Best Cash ISA Savings Account for Least Stealth Inflation Theft from UK Savers

Personal_Finance / ISA's Jul 05, 2013 - 02:02 PM GMTBy: Nadeem_Walayat

Mark Carney has just taken over from the Mervyn King as Governor of the Bank of England, or should I say SIR Mervyn King who as is always the case was rewarded with a knighthood for his failures at the Bank of England because rather than to be held to account for his part in the ongoing banking catastrophe that has yet to see any bankster's go to jail for the financial crimes of the century that literally brought the country to its knees as evidenced by the greatest drop in GDP since the Depression that followed the First World War.

Mark Carney has just taken over from the Mervyn King as Governor of the Bank of England, or should I say SIR Mervyn King who as is always the case was rewarded with a knighthood for his failures at the Bank of England because rather than to be held to account for his part in the ongoing banking catastrophe that has yet to see any bankster's go to jail for the financial crimes of the century that literally brought the country to its knees as evidenced by the greatest drop in GDP since the Depression that followed the First World War.

Mark Carney's governorship will be a case of business as usual which means a continuation of the official policy of rampant money and debt printing in perpetuity, the consequences of which is the ongoing exponential inflation mega-trend that currently manifests itself in an official inflation rate of 2.7% CPI, though real inflation tends to average between 1 to 1.5% above the highly suspect official rate therefore at between 3.7% and 4.2%.

Cash ISA Interest Rates Crash

At the start of the new tax year savers had a small window of opportunity to lock in rates that just barely beat inflation after the interest rate crash of 2012-2013, Cash ISA savers could have fixed at as high as 4.5% for 5 years, but as the below table shows of the rates offered by the Halifax that the savings rates have crashed directly in response to the Bank of England's Funding for Lending Scheme that was announced in July 2012 which sought to provide the Banks with cheap money to entice lending to the general public that originally would total an estimated £80 billion over 18 months which has now been indefinitely extended. The effect of which is that the Banks are able to rely on Bank of England / UK Treasury for funding for loans instead of savings and thus savings interest rates continue to crash.

| Halifax ISA's | May 2012 | Sept 2012 | Nov 2012 | Mar 2013 | % Cut |

|---|---|---|---|---|---|

| Instant Access | 3% |

2.75% |

2.35% |

1.75% |

-41% |

| 1 Year Fix | 2.25% |

2.05% |

2.05% |

-9% | |

| 2 Year Fix | 4.00% |

3.25% |

2.25% |

2.5% |

-37% |

| 3 Year Fix | 4.25% |

3.75% |

2.35% |

3.00% |

-29% |

| 4 Year Fix | 4.35% |

3.80% |

2.40% |

3.05% |

-30% |

| 5 Year Fix | 4.50% |

4.15% |

2.60% |

3.10% |

-31% |

In my April article on Cash ISA's at the start of this tax year I warned that savers only had a short window of opportunity to lock in rates before they once more resumed their crash - 06 Apr 2013 - Best Cash ISA Savings Account for New Tax Year 2013-14.

Therefore cash ISA savers have perhaps a 4-6 week window to pickup tax free savings accounts before probability favours the rates being cut once more as occurred during 2012 as the Bank of England and government continue to funnel tax payer cash into what still mostly remain bankrupt banks that await the next domino (Slovenia? Spain? Portugal? Italy? Greece? France?) to tip them over the edge once more.

And right an cue the Banks followed through by taking a meat clever to savings interest rates by slicing over 25% off the rates by Mid May as illustrated by the updated table for the Halifax Cash ISA rates -

| Halifax ISA's | May 2012 | Sept 2012 | Nov 2012 | Mar 2013 | May 2013 | July 2013 | % Cut |

|---|---|---|---|---|---|---|---|

| Instant Access | 3% |

2.75% |

2.35% |

1.75% |

1.35% | 1.35% | -55% |

| 1 Year Fix | 2.25% |

2.05% |

2.05% |

1.75% | 1.75% | -22% | |

| 2 Year Fix | 4.00% |

3.25% |

2.25% |

2.5% |

2.10% | 2.10% | -48% |

| 3 Year Fix | 4.25% |

3.75% |

2.35% |

3.00% |

2.25% | 2.25% | -47% |

| 4 Year Fix | 4.35% |

3.80% |

2.40% |

3.05% |

2.30% | 2.30% | -47% |

| 5 Year Fix | 4.50% |

4.15% |

2.60% |

3.10% |

2.35% | 2.35% | -48% |

So whilst the mainstream press blindly continues to pander to its banking advertisers by promoting 'Best' saving accounts, the reality is that there aren't any best rates out there. In fact as mentioned earlier it's a case of business as usual with NO discernable up tick in savings rates.

Current Best Cash ISA's for Least Stealth Inflation Theft

Baring in mind the ongoing systemic fraud perpetuated against savers, the following will seek to represent the least loss of purchasing power against an estimated real inflation rate of 4% that at least protects against the 20-40% tax on savings.

Given the abysmal rates on offer at the moment many people may be questioning if its worth opening an ISA at all, in which respect I suggest savers focus on the long-game which is to get as much of your bank deposits into tax free accounts as possible with a view to fixing them at a later date for multiple years as I repeatedly advocated doing in the 6 months leading upto the financial crisis of October 2008 -

08 Oct 2008 - UK Interest Rate Forecast 2009

Savers - To reiterate what I have been saying over the last 6 months, savers still have a a golden opportunity to lock in high fixed savings rates which in the UK are above 7% . These rates won't stay around for much longer, were talking perhaps in the days rather than weeks or months. So the time for action is now ! - Yes, banks can go bankrupt but savings are protected which includes accumulated interest. In the UK the protection is for the first £50k per banking group.

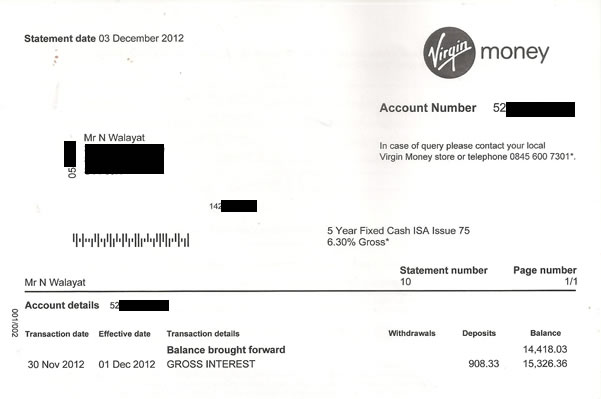

In which respect I am still personally in receipt of rates of as much as 6.3% per annum on fixed rate cash ISA's taken out during 2008 (non ISA accounts tended to pay 1% more interest per annum), though all of these are set to mature over the next few months (Northern Rock ISA- taken over by Virgin), which also leaves me with a big dilemma.

So where cash ISA's are concerned, play the long-game and wait for savings rates to rise then lock them in for as long as possible to beat both inflation and the tax man. Remember that rates can only remain low as long as the Bank of England retains control of the bond market, which as the euro-zone illustrates that confidence is always fragile i.e. it does not take much to tip bond investor perceptions from low risk to extreme high risk especially as UK, US, German and Japanese bond markets ARE in the mother of all bubbles.

In the meantime Richard Branson's Virgin continues to pay me 6.3%, which is triple the rate being offered to new Virgin Cash ISA customers (2% for a 1 year fix).

Best Instant Access ISA

| Financial Institution | Interest Rate | After CPI 2.7% | After Real Inflation 4% | Minimum £ | Comments |

| Nat West | 2.25% | -0.45% | -1.75% | £30,000 | Large minimum balance of £30k! - Allows transfers in. |

| Dunfermline BS | 2% | -0.7% | -2% | £1 | Easy Isa - Includes a 1.5% bonus for 12 months, No transfers in. |

| Nationwide | 2% | -0.7% | -2% | £1 | Easy ISA - Includes a 1.5% bonus for 16 months, No transfers in. |

Best Current Fixed Rate ISA's (1 Year)

| Financial Institution | Interest Rate | After CPI 2.7% | After Real Inflation 4% | Minimum £ | Comments |

| Tesco | 2.05% | -0.65% | -1.95% | £1 | No transfers in. |

| Virgin Money | 2% | -0.7% | -2% | £1 | Allows transfers in. |

Best Current Fixed Rate ISA's (2 Year)

| Financial Institution | Interest Rate | Fixed Period | Minimum £ | After CPI 2.7% | After Real Inflation 4% | Comments |

| Halifax | 2.1% | 2 Years | £500 | -0.6% | -1.9% | Allows transfers in. Early withdrawals allowed subject to 180days loss of interest. |

Best Current Fixed Rate ISA's (3 Year)

| Financial Institution | Interest Rate | Fixed Period | Minimum £ | After CPI 2.7% | After Real Inflation 4% | Comments |

| Coventry | 2.5% | 3Years | £5,760 | -0.2% | -1.5% | No transfers in. |

Conclusion

All of the best cash ISA's available today FAIL to even match official CPI inflation, let alone real inflation therefore what ever choice savers make will still result in being financially tortured by the banking crime syndicate.

Don't Forget the Cyprus Factor

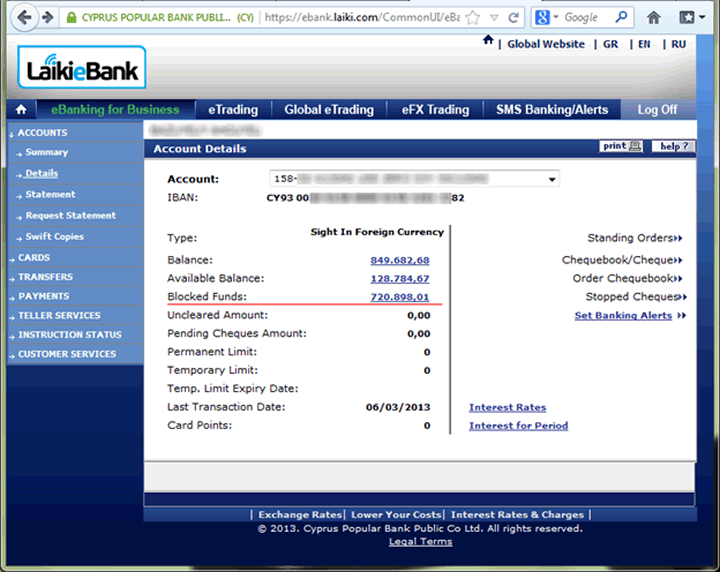

Furthermore Cyprus shows that when push comes to shove, if the Government is squeezed into a corner, then it will outright steal your bank deposits, not just 20%, or 40% or with real life examples of Cyprus bank customers having 85% stolen (as illustrated below), but ALL of your money - 99.9%, as the Banking system would be closed whilst the Bank of England worked out the mechanism of how your money would be stolen by means of seizure and high inflation (more than 20% per month!).

At this point you may start wonder that this is all conspiracy theory nonsense but consider this that the Bank of England has already paved the way for how your bank deposits will be stolen during a future banking crisis as the following excerpt illustrates from a document dated 10th of December 2012 - http://www.bankofengland.co.uk/publications/Documents/news/2012/nr156.pdf

Resolving Globally Active, Systemically Important, Financial Institutions Federal Deposit Insurance Corporation and the Bank of England

Executive summary

The financial crisis that began in 2007 has driven home the importance of an orderly resolution process for globally active, systemically important, financial institutions (G-SIFIs). Given that challenge, the authorities in the United States (U.S.) and the United Kingdom (U.K.) have been working together to develop resolution strategies that could be applied to their largest financial institutions. These strategies have been designed to enable large and complex cross-border firms to be resolved without threatening financial stability and without putting public funds at risk. This work has taken place in connection with the implementation of the G20 Financial Stability Board’s Key Attributes of Effective Resolution Regimes for Financial Institutions. The joint planning has been productive and effective. It has enhanced the resolution planning process in both jurisdictions, tackled key issues in relation to crossborder coordination, and identified potential challenges that will be addressed through further work.

This paper focuses on the application of “top-down” resolution strategies that involve a single Such a strategy would involve the bail-in (write-down or conversion) of creditors resolution authority applying its powers to the top of a financial group, that is, at the parent company level. The paper discusses how such a top-down strategy could be implemented for a U.S. or a U.K. financial group in a cross-border context.

In the U.S., the strategy has been developed in the context of the powers provided by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Such a strategy would apply a single receivership at the top-tier holding company, assign losses to shareholders and unsecured creditors of the holding company, and transfer sound operating subsidiaries to a new solvent entity or entities.

In the U.K., the strategy has been developed on the basis of the powers provided by the U.K. Banking Act 2009 and in anticipation of the further powers that will be provided by the European Union Recovery and Resolution Directive and the domestic reforms that implement the recommendations of the U.K. Independent Commission on Banking. at the top of the group in order to restore the whole group to solvency.

Both the U.S. and U.K. approaches ensure continuity of all critical services performed by the operating firm(s), thereby reducing risks to financial stability. Both approaches ensure activities of the firm in the foreign jurisdictions in which it operates are unaffected, thereby minimizing risks to cross-border implementation. The unsecured debt holders can expect that their claims would be written down to reflect any losses that shareholders cannot cover, with some converted partly into equity in order to provide sufficient capital to return the sound businesses of the G-SIFI to private sector operation. Sound subsidiaries (domestic and foreign) would be kept open and operating, thereby limiting contagion effects and crossborder complications. In both countries, whether during execution of the resolution or thereafter, restructuring measures may be taken, especially in the parts of the business causing the distress, including shrinking those businesses, breaking them into smaller entities, and/or liquidating or closing certain operations. Both approaches would be accompanied by the replacement of culpable senior management.

The above text clearly implies that a bail-in of all creditors will be involved in the case of bankruptcy to recapitalize the bankrupt banks.

I won't post the whole document but again refer to an excerpt that makes it clear that only insured depositors will be protected i.e. holdings of less than £85,000 per banking licence.

U.K. regime 17 In the U.K., the Banking Act provides the Bank of England with tools for resolving failing deposit-taking banks and building societies.5 Powers similar to those of the FDIC are available, including powers to transfer all or part of a failed bank’s business to a private sector purchaser or to a bridge bank until a private purchaser can be found. The Banking Act also provides the U.K. authorities with a bespoke bank insolvency procedure that fully protects insured depositors while liquidating a failed bank’s assets. These powers have proved valuable; for example, during the crisis they allowed the authorities to transfer the retail and wholesale deposits, branches, and a significant proportion of the residential mortgage portfolio of a failed building society to another building society.

This further reinforces the fact that savers have to take some risk with their capital be it in the stock market or the housing market or commodities because as things stand you are guaranteed to lose at least 1/3rd of the real value of your bank deposits during this decade, with the ever prevalent risk that in a worse case scenario the Government WOULD Cyprus style outright steal near ALL of your money in the bank.

UK Housing Market Exposure Less Risky than Bank Deposits!

As a guide of what one could consider doing to protect themselves from the ongoing fraud and the outright risk of theft of bank deposits, the following updated table illustrates how my portfolio is trending in terms asset classes to protect both against inflation stealth theft and possible outright theft.

| Jan 2012 | Mar 2013 | July 2013 | Dec 2013 | |

|---|---|---|---|---|

| UK Property | 0% |

50% |

60% |

60% |

| Cash & Bonds | 60% |

32% |

26% |

20% |

| Stocks & Commodities | 40% |

18% |

14% |

20% |

The following graph illustrates the current state of the new UK housing bull market of 2013 following the embryonic bull market of 2012. The UK housing bull market is now well underway for which readers of my articles have had well over a years head start! This is a new bull that has many years to run the trend for which I will seek to map out over the coming months.

The bottom line is that as a saver, just like you I have no choice, I either take risks in dividend paying stocks and the UK housing market or all of my hard earned wealth will be stolen by the government and the banks. Off course one of the main objectives of ZIRP is to force everyone to spend their savings, then we will all be in the same boat, become reliant on state benefits because the government's stealth tax - inflation will have eroded the purchasing power of our earnings away.

Ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis which will be on the UK housing market.

Summary of ISA Rules & Benefits

- The ISA accounts are TAX FREE, and do not have to be entered onto any tax returns. The equivalent taxable return on a 3% cash ISA for standard rate tax payers is 3.6%. For higher rate tax payers it is 4.2%.

- The income from tax ISA's does not count against many mean tested benefits such as Tax Credits.

- The Allowance for 2013-14 is £11,520, £5,760 for cash and £5,760 for shares ISA's or the whole £11,520 into a shares ISA.

- You can only open ONE New cash ISA per tax year, and you can add new monies to One Cash ISA per tax year (see transfers). Similarly you can open only one new Shares ISA per tax year.

- You do not have to open a Cash ISA with your existing provider, i.e. you can open an account at different providers every year.

- Most providers allow for transfers in. And ALL should allow you to transfer out.

- Once you withdraw from a Cash ISA you cannot then then re-deposit into. The £5,760 limit refers to total deposited, and not maximum account balance. So if you deposit £5,760, and withdraw £1000, then you cannot re-deposit that £1000 in the same tax year as you have used up your £5,760 deposit limit.

- To maximize your tax free interest, it is best to open your account at the start of the tax year.

- The Financial Services Compensation Scheme (FSCS) guarantees the first £85,000 (Euro 100,000) per person, per banking licence . Those with sizable savings that total more than £85,000 should ensure that their institutions really are separate, especially given the banking crisis forced mergers.

- There is the facility to transfer Cash ISA monies into Shares ISA's but NOT from Shares ISA's to Cash ISA's .

- Next years Cash ISA allowance (2014-15) will increase inline with CPI inflation to around £5,880.

Source and Comments: http://www.marketoracle.co.uk/Article41257.html

Nadeem Walayat

Copyright © 2005-2013 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of four ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series.that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.