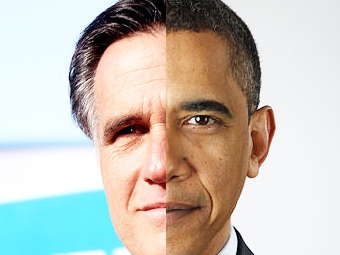

Romney and Obama, Middle Class Mumbo Jumbo

ElectionOracle / US Presidential Election 2012 Oct 18, 2012 - 02:38 PM GMTBy: Brady_Willett

Like many, I partook in debate watching Tuesday evening. And during the entire debate all I kept thinking was when is Jerry Springer going to pop out and/or this must be some new show called Punk-the-Prez. Two grown men, bought and paid for, arguing over when the President first used the word 'terror', why Romney has flip-flopped on countless issues (a surprise for a politician?), and why the U.S. economy smells just as bad as it did 4-years ago. An enthralling dance, and yet at the same time devoid of substance.

The Winner Is?

The Winner Is?

Being from Canada I don't get a vote. However, if pushed, I would probably vote Obama. Sure, President Obama didn't do half of things he said he was going to do and the political capital he had when he accepted the Nobel peace prize has all but vanished. But I just can't look past the fact that Romney's biggest idea is to aggressively cut taxes (I also can't ignore Romney yelling 'the government doesn't create jobs!' while at the same time saying he has a secret plan to create 12 million jobs once he takes over the government). Is it just me, or do big policy pledges by Republicans always seem to vacillate between threatening to bomb someone and cutting taxes?

It is nonsensical to think that it is always a good time for a tax cut. To be sure, the allure of the laffer curve eventually meets the indisputable fact that if taxes fall to zero the government collects exactly zero. Supply-side politicians like to point out that poor (near record profit producing) U.S. companies are taxed at the highest rate in the developed world. However, the reality is that U.S. corporations actually pay the lowest rates in the developed world. Tax reform - yes!...but tax cuts in the face of trillion dollar deficits and burgeoning unfunded liabilities - no!

Obama would add to this topic that Romney is focusing on cutting taxes for the rich. This is the same Obama that repeatedly pledged to let Bush's tax cuts expire but backed away moments before his promise was about to be fulfilled. With Bush's tax cuts set to soon expire (again), Obama has already said he will really allow them to expire this time. We shall see.

Incidentally, many have contended that Obama has been bamboozled over the last 2-years by Republicans that stonewalled everything to try and make him look bad. I don't buy it. President Obama has had ample opportunity to stand his ground and he has caved repeatedly. 'What? - Republicans don't want to rubber-stamp another reckless increase in the debt limit? Fine by me - shut it [the government] down...'

Suffice to say, it is stupefying how two parties with such deplorable histories of mismanagement continue to be the only options come election day. The candidates may differ and waffle on issues of contraception, abortion, and immigration, but they are more aligned on keeping the game rigged than anything else. For example, a popular theme in Tuesday's debate was the hapless U.S. middle class - or the large segment of the U.S. population that is being completely screwed over by an asset boosting, interest rate suppressing, debt monetizing monster called the Federal Reserve. Neither candidate has cared to even mention the Federal Reserve once through two debates! Instead of an intelligent debate on how to stop Fed machinations from crushing the middle class, 'binders of women' is all the rage today...

Hope for Change

The platform for real change in the U.S. begins with a politician that refuses to pander and pledges straight forward ideas such as a flat tax rate, the end of the IRS, and the end of the Fed (for a start). An intelligent, charismatic individual could harness the imagination of the American public with these and other libertarian-like ideas. Unfortunately, the American public can't leap across the sponsorship hurdles to get someone like this on the show.

In short, those that are either too scared or too old to throw their hard earned dollars into equities are under attack by the Federal Reserve. That this blatant attack on middle class savers is being done under the guise of floating all boats via asset bubbles and debt expansion should be the key issue at any Presidential debate. But alas, in a firmly entrenched two party system real change is unlikely to happen. After all, who would help fund all the hopes and dreams of bought and paid for politicians if the Fed were to close its doors?

By Brady Willett

FallStreet.com

FallStreet.com was launched in January of 2000 with the mandate of providing an alternative opinion on the U.S. equity markets. In the context of an uncritical herd euphoria that characterizes the mainstream media, Fallstreet strives to provide investors with the information they need to make informed investment decisions. To that end, we provide a clearinghouse for bearish and value-oriented investment information, independent research, and an investment newsletter containing specific company selections.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.