BrExit Implications for UK Stock Market, Sterling GBP, House Prices and UK Politics...

Stock-Markets / Financial Markets 2016 Jul 04, 2016 - 07:24 AM GMTBy: Nadeem_Walayat

Britain's vote to LEAVE the European Union triggered immediate financial markets panic that prompted the Bank of England to implement its emergency market rescue plan that included making upto £250 billion available to Britains banks that succeeded in halting the BrExit financial panic in its tracks as sterling stabilised at lower levels whilst the FTSE soared into the stratosphere recovering all of Fridays plunge and registering its best weekly gain in over 4 years. So what's next for the financial markets? Is the BrExit financial storm over? Find out in Part 2 of the Implications of BrExit on the financial markets, stocks, sterling, house prices and UK politics.

Britain's vote to LEAVE the European Union triggered immediate financial markets panic that prompted the Bank of England to implement its emergency market rescue plan that included making upto £250 billion available to Britains banks that succeeded in halting the BrExit financial panic in its tracks as sterling stabilised at lower levels whilst the FTSE soared into the stratosphere recovering all of Fridays plunge and registering its best weekly gain in over 4 years. So what's next for the financial markets? Is the BrExit financial storm over? Find out in Part 2 of the Implications of BrExit on the financial markets, stocks, sterling, house prices and UK politics.

Part 1: Covered the following key areas of the UK economy - http://www.marketoracle.co.uk/Article55771.html

1. UK Economy - 2% GDP Price for Freedom

2. UK Interest Rate Cuts and More QE

3. UK Bonds

4. UK Debt and Deficit - George Osborne's BrExit Excuse to Scrap UK Government Borrowing Targets

5. UK BrExit Inflation Forecasts Spike CPI to 3%, RPI 4%

But first a quick recap of what actually happened on BrExit night that caught virtually ALL by surprise in this video of my selection of the highlights from 8 hours of BBC coverage of the EU Referendum result.

6. British Pound - BrExit WIns Britain Currency War!

The mainstream press is in a state of hysteria, panic even following the plunge in the British Pounds from a Thursday night high of £/$1.50 to currently stand at £/$ 1.33. Whilst yes the 12% downwards plunge from £/$1.50 is in forex markets terms HUGE, a move not seen the likes of for many decades that takes the dollar exchange rate down to levels last seen in 1985. Nevertheless the mainstream press has missed one fundamental fact for the obvious reason that they just DO NOT understand the financial markets and what the market movements actually mean or translate into.

For instance the MAIN Forex markets story for the whole of this year, in fact for virtually much of the past 5 years has been the Currency Wars, one of central banks attempting to competitively DEVALUE their currencies against one another's in an attempt to IMPORT Inflation and EXPORT deflation. Which I have covered many times before as the following video from mid February illustrates:

This despite the same clueless press earlier on in the year reporting on the likes of Japan implementing NEGATIVE interest rates in an attempt to PUSH the Japanese Yen LOWER as each nation in an attempt to boost domestic demand by means of importing inflation and exporting deflation in what is commonly termed as the CURRENCY WARS.

Therefore rather than the plunge in the British Pound being disastrous, instead Britain has effectively won a regional war in a raging global currency war all without implementing any panic monetary tools or economic policy, which is set against other central banks right across the western world from Switzerland to the whole Euro-zone block and Japan, repeatedly cutting their interest rates to below ZERO in panic attempts to push their currencies LOWER!

With the sterling plunging towards 1.30 the 1.40-1.50 range may now seem very distant but I think that when the dust settles a year from now sterling should be back in to its pre-Brexit trading range against the US Dollar as the forex markets turn their attentions to the EURO! And a reminder that a weak currency is the objective of EVERY central bank in what has been termed as currency wars, the most notable manifestations of which are zero and NEGATIVE interest rates, Japan, the European Union, China and the United States ALL WANT a WEAK currencies so that they can export deflation and import inflation. So Britain's currency plunging boosts exports and cuts imports which means Britain has effectively won a major battle in the currency wars without implementing any extreme market measures such as the likes of BoJ, ECB and Swiss central banks have this year!

7. BrExit Stock Market Upwards Crash as FTSE Recovers Friday Plunge and More!

Friday's stock market plunge in the wake of BrExit that caught the financial markets, bookmakers and pollsters by surprise who had by the close of polls all but discounted a REMAIN outcome and thus sent stock futures and sterling soaring, only to do a panic reversal a couple of hours later as the actual results started to be announced with the initial triggers being results out of Sunderland and Newcastle. And so with each result a new wave of selling would hit the markets that by 5am had seen the FTSE futures plunge to below 5800, and sterling to spike below £/$ 1.32. Which triggered waves of doom laden commentary warning of End Times for the UK economy, stocks, housing and sterling, as so called analysts published reams and reams of nonsense to explain why the End Was now and stocks were set to literally crash into a brexit black hole.

Effectively all those who had been wrong for the 7 year duration of the stocks bull market were once more proclaiming its demise, and it did not matter what the FTSE actually did post Brexit for the blogosfear perma-doom infection had firmly spread and taken hold of the mainstream press such as the FT, who already predisposed to SELLING FEAR and PANIC to the masses, of doom laden calls of an imminent Brexit disaster, a BrExit Lehman's moment even!

So what did the FTSE actually do? Well, the FTSE futures bottomed early Friday morning at about 5750, before the markets opened, and then with each passing trading day have gathered strength and momentum to the UPSIDE! With the last FTSE close of 6577, its highest since August 2015 and apparently having had its best week in over 4 years!

So what happened to the brexit stock market apocalypse? Take note dear reader of the garbage that is 90% of that which passes for market commentary, written by clueless journalists, academics or salesmen.

And as for trading BrExit, then as of 12th of June my forecast conclusion based on year long analysis was for a LEAVE victory on 51.3% against REMAIN on 48.7% (12th June 16 - EU Referendum Forecast) and as illustrated by the following pre-voting video:

Thus a Brexit forecast implied that the FTSE and Sterling WOULD PLUNGE on Brexit night, especially as in the immediate run up to the count the FTSE and Sterling were strongly trending in the WRONG direction by discounting a REMAIN win, which was also true of the bookmarkers and pollsters all of which was resulting in an excellent risk vs reward opportunities to profit from as illustrated by the following article and subsequent video posted Thursday afternoon as the bookmakers and markets increasingly discounted a REMAIN outcome.

23 Jun 2016 - Trading BrExit - Stocks, Bonds, Sterling, Opinion Polls, Bookmaker Odds and My Forecast

In terms of trading the markets, and despite the markets apparently no longer treating Brexit consequences seriously, a case of whatever happens it will be business as usual, nevertheless a BrExit outcome will result in sharp downwards swings for sterling and FTSE, even if the moves prove temporary as the politicians and central bank officials are likely to respond to both with market soothing words of nothing has really changed and of course the Bank of England releasing tens of billions of more market liquidity support.

So taking account of my forecast conclusion for a BrExit outcome then the current stock and forex markets are offering the potential for good risk vs reward short-term trades. However remember that volatility will be HIGH which means that even if one gets the direction right then if the stops are not set wide enough then traders can get stopped out of positions BEFORE the profit making moves take place. Or that of REMAIN does win then the market may gap well beyond ones stops resulting in larger losses than the potential that had been allowed for.

And so also are the bookmakers giving what appear to be good risk vs rewards odds of 4.3 to 1.

Friday definitely looks set to be a very interesting trading day, your analyst hoping he does not get stopped out of short side profit making moves!

And then the polls closed and all hell broke loose as YouGov confirmed that REMAIN would win triggering a further sharp rally for the ftse futures and sterling that was sustained until the actual results started to be announced shortly after midnight. Which I covered in this comprehensive video of exactly what happened in the markets during a very volatile trading session.

Stocks Bull Market

So against prevailing year long perma-doom my consistent view ALL year has been that the stock market would trend towards NEW ALL TIME HIGHS before the end of this year. Whilst my last in-depth analysis of Mid May concluded that stocks had entered a correction that would see the Dow trend lower towards 17,000 by the end of June 2016, just as that which has subsequently come to pass and now resolved in a trend that should take the Dow to new all time highs.

Therefore, so far the stock market has been trending inline with my expectations i.e. to temporarily plunge on Brexit, and now having recovered ALL of the decline and more, so has done nothing to alter my long standing view that the stock market remains on track to trend towards new all time highs during the second half of this year as the above video of Mid May illustrates, and which I will come back to in great detail in forthcoming analysis but for now take this as another warning not to listen to the perma doom near always wrong crowd who today are once more busy peddling crash, collapse, and worst bear market in history fear, that if they actually acted on their calls would now also be going broke! This whilst the likes of the FTSE clearly remains firmly within its trading range which for a bull market tends to be a precursor for breakout to new highs, as has been the case for over 7 years now and which is the message I have iterated for the duration of this stocks bull market.

8. UK House Prices BrExit Crash NOT Likely Despite London Property Market Weakness

The establishment REMAIN camp peddled the same story for the UK housing market all year, one of a collapse, crash or worse! As operation fear each month ramped up the threats of that which awaited a post Brexit Britain. The house prices crash fear mongering even emanated direct from George Osborne himself who warned: “If we leave the European Union there will be an immediate economic shock that will hit financial markets... That affects the value of people’s homes and the Treasury analysis shows that there would be a hit to the value of people’s homes by at least 10 per cent and up to 18 per cent."

And Apparently in a world where zero interest rates are moving to negative rates the UK would be the odd one out to actually increase interest rates as George Osborne added And at the same time first time buyers are hit because mortgage rates go up, and mortgages become more difficult to get.”

David Cameron and George Osborne then continued with their contradictory statements of a plunging sterling and rising inflation but falling house prices inflation.

"If we leave the EU the fall in the value of sterling would be an average 12%."

"Let's be clear what that means: a weaker currency means more expensive imports; that means more expensive food and it drives higher business costs; and we all know where that ends up: higher prices in the shops." - David Cameron

Firstly, as I have repeatedly pointed out that a fall in exchange rate is what virtually every central bank is trying to engineer by means of zero and negative interest rates! It's called the CURRENCY WARS, central banks trying to IMPORT inflation and EXPORT deflation as I covered in this video in response to earlier government propaganda -

In a world starved of yield with many bond holders in Japan and Germany actually PAYING interest to lend money to the government (bonds), rising UK interest rates would act as a huge financial hoover, sucking in foreign investment into UK bonds which ironically would result in a FALL in UK interest rates i.e. demand exceeding supply.

Though of course now post brexit interest rates have done the OPPOSITE to the fear mongering and so are house prices likely to RISE rather than crashing by 18%! For the fundamental fact that UK house prices in dollars are now 12% CHEAPER! A BrExit discount for potential foreign buyers who primarily will be wondering whether UK house prices will get cheaper in currency terms or should they act to seize the moment and pick up a bargain now. So in my opinion foreign demand will be STRONGER for UK property going forward and the only delay is in investors waiting and watching for sterling to stabilise which it seems to be doing so in the £/$ range of 1.30 to 1.38, and the longer sterling holds this range or trends higher then the greater will be foreign interest in buying UK property, especially if the doom merchants headlines for a house price falls fail to materialise.

Whilst post-brexit nothing much has really changed in the doom commentary as the mainstream press remains focused on stories for imminent falls in UK house prices as the following illustrates:

Property market on the ropes following Brexit vote

Mirror.co.uk-28 Jun 2016

Annual house price growth will rapidly slow down towards the low single digits across the UK's major towns and cities as the EU referendum ...

A Post-Brexit House Price Crash Is the Real Danger for the U.K.

TheStreet.com-30 Jun 2016

Unlike in the U.S. and in European countries like Spain or Ireland, the U.K. did not see a real house price crash following the financial crisis of ...

The Brexit effect on UK property will be more devastating than ...

Business Insider-10 Jun 2016

While Chancellor George Osborne already warned in May that a Brexit would make house prices crash by 10% to 18%, Mark Burrows and his ...

Zoopla's EU warning claiming house prices could drop by 20%

Daily Mail-18 Jun 2016

The company, which allows owners to monitor the estimated value of their property, said the current average house price of just over £297,000 ...

London house prices are heading for a 20% fall

MoneyWeek-23 Jun 2016

In other words, unless you believe that property prices will keep ... of MoneyWeek, house prices elsewhere in the UK are expensive by historic standards. ... A muted or crashing London market certainly will make most people ...

And many of those proposing a drop in UK house prices or worse are the same who have been wrongly calling for its imminent demise for years!

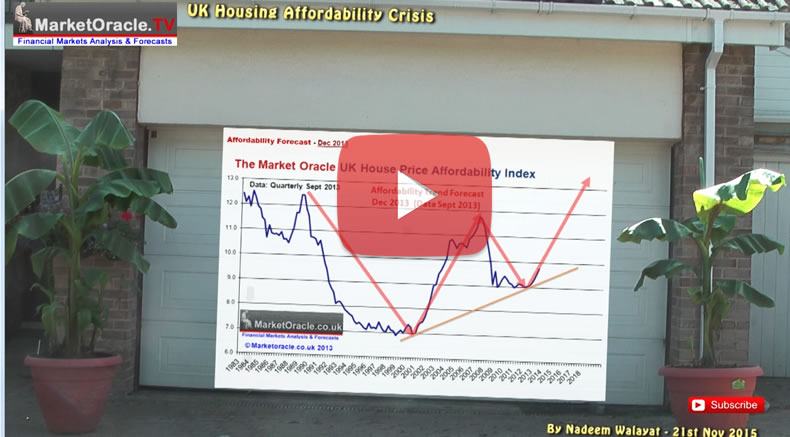

What the academics and mainstream press commentators persistently fail to comprehend is TREND, or more precisely the TREND in AFFORDABILITY. The trend over the past 40 years has been for the proportion of household earnings spent on housing costs to rise from 20% 40 years ago to an average of 35% for Dec 2013, which is trending towards 50% by 2030. This is the big story that the academics have missed as over time, decades in fact people are gradually becoming conditioned to spend more and more of their earnings on housing costs as being the norm which the government subsidises through benefits such as tax credits and housing benefit.

Affordability Forecast - Dec 2013

The reason why I expected affordability to trend ever higher again has its roots in the exponential inflation mega-trend as workers relentlessly face a loss of purchasing power of earnings and savings due to reasons such as the Inflation of the size of the population that is MOSTLY as a result of continuing out of control IMMIGRATION, as evidenced by the baby boom now underway mostly amongst migrant families of the past 15 years that acts to relentlessly put pressure on housing availability where annual construction (new builds) are not able to keep pace with even half of the new demand generated each year. Therefore workers have no choice but to commit an ever larger proportion of their earnings towards housing costs, the effect of which is that housing bear market affordability troughs are being ratcheted ever higher, which has left many academics confused as they remain fixated on their theoretical models that imply house prices must fall so as to return to affordability levels of past troughs as the real world trend passes them and their models by.

The updated affordability graph (Dec 2015) shows the underlying relentless trend of affordability being once more ratcheted higher that looks set to breach the 2007 bull market peak during 2016 i.e. house prices this year will be even more unaffordable then they were right at the very peak of the last housing bull market mania!

More on the housing affordability crisis in the following video -

UK House Prices 5 Year Forecast

In terms of the prospects for UK house prices, it is now 2 1/2 years since excerpted analysis and the concluding 5 year trend forecast from the then forthcoming UK Housing Market ebook was published:

30 Dec 2013 - UK House Prices Forecast 2014 to 2018, The Debt Fuelled Election Boom

UK House Prices Forecast 2014 to 2018 - Conclusion

This forecast is based on the non seasonally adjusted Halifax House prices index that I have been tracking for over 25 years. The current house prices index for November 2013 is 174,671, with the starting point for the house prices forecast being my interim forecast as of July 2013 and its existing trend forecast into Mid 2014 of 187,000. Therefore this house prices forecast seeks to extend the existing forecast from Mid 2014 into the end of 2018 i.e. for 5 full years forward.

My concluding UK house prices forecast is for the Halifax NSA house prices index to target a trend to an average price of £270,600 by the end of 2018 which represents a 55% price rise on the most recent Halifax house prices data £174,671, that will make the the great bear market of 2008-2009 appear as a mere blip on the charts as the following forecast trend trajectory chart illustrates:

The most recent UK average house prices data (£216,017) is showing just a 3.2% deviation against the forecast trend trajectory, which if it continued to persist then in terms of the long-term trend forecast for a 55% rise in average UK house prices by the end of 2018 would then translate into a 7% reduction in the forecast outcome to approx a 48% rise by the end of 2018.

UK House Prices Momentum

UK house prices momentum gong into the EU referendum had significantly slowed from + 11.1% for March 2016 to +8.7% for May 2016. I expect momentum to continue to slow over the next few months, probably bottoming out at above 5% before rising again towards +10% by the end of thus year. Thus UK house prices will continue to defy the highly vocal perma-wrong crowd who have been proclaiming that a house prices crash is imminent for the past for 4 years! Who I am sure will be jumping up and down like demented rabbits as they assume the slowdown in momentum is anything other than just that a slowdown in the rate of the annual increase in house prices, which I still expect to remain strongly positive i.e. at above +5% and end 2016 trending back towards 10%.

Whilst London will see a more severe slowdown in momentum than the rest of the UK and actual year on year falls in some over priced locations and for flats, as per my in-depth analysis of December 2015 that had expected London to take a hit but overall UK average house prices to continue trending higher for 2016, a trend that should become apparent over the coming months.

The bottom line is that UK house prices are going to continue to get ever more expensive where those who are waiting for a crash to more affordable levels will continue to regret not buying as the only way housing can even start to become more affordable is if the UK literally triples the number of new builds each year from approx 140,000 per year to 400,000, something that is just not going to happen as it would literally mean the government undertaking to build a new major city EVERY YEAR! Instead it has been over 40 years since the last new town let alone city was built.

Therefore the UK housing crisis is not just one of the inability of the housing market to cope with current demand, but as the earlier housing affordability trend graph illustrates that the crisis is going to get much WORSE with each passing year, which ultimately means an social EXPLOSION of some kind, maybe not a revolution but it's not going to look pretty! And where BREXIT is just the first rebellion of the people against the establishment that want to import cheap labour that the tax payer picks up the bill for in terms of in work benefits and the people of Britain pay the price for in terms of the slow motion collapse of society as literally each service after service FREEZES! Hence why the housing crisis cam ONLY be addressed AFTER Britain has LEFT the European Union, which still remains several years away.

9. UK Politics - Boris Johnson Brexecuted by 'Little Finger'

David Cameron's announcement to step down as Prime Minister by early September propelled Brexit Leader Boris Johnson to become the favourite to takeover as Britain's next Tory Leader and Prime Minister. However, the great game for the Tory 'iron throne' was on, as Michael Gove today both discredited Boris Johnson whom he was supposed to be the campaign manager for and then went against EVERYTHING he has stated during the EU Referendum Campaign, in fact against everything he has been saying for the past 4 years by declaring that he himself would now stand for the Tory Leadership, so it looks like Gove, just like 'Little Finger' has apparently been manoeuvring towards the Tory 'iron throne' all along!

For instance during the referendum campaign when asked in one of the debates - "When Mr Cameron steps down are you considering a leadership bid?"

Michael 'Little Finger' Gove replied " I can tell, I am absolutely not. The one thing I can tell you is that there are lots of talented people who could be Prime Minister after David Cameron, but count me out"

And earlier still ""The one thing I do know having seen David Cameron up close is it takes extraordinary reserves of patience of judgement of character to lead this country and he has it and I don't and I think it's important to recognise in life you’ve reached an appropriate point."

And one more time - "There are lots of other folk including in the Cabinet who could easily be prime minister, I am not one of them. I could not be prime minister, I am not equipped to be prime minister, I don’t want to be prime minister."

And then today the stage was set for Boris 'Baratheon' Johnson to declare his intention to stand as next Tory Leader and Prime Minister, only for Michael 'Little Finger' Gove to make his surprise announcement a couple of hours beforehand in what looks like a co-ordinated assault to pull the rug from under Boris Baratheon Johnson by taking a large chunk of the MP's who would have supported Boris Johnson by stating -

"I have come, reluctantly, to the conclusion that Boris cannot provide the leadership or build the team for the task ahead. I have therefore decided to put my name forward for the leadership."

In response to which Boris Johnson surprised all by stating that he would not be standing - "I must tell you my friends, you who have waited patiently for the punch line of this speech that having consulted colleagues and in view of the circumstances in Parliament I have concluded that person cannot be me, my role will be to give every possible support to the next Conservative administration to properly fulfill the mandate if the British people"

So whilst Michael 'Little Finger' Gove may today be the rank outsider amongst the list of declared candidates to sit on the Tory 'iron throne' now that Boris 'Baratheon' Johnson has been slain along with his bullingdon club buddy David 'Lanister' Cameron, which effectively clears the field for previously unthinkable candidates such as Michael 'Little Finger' Gove to continue working his way on the Tory 'iron throne'.

Of the list of candidates the following now stand out with Theresa May the clear favourite to seize power and the keys to No 10 -

- Theresa 'Cersi' May - Favourite

- Michael 'Little Finger' Gove

- Andrea 'Martell' Leadsom

- Stephen 'Greyjoy' Crabb

It's too early to see who will win the chaotic great game to become the next Tory Leader and Prime Minister as there is a long way to go and with much more political bloodshed expected along the way, but for now do NOT underestimate Michael 'little finger' Gove.

And whilst the Tories sort out their next Leader Britain is effectively being run by Mark Carney at the Bank of England who has been busy pumping hundreds of billions into the markets and banking sector.

Meantime the Labour party seeing the Tories in complete disarray have decided to go one step better by completely self destructing as Labour MP's attempt to get rid of Jeremy Corbyn, who is the overwhelming choice of the ordinary Labour party members, an effective Westminister coup which does not bode well for Labours electoral prospects.

In fact we may be seeing the death of the Labour party as we have know it splitting into god knows what factions. After all Labour is already dead in Scotland and has been dealt a hammer blow in North England and Wales with UKIP turning its core heartlands into hollow husks as illustrated by the results out of the supposed Labour strong holds of Sheffield (52% Leave) and Rotherham (67% Leave) as Labour is morphing into a party just of London, completely detached from its traditional supporters across England, this changing the Leader is not going to make any difference to the crisis Labour faces!

All of which acts to reinforce my long standing expectations that the Conservatives remain firmly on track to win the NEXT General Election regardless of who eventually claims the Tory 'iron throne' because the opposition is disintegrating before our very eyes.

REMAIN vs LEAVE

And where BrExit is concerned, it is useful to know that whilst 52% of the British people voted for LEAVE, 75% of Westminister MP's backed REMAIN, which means it is going to be tough to achieve a BrExit outcome, especially if the next PM is not selected from the BrExit camp.

And this throws up an even bigger problem for Westminster which is that the mainstream political parties DO NOT reflect the electorate. The divisions between the three centrists parties - Labour, Liberals and Conservatives does not reflect the real world divisions in the country which the EU Referendum highlighted , i.e. LEAVE and REMAIN were better representative entities than either of the Conservative or Labour party's, which implies that the referendum may claim at least one of these parties (Labour most probable) as the political spectrum is redrawn.

Meanwhile Tony Blair has popped up again to propose subverting the will of the people by the government to consider IGNORING the 52% LEAVE EU Referendum outcome by stating:

"Okay, it's clear there was a vote to leave, but it wasn't 70-30 or 60-40, it was 52-48. Yes the referendum expressed the will of the people but the will of the people is entitled to change."

Tony Blair is apparently forgetting that his own Labour election victories never achieved anywhere near 52% of the vote, with his last election win on barely 35%, but now apparently he wants to subvert the clear will of the people far beyond that which any government has achieved since before the second world war!.

10. EU Does Not Want Scotland

And finally we come to Scotland, shrill voices heard from north of the wall as the likes of the SNP are seeking to subvert the will of the British People with threats of their own second Independence referendum. However, IF that happens I am sure Scotland will once AGAIN vote to REMAIN within the United Kingdom because by the time the referendum is held, say 2 years from now, then it will become crystal clear that EXITING the European Union WAS INDEPENDENCE not just for the UK but also for Scotland. BrExit really is in the BEST interests of ALL of the people of Britain, even those that support the SNP fundamentalist fanatics who in their hatred of all things England would rather see Scotland burn then remain within the United Kingdom, which includes being members of a dieing European Union that in my long standing opinion is heading for disintegration of which BrExit is just the most recent step along its ultimate path towards collapse.

So whilst the likes of Sturgeon fantasises that the European Union will welcome breakaway Scotland with open arms, however, virtually every EU nation has their own Scotland, each seeking independence from their nation states and thus the EU giving Scotland 'special treatment' would rejuvenate secessionist movements right across the EU with the likes of Catalonia and the Basque region in Spain, Venice and Tyrol in Italy, Corsica in France, Flanders in Belgium and even Bavaria in Germany are just some of Europe's many independence flash points which means few EU nations will be willing to open up that can of worms.

And then we have the economic reality of Scotland that is on the receiving end of a net subsidy from England of £11 billion. So if Scotland leaves the UK are the SNP fantasising that the bill for filling the £11 billion black hole will be picked up by the likes of Germany? And what happens when Scotland fails to realise its annual net subsidy of £11 billion from the European Union? Scotland will within a matter of months if not weeks become Greece 2.0. So does Sturgeon really think that with all the chaos Greece has wrought on the Euro-zone that the EU wants to repeat the same mistake with Scotland i.e. to replace the UK which is a net contributor to the tune of about £10 billion per annum with one that demands a net subsidy of £11 billion per annum?

A reminder that Scotland's break even oil price i.e. one where Scotland could finance what it spends without subsidy is $150. So where is the price today? $48, which isn't enough to keep Scotland's oil sector alive without additional English subsidies let alone cover the Scottish governments £11 billion black hole! An Independent Scotland as part of the Euro-zone would be the same bankrupt sinking ship as is Greece, in permanent recession, where the voice of 5.3 million Scots would count for little amidst a pool of 450 million europeans (after brexit).

And that is before we come to the details that would once more crop up during a second referendum campaign, the details of currency, debt, subsidy, oil fields and more. All of which led the people of Scotland last time to vote to REMAIN within the UK.

So this is where I stand in the immediate aftermath of Brexit on 10 key economic indicators and markets, that I will each come back to as I map out in detail the prospects for Britain and Europe over the coming months and years so do ensure you are subscribed to my always free newsletter to get this analysis in your email in box.

Your Independence Day analyst who expects over time more and more people will come to realise that Britain really did make the RIGHT decision to LEAVE the EU.

Source and Comments: http://www.marketoracle.co.uk/Article55772.html

By Nadeem Walayat

Copyright © 2005-2016 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.