Goldman Sachs Is Highly Motivated To Low-Ball Gold Price

Commodities / Gold and Silver 2014 Apr 19, 2014 - 05:34 AM GMTBy: Steve_St_Angelo

The distinguished analysts from Goldman Sachs reiterated their 2014 forecast for gold to hit $1,050 by the end of the year. They believe the paper price of gold will continue to decline as the supposed "Powerhouse" U.S. economy picks up speed and accelerates growth.

The distinguished analysts from Goldman Sachs reiterated their 2014 forecast for gold to hit $1,050 by the end of the year. They believe the paper price of gold will continue to decline as the supposed "Powerhouse" U.S. economy picks up speed and accelerates growth.

If someone recently had a frontal lobotomy... this forecast might make perfect sense. On the other hand, if a person belongs to the 95-99% group of Americans who believe everything coming from the Boob Tube, this forecast is exactly what the doctor ordered.

Goldman isn't that stupid to realize the well-educated precious metal investors don't believe a word coming from the bank's talking heads, rather their forecasts are designed and targeted at Americans who still believe in the Greatest Fiat Ponzi Scheme in history.

Furthermore, Goldman Sachs has serious motivation for throwing the paper price of gold under the bus. You see... Goldman is by far the weakest and most vulnerable bank when it comes to its Assets to Derivatives ratio. Not only does Goldman rank DEAD LAST compared to the other banks in this ratio, it does so with flying colors.

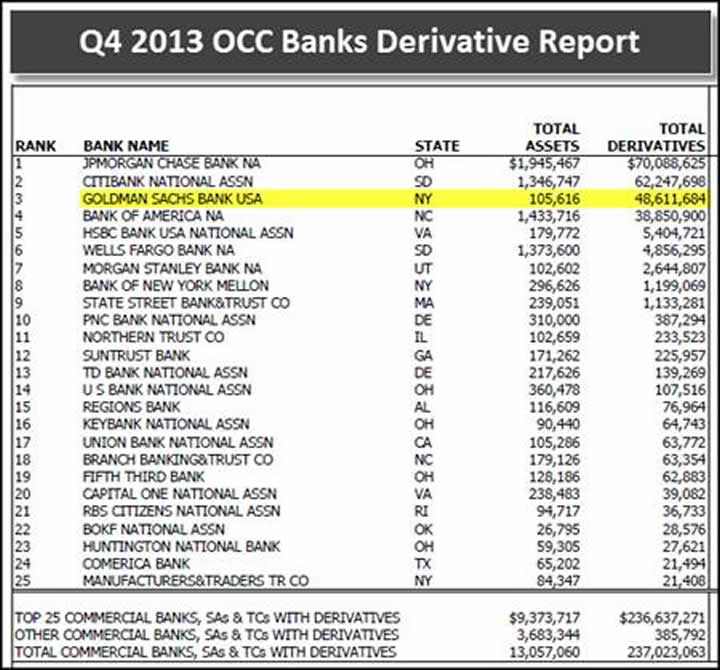

Here is the most recent break-down of Derivatives holdings by the top 25 U.S. Commercial Banks:

This is a table from the OCC's Q4 2013 Report on Bank Trading and Derivatives Activity. Let's focus on the top 4 banks. You will see that while Goldman has $48.6 trillion in derivatives on its books, it only has a measly $105 billion in assets to back it up.

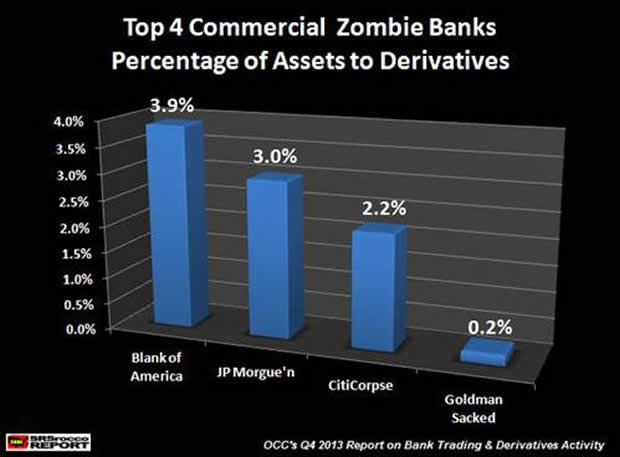

Dividing each of the top 4 U.S. banks assets to derivative holdings, we have the following percentages:

Starting with the best of the worst Zombie Banks, Blank of America has a 3.9% asset to derivatives ratio, while JP Morgue'n comes in second with 3%, Citicorpse follows third at 2.2% and Goldman Sacked places dead last with a pathetic 0.2%.

Goldman Sacked doesn't have much in the way of assets to back up those $48.6 trillion in notional derivatives. I find it simply hilarious that the bank with the worst asset to derivative ratio has the gall to throw out a STINK BID of $1,050 gold. But we really can't blame them as they have the most to lose if things were to get out of control in the markets.

Goldman Sacked: The King Percentage Holder Of Interest Rate Swaps

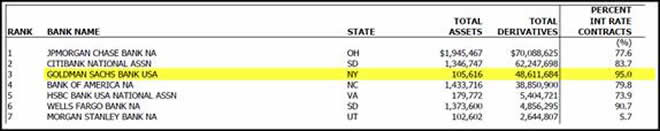

Another reason Goldman has more SKIN in the game to delude Americans of the value of gold is their exposure to the Interest Rate Swap market. Out of the top 7 U.S. Banks, Goldman Sacked holds the highest percentage of Interest Rate Swaps:

Here we can see that Goldman has invested 95% of its derivatives in Interest Rate Contracts. Which is why Goldman also needs the Fed to keep interest rates low. If interest rates were to rise substantially, Goldman would be on the losing end of the trade.

The global financial system is leveraged more than ever. Leverage is great on the way up, but certainly a BEE-OTCH on the way down. So, we precious metal investors need to understand that these banks are forced to LIE, CHEAT and STEAL even more as the leverage on their balance sheets becomes greater.... especially GOLDMAN SACKED.

Please check back at the SRSrocco Report as I will be providing a new REPORTS PAGE including my first paid report, THE U.S. & GLOBAL COLLAPSE REPORT. You can also follow us at Twitter at the link below:

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.