Bloomberg Interest Rate Hike Odds Still Wrong; Deflationary Bust Coming

Interest-Rates / US Interest Rates Sep 11, 2015 - 04:53 PM GMTBy: Bloomberg

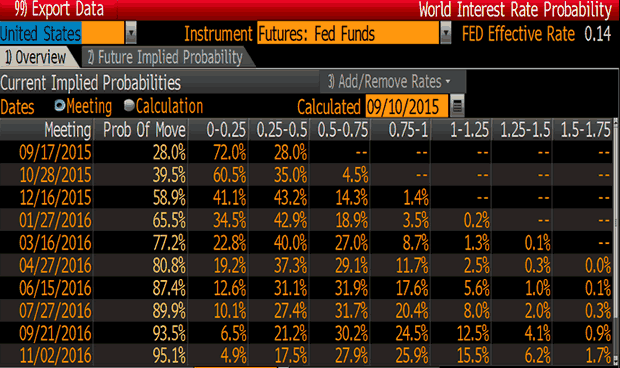

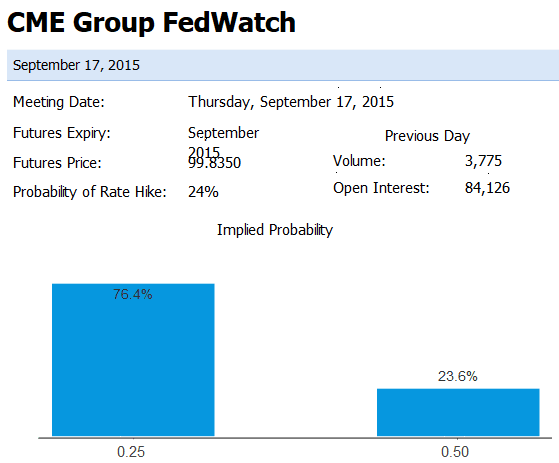

As of September 10, the CME has the of a September hike by the Fed at 24%. Bloomberg says the probability of a move is 28%.

As of September 10, the CME has the of a September hike by the Fed at 24%. Bloomberg says the probability of a move is 28%.

Bloomberg Rate Hike Odds

CME Fedwatch Odds

Both Models Wrong

What's wrong with both models is they still presume a quarter point hike.

Neither Bloomberg nor the CME allows for the possibility of a Fed hike to precisely 0.25% or to a smaller tighter range.

Given the effective Fed Funds Rate is 0.14% (see upper right of Bloomberg chart), a setting the rate to a flat 0.25% from the current range of 0.00-0.25% (now at 0.14%), would be both a "move" and a "hike".

Tighter Range

The Fed could also use ranges as Bloomberg and CME imply, but target ranges in 1/8 of a point increments rather than 1/4 point increments.

For example the Fed could target a range of 0.25% to 0.375%.

I suspect the odds of a move to a flat 0.25 or a range (0.25% to 0.375%), are far greater than Bloomberg's "probability of a move" set at a mere 28%.

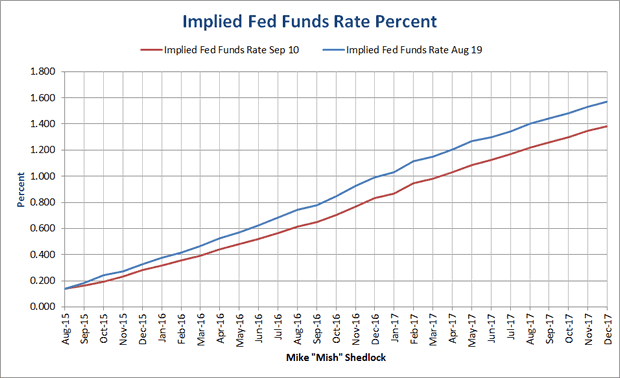

I went over this before, on August 19, in Plotting the Fed's Baby Step 1/8 Point Hikes; Yellen vs. Greenspan "Measured Pace".

I updated my charts today.

Flattening of Rate Hike Expectations

Using Fed fund futures from CME, I calculated implied interest rates through December 2017. The line in Blue shows what futures implied on August 19. The line in red is from September 10.

Note the flattening of the curve. This has been happening pretty much all year.

The market initially penned in hikes for January. The hikes then shifted to March, then June, then September, and now December by both the Bloomberg and CME models.

Range Watch

Curve Watchers Anonymous is closely watching the implied baby steps in the the Fed fund futures. Incrementally, the hikes appear as follows.

| Month | Fed Funds Future | Rise in Implied Rate |

| Aug-15 | 99.863 | |

| Sep-15 | 99.835 | 0.028 |

| Oct-15 | 99.805 | 0.030 |

| Nov-15 | 99.765 | 0.040 |

| Dec-15 | 99.720 | 0.045 |

| Jan-16 | 99.685 | 0.035 |

| Feb-16 | 99.645 | 0.040 |

| Mar-16 | 99.610 | 0.035 |

| Apr-16 | 99.560 | 0.050 |

| May-16 | 99.520 | 0.040 |

| Jun-16 | 99.480 | 0.040 |

| Jul-16 | 99.435 | 0.045 |

| Aug-16 | 99.385 | 0.050 |

| Sep-16 | 99.350 | 0.035 |

| Oct-16 | 99.295 | 0.055 |

| Nov-16 | 99.230 | 0.065 |

| Dec-16 | 99.170 | 0.060 |

| Jan-17 | 99.135 | 0.035 |

| Feb-17 | 99.055 | 0.080 |

| Mar-17 | 99.020 | 0.035 |

| Apr-17 | 98.970 | 0.050 |

| May-17 | 98.915 | 0.055 |

| Jun-17 | 98.875 | 0.040 |

| Jul-17 | 98.830 | 0.045 |

| Aug-17 | 98.780 | 0.050 |

| Sep-17 | 98.740 | 0.040 |

| Oct-17 | 98.700 | 0.040 |

| Nov-17 | 98.650 | 0.050 |

| Dec-17 | 98.615 | 0.035 |

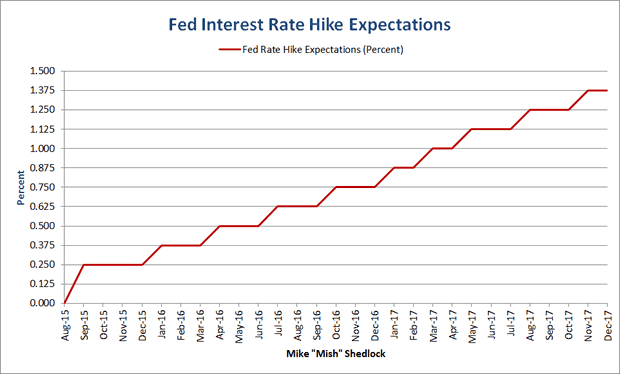

Baby Steps Plotted

Fed fund futures imply a very slow tightening of 3-6 basis points a month. The only exception is January to February of 2017 where the incremental rise is 8 basis points (0.080 percentage points).

The Fed does not set policy every month. Instead it does so about eight times a year. FOMC dates are not yet set for 2017, but futures imply something like the following.

Fed Rate Hike Expectations Through 2017

Yellen vs. Greenspan

- The above market expectations are clearly similar to Greenspan's famous statement: Hikes will be at a "pace that's likely to be measured".

- The Yellen expected "pace" is half as often.

- The Yellen expected "measure" is half as much.

Just Get On With It!

Via email, Albert Edwards at Society General writes:

The clamour for the Fed not to enact the long-awaited ¼% rate hike next week is growing by the day. Misgivings come not just from reputable mainstream commentators, but now also the World Bank has repeated the IMF's recent words of caution in advising delay. What a load of nonsense! My esteemed colleague Kit Juckes characterises the current consensus thinking as "If the Fed hikes, pestilence, plague and never-ending deflation will follow." Well even those like me who see a deflationary bust awaiting think the Fed should hike next week - because the longer you leave it, the bigger the financial market excesses become, and the bigger the risk of financial dislocation and global recession ensuing. Have we learned nothing from the 2008 Great Recession? Just get on with it!

Exactly!

A deflationary bust is coming and there is nothing the Fed or any central bankers can do about it.

And when the bubble busts, Paul Krugman, Larry Summers, the World Bank, and Christine Lagarde at the IMF will all be singing the "I told you so" tune.

The irony is Krugman, Summers, the World Bank and the IMF are all wrong. The seeds of the upcoming deflationary bust were planted, watered, and over-fertilized by central bankers everywhere, all in the asinine name of "price stability" and deflation fighting.

For further discussion on the sheer ridiculousness of price stability policy, see Cross-Border Deflation: US Export Prices Collapse Most Since July 2009; How Damaging is Price Deflation?

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.