Italian Banks & Moving The Risk During Crisis

Companies / Credit Crisis 2016 Jul 01, 2016 - 06:09 PM GMTBy: Dan_Amerman

Europe is changing by the hour and the day at this point. In this analysis, I'm going to take a quick look at critical events that have happened in Italy in the last day or so, and how they relate to my recent Video Guide To Bail-Ins series. I will be using three current Bloomberg articles that came out in the space of about 7 hours as references.

Europe is changing by the hour and the day at this point. In this analysis, I'm going to take a quick look at critical events that have happened in Italy in the last day or so, and how they relate to my recent Video Guide To Bail-Ins series. I will be using three current Bloomberg articles that came out in the space of about 7 hours as references.

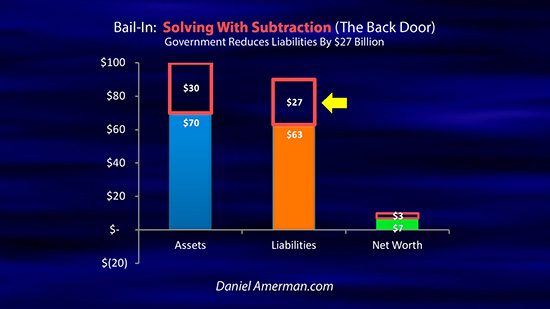

Italy did a bail-in of four banks at the end of 2015, which inflicted bail-in losses on many individual savers, using the process explained in Video #2 of the series, "Comparison Of Bail-Outs vs Bail-Ins For Banks", linked below.

This was extremely unpopular in Italy, but those are the new rules, as agreed to by the EU and the G20 - including the United States, Canada and Australia.

Here is a link and quote from Bloomberg:

http://www.bloomberg.com/news/articls/2016-06-29/italy-s-longshot-bid-for-bank-bailout-last-chance-to-stop-crisis

"An Italian banking bailout would evoke the darkest days of 2008 and 2009, when governments on both sides of the Atlantic were forced to save their financial systems with public funds. It would also be a blow to the EU’s efforts to protect taxpayers from the vagaries of the financial world. In 2013, lawmakers approved rules that took full effect this year requiring bondholders and shareholders to absorb losses in failing lenders in the event of a rescue, a process dubbed a 'bail-in.'"

So, the Italian bank problem did not go away, but has gotten worse, due to long term economic stagnation and now Brexit. The legal requirement in the EU is for bail-ins. Handling much larger losses without bankrupting government finances are the exact reason for bail-ins. Yet, Italy moved the opposite direction and was seeking a bail-out, over the vigorous objections of Germany. What is happening here?

If it were just Italy, then it is Italian depositors vs Italian taxpayers. Italy takes the hit either way, and the need for bail-in could be existential for the Italian government. Italy is already heavily indebted, and guaranteeing securities for the banks would just increase the problems.

But Italy is not by itself, it is part of the EU. So Italy went to the European Union, to ask for permission to bail-out its troubled banks, with government guarantees that are backed by the EU.

So, while the Italian government guarantees remain part of the loop, everyone else in Europe is on the line for the Italian bail-out. This is against the rules, and is why the Germans are upset. Because if this sets the precedent, then Germany is back in line for essentially guaranteeing the European banking system, in a way that mandatory bail-ins was supposed to change.

Italian depositors were supposed to take the risk for Italian banks, Danish depositors for Danish banks and so forth.

So Italy went to the European Commission seeking approval for a 40 billion euro liquidity guarantee. And what they got back, was permission for a 150 billion euro guarantee.

http://www.bloomberg.com/news/articles/2016-06-30/eu-approved-167-billion-liquidity-guarantees-for-italy-banks

"Italy was given the go-ahead by the European Commission to supply as much as 150 billion euros ($166 billion) in government liquidity guarantees for its struggling banks until the end of the year, according to an EU official. Liquidity support for solvent banks is a “precautionary measure” requested by Italy, the EU said in an e-mailed statement. The guarantees of senior debt allow lenders to maintain access to financing, often at a better price."

So Italy not only got a remarkably quick waiver to break the rules, but it got almost four times the amount that it was publicly stating that it was requesting! Why did that happen?

Well, let's go to the IMF Twitter feed. and look for the tweet below on June 30th.

https://twitter.com/IMFNews

"Decisive policy action will make a difference should higher #Brexit uncertainty threaten to weaken global economy"

The key word here is "decisive". By acting immediately and at a multiple of the requested amount, the EU sent a strong message that it was setting all rules aside, and would do whatever was necessary, to maintain the solvency of the European banking system. Of course, it is also attempting to move the problematic Italian banking system completely out of the headlines during the coming weeks and months, and making sure it doesn't reappear if the Italians go through their first 40 billion euros and come back for another 40 billion.

As covered in my analysis from earlier this week, "Brexit & The Precipice":

"Now, none of this means that going over the precipice is inevitable. We are still on the edge at this point, not over it.

...

For now, what we have is another and particularly dangerous round of battle between market forces and the forces of financial containment and government enforced artificial stability."

The actions of the EU confirm that they are keenly aware, as is the IMF, that the precipice is indeed in sight. And little bits of that edge are starting to crumble away, much like an erosion slope during a heavy rainstorm. So what they are doing is pro-actively taking fast and hard actions, trying to win the battle as soon as possible, because that is cheapest place for doing so.

But yet, it also needs to be recognized, that this is a high-risk choice. What the EU is doing is frantically resurrecting the play book from 2008, in an attempt to keep a Brexit contagion from taking down the system. But as covered in Video #3 of the Bail-In series, linked below, the firewalls from 2008 likely can't be used again, or at least not to anywhere near the same degree. And in the act of attempting to use them, the EU is multiplying the damages if it fails.

The problem with gambling on early containment is that they have also increased the pressure on the EU and the European Central Bank, which increases the degree of the losses in the event the event of a catastrophic failure of the firewalls, and increases the likelihood that insured depositors in the EU - and possibly other nations - will at some point need to be bailed-in as well.

There is some very high information value here, if we contrast talk and actions. The talk from the EU is that they do not expect the Italian bank guarantees to be used. The action is that the EU and G20 spent 7 years, from 2009 to 2016, developing and all agreeing to a method for transferring risks from governments to savers and investors via bail-ins, so that the system would survive the next crisis. And one week from the start of the Brexit crisis - they threw that entire elaborate system and rulebook right out the window.

That would seem to indicate deep fear and even borderline panic, not calm.

The quote below from Jesper Berg, director general of Denmark’s Financial Supervisory Authority, is well worth studying, for savers in the United States as well as Europeans and others.

http://www.bloomberg.com/news/articles/2016-06-30/eu-s-bank-resolution-plan-questioned-as-denmark-joins-doubters

“The one really important lesson is that we have a gigantic communication problem to make people aware that the risks are now in their private pockets, not their pocket as a taxpayer. That message cannot be under-communicated.”

The battle is on right now, on multiple fronts in Europe. And the risks lead to a place that most of the population simply does not understand.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

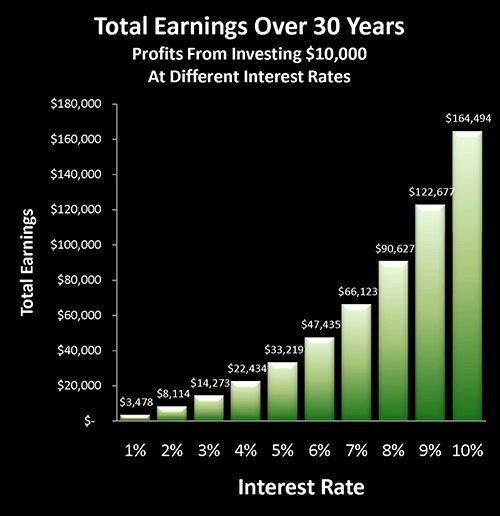

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

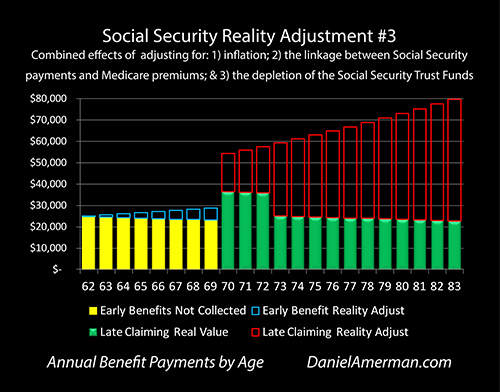

Much has been written about a $150,000+ advantage to waiting until age 70 before collecting Social Security. However, as explored in the analysis linked here, once we "raise our game" a bit, and use a more sophisticated type of analysis than some of the simplistic Social Security decision aids in wide circulation ─ all of that advantage can vanish.

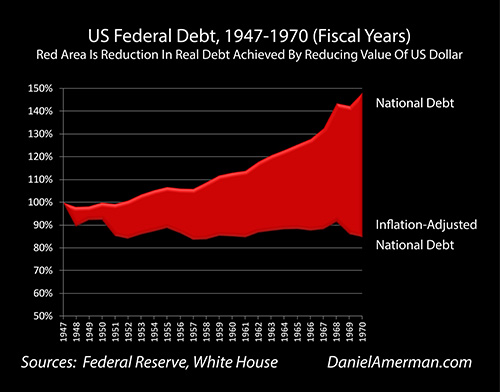

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2016 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.