Improve The Productivity Of Your Dividend Growth Portfolio With Technology Stocks

Companies / Tech Stocks Aug 09, 2013 - 09:45 AM GMT Introduction and General Observations of the Information Technology Sector

Introduction and General Observations of the Information Technology Sector

Dividend growth investors seeking quality dividend growth stocks to fund their retirement portfolios have not historically looked to the Information Technology sector. Traditionally, the Information Technology sector has been associated with higher growth and higher risk. However, in addition to higher growth, many technology companies are also very cyclical in nature. Another common attribute for tech companies is how they have traditionally utilized their capital. In order to finance their high-growth needs, the majority of Information Technology companies have traditionally not paid dividends. Instead, they used their capital to fund future growth. However, another contributing factor to the no dividend policy of Information Technology companies was the nascent nature of this industry.

But with the passing of time, the Information Technology sector has matured. Today, we find an eclectic mix of large and mature companies, mixed in with younger and smaller enterprises. Moreover, Information Technology has become an integral and ubiquitous part of virtually every other sector. In other words, no matter what industry or sector a business operates in, today they are all using technology to make their businesses more efficient, productive and more profitable. Therefore, as information technology has evolved and matured, the way investors relate to this industry needs to evolve and mature along with them.

Nevertheless, and with the above said, many of the old attributes associated with Information Technology continue to persist. On the other hand, the characteristics’ of companies within the Information Technology sector remains fragmented and diverse. Because one aspect of the Information Technology sector that has not changed, is the dynamic nature and evolution of technology itself. Inventiveness remains a key trait of the Information Technology sector. Amazingly, Moore’s law continues to be relevant to computing hardware, the Internet continues to evolve (The Cloud), and technological advances continue to pop up at dizzying and mind-boggling rates.

The continuous evolution of the Information Technology sector brings with it both great risk and great opportunity. Consequently, the Information Technology sector presents both a great challenge and a great opportunity at the same time for investors seeking above-average total returns and even a growing dividend income stream. More simply stated, I believe that the dividend growth investor should not make the mistake of ignoring this exciting and dynamic sector, but at the same time extreme caution and continuous monitoring are warranted. But I believe the opportunities to turbo-charge a dividend growth portfolio are potentially extraordinary, and worth the additional risks.

Part of my reasoning behind strategically adding select Information Technology dividend paying growth stocks to a dividend growth portfolio is supported by the omnipresent need and demand that every company in every industry must make use of technology today in order to remain competitive. Moreover, the sheer size of Information Technology today brings with it the necessity for large players within the industry. For technology to remain relevant, it requires the size and scale that only large companies can deliver in order to support the seamless integration of technology across all industries and boundaries. In other words, technological standards and protocols must be universally implemented and applied.

Although innovation remains the lifeblood of the Information Technology sector, it has been increasingly common to see startups offering breakthrough technologies turn to larger established technology stalwarts to provide the scale and marketing depth required for success. Supporting that process is the need that larger established technology companies have to look to innovative startups as sources of their future growth.

I believe this symbiotic relationship will continue, notwithstanding the occasional emergence of companies offering revolutionary and disruptive technologies capable of completely rewriting the very nature of the Information Technology sector itself. Names like Google, Facebook and Twitter come to mind. But so does the rapidly-progressing mobile technologies, cloud computing, nanotechnology and other potentially disruptive technologies too numerous to mention. Herein rests one of the greatest risks of investing in technology.

But as fascinating as the rapidly-changing face of technology is, it has been equally as fascinating to watch how the capital structures of many of the most renowned technology companies have morphed from pure growth stocks, to perhaps becoming the Dividend Champions or Dividend Aristocrats of tomorrow. Later in the article, I will review several examples.

The Information Technology Sector

This is the ninth in a series of articles designed to find value in today's stock market environment. However, it is the eighth of 10 articles covering the 10 major general sectors. In my first article, I laid the foundation that represents the two primary underlying ideas supporting the need to publish such a treatise. First and foremost, that it is not a stock market; rather it is a market of stocks. Second, that regardless of the level of the general market, there will always be overvalued, undervalued and fairly valued individual stocks to be found.

My first article was titled "Searching For Value Sector By Sector," my second article was titled "Finding Great Value In The Energy Sector." My third article was titled "Finding Value In The Materials Sector Is A Material Thing." My fourth article was titled "The Industrial Sector Offers A Lot Of Value, Dividend Growth And Income." My fifth article was titled Beware The Valuations On The Best Consumer Discretionary Dividend Growth Stocks, and my sixth article was titled, Are Blue-Chip Consumer Staples Worth Today's Premium Valuations?, my seventh article For A Healthier Portfolio - Look Here, and my eighth article Is The Financial Crisis Over For Financial Stocks?

As a refresher, my focus in this and all subsequent articles will be on identifying fairly valued dividend growth stocks within each of the 10 general sectors that can be utilized to fund and support retirement portfolios. Therefore, when I am finished, the individual investor interested in designing their own retirement portfolio should find an ample number of selections to properly diversify a dividend growth portfolio with.

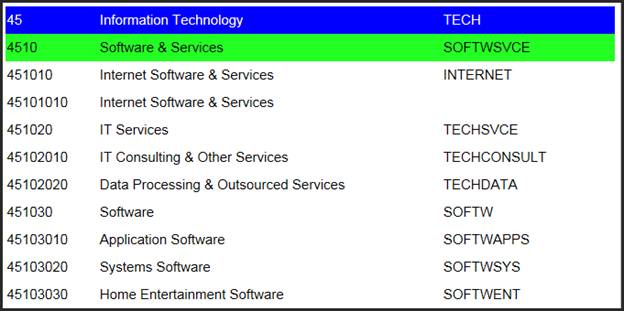

This article will look for undervalued and fairly valued individual companies within the general sector 45-Information Technology. Within this general sector, there are several subsectors, which I list as follows:

Conservative Information Technology Candidates

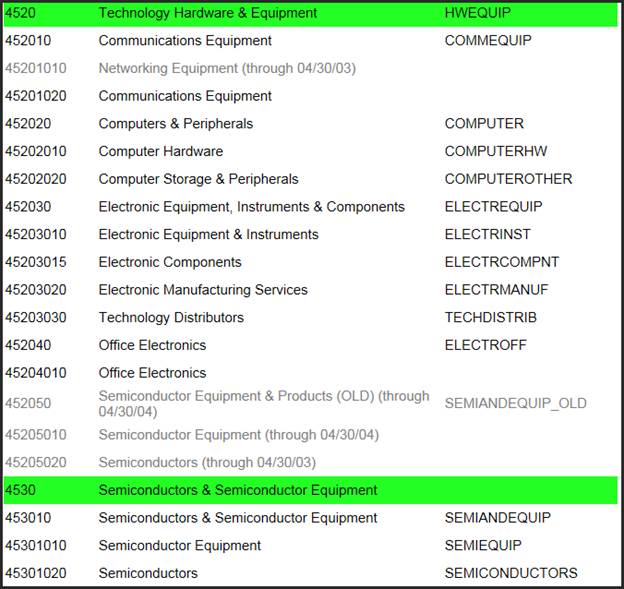

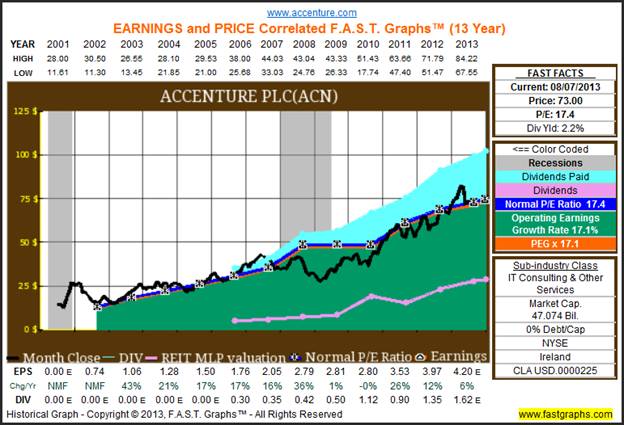

The following comprises my list of conservative dividend paying Information Technology stocks, they might also be considered the blue-chip stalwarts of this industry. Most of the names are obvious and well-recognized companies. Some of these candidates have been paying and growing their dividends for many years, while others are dividend paying newbies. As previously stated, perhaps the most interesting attribute among this group of Information Technology companies is how many are morphing from traditional pure growth stocks to becoming more like traditional dividend paying companies within other sectors.

Although most of these companies are still expected to grow at above-average rates, most of them are not expected to grow at the same rate they historically have. However, the majority are expected to grow at rates greater than the average dividend paying company found in other sectors. Moreover, the majority of these candidates also offer above-market dividend yields and below-market average valuations. Automatic Data Processing (ADT) is an exception and only included because it has historically been priced at a premium valuation to its earnings growth.

A Picture Is Worth 1000 Words

On the notion that a picture is worth 1000 words, and in order to spare the reader from enduring the same, I will let the F.A.S.T. Graphs™ research tool on each featured company speak for itself. For those who are not familiar with how these Earnings and Price correlated Graphs are designed and function, I provide the following link: The Interpretation of The Earnings and Price Correlated F.A.S.T. Graphs™ Made Simple.

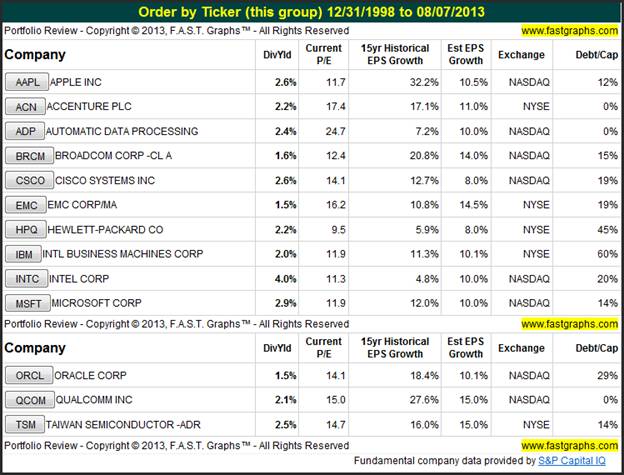

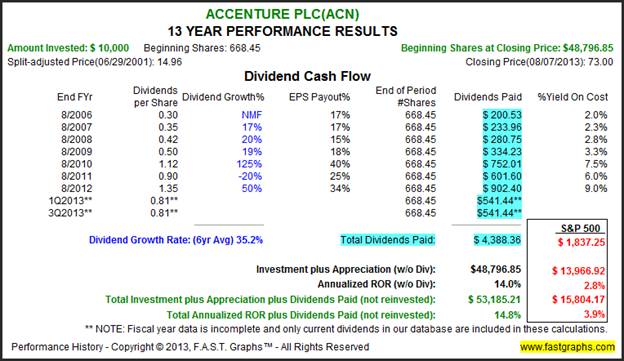

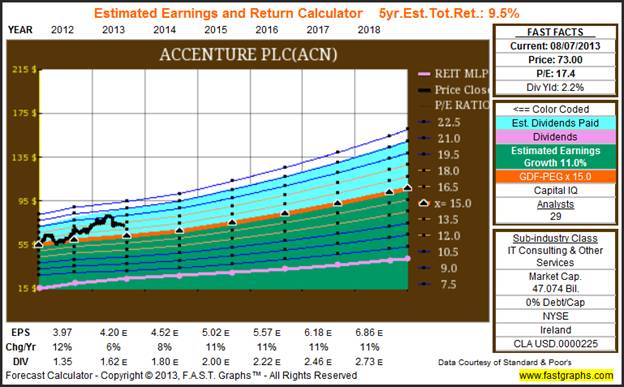

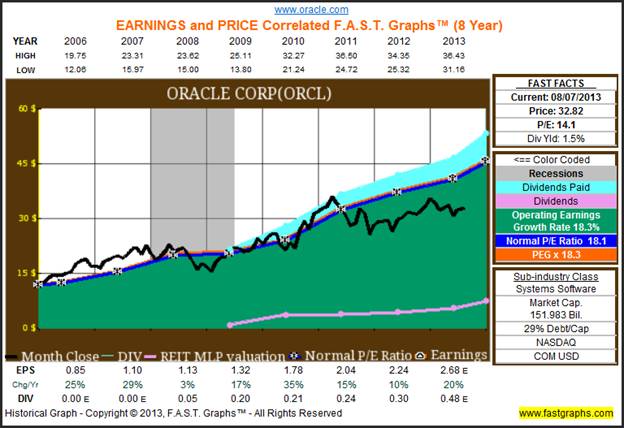

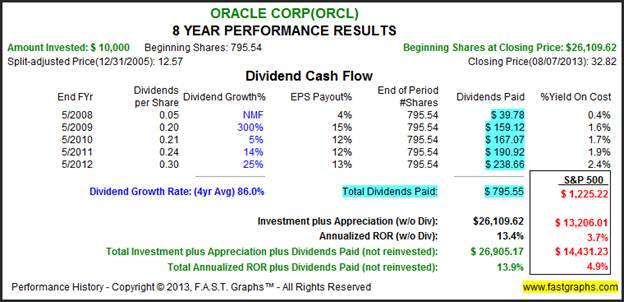

With the above said, I will suggest that the reader take note of some key facts on each graph. First and foremost, notice how price follows earnings. Next, focus on the earnings growth rate that each of these companies has historically achieved. Then check out the performance that this growth has provided to the company’s shareholders in comparison to the Standard & Poor’s 500 over the same timeframe.

Next, note that the Estimated Earnings and Return Calculator or forecasting graph will, in most cases, represent a growth rate that is different than what is found on the historical graphs. Any buy, sell or hold decisions should be made with more attention given to the forecasting graphs than on the historical graphs. On the other hand, the historical graphs tell a lot about how well each of the companies you are reviewing has historically been managed and performed.

Finally, compare the growth rates, track records and future potential of each of these companies in contrast to the expectations of the average dividend growth stock. To be clear, the average blue-chip dividend growth stock will possess historical and forecast growth rates within the range of 7% to 10% per annum. Therefore, as you review these companies I recommend asking yourself whether you believe the growth rates of these companies are worth the risk. Moreover, ask yourself how much additional risk, if any, these icons of technology really represent.

Accenture (ACN) Historical Graph

“Accenture is a global management consulting, technology services and outsourcing company, with 261,000 people serving clients in more than 120 countries.”

Accenture Performance Graph

Accenture Forecasting Graph

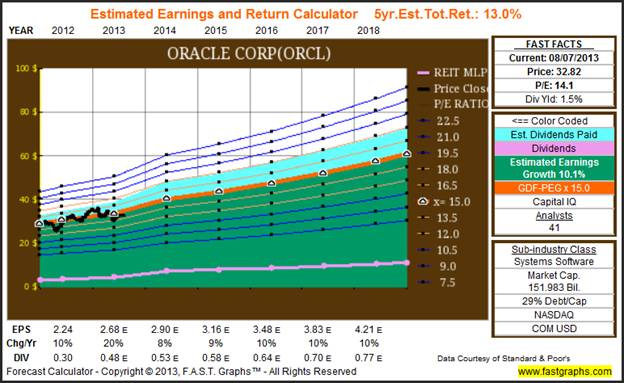

Oracle Corp (ORCL) Historical Graph

“Oracle Corp, incorporated in 2005, is a provider of enterprise software and computer hardware products and services. The Company's software, hardware systems, and services businesses develops, manufactures, markets, hosts and supports database and middleware software, applications software, and hardware systems, with the latter consisting primarily of computer server and storage products.”

Oracle Performance Graph

Oracle Forecasting Graph

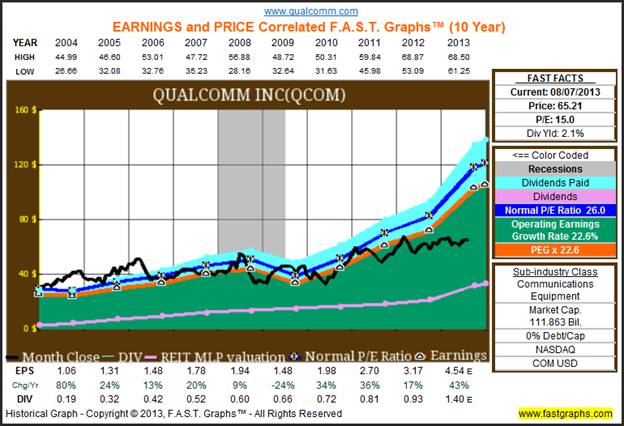

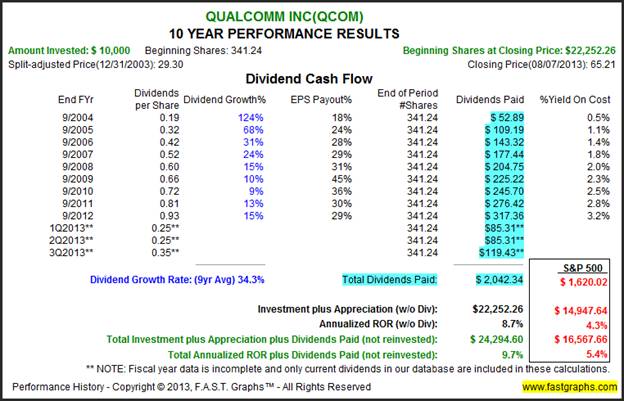

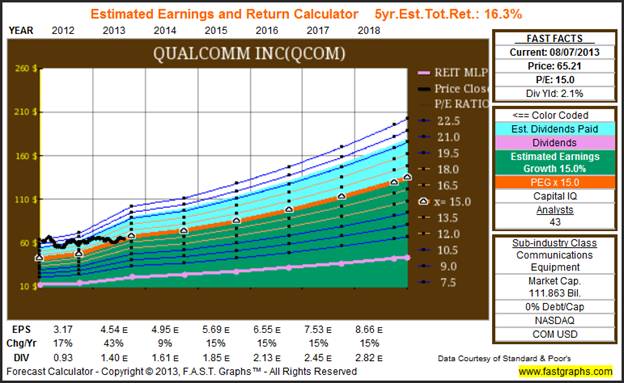

Qualcomm Incorporated (QCOM)

Since most of the companies on this conservative list are highly recognized names in technology, I have assumed that the reader is more likely than not familiar with each of them. However, I did want to call out one featured dividend growth stock in the Information Technology sector that I felt might be most appealing.

“ABOUT QUALCOMM INCORPORATED

Qualcomm Incorporated (NASDAQ: QCOM) is the world leader in 3G, 4G and next-generation wireless technologies. Qualcomm Incorporated includes Qualcomm’s licensing business, QTL, and the vast majority of its patent portfolio. Qualcomm Technologies, Inc., a wholly-owned subsidiary of Qualcomm Incorporated, operates, along with its subsidiaries, substantially all of Qualcomm’s engineering, research and development functions, and substantially all of its products and services businesses, including its semiconductor business, QCT. For more than 25 years, Qualcomm ideas and inventions have driven the evolution of digital communications, linking people everywhere more closely to information, entertainment and each other.”

Qualcomm Historical Graph

Qualcomm Performance Graph

Qualcomm Forecasting Graph

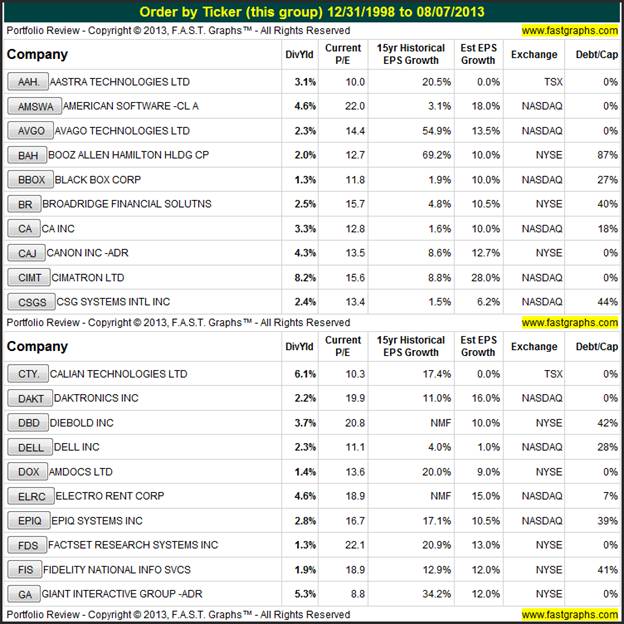

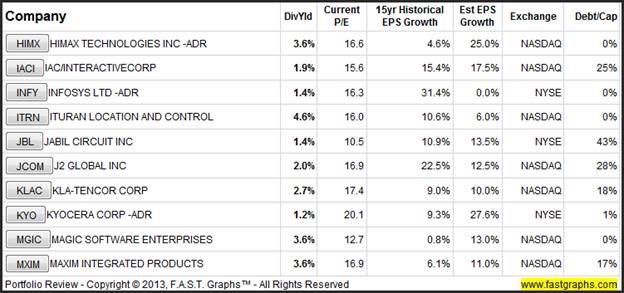

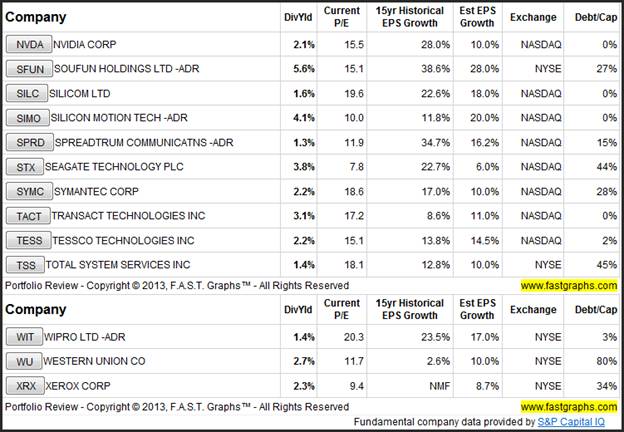

Aggressive Information Technology Candidates

I am not sure that it is appropriate for me to call the following candidates aggressive because many of my conservative selections are expected to offer higher growth than some of these. Therefore, I offer this large list of candidates because they may be unfamiliar Information Technology companies to many readers. Moreover, I might add that any company from this following list would require extensive and comprehensive research prior to investment. Since this series of articles is focused on pre-screened but not comprehensively researched companies in numerous sectors, it is important to point out the necessity for further due diligence.

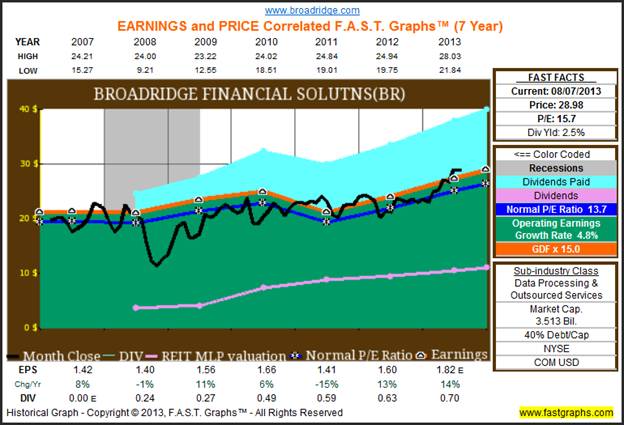

Broadridge Financial Solutions (BR) Historical Graph

“Broadridge Financial Solutions Inc is the leading provider of investor communications and technology-driven solutions for broker-dealers, banks, mutual funds and corporate issuers globally.”

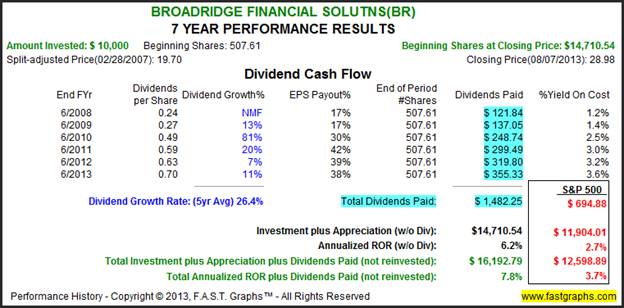

Broadridge Financial Solutions Performance Graph

Broadridge Financial Solutions Forecasting Graph

j2 Global Inc (JCOM)

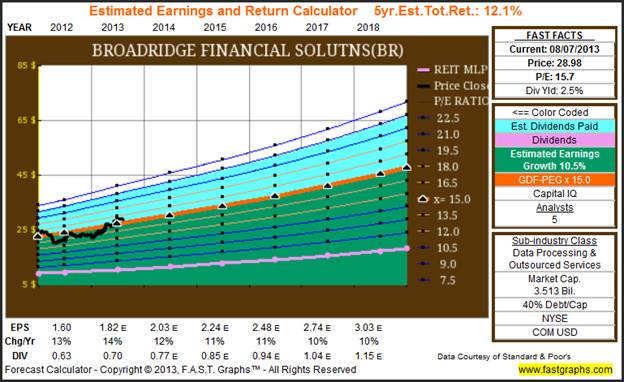

One company that many readers may not be familiar with is j2 Global Inc. My purpose in featuring this aggressive candidate was to offer an example of a historically pure growth technology company that appears to be morphing into a dividend growth stock. But before I show that, I offer the following slide that provides an overview of j2 Global’s business.

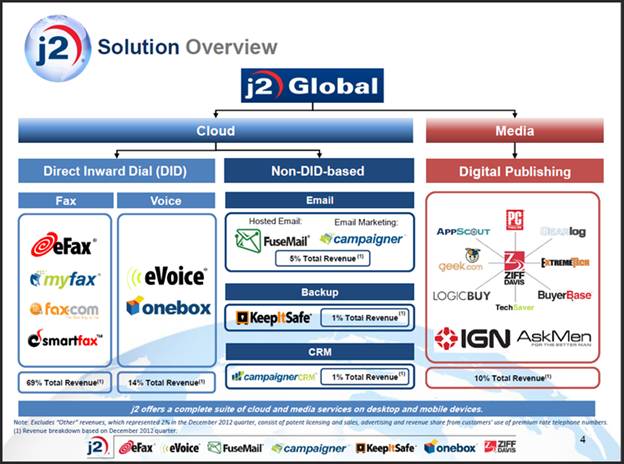

A quick glance at the Earnings and Price Correlated FAST Graphs™ on j2 Global provides an excellent example of the benefit of stacking the light blue shaded dividend area on top of the orange earnings justified valuation line. Instantly it is revealed that the company paid their first dividend in 2012.

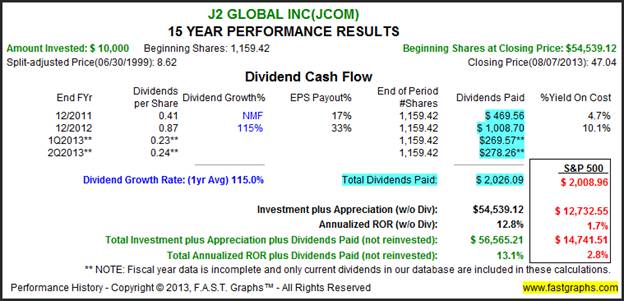

One interesting aspect of the performance history of j2 Global is how their dividend closely matches the dividends derived from the S&P 500 even though they have only paid a dividend since 2012 (first dividend paid on December 20, 2011).

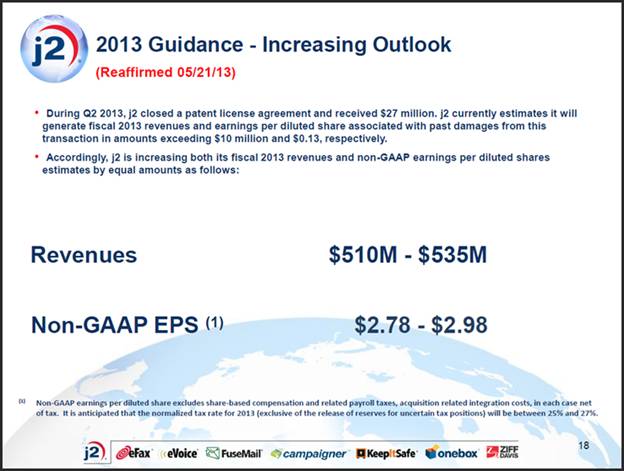

Since this company has only recently been paying a dividend, I offer the following slide where management has provided 2013 guidance. This is important because future dividends will most assuredly depend on the company’s future revenues.

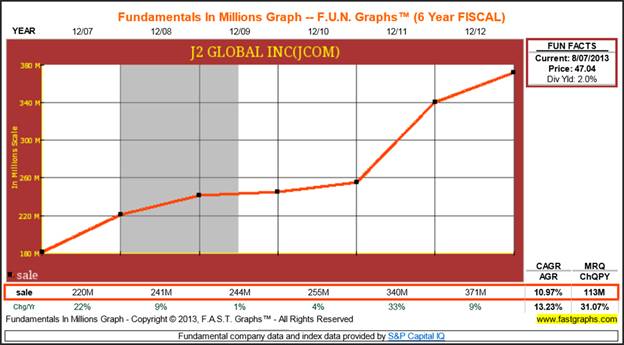

The following FUN Graph (Fundamental Underlying Numbers) shows that revenue guidance (sales) for 2013 represent a substantial increase over 2012. Therefore, it appears the company will have ample ability to continue paying and perhaps increasing their future dividends.

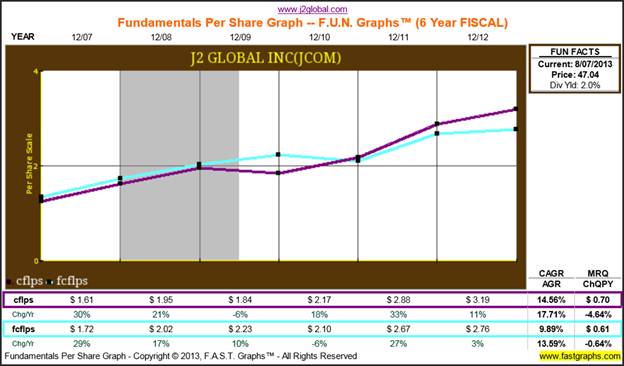

At this point one can only speculate that j2 Global’s board of directors will continue with their dividend policy. However, since the company’s most recent financial report bragged about their ninth consecutive dividend payment, this may not be an unrealistic assumption. Moreover, the following FUN Graph shows that cash flow per share (cflps) and free cash flow per share (fcflps) suggest that the company is at least capable of continuing to pay and possibly increase their dividend in the future. Note: FUN Graphs calculates free cash flow after dividends have been paid.

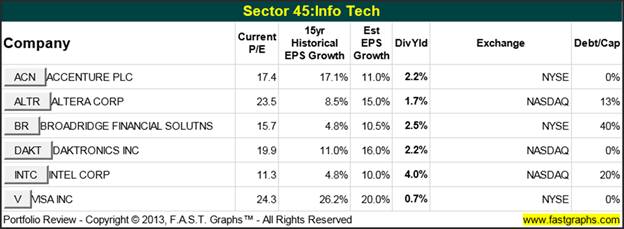

David Fish Challengers

For additional insight into the dividend paying prospects of the Information Technology sector, I thought it would be interesting to show the following companies on David Fish’s Challenger’s list. These are companies that have raised their dividend consecutively for at least 5 to 9 straight years. Only two companies on this list failed to make my cut. Altera Corp (ALTR) was rejected due to recent inconsistency in their earnings and high valuation. Visa did not meet my minimum dividend yield threshold. Otherwise, the remaining companies were included in my conservative and aggressive candidates.

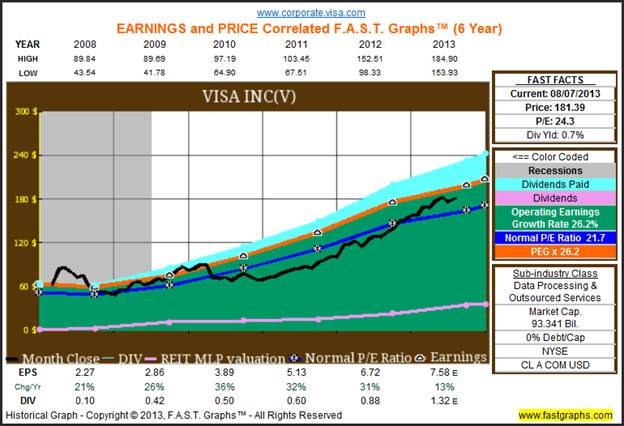

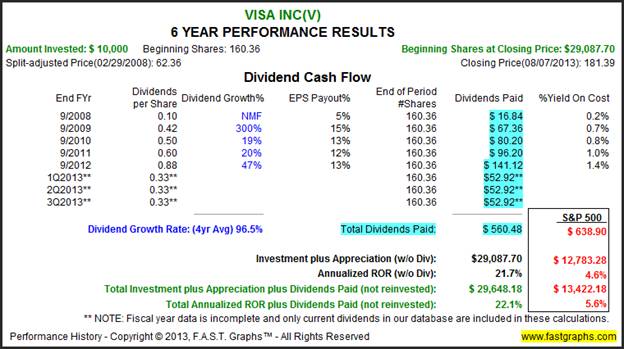

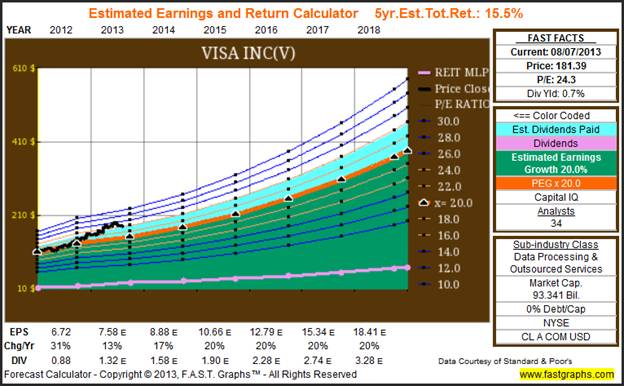

Visa Inc (V)

Even though Visa did not make my cut, I thought it would be interesting to showcase their phenomenal record. Therefore, dividend growth investors interested in total return might want to take a closer look at Visa.

Visa Inc Historical Graph

Visa Inc Performance Graph

Visa Inc Forecasting Graph

Summary and Conclusions

I believe it would be naïve to believe that large technology behemoths such as Microsoft, Cisco, Intel, Apple or IBM, etc., are destined to becoming and remaining blue-chip dividend paying stalwarts like Procter & Gamble or Johnson & Johnson. However, I further believe that their size and scale are needed to provide the solid infrastructure and foundation that the Information Technology sector needs to fulfill its inevitable destinies and even promise. Therefore, I also don’t believe it’s prudent to rule out the relevancy of our largest icons of technology. True, it is imperative that they continue to evolve and adapt. But it is also true that their scale and size provide powerful moats potentially ensuring their survival and growth potential.

Consequently, I suggest that investors seeking more total return from their dividend growth portfolios should not overlook the opportunities available in the Information Technology sector. One of the oldest doctrines for prudent investing suggests that higher risk should only be assumed when there’s an expectation for higher returns. As a general statement, most of the dividend growth stocks presented in this article are forecast to offer higher future earnings growth rates than most blue-chip dividend paying stocks found in the other sectors. I believe it is safe to assume that higher earnings growth rates should also deliver higher dividend growth rates. As a result, many dividend paying Information Technology companies hold the promise of offering the dividend growth investor not only higher total returns, but a greater level of cumulative dividend income as well.

Dividend paying Information Technology stocks may not suit the most prudent or cautious dividend growth investor. On the other hand, for those with a greater appetite for risk, or perhaps a longer timeframe, it might be wise to prudently include some high-tech for higher total returns. But if they do, the prudent dividend growth investor will simultaneously realize that a constant monitoring of their Information Technology holdings is a necessity.

My next article will cover the Telecommunication Services sector.

Disclosure: Long ACN, ORCL and QCOM at the time of writing.

By Chuck Carnevale

Charles (Chuck) C. Carnevale is the creator of F.A.S.T. Graphs™. Chuck is also co-founder of an investment management firm. He has been working in the securities industry since 1970: he has been a partner with a private NYSE member firm, the President of a NASD firm, Vice President and Regional Marketing Director for a major AMEX listed company, and an Associate Vice President and Investment Consulting Services Coordinator for a major NYSE member firm. Prior to forming his own investment firm, he was a partner in a 30-year-old established registered investment advisory in Tampa, Florida. Chuck holds a Bachelor of Science in Economics and Finance from the University of Tampa. Chuck is a sought-after public speaker who is very passionate about spreading the critical message of prudence in money management. Chuck is a Veteran of the Vietnam War and was awarded both the Bronze Star and the Vietnam Honor Medal.

© 2013 Copyright Charles (Chuck) C. Carnevale - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Chuck Carnevale Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.