European Banking System on Verge of Collapse; 'No Confidence' in Italian Bank Rescue

Companies / Credit Crisis 2016 Aug 03, 2016 - 01:54 PM GMTBy: Mike_Shedlock

European bank shares are down for the second day following a last minute bailout package aimed at Italian banks one day before a stress test showed Monte dei Paschi would be insolvent in an adverse scenario.

European bank shares are down for the second day following a last minute bailout package aimed at Italian banks one day before a stress test showed Monte dei Paschi would be insolvent in an adverse scenario.

The ECB's stress tests published on Friday showed Monte dei Paschi has a huge capital shortfall, with the bank's Common Equity Tier 1 (CET1) ratio of negative 2.44 percent.

Forget the adverse scenario bit, Monte dei Paschi, Italy's third largest bank and oldest bank in the world is insolvent in any realistic scenario.

On ZeroHedge provided the Full Details Behind Monte Paschi's €5 Billion Bail Out but the short synopsis is the same as ever: It cannot possibly work.

Supposedly, a €1.6 billion investment into a mezzanine tranche of Monte dei Paschi from the €5 billion Atlante (Atlas) rescue fund is all it takes to cure some €50 billion in nonperforming loans at the bank.

In total, the Italian banking system has €360 billion in nonperforming loans and Atlas is supposed to take care of the entire mess.

Monte dei Paschi Rescue Hits Bank Shares

Yesterday the Financial Times reported Monte dei Paschi Rescue Hits Bank Shares.

Confidence Shell Game

Instead, debt was repriced lower across the board and more write downs are feared.

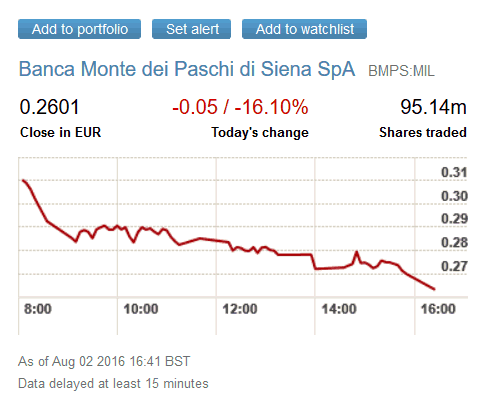

Monte dei Paschi Down 16% Today

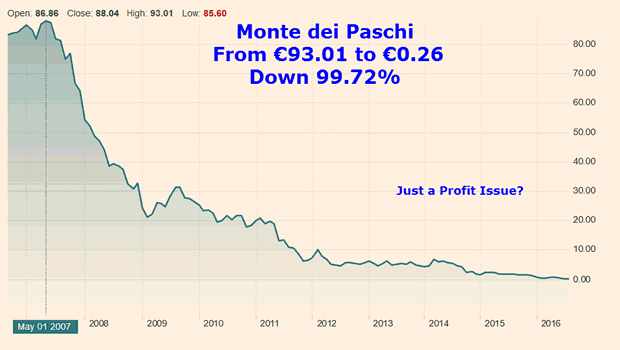

Monte dei Paschi Down 99.72% Since May 2007 High

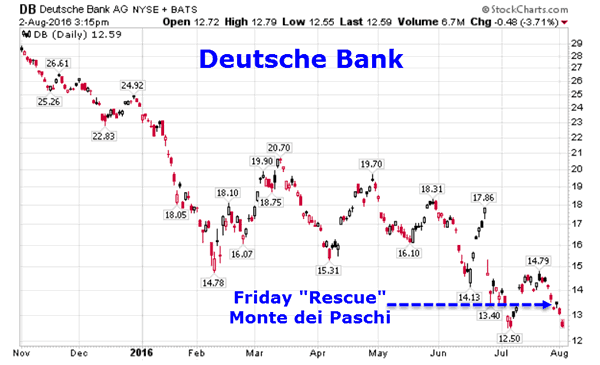

It's not just Monte dei Paschi, or even just Italian banks.

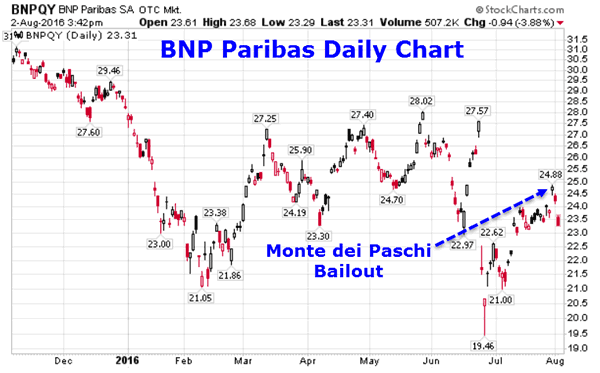

BNP Paribas Daily Chart

BNP Paribas, a French multinational bank is a certified all star compared to German banks.

Deutsche Bank Daily Chart

Deutsche Bank Monthly Chart

What About Commerzbank?

May 1, 2016: Commerzbank Looks to Build on Gains of Recent Years

July 25, 2016: Commerzbank Warns of Decline in Capital Position

In an unscheduled announcement, Germany's second-largest bank by assets said that its core tier one capital ratio -- a key measure of financial strength -- had fallen from 12 per cent at the end of March to 11.5 per cent at the end of June.

That is still above regulators' minimum requirements -- but diverges from the 12 per cent that analysts had been expecting, which triggered the impromptu disclosure under Germany's strict securities laws.

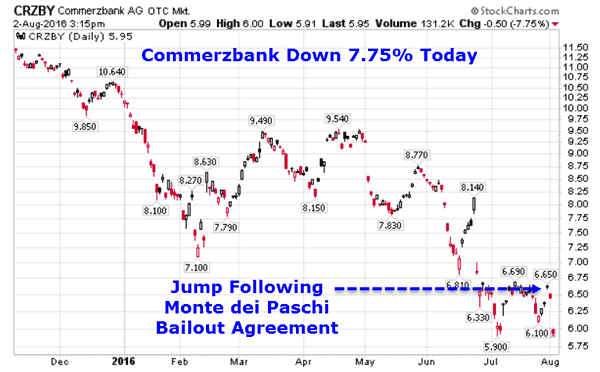

Commerzbank Daily Chart

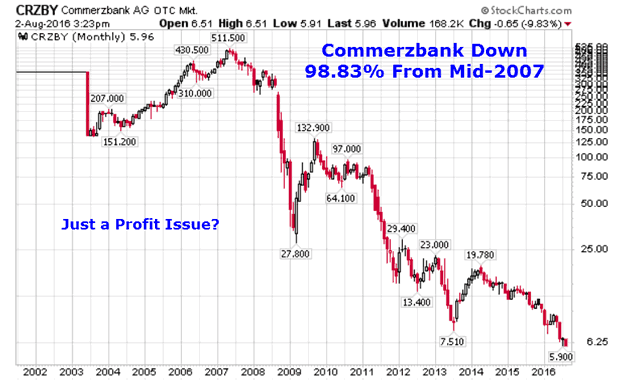

Commerzbank Monthly

Race to Zero

I am sure glad "Commerzbank Looks to Build on Gains of Recent Years".

Are they talking about gains in the race to zero?

If so, percentage-wise Commerzbank is ahead of Deutsche Bank but behind Monte dei Paschi. The last final plunge takes considerable effort however. Monte dei Paschi remains the overwhelming odds-on favorite.

The Financial Times discusses the Vanishing Market Value of European Banks.

"The key to us is understanding this is a profitability issue versus an insolvency issue," says Hani Redha, a portfolio manager at PineBridge Investments, regarding the sector's performance."

I suggest (as does the market) the entire European banking system is on the verge of collapse.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.