Christmas In October – Desperate Measures

Companies / Sector Analysis Oct 26, 2014 - 12:33 PM GMTBy: James_Quinn

The desperation of retailers grows by the day. I head to Wal-Mart and Giant in Harleysville every Sunday morning at 7:00 am. to do my weekly grocery shopping. I go to Wal-Mart at opening to avoid the freaks we see weekly on the People of Wal-Mart post. The workers at Wal-Mart are only a small step above the customers. They can barely communicate, rarely look you in the eye, and generally act like they are prisoners in an asylum.

The desperation of retailers grows by the day. I head to Wal-Mart and Giant in Harleysville every Sunday morning at 7:00 am. to do my weekly grocery shopping. I go to Wal-Mart at opening to avoid the freaks we see weekly on the People of Wal-Mart post. The workers at Wal-Mart are only a small step above the customers. They can barely communicate, rarely look you in the eye, and generally act like they are prisoners in an asylum.

I’m in winter/bad times ahead prep mode. I had a load of fire wood delivered yesterday which I wheelbarrowed to the back yard and stacked with my already decent sized stack. Last week I took an empty propane canister back to Wal-Mart to replace it with a full canister. That would give me three full propane tanks. I left the empty tank outside next to the propane cage and went in to pay. The old lady cashier with the gravelly smoker voice told me she would call for someone to get me a new tank.

I went over the cage and patiently waited for a Wal-Mart drone to come out, unlock the propane cage and give me a full tank. Two minutes, five minutes, and eventually ten minutes go by with no one coming out to help me. The cashier pokes her head out the door and shrugs her shoulders and says no one is responding to her calls. What a well oiled machine they have at Wal-Mart. Eventually the old lady abandoned her cashier post and in a painstakingly slow manner proceeded to unlock one bin after another until she found a full tank. I’m sure a line of unhappy customers were piling up at the only register in the garden center while she spent ten minutes getting me my propane tank.

A transaction that should have taken five minutes from start to finish ended up taking closer to twenty five minutes, with another five or six customers also dissatisfied with their extra long wait. This is a perfect example of how not to do business. Maybe Wal-Mart’s problems are bigger than households having less to spend. They are attempting to maintain their profit margins by reducing staff hours, hiring low quality people, and paying them shit wages. In the short run it may keep profits higher, but in the long-run customers will go elsewhere. Except most of the elsewhere stores closed up years ago when Wal-Mart arrived and underpriced them into bankruptcy.

My shopping experience at Giant is generally pleasant. The staff are nice, competent, and have been there for years. They know what they are doing and serve you with a smile. But their store is part of a worldwide conglomerate, so things have changed for the worse over the last four months. They renovated the entire store, creating bigger aisles and moving stuff around. That’s annoying, but after a while you figure out where they moved the stuff you want. The real negative change was the dreaded “Everyday Low Pricing”. This weasel phrase means you will be paying more. This is what the Apple idiot CEO – Ron Johnson – did at JC Penney. It put them on a rapid path to bankruptcy.

The weekly sale items at Giant have virtually disappeared. This has coincided with the drastic increase in beef, pork and fresh produce prices. Since “Every Day Low Pricing” went into affect our weekly grocery bill has gone up 20%. And I am buying far less beef and more chicken. In the past I would stock up on sale items and put beef, pork and whatever was on sale in our storage area freezer. Now I am stuck buying what we need that week. No bargains, just fully priced food items. Be forewarned, whenever you see a store announce “Everyday Low Pricing” you are getting screwed.

The Boos Begin in August & Bells Start Jingling in October

The desperation of Wal-Mart and most of the other mega-retail chains is no more clearly evident than in their relentlessly ridiculous acceleration of holiday marketing displays. I was flabbergasted when I saw Halloween candy, decorations and costumes in row after row BEFORE Labor Day at my local Wal-Mart. Selling Halloween candy two months before Halloween is idiotic and a sure sign of desperation. Retailers have run out of merchandising ideas. I wouldn’t even consider buying Halloween candy until the week before Halloween. Do Wal-Mart freaks of the week actually buy Halloween merchandise in September?

Holidays used to be special occasions that lent a sense of sales urgency for retailers for a week or two, to pump up sales. Now Wal-Mart and the rest of the dying retailers have Christmas, Easter, Fourth of July, and Halloween displays up for 80% of the year. There is no sense of urgency to buy. From September 1 though October 31 there are rows and rows of bags of corporate produced chemicals disguised as candy. I suppose the obese masses buy this crap in anticipation of Halloween, tell themselves they’ll only take one, and then shovel the entire bag down their gullets.

So last week, still a full two weeks before Halloween, Wal-Mart had already converted their entire garden center into a Christmas wonderland of cheap mass produced Chinese cookie cutter Christmas decorations and lights that will blow out after three hours of use. They had also converted aisles at the front of the store to Christmas displays. Who the hell shops for Christmas crap in October? There is nothing like having cheap Chinese Christmas crap available for over two months to create a sense of urgency to buy. Wal-Mart and the rest of the mega-retailers have got nothin. They have no original merchandising ideas. They don’t even try anymore. They source low quality goods from China and compete solely on price. I can’t wait for the Easter candy to appear on Wal-Mart’s shelves in late December.

Black Thanksgiving

Black Friday is dead. Long live Black Thanksgiving. The riots and stampedes by the ignorant masses for toasters and HDTVs on Black Friday are now being replaced by retailers and malls across America opening at 6:00 pm on Thanksgiving. It actually seems fitting. How better to give thanks for our mass consumption, debt financed, materialistic, iGadget addicted society than to open stores on Thanksgiving. Spending time with family is overrated anyway. If you had to spend six hours with cousin Eddie and aunt Bethany, you’d be looking forward to an early opening at Macy’s.

The bullshit message from the mega-retailers is: “We’re not opening on Thanksgiving out of desperation or greed. We’re doing it simply to satisfy the demands of our customers”. It’s a racist national holiday anyway. We should be going to an Indian run casino on Thanksgiving to make up for our past sins. Opening stores and forcing workers to work on Thanksgiving is pathetic, disgusting and a truly desperate measure in this consumer empire in decline. The law of diminishing returns has been invoked upon the mega-retailers that dominate our suburban sprawl paradise.

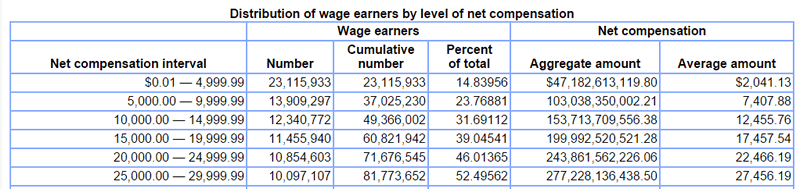

These retailers can start holiday merchandising three months before the actual holiday. They can open their doors on Thanksgiving, Easter and Christmas. It’s nothing more than shuffling the deck furniture on the Titanic. We’ve allowed bankers, politicians and corporate titans to financialize our economy, gutting the once thriving middle class, sending manufacturing jobs overseas, and convincing the clueless masses that consumer goods purchased with debt is equal to wealth. But, we’ve reached the point of no return. There are 248 million working age Americans and 102 million of them are not employed. Of the 146 million working Americans, 82 million of them make less than $30,000 per year.

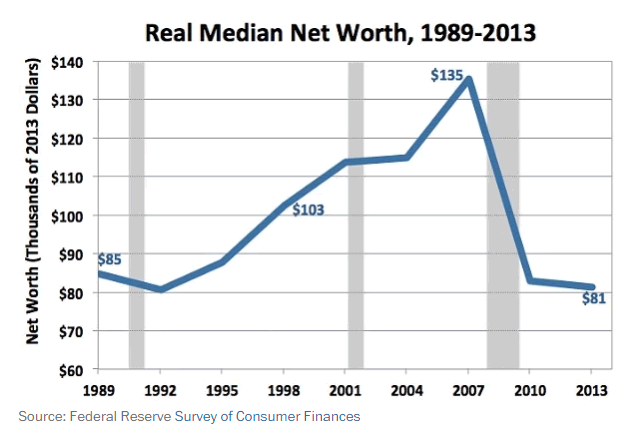

While retailers have added billions of square feet since 1989, real median net worth is 5% lower over 24 years. Retailers are attempting to get blood from a stone. The stone is in debt, approaching retirement with no savings and dead broke.

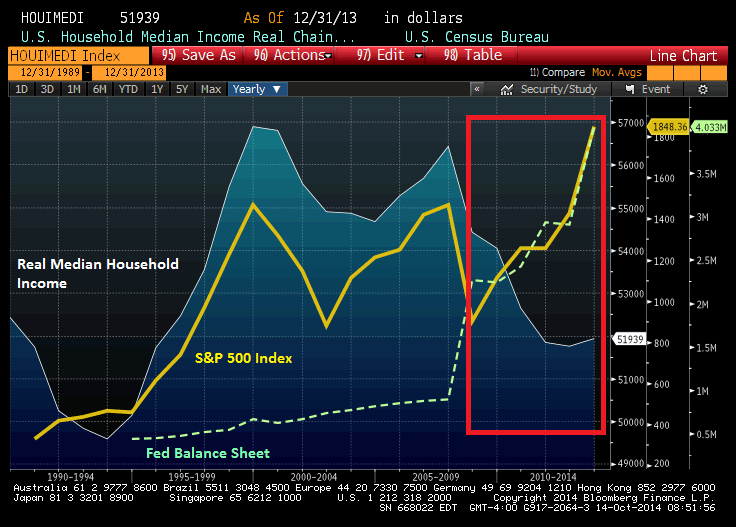

We have one entity that deserves the most credit for destroying the American Dream. Real median household income is lower than it was in 1989. The 2008 collapse was caused by the easy money bubble machine at the Federal Reserve. We had the opportunity to hit the reset button, implement rational economic and monetary policies, take our lumps, and make the banking culprits pay for their crimes. Instead, the easily manipulated masses believed the Wall Street storyline and allowed the Federal Reserve and feckless politicians to save the banking cabal with extreme money printing and debt creation. This has pushed the middle class closer to the breaking point, while further enriching the oligarchs. The Federal Reserve saved their owners and lured the masses further into debt.

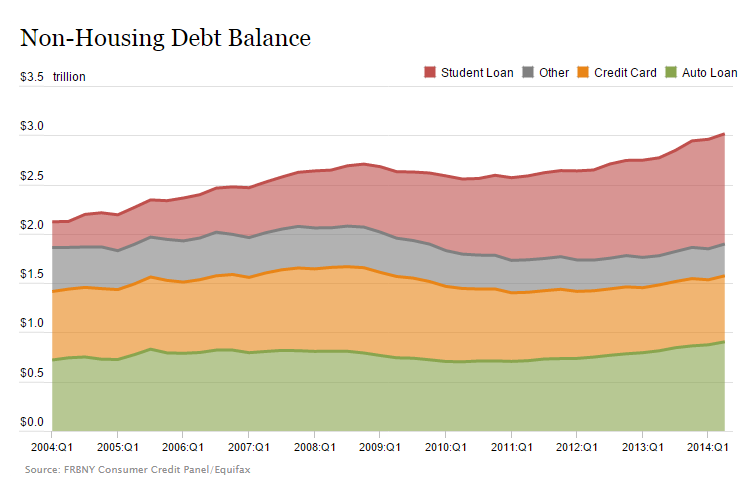

The Fed, Wall Street, and Washington DC have successfully driven consumer debt to an all-time high, blasting through the $3 trillion level. Declining real incomes and rising debt are a sure recipe for success.

Our entire economic paradigm is built upon desperate measures. Zero interest rates, $3 trillion of QE, systematic accounting fraud, fudged economic data, and doling out subprime loans to auto renters and University of Phoenix wannabes have failed to revive our moribund economy. Delusions don’t die easily. But they do die. We are reaching the limit of this delusionary dream built upon debt, denial, and deception. Make sure you wolf down that Thanksgiving feast before 5:00 pm. There are HDTV’s to fight for at 6:00 pm.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2014 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.