Bitcoin Price Did We Just See an Important Slump?

Currencies / Bitcoin Nov 18, 2014 - 10:00 PM GMTBy: Mike_McAra

The Commodity Futures Trading Commission (CFTC) expressed an opinion it does have authority over Bitcoin, at least as far as investigating any possible price manipulation is concerned, we read on The Wall Street Journal website:

A commissioner at the Commodity Futures Trading Commission said Monday that the agency was authorized to intervene with enforcement actions against price manipulation in bitcoin markets.

“It has not been tested, but I do believe we have the authority because if you think of any reasonable reading of our statute, bitcoin classifies as a commodity,” said CFTC Commissioner Mark P. Wetjen during a panel discussion at a seminar on the digital currency organized by Bloomberg in New York. “This gives us the authority to bring enforcement against any type of manipulation.” He added that the CFTC statute’s definition of a commodity is very broad.

Our comment here is that the government agencies are starting to give their opinions on Bitcoin and possibly signaling what kind of authority over Bitcoin they deem they have. This particular opinion on the part of the CFTC shows that the general approach toward Bitcoin is one in which the cryptocurrency is regarded as commodity and legally this is the approach other agencies are going to take, in our opinion.

In their assessment of Bitcoin, the CFTC does seem to focus more on the idea of Bitcoin as a means of storing and transmitting value but in a way more similar to other commodities than to the U.S. dollar. It’s not that Bitcoin is really that similar to oil or soybeans. It’s rather that the authorities have to put in some category for legal purposes and for the CFTC this category seems to be “commodities.”

Other agencies, such as the New York Superintendent of Financial Services, focus less on the commodity side of Bitcoin, more on its use as a payment system. The perception of a payment system is also one more readily adopted by venture capitalists.

Eventually, Bitcoin will not be treated by law as a currency but rather as a payment system akin to PayPal, even though there are vast differences to how the two systems operate. On the other hand, the disruptive idea behind Bitcoin shows that it might just as well reinvent the payments. The fact that the authorities are having a hard time getting to figure out how to approach the currency shows that it’s something that we haven’t exactly seen before.

But it’s not all of the disruptive potential of Bitcoin. Startups are working on solutions to apply the principles behind Bitcoin to other types of services that would typically involve a third counterparty. Other companies try to improve the security and ease of use of the network. All in all, it seems that the years to come will be exciting for Bitcoin and for cryptocurency-based systems as well.

For now, let’s turn to the charts.

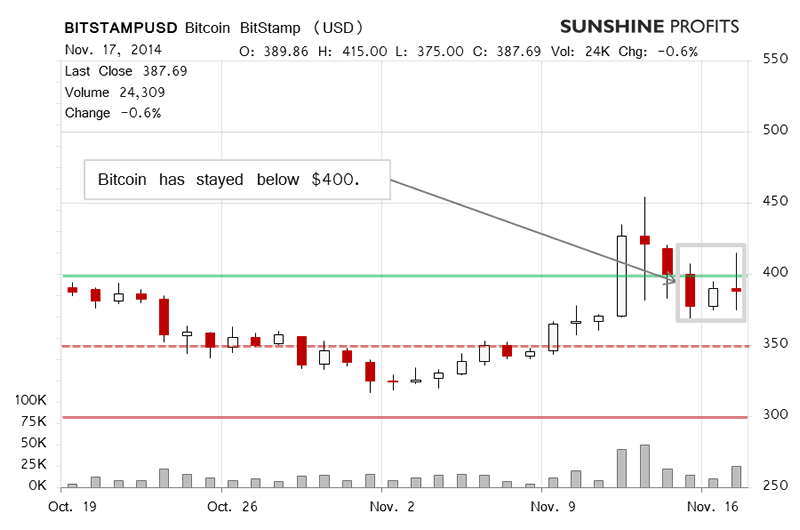

On BitStamp, we saw Bitcoin fluctuate above and below $400 (solid green line in the chart) only to end the day more or less where it had started it. Yesterday, we wrote:

Taking the events as we see them, it seems that we are seeing a rebound. If this move takes Bitcoin to $450 or above, this might have further bullish implications. For the time being, however, the volume is not extremely strong, so we wouldn’t get too optimistic about Bitcoin’s recovery just now.

Turns out we were right to hold back since Bitcoin has gone down today (this is written before 1:30 p.m. ET), not decisively and potentially weaker volume. The next couple of days or weeks will be crucial as far as the medium term is concerned. If we see a pull down, Bitcoin could very well backtrack to $300. Based on today’s action, the situation has become less bullish than it was yesterday. The first bigger move now could determine the immediate trend for the next couple of days. Our bet here is still on a move up.

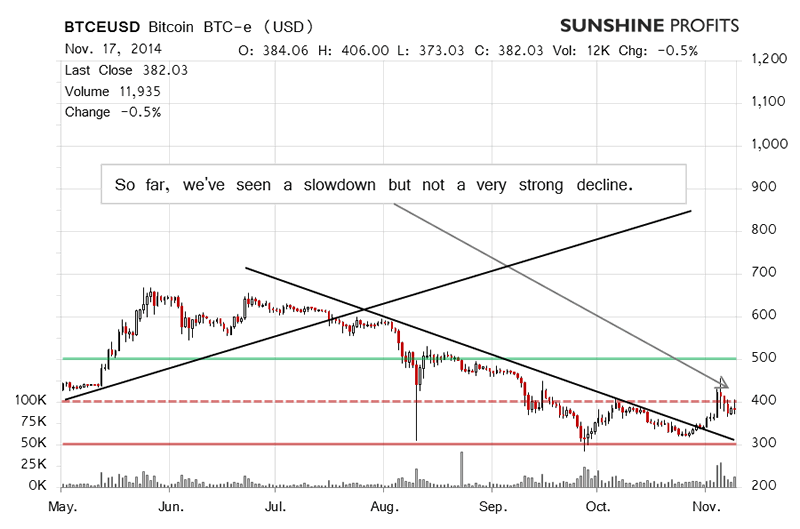

On the long-term BTC-e chart not that much has changed since yesterday’s alert. Based on that, our comments from Friday are still up to date:

(…) unless we see a slip below $350, the situation might actually stay bullish for us, not only from the short-term perspective. Currently, we’re still inclined to bet on a move up to follow. If this actually happens, we might see Bitcoin at $500.

The depreciation we’ve seen today makes us slightly more cautious of any further slides but, just as was the case yesterday, we don’t see the situation as bearish just now. Actually, we saw a first higher high in months. If it’s followed by a lower low, a new move up might just as well build up.

Summing up, we think long speculative positions might become profitable.

Trading position (short-term, our opinion): long speculative positions, stop-loss at $357, initial target at $500.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.