Gold Price Hovering Above Support

Commodities / Gold and Silver 2015 Nov 17, 2015 - 10:29 AM GMTBy: Dan_Norcini

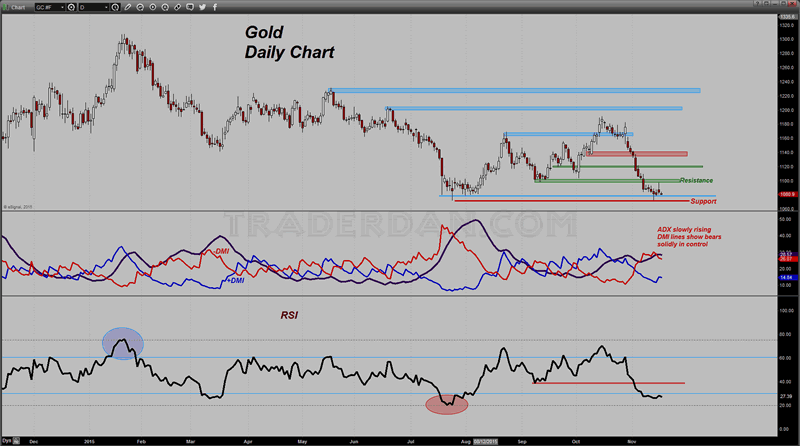

Just as the Euro is hanging by a thread above its chart support zone, so too is gold hanging by a thread above a critical chart support zone. The bottom of that zone is the July low near $1070 with the zone extending upward towards $1080.

Just as the Euro is hanging by a thread above its chart support zone, so too is gold hanging by a thread above a critical chart support zone. The bottom of that zone is the July low near $1070 with the zone extending upward towards $1080.

Gold drew a bit of support in today’s session ( Monday) out of safe haven buying tied to the horrific carnage in Paris but as is always the case with gold, rallies that come from geopolitical events, generally do not last long, especially when the underlying fundamentals for gold are as poor as they currently are.

On the chart, the RSI failed to hold near 30 and has been trapped below that number for the last ten days or more portraying its inherent weakness. The market is oversold but markets can work off oversold readings by moving sideways. That is currently what gold is doing ever since it fell below $1100.

You can see the ADX has flattened out due to the sideways movement but the -DMI remains solidly above the +DMI denoting that the bears are still in control of this market.

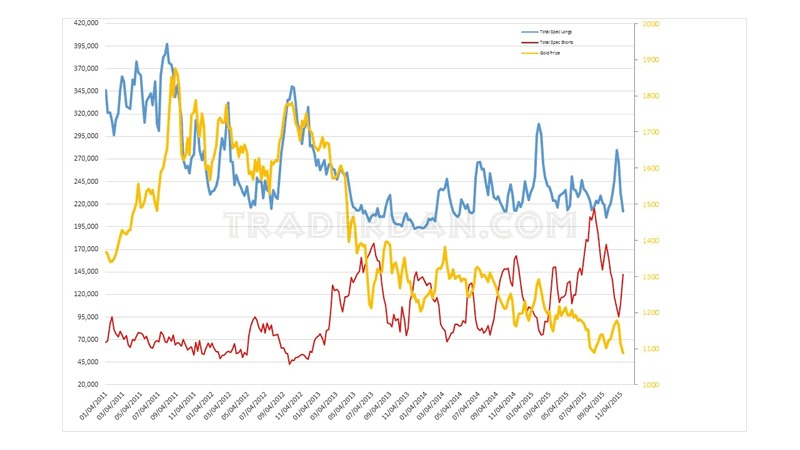

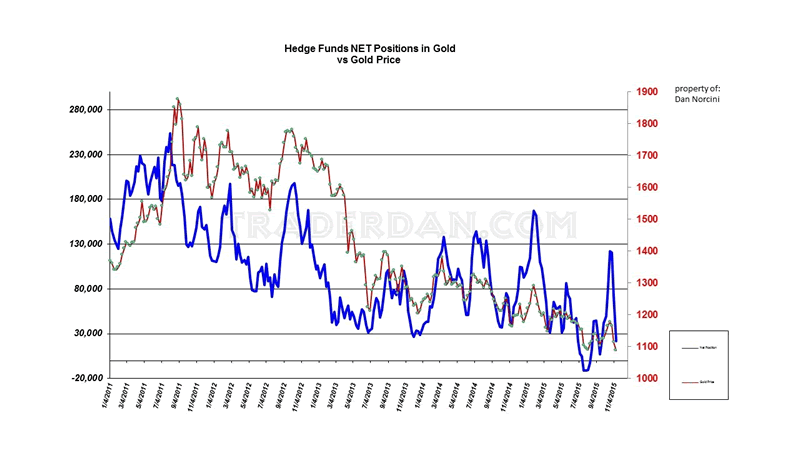

From the COT standpoint, hedge fund longs are bailing out while some other entities within that classification are pressing it from the short side as they viewed the collapse beneath $1100 as a signal to sell. They are now hoping to press it down through $1080 on a CLOSING BASIS as that will more than likely trigger a break of $1070 if they are able to achieve the former.

One thing to note -the hedge fund outright short position is a long way from its recent peak this past August. Their outright long position is relatively small by comparison to levels they have held in the past but it is still nothing to sneeze at for if that downside support level is taken out, there is still a significant number of them that will be forced to sell.

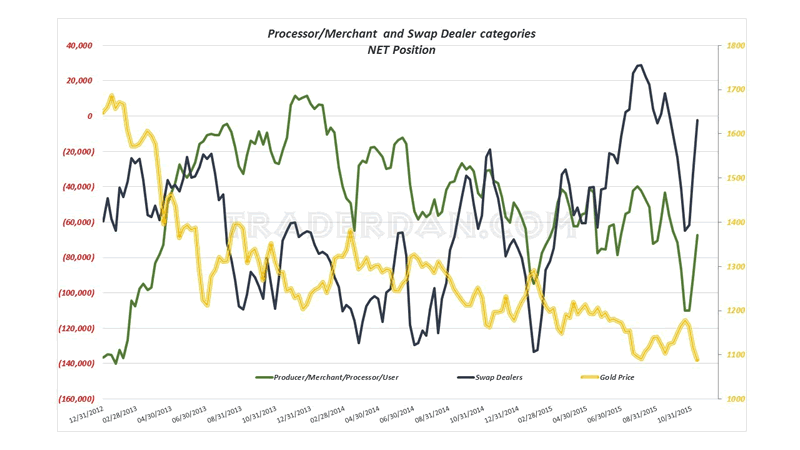

Here is a look at how the Commercials and the Swap Dealers have been dealing with the gold futures market.

You can see that the recent large net short position held by both categories corresponded nicely with the peak in the gold price during the third week of October.

The Hedge fund long liquidation can be seen in the following chart with the gold price following it lower.

As noted above, a downside breach of $1180 on a closing basis and especially the loss of $1070 should it occur, would result in a sizeable wave of remaining longs bailing out. The question is whether or not the Dollar can take out 100 basis the USDX and whether the Euro can hold 1.050. That would break the back of gold.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.