Stock Market Déjà vu 2011- Is the Dow Getting Ready to Soar?

Stock-Markets / Stock Markets 2015 Oct 20, 2015 - 05:48 PM GMTBy: Sol_Palha

The paranoiac is the exact image of the ruler. The only difference is their position in the world. One might even think the paranoiac the more impressive of the two because he is sufficient unto himself and cannot be shaken by failure. -

Elias Canetti

The paranoiac is the exact image of the ruler. The only difference is their position in the world. One might even think the paranoiac the more impressive of the two because he is sufficient unto himself and cannot be shaken by failure. -

Elias Canetti

Feels like 2011 all over again. The Dow is tracing a pattern that bears an uncanny resemblance to the one set in 2011. History could be repeated again; the Dow could be ready to rumble instead of being taken down for the count. When the markets were plummeting in 2011, many experts were making the same dire predictions, while others were wondering if the bull had bashed its head into a brick wall. Turns out that the so-called crash was nothing but a hiccup in what turned out to be one of the most massive bull run’s of all time. Faced with the same paradigm again, the talking heads (many who actually have the impudence to call themselves experts) are marching to the same drumbeat and chanting the same hymn of doom.

As we live in an era of lies and deceit, where rampant manipulation is the order of the day; worse still, no one is contesting this manipulation. The masses have embraced that this is their destiny and surrendered to this new market norm. A norm that rewards speculators and punishes savers. As the laws of reality have been suspended (courtesy of the masters of deception, otherwise known as the friendly Fed), the markets will only crash if access to easy money is eliminated. This hot money is what’s fueling the markets and will continue to do so in the foreseeable future. Against this backdrop of deceit and corruption, normal market rules cease to apply.

Therefore, our contention has been that every major correction for the past several years is nothing but the market letting out a well deserved dose of steam and that a massive crash is not the makings; at least not yet. One day the markets will crash, but as this market is being propped up a by hot money, anything and everything will be done to prevent the markets from crashing. If there was any dose of freedom left in these markets, they would have crashed long ago. There is a stark difference between thinking you know what will happen and from knowing what is going to happen. Mass psychology clearly states that markets usually run into a brick wall when the Crowd is Euphoric and chanting “Kumbaya my love”. This is not the case yet and sentiment is far from the euphoric zone. This is one of the most hated bull markets in history.

Is this Deja Vu?

The predictions that Dow was destined for destruction during the correction of 2011 might have appeared erudite in nature. Those predictions, now in retrospect, sound more like the ravings of a lunatic. Be wary when the masses are joyous and Joyous when they are not, that in essence is the most basic tenet of mass psychology.

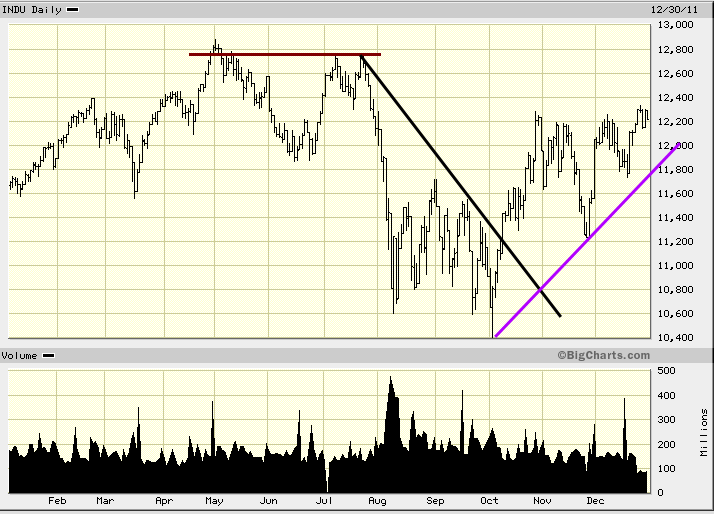

Dow Pattern in 2011

• In 2011, the from high to low the Dow shed roughly 16.2% or 2,070 points. Now, depending on your entry point the experience could have ranged from being mild to crash like in nature. If you purchased right at the top, then the word crash was probably flashing through your mind. Just because you think it’s a crash does not necessarily signify that your perceptions, that are being overwhelmed by fear are correct.

• All media outlets were busy flooding the waves with stories that extremely pessimistic in nature. Misery loves company and stupidity simply adores it. Consumer confidence was not strong, the U.S. credit rating was downgraded, manufacturing was slowing down, and the list goes on. . The 3rd quarter ended and the 4th quarter began and all those bogeyman stories well proved to be just that.

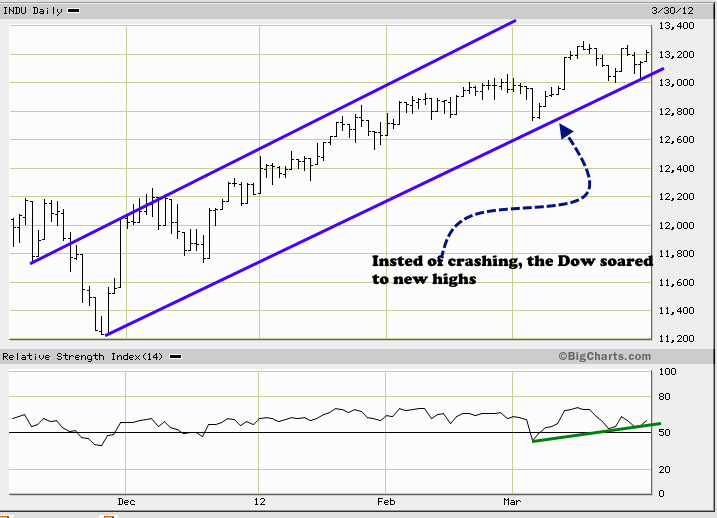

Markets climb a wall of worry and plunge down an abyss of joy; this is clearly demonstrated in the chart below

. In 2011, the Dow ended the year on a positive note, defying all the predictions of disaster. Three months into the new year (20120, the Dow soared to a series of new highs. Like cockroaches, the naysayers vanished into the woodwork waiting for another day to sing the same old monotonous song, buoyant that time would make the masses forget the old proclamations and embrace the new ones; this falls dangerously close to the definition of insanity. Doing the same thing and expecting a different outcome. So far the outcome appears to be the same and if the pattern is repeated, then these chaps are going to get clobbered.

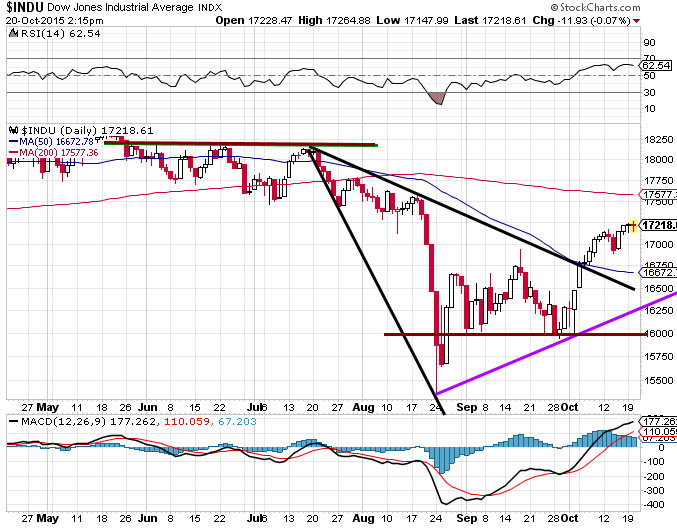

Dow outlook 2015

During the so-called market crash phase that started in August, the Dow from high to low shed approximately 16.3%..... Strikingly close to the 16.2% that the Dow gave up during the 3rd quarter of 2011. So far, in the 4th quarter, all the major market indices are faring much better as was the case back in 2011. In the 4th quarter, the Dow has tacked on almost 5%.

Market Sentiment during the so-called crash phase

The VIX, which is an index that measures fear blasted as it was being chased by the hounds of hell. ItX surged to a new 5 year high, pointedly illustrating that the masses were hysterical. Panic is the secret code name for opportunity. Mass psychology clearly indicates that when the crowds panic, the astute investor should be ready to jump in.

The bullish case for the Dow builds:

• A host of technical indicators are still trading in the extremely oversold ranges.

• Our trend indicator is dangerously close to triggering a new buy signal. The fact that it did not move into the sell zone validated that the correction was nothing but a market letting out some well-deserved steam.

• Retailers like Costco (COST), L Brands (LB), Fred’s (FRED), etc., all surprised analysts by reporting stronger than projected same-store sales.

The Game plan going forward

Fear has to be avoided under any circumstance when it comes to investing. It is a detestable emotion that just sucks you dry. It takes and gives nothing back in return. When the crowd panics, one should resist the urge to become one with fear and the crowd. We are not in the jungle and fear is a useless emotion when it comes to making money in the markets. Get rid of it or it will get rid of you. Fear is a parasitic emotion; the only good parasite is a dead parasite. So shoot to kill when it comes to fear

To break even for the year, the Dow only needs to trade approximately 600 points higher. If examines the entire journey (up and down) the Dow traversed from August to Oct, the count comes in at roughly 5000 points. Examined from this angle, 600 points does not amount to that much; the Dow still has roughly three months to achieve this objective.

The ride up is expected to be volatile as our V indicator is trading well above the danger zone; 1100 points higher to be precise. This means that extreme volatility is going to be the order of the day. One should not expect the ride up to be smooth. We have a fair amount of resistance in the 17300-17400 ranges. The ideal set up would be for the Dow would trade in these ranges, with a possible overshoot to 17,600 and then proceed to test 16,500-16,600 ranges. The Dow is then expected to put in a series of higher lows, ending the year on a positive note.

Bear in mind that the above targets should serve as rough guideposts. We never focus on trying to identify the exact bottom or top, a task we think is best left to fools with an inordinate appetite for pain. The game plan should be to view all strong pullback as buying opportunities.

Dow Dejavu? When one examines both the patterns (2011 and 2015); the answer appears to be “yes”

Action cures fear, inaction creates terror.

Doug Horton

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2015 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.