Greece Stock Market, The Real Contrarian Investing Play?

Stock-Markets / European Stock Markets Jun 11, 2012 - 04:52 AM GMTBy: Willem_Weytjens

It might sound CRAZY when I say that Greek stocks could become a good LONG TERM investment soon.

It might sound CRAZY when I say that Greek stocks could become a good LONG TERM investment soon.

However, from a real contrarian point of view, it might not be that crazy.

Here’s why.

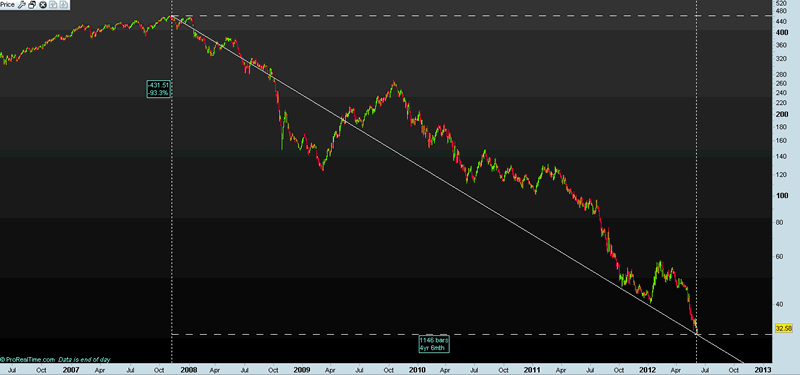

The Greek stock market has lost 93.3% from its top in late 2007 to its recent low. Yes that’s correct: 93.3%!

Chart: Prorealtime.com

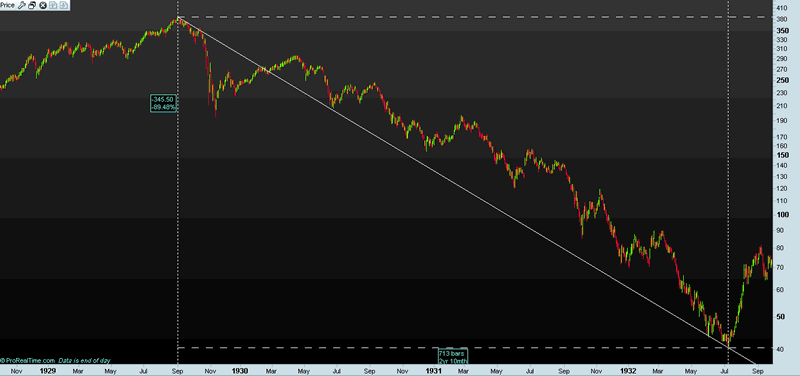

When we look at the Dow Jones in 1929, we can see a similar move: From the top in 1929 to the bottom in 1932, the Dow Jones lost 89.48%… So Greece has declined even more than the Dow Jones in the GREAT DEPRESSION!

Chart: Prorealtime.com

When we overlay both charts, we see striking similarities between the two indices:

Chart: Prorealtime.com

So if this pattern holds, we could expect the Greek market to drop another 30% before a MAJOR turn takes place (perhaps a “GREXIT” (referring to a Greek Exit of the Eurozone) combined with a huge devaluation of the new “Drachma”? This would boost Greek exports and could be the beginning of the end of the Greek mess…

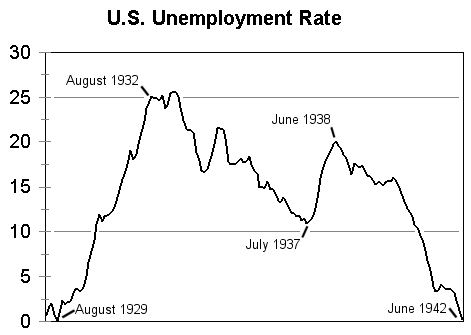

Greece’s unemployment shot up to 21.9 per cent in March, rising sharply from the 15.7 per cent rate in March 2011 and up from 21.4 per cent in February.

So yes, it looks like “Hellas” is going to “Hell”

However, when we have a look at the Unemployment in the US during the Great Depression, we can – again – see striking similarities:

Let’s think positive: How much worse can it get than during the Great Depression?!?

Greece is missing €60 Billion in taxes. Is that good news No, Maybe not the fact that it is MISSING it, but imagine if Greece could suddenly collect all (or part of) these taxes and invest it in the Economy!

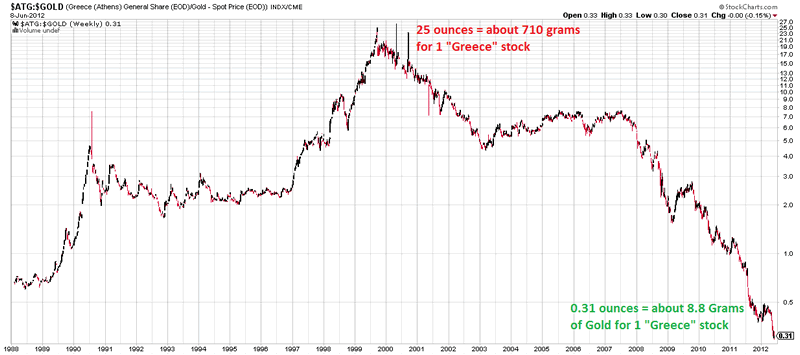

Now how “badly” did Greek stocks perform actually?

Let’s have a look at some ratios:

“Greece” measured in Gold shows us that in 1999, people were willing to give 25 ounces of Gold for 1 “Greece” stock. Now they are only willing to give 0.31 ounces for that same stock. Clearly times have changed…

Chart: stockcharts.com

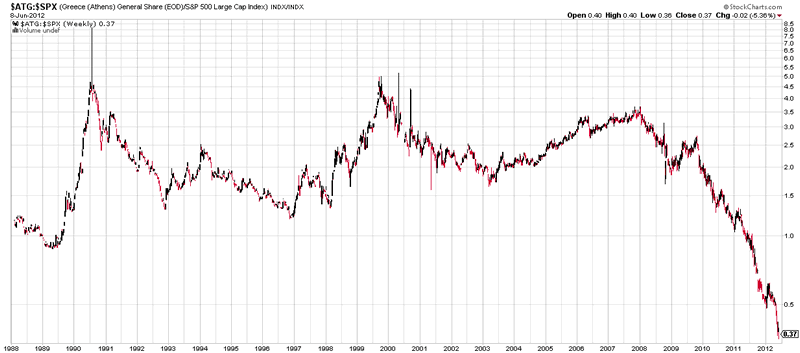

Greece vs the SP500: only 0.37 shares of the SP500 needed to buy 1 “Greece” stock, versus an historical average of around 1.5-2 stocks…

Chart: stockcharts.com

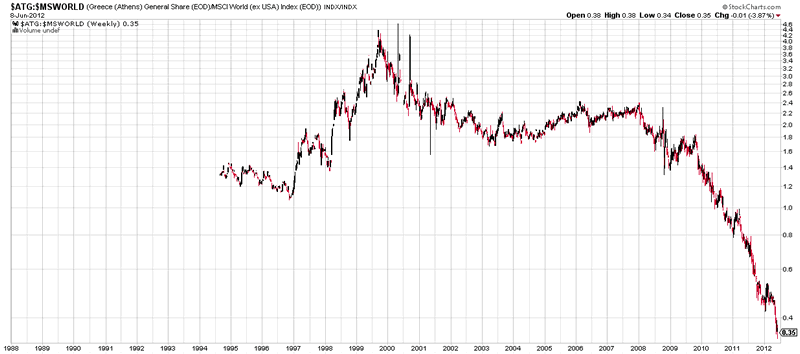

Greece vs the MSCI World index (excl. USA): showing a dramatic underperformance:

Chart: stockcharts.com

Now let’s have a look at Greece vs the other “PIIGS”:

Greece vs Spain: 0.075 “Spain” shares needed to buy 1 “Greece” stock vs an historical average of 0.3 shares…

Chart: stockcharts.com

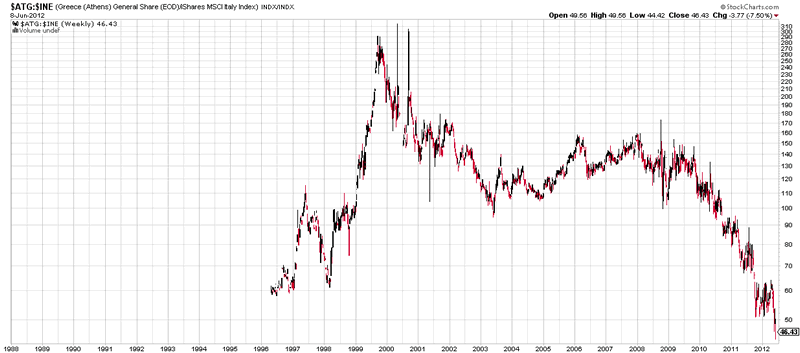

Greece vs Italy: 50% below the historical average:

Chart: stockcharts.com

Now let’s have a look at Greece’s neighboring country Turkey:

This looks like a “Pennystock” doesn’t it?

Chart: stockcharts.com

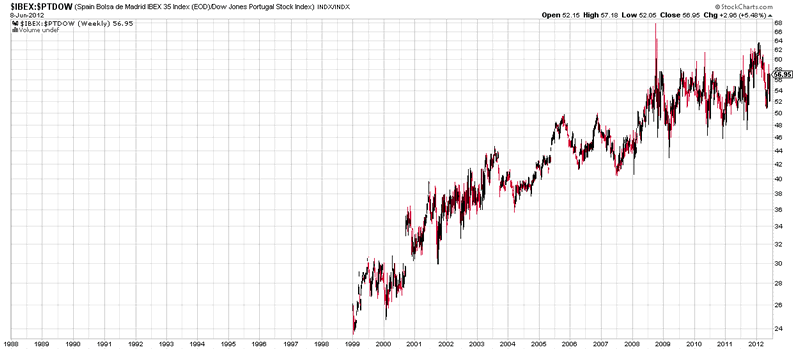

Speaking about neighboring countries, please have a look at this stunning chart of Spain vs Portugal:

Looks like a lot of money has been made going Long Spain, Short Portugal:

Chart: stockcharts.com

One thing is sure, Greece won’t “disappear”. There will always be people living in Greece. This means that there will always be a Greek Economy. Sure it can change dramatically, and will unlikely be the same as it was 10 years ago, but one day or another Greece will start to grow again.

When that day comes, the Greek market will have rallied by several %. It’s always hard to catch a falling knife as you never know where the bottom will be, but one thing is sure: compared to the rest of the world, Greece looks like a nice opportunity to me for contrarians.

There’s only one catch here: If you buy stocks now and Greece devaluates its currency (after exiting the Eurozone), you could lose sh*tloads of money due to the currency devaluation.

Therefore, I will wait until the moment that that happens. That day, I will buy the HELL out of HELLAS stocks…

I wonder if there will be other “contrarians” (the John Templeton-likes) who will follow me…

I have decided to only accept new subscribers until June 30th. From then on my services will be open to existing subscribers ONLY. To secure your membership now, visit www.profitimes.com and subscribe now!

Willem Weytjens

www.profitimes.com

© 2012 Copyright Willem Weytjens - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.