The Stock Markets Are Extraordinarily Volatile, Here's What to Do

Stock-Markets / Stock Markets 2015 Aug 25, 2015 - 02:42 PM GMTBy: ...

MoneyMorning.com  Keith Fitz-Gerald writes: The Dow swung more than 1,000 points in each direction over the course of trading yesterday. The market chaos started in Asia and spread to the United States as the day went on.

Keith Fitz-Gerald writes: The Dow swung more than 1,000 points in each direction over the course of trading yesterday. The market chaos started in Asia and spread to the United States as the day went on.

That the markets plunged that far in the first place is a sure sign that panic is definitely setting in. I'd be lying if I said I didn't feel the angst just like you do. You're not alone.

But here's the thing. Unlike most investors who are going to let panic take over, we know that the first step in building wealth is to take emotion out of the equation. And, instead, to focus on navigating the situation:

- No investor ever has to suffer the ravages of a bear market if they're prepared; and,

- There is always opportunity in chaos if you know where to look.

So today, let's talk about how you do that and, as usual, take a quick look at three specific investments you can put to work immediately if the U.S. markets fall further or if China's markets have not yet bottomed.

Here's how to protect yourself from a market correction – and make a profit when everybody is losing.

First, This Isn't a "Crash"

Most investors throw the word "crash" around like candy without bothering to understand what it really means. Not surprisingly, they get caught up in the moment and make a slew of bad decisions as a result.

A true market crash is something you don't need to spend a lot of time on because there will be nothing you can do about it. I don't want to make light of the situation, but I want to put the term in perspective.

Examples include 9/11 and Black Friday on Sep. 24, 1869, when Jay Gould tried to corner the gold market with James Fisk. Even the Kipper und Wipper of 1623 caused by the fraudulent debasement of currency in connection with the Thirty Years War qualifies.

When stuff like that happens, you have bigger problems… like how you're going to put food on the table. They are true economic disasters.

Again, I'm not trying to make light of the situation we're dealing with this week. The Fed has failed the markets and big down days feel terrible. It's hard to see red across the board when you look at your statements.

A day or two of bad trading, or even a few months of nasty stuff, do not qualify as a crash. It's a correction and it's normal. You want the markets to periodically scare the weak money out for the simple reason that chaos always creates opportunity.

You have to have lower prices before you have higher prices. That's why "buy low and sell high" is what it is… the true path to profits.

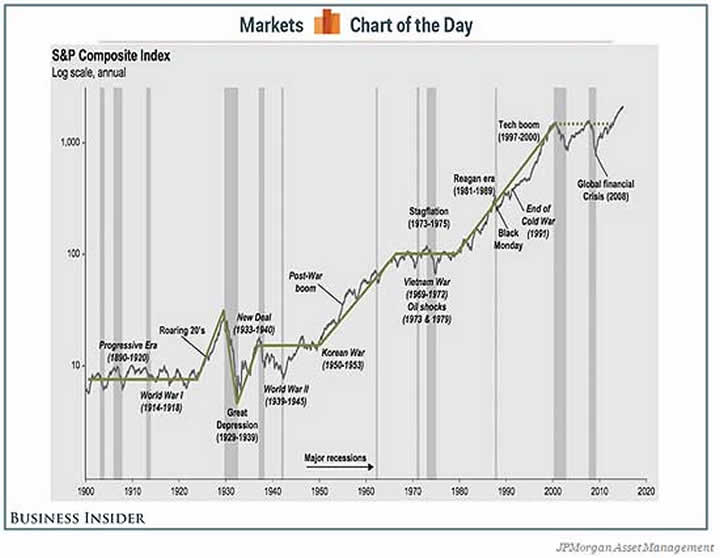

Let me prove it to you with a simple chart.

War, famine, recession, assassination, global terrorism… they're all terrible and, over time, they all fade into history's rearview mirror.

It's what you do in the meantime that will keep you on top…

The Last Market Correction Validated Our Unstoppable Trends… This One Will, Too

Investing in what I call "Unstoppable Trends," trends that will withstand market corrections and all manner of political interference, is an important part of our approach to investing.

One of the biggest reasons we pursue the Unstoppable Trends is because they hold more profit potential than the next 100 "hot stocks" combined. Perhaps more importantly, they're also tremendous insurance against just the sort of market hijinks we're dealing with now.

By tapping into companies that are backed by trends so powerful that nothing short of a meteor hitting the planet could derail them, we're not only aligned with growth, but also with trillions of dollars that will be spent no matter what happens, for the simple reason that people can't live without 'em. They're truly "must haves."

Take American Water Works Inc. (NYSE: AWK), for example. The company provides vital plumbing and water services to more than 15 million people in Canada and the United States, placing it squarely in line with the Unstoppable Trend, Demographics.

Because the demand for its product is almost completely unaffected by major economic downturns, it shouldn't be surprising that AWK shares saw a mere 1.67% decline from June 2008 to early February 2009, even while the S&P 500 lost more than 40% of its value over the same time frame.

Source: Yahoo!Finance

Or, consider Becton, Dickinson and Co. (NYSE: BDX), which saw just a 6.53% decline from mid-June 2008 to early February 2009, even while the S&P 500 cratered 34.30%. Because it sells medical supplies – including single-use supplies that keep demand for its products particularly robust – BDX kept its profits, and therefore its valuation, largely intact for its shareholders. BDX's resilience while the broader markets seemed to be melting down is a testament to the power of the Unstoppable Trend, Medicine.

Source: Yahoo!Finance

Sure, companies like these are going to come under pressure when everybody hits the sell button from time to time. To think otherwise is naïve.

My point is that they're going to be far more resilient and far more likely to come roaring back because short-term market disruptions do not interrupt the business case meriting your investment dollars.

Make Money Up to 3x the Rate the Market Falls

Now let's shift gears and talk about how to actually profit from the chaos that's scaring the heebie-jeebies out of a lot of people at the moment.

The way I see it, there's no reason you have to stop at merely defending your money when you can take advantage of sloppy trading.

Wall Street's Armani Army talks a lot about diversification under the guise of protecting your money. The concept is alluring and basically involves spreading your money around on the assumption that not everything goes down at once.

They may as well be rearranging the deck chairs on the Titanic. What they don't tell you is that conventional diversification doesn't work when everything goes down at once.

And what they don't mention is a very specialized class of investments that can help you profit when that happens – inverse funds.

There are all sorts of reasons why, but the biggie is that they want you trading because that's how they earn commissions. They want you to panic because you'll do more buying and selling, boosting their top line even as you take losses on yours.

Instead, try investing 3% to 5% of your total investable assets in these things because they appreciate even as the rest of the markets get carried to hell in a handbasket.

If you've never heard the term before, inverse exchange-traded funds (ETFs) are funds that inversely track the performance of certain indices or benchmarks. They closely (but not perfectly) mirror the returns of what they track using a combination of short-selling, derivatives, and other leveraging tools.

Take, for example, the Short S&P 500 (NYSE: SH), which negatively tracks the S&P 500. During the nadir of the financial crisis, from October 2007 to February 2009, the fund returned 59%, while the overall markets saw their values drop by more than half.

It's what they call a 1:1 inverse, meaning it's expected to gain one percentage point for every point the S&P 500 drops.

Some inverse funds are leveraged 2 or even 3 to 1, which means that they'll move 2 or 3 points for every single point the index they track drops. The Market Vectors Double Short Euro ETN (NYSE: DRR) is a two-times leveraged inverse ETF that tracks the performance of the Double Short Euro Index, minus investment fees.

It's a shrewd play given the ECB's stated goal is to weaken the euro as it stimulates the economy there, and a means of coping with easy credit.

And finally, there's the ProShares Short FTSE China 50 (NYSE: YXI).

It's a 1:1 fund that taps into the ongoing Chinese market madness. If you're of the opinion that Chinese markets will drop further or simply want to hedge investments you've already got there, this may be a great choice to get started.

What I love about inverse funds is that they're investments you buy. That means there are no options and no margin required to own them. That makes them a convenient choice if you'd prefer not to mess with options or simply don't like the concept of shorting – both of which can be used to structure similar inverse holdings to the ETFs we've talked about today.

I'm also a big fan of these things because they can be used to hedge your portfolio not just when the markets crash, but also ahead of time. Depending on your risk tolerance and objectives, the 1 to 1 inverse funds can make a great shock absorber for your core holdings. The double- and triple-leverage funds are a bit more specialized given their tracking error, but we'll talk about that another time.

In closing, remember that risk is not the same thing as volatility, which is why a "crash" is often simply a market correction.

Understanding the difference and knowing what to do about it ahead of time is to your advantage.

Warning! Here's Where "Big Tech" Is Dead Wrong: These 10 high-valued private equity darlings are currently valued at 39 times what they actually have. Even worse, these "unicorns" are valued on so-called potential -read: fantasy – instead of real results. Don't believe the hype…

Source http://moneymorning.com/2015/08/25/the-markets-are-extraordinarily-volatile-heres-what-to-do/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.