If You Own Gold, You Must See This Chart…

Commodities / Gold and Silver 2013 Jul 10, 2013 - 12:46 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: What I'm about to say will challenge even the most steadfast gold bears - or anyone for that matter right now who thinks that gold has seen its better days.

Keith Fitz-Gerald writes: What I'm about to say will challenge even the most steadfast gold bears - or anyone for that matter right now who thinks that gold has seen its better days.

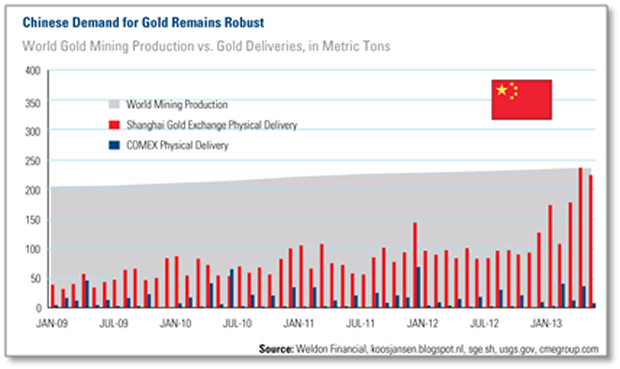

The chart below tells a story - a big story. In fact, I encourage you to forward this email to anyone you know who serious about his money.

What I found here, with the help of Frank Holmes from U.S. Global and one of the smartest people on earth on the potent combination of Asian markets and commodities, is a chart that shows a truly astounding fact about gold.

Let me walk you through it, and what it could mean to your money, your gold and your financial future.

Courtesy U.S. Global Advisors

The grey backdrop is total world mining production. The blue vertical lines represent COMEX gold deliveries. And the big long vertical red lines? That's physical gold delivery on the Shanghai gold exchange.

The takeaway? - Chinese demand for physical delivery all by itself is nearly equal to total worldwide gold production.

That's not a misprint.

In fact, so far this year Chinese deliveries through the Shanghai exchange account for nearly 50% of total global production all by themselves. The COMEX that's part of the New York Mercantile Exchange is almost an afterthought.

This is about as bullish as it gets because the basic laws of supply and demand stipulate that whenever supply is reduced but demand remains constant or accelerates, higher prices result.

No Stopping It

This is as immutable as the sun coming up tomorrow or the grass turning green in the spring.

This is good for the markets in general, especially with Bernanke hell bent on keeping the "bad is good theme alive" when it comes to further stimulus.

And this is positively great for gutsy gold investors at a time when others want to relegate it to the scrap pile.

Imagine what happens when people actually figure out that China is buying so much gold that physical deliveries there could account for 100% of worldwide production by year's end?

The first will be additional opportunities that I expect current volatility to create in the weeks ahead. My Geiger Index is flickering yellow on a handful of solid gold related opportunities as I type this.

The second are simply related to capturing profits. I expect the pace to pick up as gold becomes an important part of that annual money management right of fall passage - "window dressing" when entire portfolios are rotated in an effort to build in bigger Wall Street bonus checks.

Savvy Investors could be very busy and incredibly profitable a few months from now.

Editor's Note: I hope you're one of these smart gold investors. I know Keith's Geiger Index subscribers will be.

Source :http://moneymorning.com/2013/07/10/if-you-own-gold-you-must-see-this-chart/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.