UK CPI Inflation Smoke and Mirrors Deflation Warning, Inflation Mega-trend is Exponential

Economics / Inflation Jan 14, 2015 - 05:00 AM GMTBy: Nadeem_Walayat

The official CPI measure for UK Inflation fell to just 0.5% in December with the more recognised RPI falling by 0.4% to 1.6% prompting the mainstream press to turn it's Eye of Sauron onto Inflation as the topic of the day, usually leading with commonsense reporting of the positives of low inflation such as falling energy and fuel costs and more disposable earnings for Britains wages slaves after having struggled for over 6 years with stagnating and even falling real terms wages. Though the media reports soon conclude with a lengthy explanation by an academic economist of why deflation is very, very, very bad in that it could trigger a downward economic death spiral as consumers put off buying goods and services in anticipation of lower future prices and hence the economy enters into an deflationary spiral of falling demand and output as occurred during the 1930's and for a few months into Mid 2009.

The official CPI measure for UK Inflation fell to just 0.5% in December with the more recognised RPI falling by 0.4% to 1.6% prompting the mainstream press to turn it's Eye of Sauron onto Inflation as the topic of the day, usually leading with commonsense reporting of the positives of low inflation such as falling energy and fuel costs and more disposable earnings for Britains wages slaves after having struggled for over 6 years with stagnating and even falling real terms wages. Though the media reports soon conclude with a lengthy explanation by an academic economist of why deflation is very, very, very bad in that it could trigger a downward economic death spiral as consumers put off buying goods and services in anticipation of lower future prices and hence the economy enters into an deflationary spiral of falling demand and output as occurred during the 1930's and for a few months into Mid 2009.

The inflation data triggered the Bank of England to once more step forward with its media superstar Governor Mark Carney to iterate the mantra of the risk of deflation so as to sow the seeds for a further dose of rampant QE money printing during an ELECTION YEAR which will act to further INFLATE Britain's Mini Election boom that is already well underway.

“We will expect it to fall further, and inflation to continue to drift down in the coming months.”

"deflation was now "possible".

This is the inflation graph that the academics most focus on towards the most recent data that highlight falling and LOW inflation and the THREAT of DEFLATION.

This also illustrates the fact that the Bank of England has FAILED to reach its 2% inflation target rate for 58 out of 60 months. However, the real inflation truth is far removed from that which the media focuses upon with the annual percentage rates of inflation that masks the truth of what is an exponential inflation mega-trend which is the primary consequences of perpetual money and debt printing monetization programmes that the government is engaged in, in an attempt to buy votes through high deficit spending, an inflation trend that asset prices are leveraged to and oscillate around to what amounts to an exponential trend.

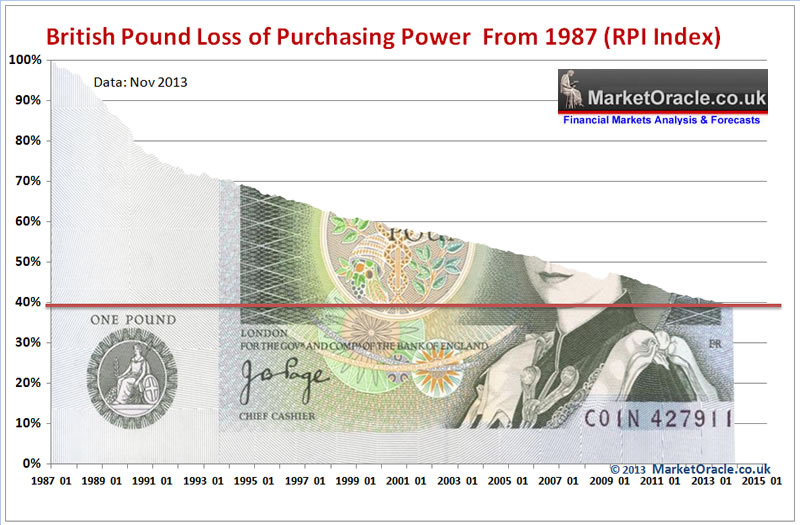

The below graph again illustrates how much Inflation we have experienced that most people are likely unaware of is that of the loss of purchasing power of the British Pound which is now worth less than 40% of its value of 25 years ago as governments continue to relentlessly erode its value all the way towards zero.

This IS the reason why your real experience of day to day living expenses does not match government / media propaganda. However, it is even worse because as I keep reiterating that the rate of Inflation is EXPONENTIAL. What this means is that if you stuffed money under your mattress 20 years ago, today it's value would have been inflated away by near 50%.

The debt / money printing induced inflation mega-trend is forcing people to either spend or put their hard earned cash into the bankrupt banks for a pittance in interest that is TAXED, so that it is near impossible to consistently get a return that is greater than an average of the official inflation rate let alone the real rate of inflation that is currently about 2.4%, as governments continuously tinker with the CPI methodology to reduce the official inflation rate as you will likely experience when you go to do you weekly shops and experience inflation rates nearer to 5% then 0.5%.

Government Money Printing Causes Inflation

Inflation is as a consequence of rampant government money printing by two primary mechanisms -

a. The off balance sheet bailout of the bankrupt banking system estimated at £700 billion since 2008.

b. Funding of the public sector black hole that manifests itself in an an average budget deficit of £110 billion per year, so totaling £760 billion since 2008.

Therefore the Bank of England's primary remit is not to target inflation but to instead to produce lots of graphs and fancy reports so as to give credibility to what amounts to nothing more than economic propaganda for the politicians to utilise towards the stealth inflation theft of purchasing power of savings and earnings in perpetuity as the price paid for rampant money printing be it called QE or debt that is never repaid but constantly rolled over and as has been the case for 6 years monetized i.e. effectively cancelled as the Bank of England returns most of the interest paid on the government bonds it has monetized back to the UK Treasury as the below graph illustrates the effect of on Debt to GDP %.

The REAL UK Debt to GDP Ratio appears to be have been systematically engineered to stay at a constant 41% of GDP (actual 77%), which I expect to remain constant at 41% into March 2015, as opposed to my forecast of actual of 79% as per my forecast of June 2010, on the official measure as a consequence of the effective cancellation (not actual) of approx £600 billion or 40% of outstanding government debt by 2015.

What is missing from the self congratulating Bank of England and politicians is the crash in earnings that has failed to keep pace with inflation for 6 years, having also fallen in nominal terms in large part as a consequence of immigration of several million extra workers prepared to work for longer hours for less pay that acts to drive down wages and boost corporate profits without adding much extra inflationary pressures apart from the housing sector, as immigrants tend to be less inclined to spend earnings, rather to save for investment or transfer funds back to their countries of origin.

The bottom line is that the Inflation mega-trend is exponential and the central banks deflation fears amount to nothing more than propaganda so as to allow governments to print money to buy votes with during an election year which means a year from now CPI Inflation will back above the 2% target, and probably nudging past 3%.

Source and Comments: http://www.marketoracle.co.uk/Article49008.html

By Nadeem Walayat

Copyright © 2005-2015 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.