What's Going on in Customer Relationship Management?

Companies / Sector Analysis Oct 20, 2012 - 01:27 PM GMTBy: Doug_Horning

Doug Hornig, Casey Research Writes: In Mike Judge's wicked 1999 satire of corporate culture, Office Space, there's a delightful character named Milton. Poor Milton. He's all but invisible. No one likes him, no one talks to him, and coworkers are forever stealing his stapler. Management doesn't notice him enough to fire him. Instead, Milton is shunted from desk to desk, each time losing more of that precious commodity denoted by the film's title, until he finally winds up alone in the basement, where he plots the delicious revenge he'll take on the company.

Doug Hornig, Casey Research Writes: In Mike Judge's wicked 1999 satire of corporate culture, Office Space, there's a delightful character named Milton. Poor Milton. He's all but invisible. No one likes him, no one talks to him, and coworkers are forever stealing his stapler. Management doesn't notice him enough to fire him. Instead, Milton is shunted from desk to desk, each time losing more of that precious commodity denoted by the film's title, until he finally winds up alone in the basement, where he plots the delicious revenge he'll take on the company.

In times past, customer relations staffs were where the Miltons of the world most likely landed. If you couldn't do anything else, you could probably listen to phone complaints all day. No one wanted to, but somebody had to do it. And so they did, until they went mad from boredom or frustration.

That was then. Today, there's a new shine on customer relations departments, and the field has earned itself a fresh, glossy title and a widely recognized abbreviation: customer relations management, or CRM. And it's become an integral part of the SaaS (software as a service) industry.

The Rear-View Mirror

But first turn back the clock to the 1970s, before the real blossoming of the computer revolution. In that era, most companies – especially those in the Fortune 500 – paid little attention to customers, who were largely forgotten after they'd ordered something. Big company execs, knowing they had enormous resources at their disposal, along with a major market presence, had the attitude that they could always replace customers, if necessary.

Then came the dawn of the Information Age, with evermore powerful business computers and personal machines that began to proliferate in buyer's homes. Now people could make more informed decisions about whom they wanted to buy from. Globalization eased the task of switching suppliers if they were unsatisfied with someone's customer service. At the same time, businesses had rapidly increasing computing power at their fingertips.

The confluence of these two factors led directly to the beginnings of CRM in the 1980s.

At first, with the rise of sophisticated database creation and maintenance technology, it was referred to as "database marketing." Databases were employed to create focus groups to communicate with customers, particularly the most valued. Problem was, data was gathered primarily through repetitive and inefficient surveys, and in the end surveys don't yield a great deal of useful information.

There were processing and analysis hurdles, as well. No task-specific software yet existed that could take all the data being amassed and spit something actionable out the other end. Eventually, companies came to realize that what they needed was to compile simple information they could make plans around: what the customer was purchasing, in what quantity, how often, how much was being spent, and what was done with the products purchased.

Sounds pretty basic today, but it wasn't until the '90s that the phrase "customer relationship management" was coined, and more comprehensive versions of the software were written. Everything that could be automated, was.

CRM, however, is not just about technology. As it has evolved, it has also become more complex, more of a two-way street. While gathering information for the purpose of decision-making remained primary in order to drive increasing profits, companies also put some effort into building strong, enduring relationships with their clients in order to build loyalty. Many began giving back to favored customers, in the form of gifts, discounts, perks, and sometimes even cash.

Customer support, integrated into a CRM system, became more solid, even as machines were taking over much of the heavy lifting. Management began to treat the old saw, "the customer is always right," with greater respect. That was more difficult before the computer revolution. Now it's a cinch. When customers complain, their grievances can be handled quickly and efficiently, on an individual basis. And the mistakes that caused the problem can immediately be rooted out so that they don't happen again.

Sales, once made, can be logged into the database and tracked. They can be cross-referenced to any number of other areas, and analysis can proceed from different angles. Customers' interests and buying patterns can be identified. Sales managers can have direct access to information that allows personalization of the buyer's experience. Electronic sifting of sales data can help drive product development in the best possible direction. And customer follow-ups can be generated automatically, according to any criteria desired.

Designing a CRM System

In order to achieve these goals, it's important for the architecture of a CRM system to be broken down into three broad categories:

- the collaborative, which deals with communications between companies and their clients

- the operational, which deals with the automation of as many processes as possible

- and the analytical, which analyzes customer information and uses it for business intelligence purposes

Collaborative CRM involves all the interactions a company makes with its customers – either face to face or through electronic means such as telephone and Internet. Here, the personal touch is very important. Customers must be provided not only with goods and services, but with whatever assistance and information they may require. Satisfied customers become repeat customers, and CRM can use multiple technologies to bring that about.

Operational CRM deals with the automation of business processes such as enterprise marketing, customer service, and sales-force matters. All data relating to customer interactions is stored in a database, allowing for staff to pull information specific to that customer as needed.

Within Operational CRM:

- Enterprise Marketing Automation gives the company quick and easy access to aspects of the business climate, data on competitors, industry trends, and other critical input. That access yields strategies a company can employ to guide its overall marketing plan.

- Customer Service and Support Automation takes care of such things as returns and customer complaints.

- Sales Force Automation (SFA) covers demographics, special customer needs, and accounting management, with access to information made available not only to salespersons but, in appropriate instances, to clients as well.

Finally, there is Analytical CRM, which deals with analysis of all data input that bears upon customer service capabilities. Some examples would be: cross-selling products to customers; finding ways to retain customers who might be switching to competitors; and providing important information to customers without delays. Analytical CRM is also a tool for fraud detection and/or prevention, and for pattern recognition with regard to sales, inventory, and profits. It can be applied to product development and risk management, areas in which it needs to be particularly dynamic, so that the business plan can respond in a timely manner to any winds of change out in the real world.

When these are all integrated into a cohesive whole, then the company can realize substantial benefits in a competitive environment. But managing such an extensive suite of procedures is a daunting task for many companies to try to accomplish in-house. It means adding considerable (and expensive) expertise. A bespectacled software engineer lurking around every water cooler.

On the other hand, what if you could simply purchase what you needed, in the form of software as a service?

It was a good question, and people on both the user and provider ends of things began asking it. The result: creation of an instant niche for companies with CRM software products that were more cost effective than hired IT guns, and that were applicable across a wide spectrum of the business world.

CRM as a Service (SaaS)

First to jump into this space in a big way was Siebel Systems, founded by Thomas Siebel and Patricia House in 1993.

Siebel began by offering only sales force automation software, but with the explosive growth in demand for CRM through the '90s, it quickly expanded to include marketing and customer service applications. By 1999, it was by far the dominant player and was named the fastest-growing company in the United States in that year by Fortune magazine.

Along the way, Siebel pursued a strategy of forming strategic alliances and making acquisitions to provide e-business solutions for CRM and related areas; as of late 2000 the company had more than 700 alliance partners.

The company went public in 1996, and in 2000 its annual revenues broke through the $1 billion mark. A year later that had doubled, and in 2002 Siebel peaked, grabbing a 45% market share. Today, Siebel is a brand name owned by Oracle, which bought out the company in September of 2005 for $5.8 billion. Although its market share has slipped considerably, it is still a major player.

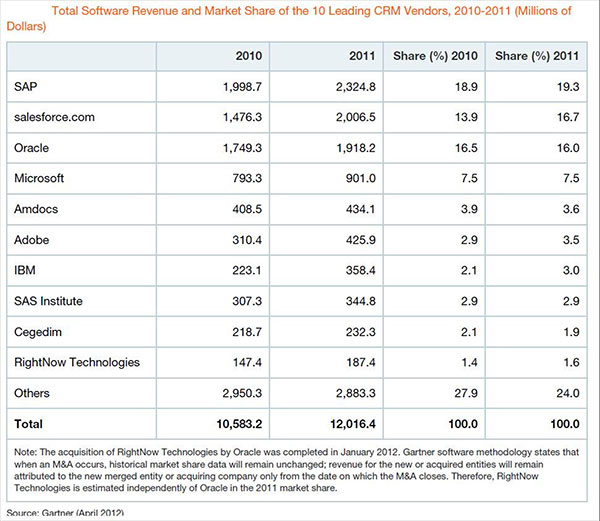

Next to throw its hat into the ring, in 1998, was the giant German multinational software company SAP. It was followed by Salesforce in 1999 and Microsoft's Dynamics CRM in 2002. Together with Oracle, these companies make up the Big Four of CRM vendors, collectively holding about 60% of market share.

Obviously, three of the four are large, diversified companies, for which CRM represents only a fraction of their revenue stream. Salesforce is the upstart. It's a company whose NYSE ticker symbol is, fittingly, CRM. That's what it's always specialized in (even though of late it has been moving aggressively into the social-networking arena).

The Rise of Salesforce

Salesforce established its position by targeting smaller to mid-sized companies, an area largely neglected by its bigger rivals – primarily because the high cost of the CRM solutions of the day was affordable only by big-budget outfits. It also pioneered the delivery of subscription-based CRM software online. Put the two together, and you have one of the biggest corporate success stories of the new century.

And no wonder. According to its website, "With Salesforce, every step of a sale – from phone calls and emails to collaboration with colleagues – is tracked in one place, so reps stay on top of deals and build stronger relationships with their customers. The average Salesforce.com customer experiences: +29% increase in sales; +34% increase in sales productivity; +42% increase in forecast accuracy."

Salesforce currently has more than 82,000 customers and over 2 million subscribers. It's international – with regional headquarters in Switzerland, Singapore, and Tokyo – and its software supports 16 different languages. It is annually recognized as one of Fortune's 100 best companies to work for, with a ranking that vaulted from 52nd in 2011 to 27th in 2012.

The company is working hard to utilize social-networking websites and to lock up a dominant role in mobile CRM. It's a leader of the migration to the Cloud, as can be seen in the way its CRM suite is broken down:

- The Service Cloud enables companies to create and track cases coming in from every channel, and automatically route and escalate what's important. For their part, customers have the ability to track their own cases 24 hours a day.

- The Sales Cloud provides sales representatives with a complete customer profile and account history, allows the user to manage marketing campaign spending and performance across a variety of channels from a single application, and tracks all opportunity-related data including milestones, decision makers, customer communications, and any other information unique to the company's sales process.

- The Data Cloud leverages crowdsourcing via its member community to create a highly accurate worldwide business contact list. Sales leads, changes of contact information, and organizational profiles can be viewed within the Salesforce application, all generated from up-to-the-minute data created by real business interactions.

- The Collaboration Cloud utilizes the type of features embraced by Facebook and Twitter users, and with it employees can tap into social, mobile, and real-time technology to collaborate on documents, business processes, projects, and application data. Components include profiles, status updates, and real-time feeds.

- The Custom Cloud is a platform that allows external developers to create add-on applications that integrate into the main Salesforce application and that are hosted on Salesforce's infrastructure.

For its efforts, Salesforce has been amply rewarded. It's jumped from nothing to over $2 billion in revenues in 13 years. Its CAGR for the past five years has been 22.2%. It led the field in market share addition in 2010-'11, with a 2.8% increase. Since it IPOed at $11 in June of 2004, its share price has rocketed to around $145 today, a rise of better than 1,200%. And along the way, it steadily buttressed itself (and dampened competition) through strategic acquisitions, gobbling up 24 other companies between 2006 and 2012.

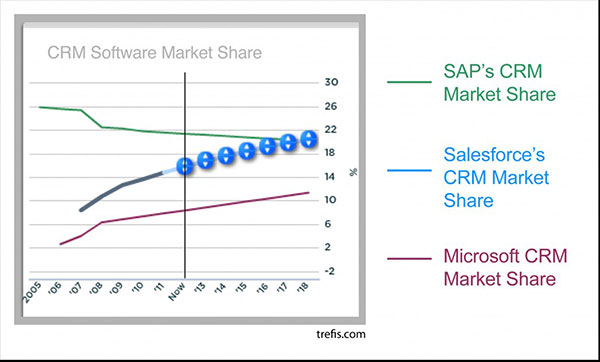

Though nothing in this fast-evolving space is certain, of course, the consensus is that Salesforce will continue to eat market share, as this projection graph against two of its primary competitors illustrates:

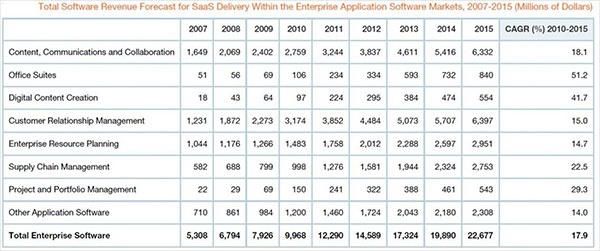

And Salesforce is expanding in all the right ways. According to leading technology analysis firm Gartner, the SaaS-based CRM sales the company specializes in are expected to leap to $6.4 billion in 2015, from $4.5 billion this year. That's the biggest slice of the SaaS pie, as can be seen in this table from Gartner:

At the same time, clients will be integrating social media into their customer service centers; while only 1% of companies adopting CRM are now involved with Facebook, Twitter, and the like, by 2017 that number will reach 25%, Gartner believes.

The Tentacles' Reach

CRM is continually pushing into new industries, as well. Telecommunications leads the customer list at the moment, with the energy/utilities and financial-services sectors close behind. But health care and public services are coming on strong, and are expected to take over the top spots relatively soon.

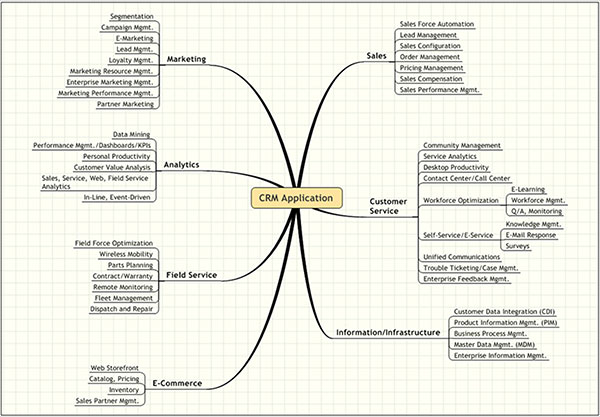

There is also plenty of room to broaden the reach of CRM services. Whereas CRM systems originated as uncoordinated, separate department servers, the key word today is "integration." And there seems to be no end to the number of corporate elements that can be drawn together, as you can see from this near-octopus that depicts the CRM of the future:

The goal – always – is to put customers first, and to offer them a buying experience that is seamless from beginning to end. The vending company's website becomes the portal through which customers can browse inventory to find what they're looking for, place orders, track order status, and provide feedback about the results. On its end, the company can gather data about customers, personalize its response to them, and set itself up to generate repeat interactions. All of this allows the vendor to transform itself from a purely static entity to one that is much more dynamic.

The Magic Quadrants

With Oracle and SAP losing market share, Salesforce and Microsoft seem poised to benefit the most. But what about other potential competitors, those that make up the 40% not controlled by the Big Four? Might some serious challengers arise?

They might – at Casey Extraordinary Technology, we're always on the lookout for them.

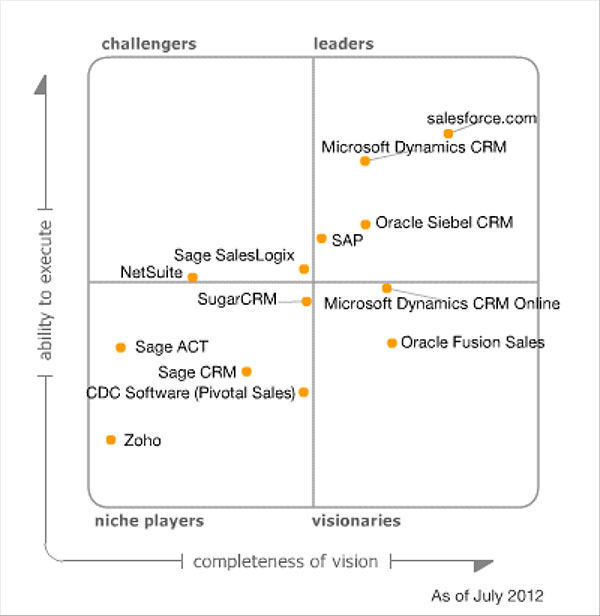

Each quarter, Gartner publishes its famed Magic Quadrants, in which it divides technology firms in a given field into four categories – Visionaries, Niche Players, Challengers, and Leaders – and places them inside a square partitioned into boxes. A company's position in the Magic Quadrant depends upon how Gartner sees it in relation to its peers.

There is no Magic Quadrant for CRM as a general designation; rather, there are separate charts for different aspects of the business. Thus we have this one for MultiChannel CRM Lead Management:

And quite a different one for Sales Force Automation:

There are others as well, but these two identify some of the up-and-comers in the business.

According to CMSWire, lead management involves "processes [that] take in unqualified leads from sources including Web registration, direct mail, digital and email marketing, social networks and tradeshows. CRM lead management solutions automate and optimize how those outputs are then qualified, scored, nurtured, augmented and prioritized for delivery to direct and indirect sales personnel and organizations."

In this category we find companies like top-ranked Eloqua, which Gartner cites for its ability to support complex, multichannel lead-management processes and easy-to-use user interface, and which grew revenues by 39% last year. Another is Marketo, which specializes in B2B (business-to-business) transactions, and which experienced 130% growth.

On the SFA side, SugarCRM had a big year in 2011, landing a major contract with IBM that brought aboard 75,000 users. The company is interesting in that its CRM software and associated community are open source, which enables collaborative, customer-driven enhancements. The open-source community develops and refines new capabilities, which SugarCRM then incorporates into subsequent commercial releases of its software.

The Future

Whither from here for CRM? There are probably as many answers to that question as there are those giving them. But a few themes emerge.

One of these is the integration of social media with corporate CRM. It's even got its own buzz term, "SocCRM." And one logical extension of SocCRM is what is generally referred to as "value co-creation."

Through the use of social media, companies have the ability to interact with the customer base as never before. There is a ton of information floating around out there, and it can be tapped into. Now, even major decision making can be based on real-time feedback from users. Design, marketing of product, pre- and post-purchase service – all can become true collaborative efforts, the goal being to create a win-win scenario for both the vendor and the customer. Some startups are even creating social networks before they bring their product to market, in order to find out what it is that the market really wants.

Value co-creation – both in the beginning and as an ongoing part of the toolkit – can be extremely advantageous for the company because it is, in essence, outsourcing much of the heavy lifting of product development, and getting it done for free.

With regard to its Dynamics CRM software, Microsoft put out a white paper in which it suggested uses that its product might be applied to. Among others noted by Microsoft:

- Manage online class registration automatically. In addition to automating the registration process, one could track student activity like attendance, grades, certifications, and course evaluations, as well as track and report on marketing activities, including social media, to measure the success of campaigns.

- Medical-product manufacturers and distributors can automatically notify product owners of a warning or recall; answer product questions with confidence using a CRM-based knowledgebase; and suggest additional products that could enrich a customer's life.

- Help municipalities respond to citizen requests more effectively.

- Ditch the paper order form. Work alongside customers to configure an order and send the quote immediately from a tablet device.

- Track customer goods in transit with map integration, in response to customers' expectations for knowing where their product is in the supply chain once they have ordered it.

- Compile a comprehensive view of lapsed customers and generate automated lists of customers who might be re-attracted based on purchase history.

- In a phone conversation with a clients or prospects, employ guided dialogues to prompt follow-up questions based on answers and build decision tree interviews.

- Fine-tune customer contests to meet fan interests.

- Keep track of where backup paperwork specific to each interaction is located.

But in the end, how do you get sales staff, who may be very set in their ways, to actually use this stuff?

That's the question posed by Dr. Michael Wu, principal analytics scientist and blogger for Lithium.com. Wu writes that "one of the many challenges facing Social CRM will be adoption. In fact, traditional enterprise software (e.g., sales force automation) often experiences a very steep learning curve and is not well adopted within the enterprise. Even if it is adopted, people often hate to use it. Employees only use it because their job requires it."

His simple solution: "gamify" CRM software.

That is, people are more apt to learn new skills, and to warm to new technologies, if they're presented as a game. "Social gaming dynamics," he says, "can foster team work, collaboration, and even a healthy level of competition within your organization. The result is ultimately a huge boost in productivity …

"So if you ever get involved in [CRM] software design, make sure it's entertaining! Never underestimate the power of fun."

Sounds like an idea whose time has come.

Casey Extraordinary Technology is another idea whose time has come. Learn why from CET Senior Editor Alex Daley.

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.