Two Gold Stocks You’ll Wish You Owned in 2013… and Should Still Buy Now

Commodities / Gold and Silver Stocks 2014 Jan 23, 2014 - 05:51 PM GMTBy: Casey_Research

By Laurynas Vegys, Research Analyst

By Laurynas Vegys, Research Analyst

Looking back on 2013, we have to conclude that it was one of the worst years for precious metals stocks in recent memory—despite all the reasons why it should have been a great one.

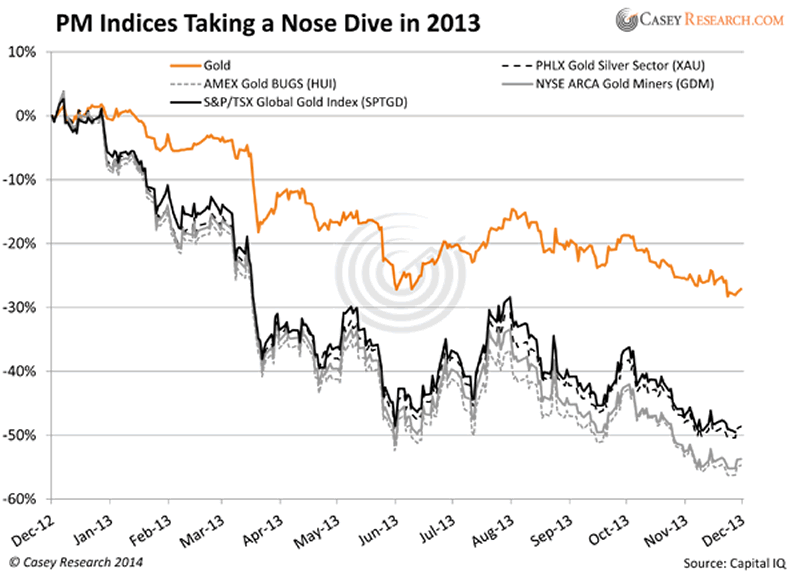

Here's a sober look at the performance of the most widely followed indices in the precious metals (PM) sector.

It's obvious that 2013 was an extremely painful year for precious metals investors.

Why? Here's a shortlist of some of the most notable reasons.

- We didn't see significant levels of price inflation in the US—the very thing that gold is a good hedge for—so there was no major flow into precious metals in America.

- Precious metals ETFs, like GLD, flooded the market with a massive amount of gold liquidations.

- The European sovereign debt crisis eased up (unless, of course, you live in the PIIGS countries, Cyprus, or pretty much anywhere else in the Eurozone).

- Rumors of the Fed tapering QE continued throughout the year, depressing the gold market and causing extreme volatility. (Oddly enough, the actual taper in December did much less harm than the rumors that preceded it, suggesting it was already priced in when it arrived.)

You can probably think of other reasons, but these no doubt contributed to the industry's precipitous decline.

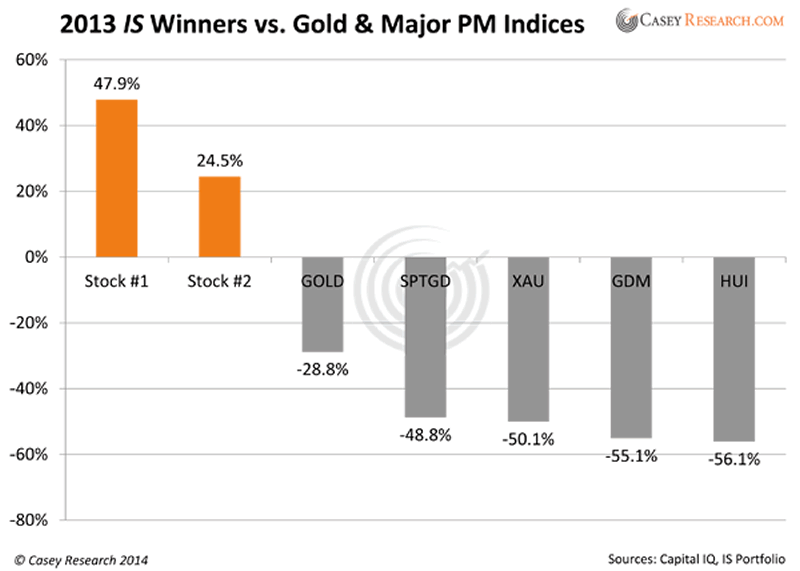

In such a depressed environment, it's not surprising that almost all gold stocks were down, though our International Speculator portfolio outperformed the market indices. And in fact, two of our portfolio companies—both 2013 recommendations—saw their share prices rise substantially.

Here's how these two stocks performed last year relative to gold and the indices:

The good news is both of these stocks are still "Buys" today, and we're convinced there's much more joy to come…

2014 Winner #1: Profit at Just About Any Price

Never mind simply beating the indices; this company gained a whopping 47.9% last year, due to its unique business model of processing third-party gold ore at its plant in South America.

We'd previously been skeptical of this model because ore suppliers are typically small scale and operate with no mine plan. This often causes irregularities in the quantity and quality of the ore received by the mill, which can lead to output and earnings seesawing wildly.

A very compelling angle to this story emerged, however, when the jurisdiction where the company operates decided to crack down on illegal and environmentally unsound ore-processing practices. This instantly created a bottleneck, allowing the company to pick and choose its potential suppliers and accept only the highest-grade deals.

Our 2014 Winner #1 has been steadily increasing output while keeping tight control over its ore grade and gross margin. One of the most attractive characteristics of its model: The company has been able to lock in a margin that remains stable even when the gold price fluctuates.

On the exploration side, our pick recently delivered high-grade drill results at its South American gold project, including some bonanza-grade hits. A large, high-grade discovery here could easily drive this stock to become a 10-bagger (i.e., produce gains of 1,000% or more).

However, successful exploration is not required for the shares to continue rising in the coming years, as the company will continue to profit from its gold processing operation.

This gold processor is still one of our favorite International Speculator picks. It will continue to earn record profits this year, even if the gold price goes nowhere—in other words, this stock still has plenty of upside with almost no downside risk.

2014 Winner #2: High-Grade Metal with Proven People

Our second favorite pick in 2013 was a new high-grade copper-gold producer in Colombia.

We had been following the story for a while, primarily because we know and trust management (and if you've read Doug Casey for any length of time, you know that "People" is the first and foremost of his Eight Ps of Resource Stock Evaluation).

We didn't recommend the stock the first time we were on site, as metals prices were falling and the company had a big property payment coming due. Flash forward to today: The company raised the money it needed, the resources in the ground have been expanding and at excellent grade, mine upgrades are under way, and the keys to the plant have just been handed over.

The dual copper-gold production is a real boon in our current, low-price environment: Even if gold were to stay down for the rest of the year, the cash flow from the copper (a base metal and, therefore, subject to different economic factors than the precious metals) should keep the company's profits humming along.

We have yet to see financial results from the operation, but we have a great deal of confidence in this mine-building team, one that has delivered for us repeatedly in the past.

Cash flow, and soon thereafter net profits, are an imminent push in this story—though the real jackpot potential comes from the large land package surrounding the company's mine, which holds multiple outcrops of high-grade mineralization that have never been drilled.

Currently, the company is busy expanding its mine, so that exploration work probably won't happen until later this year. But we do think there's a good possibility of some very big news in the second half of 2014—so you'll want to position yourself now, while prices remain relatively low.

Why You Should Own These Stocks This Year

Both of the companies—and their share prices—are poised to benefit greatly from increased cash flow, a ramp-up in production, and high-grade drill results.

In addition, 2014 Winner #1, with its ingenious long-term growth model and its ability to profit at just about any gold price, offers minimal downside risk. This company found a creative and profitable way to not only survive last year's downturn but to thrive in the midst of it—and with an effective model in place, it will continue to prosper this year. The tide doesn't need to turn in the precious metals sector for this stock to continue to do well.

Out of fairness to paying subscribers, we can't give you the names of these two companies. But you can find out all about them—plus how to invest and what to expect this year—without any risk to you whatsoever.

Here's what I suggest: Take us up on our 100% satisfaction guarantee and try Casey International Speculator for 3 months. If it's not everything you expected and more, simply cancel for a prompt, courteous refund of every penny you paid.

Even if you decide to cancel ANY TIME after the 3 months are up, you'll still get a prorated refund on the remainder of your subscription. That's our iron-clad guarantee, so what do you have to lose? Just click here to get started.

© 2014 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.