Will US Housing Real Estate Market Tank in 2017?

Housing-Market / UK Housing Dec 01, 2016 - 01:25 PM GMTBy: Clif_Droke

In many ways, 2016 has been a banner year for U.S. real estate. Housing prices continued to strengthen in several major metropolitan markets and even reached frothy proportions in at least three major markets. Below the surface of an otherwise healthy market, however, lies a set of factors that could cause problems for the housing market in 2017.

In many ways, 2016 has been a banner year for U.S. real estate. Housing prices continued to strengthen in several major metropolitan markets and even reached frothy proportions in at least three major markets. Below the surface of an otherwise healthy market, however, lies a set of factors that could cause problems for the housing market in 2017.

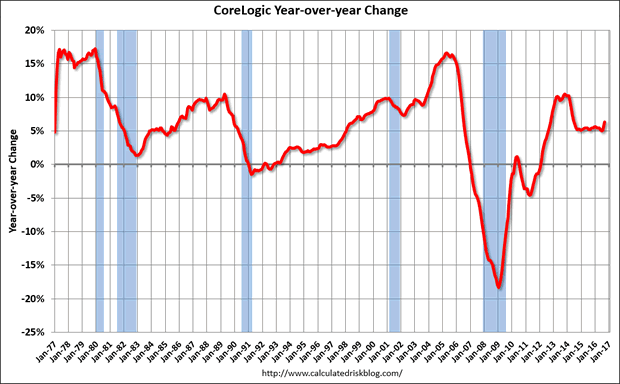

Like most financial assets, home prices have been stuck in a sideways trend since 2014 and by all appearances weren't going anywhere anytime soon. The chart shown here from the Calculated Risk blog shows the CoreLogic Home Price Index from a yearly percentage change standpoint. The dramatic increase in the tax and regulatory burden courtesy of the outgoing regime contributed to this standstill. In the last several months it was the uncertainty over the November presidential election which contributed to subdued speculative activity in the financial markets.

Now that the uncertainty has lifted to a large degree, asset prices are breaking out from their constrictive trading ranges, with many stock market sectors making nominal new highs. Investors are hopeful that the incoming administration will be more pro-business than the last one. Even real estate prices have ticked higher on a year-over-year basis, as shown by the above chart.

With continued strength in real estate prices comes an increase in home equity wealth for homeowners. According to CoreLogic, home equity wealth has doubled since 2011 to $13 trillion due mainly to the housing market recovery. Moreover, CoreLogic has forecast that a continued five percent rise in home values in the coming year would create an additional $1 trillion in home-equity wealth for homeowners.

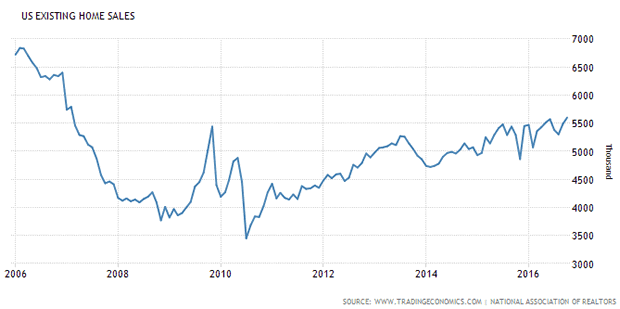

The current supply/demand balance for U.S. residential real estate is still favorable for a rising market. Existing home sales and new home building permits are on the rise, with existing home sales rising in recent months by positive increments. The National Association of Realtors recently reported that the supply of homes was a 4.5-month supply at the current level of sales. This means that supply has decreased 7 percent in the past year.

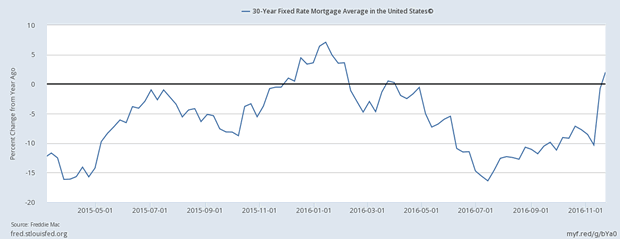

Up until now the rally in bond yields (and fall in bond prices) hasn't had much of a discernible impact on mortgage rates. That may be in the process of changing, however. The U.S. 30-Year Fixed Mortgage rate rose to 4.03% from last week's 3.94%. In doing so it pushed the year-over-year percentage change in the mortgage rate above the "zero" line and into positive territory. Whenever this has happened in the past it tends to create weakness for the real estate-related stocks in the market. It can even negatively impact the overall broad market for equities if mortgage rates continue rising over several months. Rising mortgage rates can also be quite detrimental for the overall real estate sector if they persist long enough.

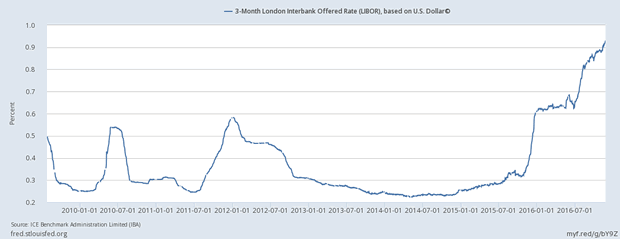

It's also worth pointing out that three-month Libor rates, which are the benchmark cost of short-term borrowing for the international banking system, have nearly tripled in the last 12 months. As Steen Jakobsen of Saxo Bank has observed, "The Libor rate is one of the few instruments left that still moves freely and is priced by market forces. It is effectively telling us that the Fed is already two hikes behind the curve."

My colleague Robert Campbell, who writes The Campbell Real Estate Timing Letter (www.RealEstateTiming.com) had this to say in his November newsletter: "Current real estate valuations are justified only if rates stay low – and if the Fed does raise rates in December as the financial markets currently expect, housing prices could start adjusting downward." This is certainly worth pondering as we head into 2017, especially if the interest rate uptrend continues.

Real estate has been on a solid footing in the last few years but looks to encounter some turbulence at some point next year. The increase in market interest rates may well pressure the homebuilding sector, especially given the vertiginous levels which bond prices have soared to in recent years. Any continued weakness in the bond market will only increase the pressure on housing loan demand.

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. Far more than a simple trend line, it's also a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you're trading in.

In my latest book, Mastering Moving Averages, I remove the mystique behind stock and ETF trading and reveal a simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today's fast-moving and sometimes volatile market environment. If you're interested in moving average trading techniques, you'll want to read this book.

Order today and receive an autographed copy along with a copy of the book, The Best Strategies for Momentum Traders. Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://www.clifdroke.com/books/masteringma.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.