking photos of public locations. Take all the photos you want, Google.

You may or may not be surprised to hear this but I am not a big "privacy buff". You've probably noticed this as I've regularly detailed the minutiea of my personal life here for a number of years. I'm certainly not one of those who would protest against Google StreetView for taking photos of public locations. Take all the photos you want, Google.

In fact, if it weren't for government, I wouldn't care about privacy much at all. I want companies to know everything they can about me so they can constantly target their products to my exact preference. If they did that then maybe I'd get a few less spams for discount Viagra every day and a few more for 90% female occupied anarcho-capitalist seastead condo offers. However, I suppose, in that case, I'd then need the Viagra.

But, the problem with privacy arises, as with almost all things, with government. Governments are thieving, criminal organizations who falsely presume to have some right to own you and your property just because you had the misfortune to be born in the particular geographic area where they run rampant. They are extortionists. And it makes sense to avoid giving extortionists any more info than possible about yourself and your assets for fear of even further theft.

But, here is the bad news for all you privacy buffs. Privacy is dead.

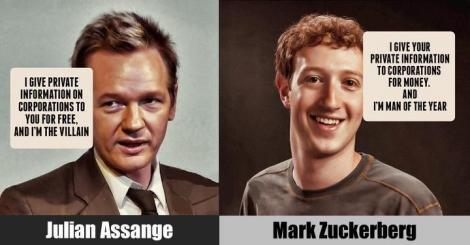

It already had one foot in the grave with the rise of the Big Brother state, but now thanks to the internet, it's deader than Aunt Edna on top of the Griswald's Wagon Queen Family Truckster. Facebook alone has almost negated the need for the FBI and CIA surveillance infrastructure completely as was detailed in this Onion spoof which is mostly just funny because it is true.

And with western governments stealing about half of your income and using a sizeable part of that loot to track you at every turn, privacy is mostly a lost cause. Sure there are ways to encrypt your communications to thwart them somewhat (which is something we'll have more info on soon), but for the most part you should consider your financial affairs to be mostly public domain, at least as far as your government is concerned, if you live in the western surveillance states.

IT'S NOT JUST AMERICANS ANYMORE

Those who have been paying attention already know that Americans are the most globally enslaved people in history. We know of not one brokerage on Earth outside of the US that accepts US clients. And the recently passed Foreign Accounts Tax Compliance Act (FATCA) has all but ensured that most international banks will soon stop accepting Americans as clients for bank accounts also.

What may come as a surprise, but shouldn't, is that all the other western nation-states are following along right behind. Most of the European nations including the UK, France, Germany, Spain and more have all begun to enter into inter-governmental information sharing agreements.

In other words, even having a foreign bank account now will give you no privacy against your own government.

TWO SOLUTIONS

In this respect there are really only two solutions if you want to keep any level of privacy or control of your assets.

One is to keep your assets outside of the financial system as much as possible. This can be done to an extent via keeping your assets in precious metals, strategically deposited at non-financial institutions worldwide. In this regard, The Dollar Vigilante will be releasing an 80+ page Special Report called "Get Your Gold Out of Dodge" in early March with in depth information on how to international your precious metals.

The other way to keep some level of privacy from your own government is to get a second passport. In this way you can open financial accounts worldwide that will not be directly reported to your "home" government. Again, we offer a few different ways to get a foreign passport with varying levels of costs or time frames. Contact us at DRPassports@dollarvigilante.com for more.

PASSPORTS & GOLD AREN'T JUST FOR 007 ANYMORE

Getting a second passport and placing gold and silver in foreign places like Switzerland and Singapore used to be considered in the realm of James Bond. But, no longer.

Today, for anyone who has any assets they wish to keep private or protect from government theft the only sane and rational thing to do is to follow some of the advice listed above because western governments have no limit to how far they will spend and how much they will confiscate from you to pay for their welfare, wars and payola. To them, the world is not enough and your financial affairs are not for your eyes only.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2012 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.