Gold And Silver Price Probability for A Lower Low Has Increased

Commodities / Gold and Silver 2015 Jan 31, 2015 - 12:01 PM GMTBy: Michael_Noonan

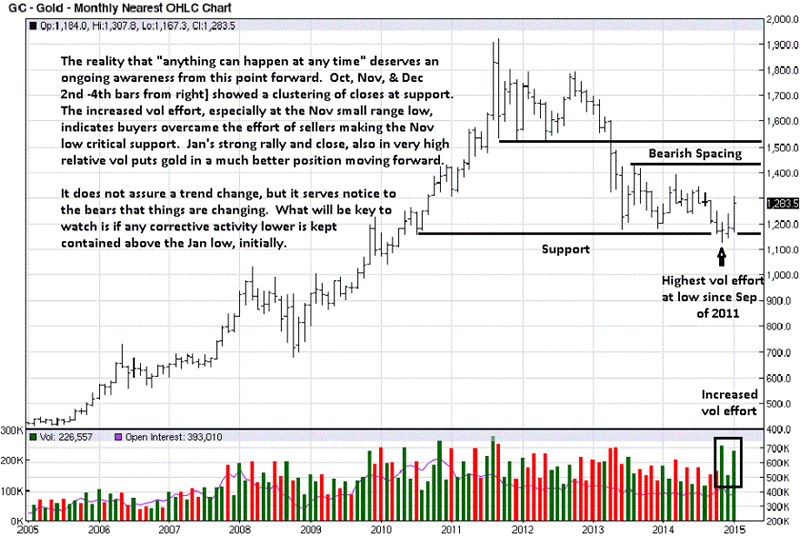

Mention is often made that one should wait for confirmation of a particular move in

futures before making a commitment, either way. Last week, it appeared evidence was

mounting that November could be a possible low for the correction since late 2011.

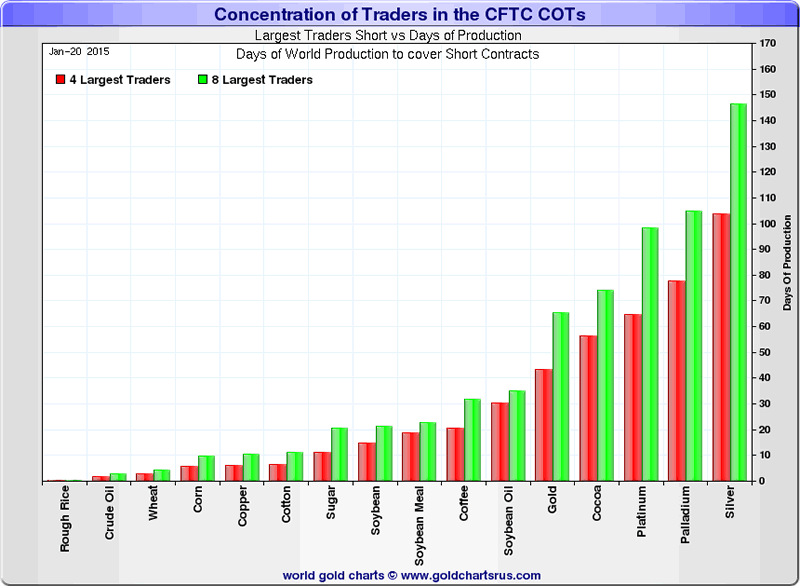

Then, we run across this graph from goldchartsrus.com which shows an inordinate

build-up of short positions in silver by what we would call “smart money,” “insiders.”

Mention is often made that one should wait for confirmation of a particular move in

futures before making a commitment, either way. Last week, it appeared evidence was

mounting that November could be a possible low for the correction since late 2011.

Then, we run across this graph from goldchartsrus.com which shows an inordinate

build-up of short positions in silver by what we would call “smart money,” “insiders.”

These large traders do not make such overtly strong commitments to the short side without expectations that things will go their way. If anything can be said about the market manipulators, mostly the elite’s central bankers/Wall Street/Fed, it does not really matter as to accurate identity, for they hide their source[s] very well. What matters is the outcome from the effort, and to date, there has been a lot of “smashing” success in taking both silver and gold lower, at will, and with no opposition.

We will rely on the proverbial picture being worth 1,000 words and not add anything further to the ominous implications that this chart portends, and it is why the probability for a lower low has to be respected as a highly possible event. The breed of faction behind these kind of moves make them for good reason and with near “slam dunk” assurances.

Silver Shorts

Crude oil’s express elevator decline is an example of what can happen when those in control decide to move a market. These days, almost every market is undergoing some degree of manipulation to the extent that “free markets” are nonexistent. It should come as no surprise that the troika US/CIA/Fed is directly behind most events whose outcomes are typically destructive. If not directly involved, then the named trio, acting individually or in concert, are indirectly involved as in the case of crude oil. An argument can be made that the Saudi’s are purposefully punishing all opposition to their market by taking the price of crude to levels that cannot be economically sustained by other world producers.

In particular, the US shale industry is being targeted as payback against the US for all the past draconian measures taken against the Saudis, and the Saudis may well be taking direction from China, or at least acting in concert with China as the “takedown” of the US and its petrodollar are being driven into oblivion. Things are getting nasty, in the process, and the US/Fed are acting more and more like cornered rats.

The elites have become terrified that everything they have been doing and working toward, as in their New World Order, is at risk, something unthinkable until they started messing with Putin and Russia. Putin has been a game-changer against the moneychangers, and things have really gone south for the elites ever since Obama has | been directed to impose unimposing sanctions on Russia. It has been Europe that is suffering the most as a result of lost business and greater economic hardships imposed by unelected, non-representative, US-led sycophant bureaucrats from the EU in Brussels.

It will be one of the world’s greatest ironies if Alexis Tsipras, Greece’s newly elected Prime Minister from the upstart Syriza Party, becomes a huge factor in upsetting the EU’s money apple cart and helping bring down the European Union, failed organization that it has been. PM Tsipras is telling Germany, and the rest of the EU, that Greece does not want their stinking loans anymore. The previous loans have destroyed Greece, its economy, and ruined the lives of so many Greek citizens suffering under German/EU austerity.

Greece is a microcosm of all that is wrong with the unelected organizations, IMF, BIS, EU, lending money created out of thin air, overburdening sovereign countries to the point where each country can no longer survive under such onerous imposed debt burdens. As other nations watch how Greece is giving the financial finger to Germany and the EU, as politely and as pointedly as possible, there could be a domino effect that would be disastrous and cause the breakup of the EU, which will happen anyway.

None of these events are directly correlated to the price of gold and silver, and these are just a few of a myriad of events occurring around the world that are keeping a lid on the PMs prices, for now. While all of the fundamental considerations are very valid, they are not what is driving gold and silver. Ukraine, as an Obama false flag, sanctions against Russia, the collapse of crude oil, the growing solidarity of the BRICS cartel, and now Greece are all factors driving the destructive ways of the US/CIA/Fed as they fight for survival. It will get uglier, and the first chart above may be a harbinger of what is yet waiting in the wings.

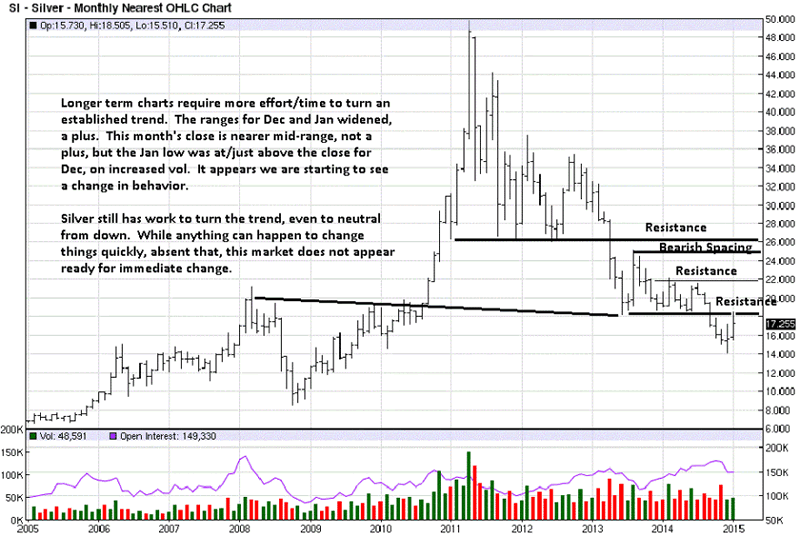

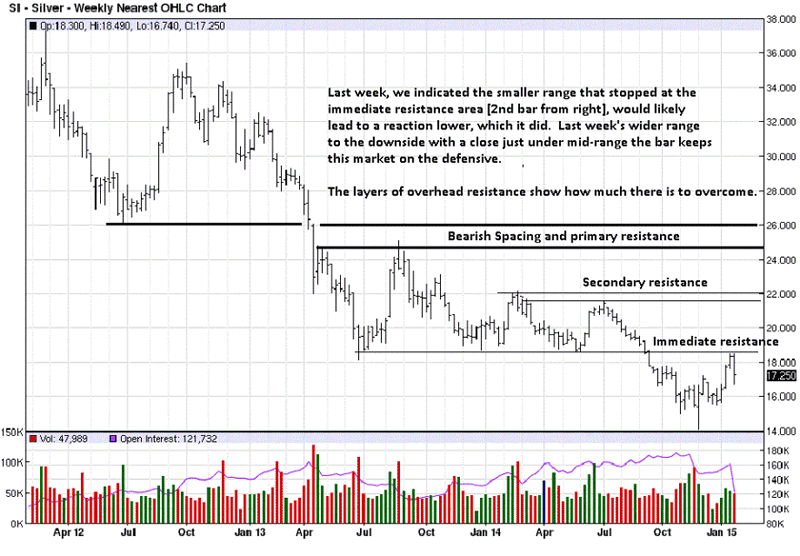

The Concentration Of Traders Chart may influence silver over the next several months. The timing of unfolding events is impossible with so many developing surprises, like Greece. The reading of the charts is irrespective of specific news and/or events, but the current prices do reflect all that is going on. We mention “anything can happen,” [crude oil as a most recent example] a few times here because the charts do not show a likely or immediate change in trend, so one has to go with “what is” as the charts currently show.

With a new recent low just two weeks ago, there is no way silver can be viewed as being in anything other than a down trend with the possibility of still lower prices to come. Even with lower prices as a possibility, silver [and gold] is artificially being suppressed. When you reflect on the increasingly faster pace of events unfolding, almost all negatively, owning silver and continuing to buy more and more is one of the best ways to protect oneself from the financial failure that is certain to come.

Price should not matter, any more. You either have silver and gold or you do not. If you do not, you are at grave financial risk when the US collapses economically, and it will as the Fed’s fiat [worthless] “dollar” is increasingly under attack.

We have refrained from putting a time frame on when silver and gold will finally break free from the manipulative forces, but 2015 could be a defining year. It remains to be seen, but events are unfolding at such an increased level and so unpredictably that this could be the year. We did not say this in 2013 nor in 2014, and it may take going into 2016, but be prepared, or you will not be spared.

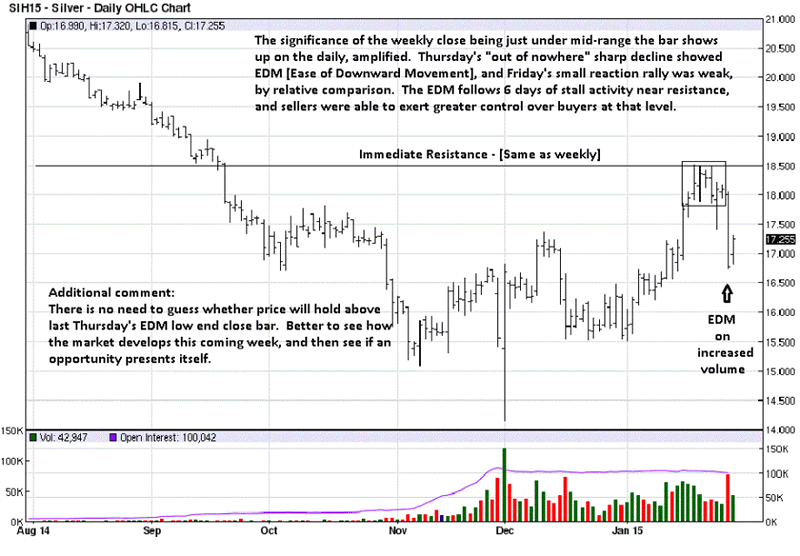

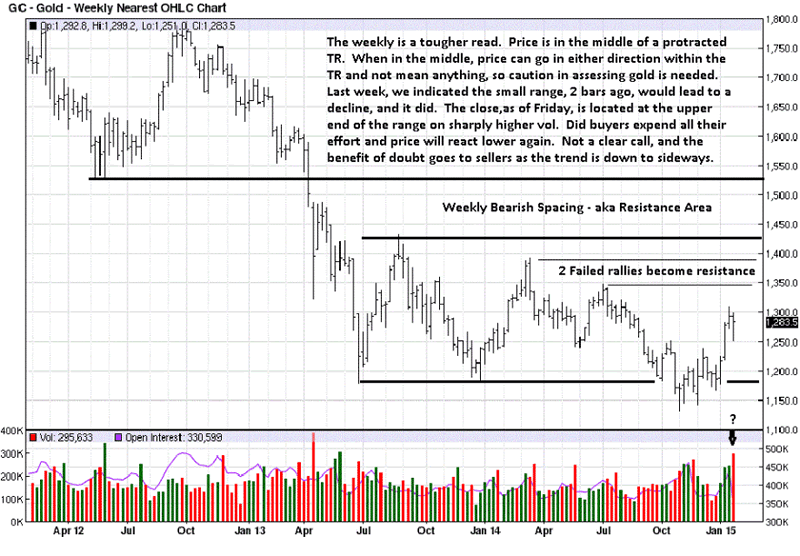

Silver’s direction has a greater degree of clarity than gold, at least in the charts. The narrower range at resistance, 2 weeks ago, said sellers were protecting that price level and preventing buyers from extending the range higher. Last week’s decline had greater ease of downward movement, noted by the larger bar. This keeps silver on the defensive, and caution is warranted.

The chart comments cover what else needs to be said.

The volume and price activity, since November 2014, has a more positive bias, but the trend has not turned up, and caution is advised. This does not imply to exercise caution in continuing to buy physical gold, and silver, as much as one reasonably can. Price will not stay down here for much longer, nor may there be the degree of availability, either. Best not to be penny wise and pound foolish.

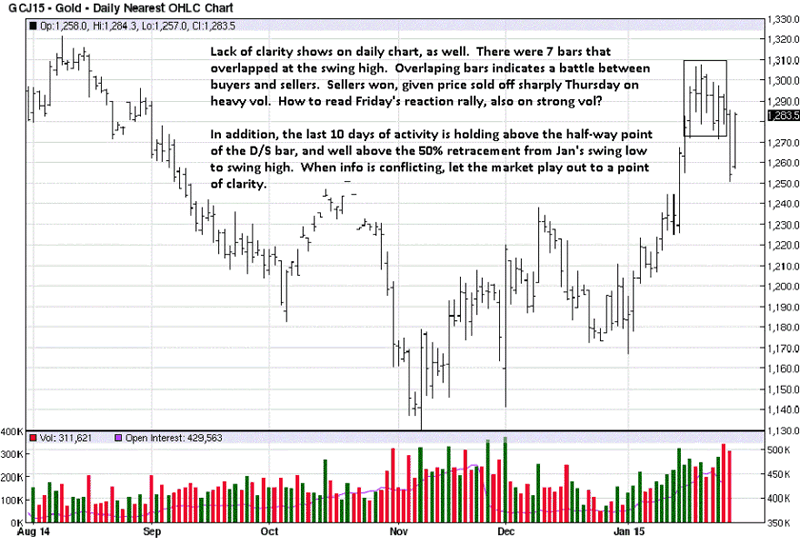

As the chart comments imply, gold is not an easy read, nor should it be, given how it is in the middle of a TR [Trading Range], where the level of knowledge is at its lowest when it comes to making an informed decision. With a greater level of ambiguity in gold, the somewhat more certainty of the silver charts may be a swaying factor, here.

The message is mixed on the daily. An area of apparent resistance held to push price lower, last week, yet the activity is holding half-way retracement areas which is to be expected in an up trending market, and less so in the current gold market.

A clearer analysis NMT. [Needs More Time].

Keep buying the physical, and do not fret over what you paid on previous purchases. Physical gold and silver are being bought for a specific purpose, and price is not the objective…security is. Remember: “if you do not hold it, you do not own it” has proven to be true in too many cases. For sure, do not keep any gold or silver in a bank under any circumstances, including and especially retirement accounts.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.