A Half-Century of Gold, War, and Costs

Commodities / Gold and Silver 2015 Nov 17, 2015 - 05:57 PM GMTBy: DeviantInvestor

In round numbers, these wars (in today’s dollars) were tremendously expensive:

In round numbers, these wars (in today’s dollars) were tremendously expensive:

Vietnam War: Estimated cost is $740 Billion

War on Drugs: Estimated cost is $1,000 Billion

War on Terror, including Afghanistan and Iraq: Estimated cost is $1,700 Billion and counting

War on Poverty: Estimated cost is $22,000 Billion

Total estimated war costs – about $25 Trillion. Really? Value received?

The following are my opinions and they are certainly not shared by everyone, so read with that caveat in mind.

In a sensible world a government would declare war, ask citizens to accept higher taxes or use accumulated national savings to pay for the war. In that sensible world, the war would produce a benefit to the country, hopefully in assets, but certainly in less tangible items such as protection of borders and internal security.

So how is the US government doing?

- Vietnam War: Benefits to the United States were difficult to see. The “Red Menace” story and the “Domino Theory” failed to satisfy most people. The war was expensive in dollars and lives. Many people fail to see any good reason for the war other than an excuse for military contractors and bankers to increase profits.

- War on Drugs: Certainly the drug dealers and gangs liked it since it massively increased their profit margins and revenues. Many people were imprisoned so the private prison corporations benefited. Large banks profited from money laundering. But illegal drugs are still prevalent and have not been eliminated.

- War in Afghanistan has stretched into its second decade. Where are the benefits? More opium and heroin are available on the street at less expensive prices but otherwise ….

- Wars in Iraq: These did not work out well for the US.

- War on Terror: The Homeland Security Agency was created and TSA grew more important. Security has been increased, but at what cost?

- War on Poverty: Much poverty still exists in the US, possibly more than before the war on poverty was initiated. Government programs, number of government employees, and debt have expanded immensely. Positive results are difficult to find.

Common elements from a half century of wars:

- Massively increased official federal debt.

- National Debt 1965: $317 Billion

- National Debt 2015: $18,600 Billion

- Expansion of government and the military.

- Consumer prices have inflated

- 1st Class postage 1965: 5 cents

- 1st Class postage 2015: 49 cents

- Loaf of bread 1965: $0.21

- Loaf of bread 2015: $3.95

- Gasoline 1965: $0.31

- Gasoline 2015: $2.00

- 6 Pack of Beer 1965: $0.99

- 6 Pack of Beer 2015: $7.99

- Prices for gold have increased along with other consumer prices and, on average, with national debt.

SO WHAT?

- The US seems intent upon creating massively more debt and increasing military activity in Syria, Eastern Europe, and the South China Sea. Based on US experiences in Vietnam, Afghanistan, and Iraq, we should not be optimistic about the benefits to the US economy, international prestige, and the economic wellbeing of US citizens.

- We can be certain expanded wars will mean more debt, higher consumer prices, more government influence over the economy, and a lower standard of living for most people in the US.

- Gold and silver prices will rise.

BUT GOLD AND SILVER HAVE GONE DOWN FOR OVER FOUR YEARS!

- Yes, they have. The dominant narrative has been that a strong dollar must be maintained. A collapsing dollar would be catastrophic to the US economy, war machine, incumbent politicians, and international prestige. A rising gold price indicates a vote of no confidence in the government, the currency, and the central bank.

- The powers-that-be want confidence in the unbacked paper dollar, not in gold. It should be no surprise that gold went down after its huge rally into 2011 while the dollar, S&P and bonds have gone up since 2011.

- But all unreal valuations must eventually end. Anyone not in the top 0.1% does not know the timing, but we can be assured that warfare, welfare, debt, spending, and gold prices will rise while stocks and bonds correct.

FOR PERSPECTIVE:

The gold “officially” stored in Fort Knox is about 147,000,000 ounces, or at current prices, less than $200 Billion. This amount is little more than a rounding error compared to the cost of the above wars. In dollar terms the Fort Knox gold is unimportant.

SUPPOSE 99% of that gold has been sold into the market (call it a lease) to suppress the price of gold and maintain the perception of dollar strength. What part of that process does not make sense from the perspective of a central banker or highly placed government official who must keep the dollar strong?

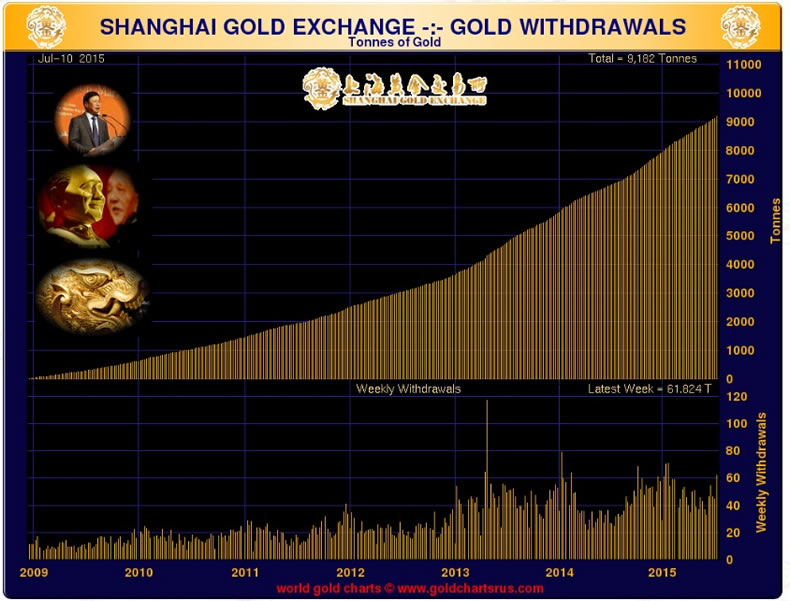

Assume the Fort Knox gold was sold to suppress gold prices, shipped to Switzerland, melted and recast as 99.99% gold kilo bars, and shipped to China or Russia. Is that difficult to imagine when we know that China, India and Russia have substantially increased their central bank and private individual gold holdings?

The Internet is filled with supposedly intelligent commentary about why gold prices will continue falling for the balance of the decade. I’m highly skeptical. I will change my mind when the US government balances its budget, begins to reduce national debt, and “gives peace a chance.”

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.