This Is What Gold Does In A Currency Crisis, British Edition

Commodities / Gold and Silver 2016 Feb 24, 2016 - 03:44 PM GMTBy: John_Rubino

It appears that Great Britain might actually do the until-recently-unthinkable, and leave the European Union. The reasons for this dramatic break-up are many, and can be Googled easily enough. For our purposes, suffice to say that traders are scrambling to figure out what this means for the British pound, and they’re not liking the answers. Here’s a quick look at the recent foreign exchange action:

The pound just hit a 7-year low — and there’s no revival in sight

(MarketWatch) – The pound has been clobbered this week, driven close to seven-year lows against the U.S. dollar — and analysts don’t see any catalyst in sight to turn that fall around.The pound on Tuesday dropped below $1.39 against the greenback for the first time since March 2009, hitting an intraday low of $1.3879, according to FactSet. Sterling versus the dollar — known as “cable” — has lost roughly 3.5% since Friday, when the floodgate of debate surrounding the potential exit of the U.K. from the European Union burst open.

Investment houses have been warning that the pound could drop sharply if U.K. voters support leaving the EU. Losses for the pound started picking up pace after London Mayor Boris Johnson over the weekend backed a campaign for the U.K. to leave the European Union.

Currencies don’t move in a “in a straight line forever,” said FxPro’s Smith. But at this point, “there is very little support between where we are now and the lows we saw in 2009.”

Hurdles: Johnson’s stance is “raising concerns that he could tilt the vote toward the ‘Leave’ camp,” said Vincent Chaigneau, head of rates and forex strategy at Société Générale.

The influential London mayor’s position puts him in direct opposition to David Cameron, his fellow Conservative Party member and party leader. On Friday, British Prime Minister Cameron struck a deal with the EU to change his country’s membership terms.

The U.K. government has set June 23 as the date for an in/out referendum on whether the U.K. should exit the EU, known as “Brexit.” While the “leave” camp is tapping into a range of dissatisfactions with the bloc in its campaign, the need to control borders in the face of the migrant crisis is a key issue.

“The deepening of the immigration crisis in Europe is going to be at the heart of the debate, and unfortunately it’s likely that as weather conditions improve into spring, we will see another wave of immigration,” said Chaigneau.

“There’s a concern that the immigration issue could make the vote very tight.”

.

HSBC believes the currency market is pricing a Brexit at around a 33% probability, the bank’s analysts said in a report published Wednesday. “So GBP-USD could fall by around another 15-20% should a Brexit become a reality — in other words, if the probability shifted from 33% to 100%,” wrote currency strategist Dominic Bunning and David Bloom, global head of FX research at HSBC.

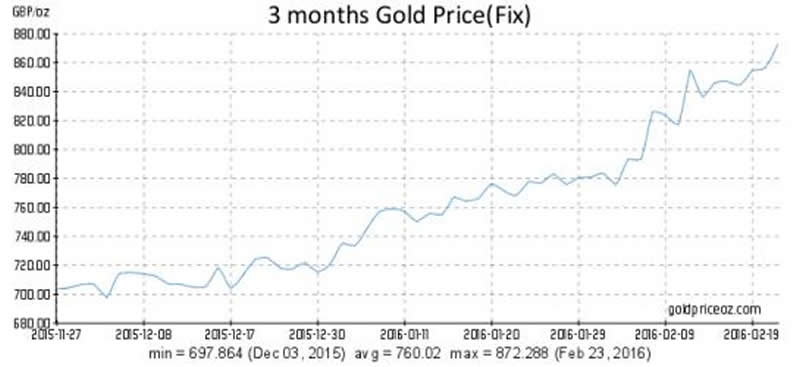

To summarize, anyone holding a lot of British pounds is sorry they made that choice, and a growing number of them are behaving as people have behaved for 3,000 years, retreating into the one safe haven that offers reliable shelter from government mismanagement. In the past three months (that is, since the Brexit debate has emerged) gold is up 22% in pound terms, and the ascent is steepening. As the article notes, warmer weather will bring more immigrants, sharpening the debate and keeping the outcome of the outcome in doubt — and making gold ever-more-attractive for Britons exhausted by the uncertainty.

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.