China’s Biggest Limitations Determine the Future of East Asia

Politics / China Mar 23, 2017 - 12:14 PM GMTBy: John_Mauldin

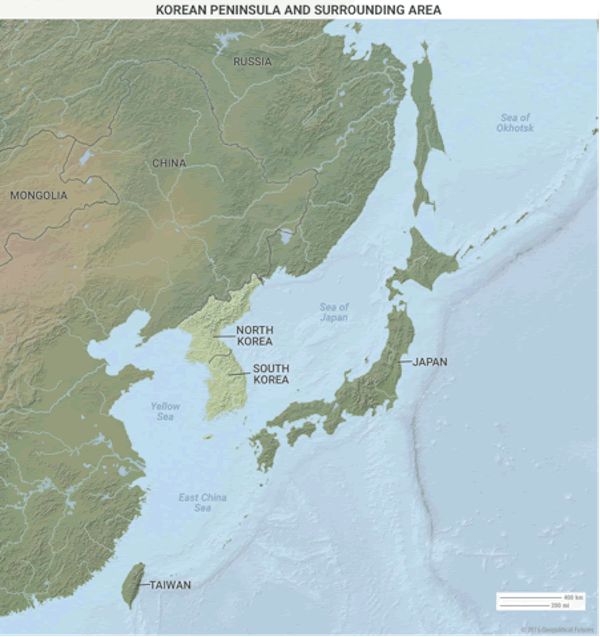

BY GEORGE FRIEDMAN : As we wrote about in “China’s Strategy,” East Asia is split into four parts: The Pacific archipelago, the Chinese mainland, the Korean Peninsula, and Indochina. East Asia holds the second and third largest world economies: China and Japan. The relationship between them and the US define modern East Asian geopolitics.

BY GEORGE FRIEDMAN : As we wrote about in “China’s Strategy,” East Asia is split into four parts: The Pacific archipelago, the Chinese mainland, the Korean Peninsula, and Indochina. East Asia holds the second and third largest world economies: China and Japan. The relationship between them and the US define modern East Asian geopolitics.

(Download my FREE e-book, The World Explained in Maps, to get more insight into the forces shaping our physical and financial worlds.)

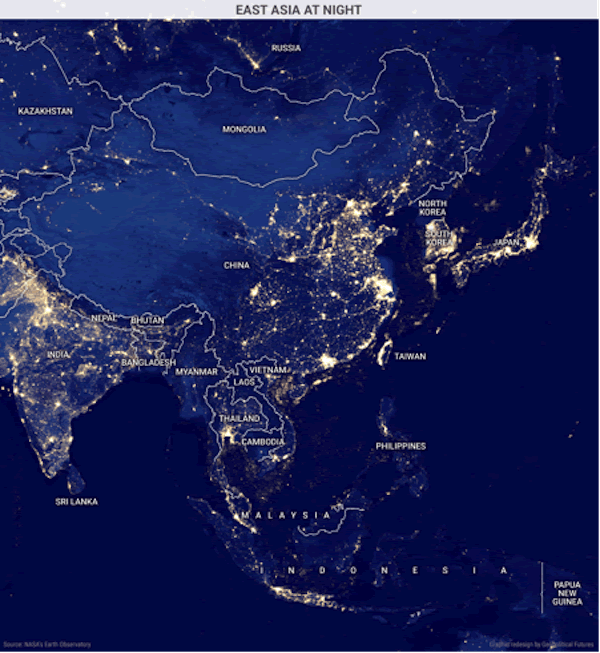

China’s Power Can Be Seen from Outer Space

The above map shows the countries of East Asia lit up at night. It reveals much about the power dynamics in this region. The centers of Chinese wealth and power—including Beijing, Shanghai, and Hong Kong—all hug China’s long coastline. Geographic features in the interior divide the country. The rest of the country is in darkness.

Japan, South Korea, and Taiwan are major industrial powers that border these waters along China’s coast. Much of the rest of East Asia is in darkness. North Korea’s darkness is particularly striking.

But relative to the bright lights of China’s coast and Japan, much of Indochina and inner China are also undeveloped.

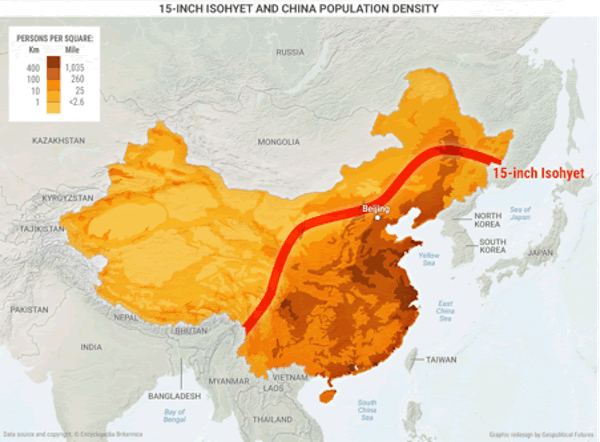

Western China Is Nearly Uninhabitable

The below map shows population density in China with the 15-inch isohyet overlaid on top.

The area of China from this line to the coast gets enough rain to support a large population. North and west of the 15-inch isohyet, China is less populated and undeveloped.

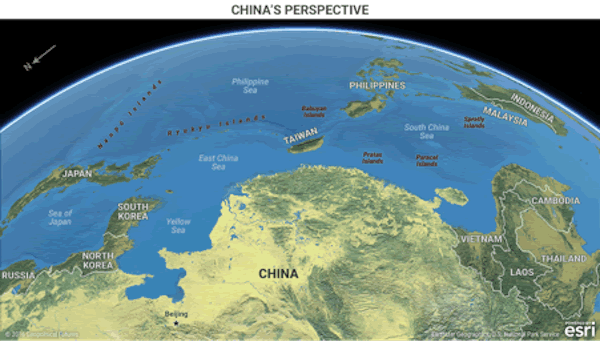

Geography Limits China’s Expansion

The distance from Beijing to Kazakhstan is almost 2,500 miles through desert and mountains. The Himalayas box China in on the southwest. They also stop conflict between India and China.

Jungles on the border with Myanmar, Vietnam, and Thailand have always limited Chinese growth south.

It is hard for China to grow westward. When China’s power is ascendant, it can grow north, south, or east toward the Pacific. This is easier said than done. Japan continues to be the major regional power. China would still face certain defeat against Japan, especially with US support of the Japanese.

So, China is mainly focused on two things. Controlling its chaotic domestic political and economic situation as growth rates have slowed. And building its military. First for resistance and then for offensive action in the region.

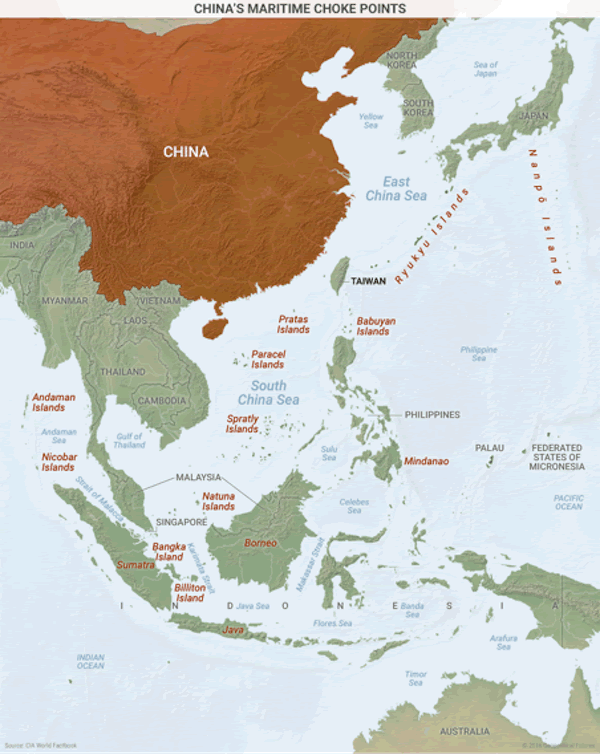

The Chinese Navy Is in No Position to Take Action

The Chinese navy is still a decade away from exerting power over the islands, rocks, and shoals that limit China’s freedom to navigate along its coast.

Many countries around China have claims over these islands. The region’s other major players—Japan and South Korea—are both key US allies. They host large and permanent US military deployments. And like we recently mentioned, the Philippines recently welcomed back US forces to their bases.

This situation has created a stalemate. The US has no desire for a bad relationship with China. But it also doesn’t want any power to control the region. And China still cannot challenge US hegemony in the seas.

As we’ve discussed before, it talks of nationalism in the South China Sea mostly for domestic consumption. Japan and the other East Asian countries view China with increasing concern. They remain staunch US allies as a result.

North Korea Is China’s Bargaining Chip

When we wrote about the North Korean strategy, we said that North Korea appears dangerous with its nuclear weapons tests and its sly, bigoted strongman regime built around a top leader. Kim Jong Un is that leader and he has been consolidating his power.

North Korea happens to also be one of the few areas China is weak. The Chinese intervened in the Korean War when US forces neared the Yalu River on the border between North Korea and China.

North Korea’s unpredictable behavior gives China a big bargaining chip in its relations with the US and the region. So, China favors keeping the status quo.

China’s Limitations Determine the Future of East Asia

East Asia is the world’s most dynamic economic region. Strong countries surround bodies of water over which there is competition. These are some of the world’s most important sea lanes. Japan and China (in that order) are the region’s two most significant powers.

But as we wrote about last year, the most powerful country in the Pacific, the US, is far away. Its Navy patrols and keeps freedom of movement across the Pacific. At the center of this power struggle is China. China’s struggle against its domestic and geographic constraints is the key to understanding the future of this region.

Grab George Friedman's Exclusive eBook, The World Explained in Maps

The World Explained in Maps reveals the panorama of geopolitical landscapes influencing today's governments and global financial systems. Don't miss this chance to prepare for the year ahead with the straight facts about every major country’s and region's current geopolitical climate. You won't find political rhetoric or media hype here.

The World Explained in Maps is an essential guide for every investor as 2017 takes shape. Get your copy now—free!

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.