Gold vs Stocks: The New Normal

Commodities / Gold and Silver 2016 Sep 11, 2016 - 08:49 PM GMTBy: Nicholas_Kitonyi

Stock prices have always been deemed to have an inverse relationship with the price of gold mainly because unlike the yellow metal, investors tend to fancy them when global economies are doing well. Gold is often seen as a fallback plan when things go caput in the stock market.

Stock prices have always been deemed to have an inverse relationship with the price of gold mainly because unlike the yellow metal, investors tend to fancy them when global economies are doing well. Gold is often seen as a fallback plan when things go caput in the stock market.

Stocks are income driven and if the economy is doing well, then equity prices are likely to improve to mirror the change in the overall economic outlook. Income driven investments tend to provide better returns than currency investments in a strong economy.

When the economy is growing, the federal government moves to convert some of its gold reserves into income generating assets while in the case of a reverse situation, more gold or the USD is needed to boost reserves in a bid to stabilizing the local currency.

This is what brings about the inverse relationship between Gold and the currencies it is quoted in—and by extension—the equities markets. That’s what has been considered to be normal for decades.

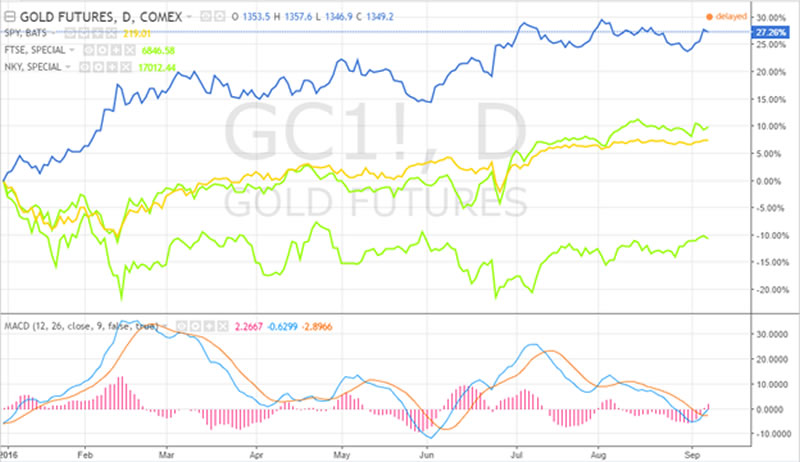

However, things appear to have changed over the last couple of months in a situation that would seem to suggest that investors are creating a new normal in the market. As demonstrated in the chart below, the inverse relationship is now being nullified.

According to Jason McFarlan, a senior analyst at 24option, the introduction of high frequency trading technologies in the stock market is slowly rewriting the principles of investing from the practices of the past to quant-driven methodologies.

As such, most investing fundamentals such as economic conditions are now being tested on their relevance to the modern investing techniques, which rely on trading data to determine the next possible price movement.

This means that the analogies of the past with regard to income generating equities versus currency-backed gold are being dumped and replaced with new speculative theories. Last year, when commodity prices were falling, stocks rallied.

This did not happen because of the inverse type of relationship but rather, because investors remained optimistic on the stock market for no ideal reasons, between January and February this year, there was a major market correction that cut across the globe.

After the correction ended in February, the stock market experienced high volatility for the following three months before finally mirroring the price of gold in June. Since then, the three major global indices have maintained an upward movement thereby creating a direct relationship with the price of gold.

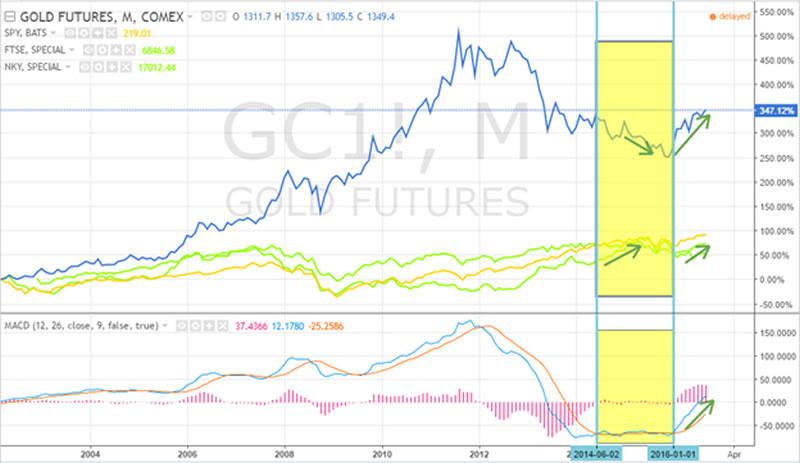

Under normal circumstances, this would be considered abnormal, but it has now become the new normal. The reason for this kind of relationship is simple. Gold is still recovering from the unfair treatment it got from investors starting in mid-2014 to the end of 2015.

The price of the yellow metal declined to multi-year lows last year to trade at just above $1,000 after hitting historical highs of $1,900s in 2011, but it has now rallied back to what most investors would consider to be within fair pricing levels--$1,300-$1,400—after the 2012-2013 correction.

During that period of unexplainable fall in gold prices, there was barely any recognizable trading momentum in comparison to other periods, which shows that investors had either pulled out their investments in the yellow metal or basically chose to hold on to their positions and avoid trading.

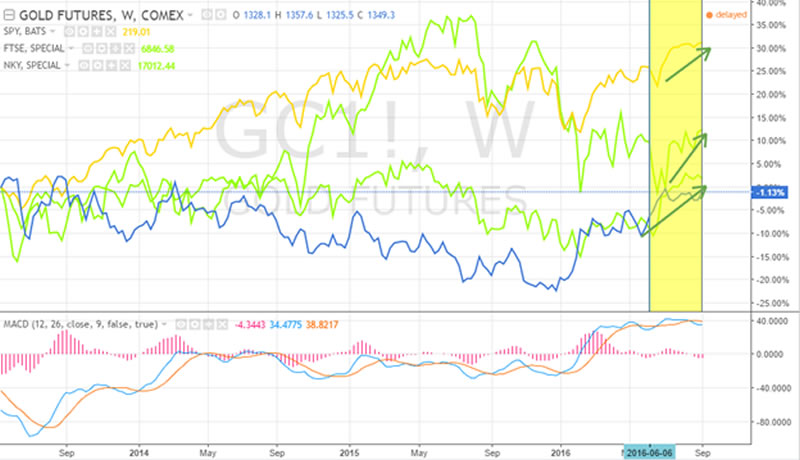

As demonstrated in the chart above, since the year 2006, the price of gold has illustrated an inverse relationship with equities. In this example, the FTSE 100, the Nikkei 225 and the S&P 500 have been used for illustration.

However, following that 18-month period when there was barely any trading activity in the gold bullion market, the yellow metal and equity prices now appear to have a picked a trend reminiscent of what happened during the pre-financial crises of 2008/2009.

This movement has led some to suggest that the global economies could be on the verge of another crisis while others believe that another market correction is due in 2016. However, unless that happens, it appears as though the current upward trend is the new normal for both gold and stocks.

Conclusion

In summary, there could be a lot that is making gold and stock prices to behave the way they currently are. Among other things, the highly anticipated second US interest rate hike in the post-2008/2009 financial crises could be a major catalyst.

However, as witnessed in January this year, another rate hike by the end of the year could yet open another bag of surprises in early 2017. This could also be the reason why the price of gold continues to rally despite the anticipation of the rate hike contrary to last year.

By Nicholas Kitonyi

Copyright © 2016 Nicholas Kitonyi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.