Why This Stocks Bubble Is Actually WORSE Than the Internet Tech Bubble

Stock-Markets / Liquidity Bubble Aug 04, 2015 - 09:59 PM GMTBy: Harry_Dent

I’ve been invited to speak on many media outlets lately, hammering on and on about how this is another bubble. Worse, an artificial one!

I’ve been invited to speak on many media outlets lately, hammering on and on about how this is another bubble. Worse, an artificial one!

A bubble occurs naturally when market forces converge. Trends come together and make the markets so hot that everyone starts piling in.

But it’s one thing when investors speculate on the fundamentals like demographics, rising technology, and falling interest rates. For example, like in 1925 to 1929, and 1995 to 1999.

It’s another when there are very few if any fundamentals at play! Like today.

Analysts still think the bull market’s just in its 5th or 6th inning. Economists continue to assure us the Fed will step in if the market or economy starts to go down.

Pretty soon, they tell us, we won’t even need endless QE or 0% interest rate policies! The economy will boom at a rate of 3%-plus. We’ll hit escape velocity.

Everyone wants to get rich speculating and not have to work again – like going to financial heaven!

This is wishful thinking and denial at its worst! It’s demented! What about supply and demand do these crazed economists not understand?

It doesn’t matter what causes a bubble. A shock in supply like the OPEC oil embargo. A surge in demand for real estate due to the rapid migration of rural Chinese to cities. The boomers in unprecedented numbers hitting their own peak in demand for homes. Falling interest rates shifting investor speculation into the stock market – whether naturally as in the Roaring ‘20s, or artificially as in now. Governments giving away land for practically nothing at super low interest rates like in the 1820s and ‘30s.

The result is always the same: a huge imbalance in demand vs. supply.

If supply gets cut off, prices skyrocket. Demands slows. Alternatives for that commodity or investment emerge rapidly.

If demand gets too high, market forces curb it. When prices reach a height that only the most affluent can afford, the market adjusts back downward.

The point is – extremes in supply and demand always rebalance themselves. That’s the brilliance of the free market system. It regulates everything by itself – without the help of pinheaded central bankers!

That includes the perverse and pervasive stupidity that allows bubbles to continue to extremes. When they escalate, investors get something for nothing. It’s like Santa scrapped the naughty and nice rule and started stuffing everybody’s sock with a huge heap of cash. Everyone’s on cloud nine! No one wants it to end.

Then everyone goes into denial and that further inflates the bubble – aggravating the extreme divergence in supply and demand.

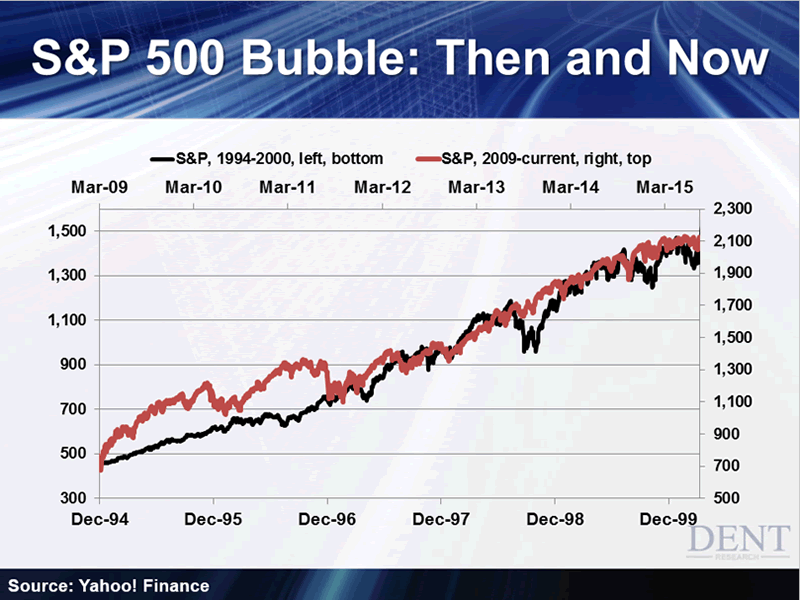

Put the S&P 500 bubble from 15 to 20 years ago on top of today’s and what do you get? A damn bubble!

The trajectories are practically the same. Yes, the recent one started out a little stronger thanks to massive QE coming out of a deeper correction. But the correlation between the final three years is spot on!

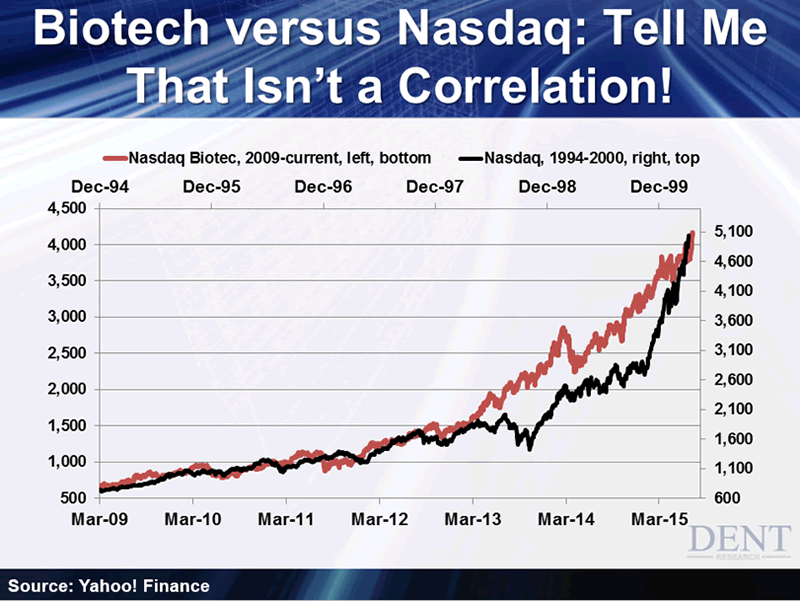

Let’s do another! How about the Nasdaq bubble over a similar period compared to the biotech bubble today?

Would you look at that? Another bubble!

And again, no – they’re not exactly alike. But it doesn’t matter! Sure, the Nasdaq bubble had a steeper finish. Clearly. And like the current S&P bubble, the biotech one’s lasted a bit longer. It’s seen massive gains of 593%. The Nasdaq had even higher at 643%!

So what!? Who in their right mind can look at this and say: “today is different?”

In some ways, this one’s actually worse, and not just because it’s artificial.

For starters, between late 1994 and early 2000 we saw the mainstream adoption of some of the most radical technologies ever introduced to the globe. We hadn’t seen anything like it since the auto revolution of the Roaring ‘20s!

This bubble can’t hold a candle to that!

More importantly, the 2007 and 2015 bubble peaks have both occurred during an adverse geopolitical cycle we’ve been wrestling with since 9/11. The 2000 bubble inflated and then burst toward the end of a very favorable geopolitical cycle starting in 1983, when investors increasingly perceived little risk in the world.

Today, there’s risk everywhere! Valuations will never be as high in such a period. So anyone who’s saying this bull market still has some juice because valuations haven’t reached tech bubble levels is kidding themselves! Those valuations were an anomaly!

My research shows that valuations during calm geopolitical periods tend to be twice as high. But the valuations on this bad boy are already higher than every bubble or major bull market peak over the last century. The only real exception is the year 2000. And we’re not far off 1929. And that’s with the poor geopolitical period we’re in!

That includes the major bull market peaks of 1937, 1965 and 2007.

So don’t believe the “this is not a bubble” arguments. This is denial plain and simple – which has happened in every single bubble in history, especially near the top.

Even the German DAX bubble looks similar to the one past. China’s current bubble went up just as exponentially in one year as its last big one did in two.

If it looks like a bubble. Walks like a bubble. And quacks like a bubble. It’s a damn bubble.

Most will be surprised when it pops as every bubble in history has. Don’t be one of them.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.