This Stocks Bull Market Is NOT Over Yet

Stock-Markets / Stocks Bull Market Jan 03, 2015 - 04:07 PM GMTBy: DailyWealth

Dr. Steve Sjuggerud writes:

The U.S. stock market boom is nearly six years old... But the fun ain't over yet!

Dr. Steve Sjuggerud writes:

The U.S. stock market boom is nearly six years old... But the fun ain't over yet!

Yesterday, I showed you how stocks could go much higher... even as interest rates finally rise. And today I'll show one more reason why this great bull market is NOT over yet...

This reason is extremely simple...

Stocks are not expensive yet.

Typically, in major stock market peaks, stocks reach "bubble" valuations before it's finally over.

We are simply not there yet.

Let me explain why...

The most common measure of stock market "value" is the price-to-earnings (P/E) ratio. Basically, high is bad and low is good.

Today, the stock market (the S&P 500 Index) trades at a P/E ratio of 18.3.

The long-term average P/E ratio is around 16... So stocks today are somewhat more expensive than normal... but they certainly aren't outrageously expensive. (Stocks are actually trading at a P/E of 16 based on 2015 earnings estimates.)

The thing is, you can't just look at the P/E ratio by itself... that doesn't give you enough information. You have to look at the current economic situation as well.

For example, the economic situation in 1980 – with high inflation and high interest rates – was much different than today. It's not "fair" to compare 1980 stock values with today's.

In our office, we use a simple metric to better compare apples to apples – we add the P/E ratio and interest rates.

You see, the level of interest rates has a lot of information built into it... It has inflation expectations... economic growth expectations... and whether or not the Fed is being accommodative (implementing policies to stimulate the economy) or restrictive (implementing policies to "cool" the economy).

The point is, we need to know what's going on with earnings AND interest rates to know what's really happening with stock valuations.

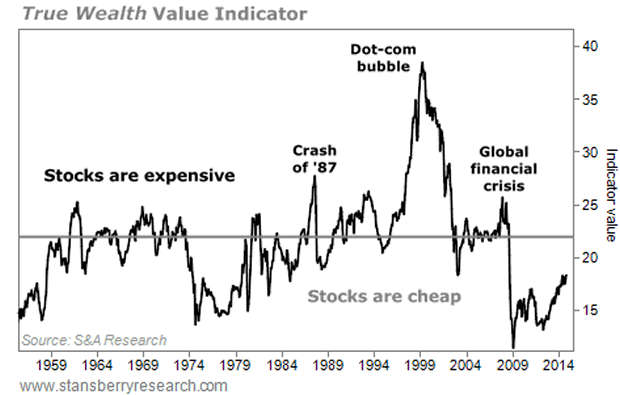

The chart below takes the P/E ratio and adds short-term interest rates. If the P/E is 10, for example, and short-term interest rates are 5%, our indicator shows a value of 15.

It's that simple. (We did smooth out a few nasty recessions that forced earnings to near zero on the P/E number.)

Today, P/E ratios are slightly elevated, but interest rates are near zero. So compared with history, today's level shows stocks are STILL not expensive based on this measure.

As you can see, stocks are a better deal today (in an environment of no inflation and low interest rates) than they were in 1980, when inflation and interest rates were in the double-digits.

The number 22 is the magic number for this indicator. When this indicator is less than 22, stocks return 12.3% over the next 12 months. But when it's more than 22... stocks fall over the next 12 months.

Today's reading is less than 19 – so we are not in a danger zone yet. And clearly we're nowhere near "bubble" valuations in U.S. stocks.

In short:

Rising interest rates won't kill the bull market in stocks, as I explained yesterday.

Stocks are not at bubble values, yet.

These conclusions might seem controversial... but they are simply based on the facts.

Yes, U.S. stocks have gone up for almost six years. But don't look backward... look ahead. And looking ahead at 2015, the U.S. is STILL an excellent place to put your money to work.

Don't let fear or emotions push you out of U.S. stocks. You want to own them in 2015!

Good investing,

Steve

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.