Reasons Why U.S. Recession Has Arrived (Or Will Shortly)

Economics / Double Dip Recession Jun 22, 2012 - 03:07 AM GMTBy: Mike_Shedlock

I am amused by the Shadow Weekly Leading Index Project which claims the probability of recession is 31%. I think it is much higher.

I am amused by the Shadow Weekly Leading Index Project which claims the probability of recession is 31%. I think it is much higher.

When the NBER, the official arbiter of recessions finally backdates the recession, May or June of 2012 appear to be likely months. Let's take a look at why.

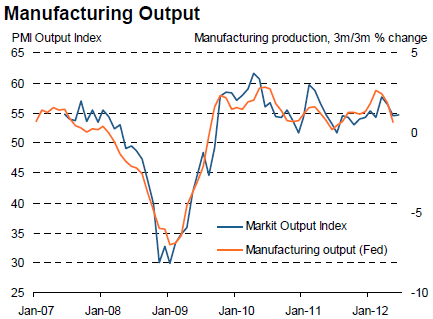

US Manufacturing PMI

Markit reports PMI signals weakest manufacturing expansion in 11 months

Key points:

- PMI lowest since July 2011, suggesting slower rate of manufacturing expansion

- Rate of output growth broadly unchanged

- New orders rise at weakest pace in four months

- Input costs fall for first time in three years

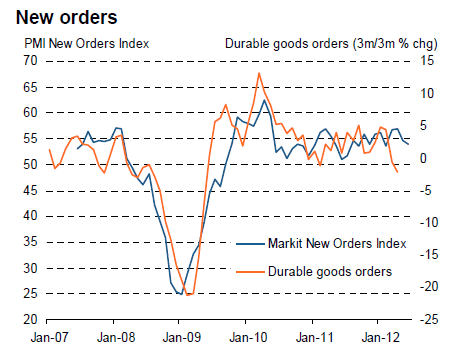

Durable Goods Orders Plunge

Those numbers do not look good but they are hardly disastrous. Here are some numbers that are disastrous.

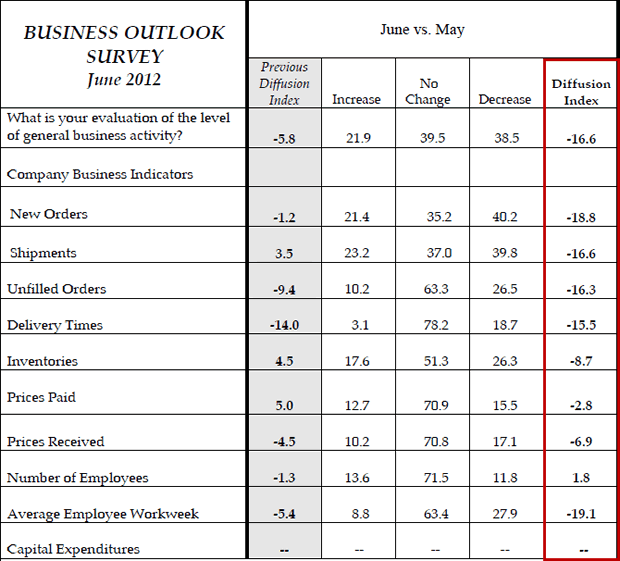

Philly Fed Survey

For the second consecutive the Philly Fed Survey has been solidly in the red.

Those numbers are nothing short of a disaster.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, fell from a reading of -5.8 in May to -16.6, its second consecutive negative reading. Nearly 40 percent of the firms reported declines in activity this month, exceeding the 22 percent that reported increases in activity.Indexes for new orders and shipments also showed notable declines, falling 18 and 20 points, respectively. Indexes for current unfilled orders and delivery times both registered negative readings again this month, suggesting lower levels of unfilled orders and faster deliveries.

Firms' responses suggest steady employment this month but shorter hours. The percentage of firms reporting higher employment (14 percent) edged out the percentage reporting lower employment (12 percent). The current employment index increased 3 points this month. Firms indicated fewer hours worked this month: the average workweek index decreased 14 points and posted its third consecutive negative reading.

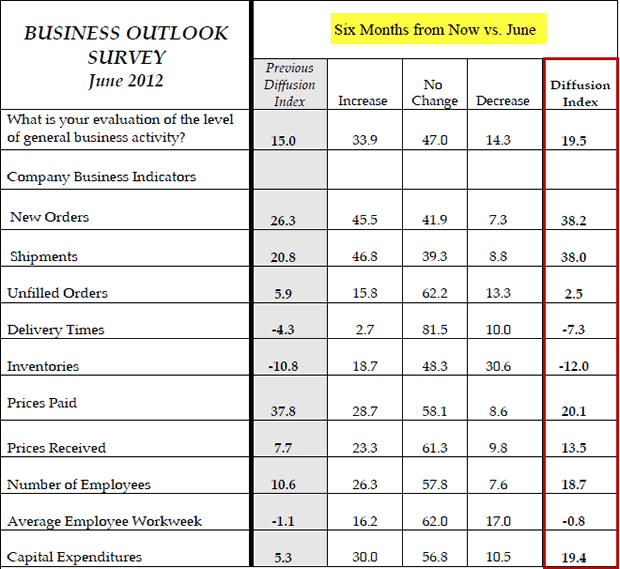

Misguided Optimism

Note the misguided optimism about six months from now. It's not going to happen.

Why?

- Europe is a disaster.

- US manufacturing is cooling rapidly

- China is cooling rapidly: China Manufacturing PMI 7-Month Low, Sharpest Decline in New Export Orders Since March 2009

- US Monetary policy is at best useless, but more likely net harmful, especially to those on fixed income.

- First year presidential politics are frequently recessionary

- US still needs fiscal tightening

- Unemployment insurance has expired for millions: 200,000 Lose Unemployment Benefits This Week, Nearly Half From California

- Self-Employment desperation: 100% of U.S. Jobs Added Since 2010 Have Been Self-Employment, Contractor, or Other Jobs Without Unemployment Insurance Benefits

- Last two jobs reports have been dismal: Another Payroll Disaster: Jobs +69,000, Employment Rate +.1 to 8.2%, April Jobs Revised Lower to +77,000; Long-term Unemployment +310,000

- The 4-week moving average of weekly unemployment claims is at the highest rate of the year, at 386,250.

- New home sales cannot gain significant traction: New Home Sales Hype vs. Reality

- Tax Armageddon

Deficit spending has carried this "recovery" further than I thought it would, but the party is now over.

It will be difficult if not impossible to overcome the above set of circumstances regardless of what anyone feels about economic back-tested recession probabilities.

Taxmageddon

Please consider Taxmageddon

The Tax Foundation reports that because of higher federal income and corporate tax collections, Tax Freedom Day came four days later this year than last. And the bad news is that unless Washington takes action, it will take working Americans 11 more days to meet next year's tax burden.That's all due to Taxmageddon -- a slew of expiring tax cuts and new tax increases that will hit Americans on January 1, 2013, amounting to a $494 billion tax hike. Heritage's Curtis Dubay reports that American households can expect to face an average tax increase of $3,800 and that 70 percent of Taxmageddon's impact will fall directly on low-income and middle-income families, leaving them with $346 billion less to spend.

Taxes Will Go Through the Roof

PolicyMic reports When the Payroll Tax Holiday Ends in 2013, Taxes Will Go Through the RoofWithout significant tax code changes, in 2013, America is scheduled to get hit with what would be the largest tax increase in our history.Not only will the $1,000 per year tax holiday for a $50,000 income household disappear, come 2013 all Americans will see the tax on their first $8,700 of income jump from a 10% rate to 15% rate.

That hike will cost the majority of filers an additional $435.

For those eligible for child care tax credits that deduction will drop from $1,000 to $500. The marriage penalty will roar back into effect. The AMT, alternative minimum tax, will finally kick in.

Roll those changes up and a family filing as married with two children making $50,000, will see their taxes increase by basically $2,700.

Regardless of whether or not you feel taxes need to be raised, a big set of tax hikes is scheduled to happen.

To be sure, some of those hikes will be undone in compromises, but many if not most will sneak through.

Who is to blame for Taxmageddon?

Republican are to blame. They accepted this silly deal instead of a far better one that Obama would actually have signed.

But No! Republicans insisted on no tax hikes at all in 2012, putting everything off until after the election, believing Romney would win in a cake-walk.

However, if President Obama wins, certainly not at all an unlikely possibility, he is going to drive a much harder bargain this go around.

Regardless of tax consequences, the US is headed for recession, if not already in one. 2013 rates to be a disaster regardless who wins.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2012 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.