Why I’m Grateful to Live in America

Politics / Social Issues Jul 08, 2014 - 06:32 AM GMTBy: Frank_Holmes

An important principle of our investment process at U.S. Global Investors is a belief that government policies are a precursor to change. As a result, we closely monitor the fiscal, monetary and other impactful governmental policies of the world’s largest countries, both in terms of economic stature and population. We’re always listening for the proverbial shot heard around the world. As we celebrated America’s Independence Day over the weekend, this belief rings especially true.

An important principle of our investment process at U.S. Global Investors is a belief that government policies are a precursor to change. As a result, we closely monitor the fiscal, monetary and other impactful governmental policies of the world’s largest countries, both in terms of economic stature and population. We’re always listening for the proverbial shot heard around the world. As we celebrated America’s Independence Day over the weekend, this belief rings especially true.

In 1776 it was America’s reaction to oppressive government policy that led to the Declaration of Independence, unbinding the 13 colonies from England’s constraint and permitting them to prosper as their own entity, what would become the United States of America.

Today, it’s undeniable that some government policies are controversial, whether it’s America’s involvement in the Middle East or changes in health care policy. Despite widely differing personal views, I believe the people of this country can agree upon one thing: the fledgling government’s policies supporting democracy, life, liberty and the pursuit of happiness crafted over 200 years ago led America to where it is today. A world leader. A global success story based on equal opportunity, upward mobility and freedom to change. An economic powerhouse. A promoter of education and entrepreneurship. A protector of freedom for its people and others oppressed outside its borders.

America is an economic leader. The United States remains the world leader in GDP, followed closely by China. Energy is the latest example of American innovation spurring this economic growth. Over the last several years, a revolution in the oil industry has taken over in the U.S. We could be looking forward to decades of drilling as we watch the energy sector continue to accelerate, so far creating thousands of jobs for Americans and increasing tax revenues for their communities to reinvest in education and infrastructure.

Nobody predicted the gigantic growth in the energy sector would come out of the United States, but as you can see below, crude oil production has reached a 25-year high in America.

It was American ingenuity, the thinkers and the doers, who worked towards the technology that made this possible. It was the determined minds who knew hydraulic fracturing would push this business forward. Freedom fuels creativity, risk taking and entrepreneurship. This is important to an evolving economy.

America is a thought leader. Government-supported and free public schools for all were established after the American Revolution and by the 1930s, 100 percent of children attended school. Today the U.S. has a reading literacy rate of 99 percent of the population over age 15. Though any parent will tell you our schools could do better, and vast discrepancies in quality exist, universal education is a fundamental right in America.

An alarming number of countries still do not allow women the basic right to an education, something we take for granted. Some 60 percent of the 10 million children not in schools throughout developing nations, for example, are girls. Public education in this country has long been a springboard to success.

Did you know that the United States is home to the largest percentage of top universities in the world? The 2013-2014 Times Higher Education World Rankings show that out of the top 10 universities in the world, seven are in the United States. Many of the business and political leaders I’ve met from around the world choose to send their sons and daughters to study in America. Not only is education an important piece of our nation’s framework, so is the push for innovation and competition. Take a look at the IMD World Competitiveness Scoreboard for 2014: the United States comes in at number one. The rankings are based on how an economy manages the totality of its resources and competencies to increase the prosperity of its population, according to the IMD website.

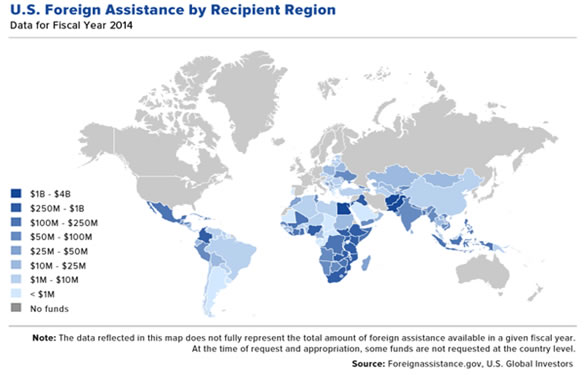

America is a benevolence leader. A portion of the United States’ budget is allocated to provide foreign aid across the world for humanitarian needs following war-related or natural disasters. Whether or not you believe in this portion of government spending, the United States continues to be a helping hand to weaker countries during times of crisis.

The U.S. also ranks first in the 2013 World Giving Index, conducted by the Charities Aid Foundation (CAF), to study giving trends and charitable growth around the world. According to the CAF’s report, proportionally more Americans gave in some way than in any other country.

America is home to hundreds of charitable organizations, one of the most notable being the American Red Cross. According to its website, the American Red Cross is dedicated to preventing and alleviating human suffering in the face of emergencies by mobilizing the power of volunteers and the generosity of donors.

America is a liberty leader. In 2013, Gallup asked people from 154 countries if they would like to migrate, and if so, where would they want to go? The United States was by far the most popular choice. Gallup estimates that around 140 million people would relocate here, if they could. The United Kingdom was the second-most popular, with 42 million people.

Why do America’s shores continue to beckon? One reason could be the opportunity to prosper in the United States. The U.S. is a country that stands for balance of power and rule of law, where political leaders are fairly elected. Political power is not ordained by birthright, taken by force or elected by farce. In America, everyone has an equal and fair chance. A chance to become wealthy, a chance to become educated, and a chance to worship who or what you want. The United States encourages and celebrates individual achievement, but is also a melting pot of cultures and ideas, where citizens feel a sense of belonging and communal pride to be Americans.

Although there is a lot to improve upon, these are just a few of the positive reflections I see in this country – things we must not take for granted, but instead continue expressing gratitude for. In order to keep up with our global competition and in order to keep the individual American dream alive, we must continue to strive ahead and push for smart government policies that support initiative and independence.

Being a Tex-Can, born in Canada and now living in Texas, I’m privileged to celebrate both Canada Day and America’s Independence Day. I have been traveling recently with President Clinton and Canadian philanthropist Frank Giustra in Haiti and Colombia to help support the efforts of the Clinton Giustra Enterprise Partnership.

This group provides thousands of youth in communities around Cartagena, Colombia, new employment and education opportunities as well as training scholarships and job internships. I also met with Colombian President Juan Manuel Santos during our visit. This is a wonderful organization and a perfect example of how great leadership and ingenuity can spread far and wide, no matter the country you are from.

Want to receive more commentaries like this one? Sign up to receive email updates from Frank Holmes and the rest of the U.S. Global Investors team, follow us on Twitter or like us on Facebook.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.