Stock Markets Are Flat-to-lower Before the FOMC

Stock-Markets / Stock Markets 2018 Mar 21, 2018 - 02:44 PM GMT SPX futures are trading within a 10.5 point range around the flat line this morning. As I write it remains under mid-Cycle resistance at 2718.90 which proved to be resistance yesterday, as well. Note that the chart contains a double death cross as both Short-term and mid-Cycle resistances are beneath the 52-day Moving Average.

SPX futures are trading within a 10.5 point range around the flat line this morning. As I write it remains under mid-Cycle resistance at 2718.90 which proved to be resistance yesterday, as well. Note that the chart contains a double death cross as both Short-term and mid-Cycle resistances are beneath the 52-day Moving Average.

ZeroHedge reports, “Global shares traded in the red, and the dollar slumped before a hike in US interest rates, while awaiting key guidance on how many more to expect for this year. S&P futures were little changed, while markets in Europe and Asia dropped; Japan’s Nikkei was closed for holiday.”

NDX futures are negative as Facebook share continue their slide.

Bloomberg reports, “Facebook Inc.’s grim week is getting grimmer.

The company on Tuesday was beset on two continents by governments suddenly focused on data security and investors unliked its stock to the point that it lost $60 billion in value.

The Menlo Park, California, company, whose social network is a ubiquitous venue for social and political life, is drawing the unaccustomed unwelcome attention after the disclosure that it released the personal data of 50 million users to an analytics firm that helped elect President Donald Trump. The company, Cambridge Analytica, has been implicated in dirty tricks in elections around the globe.”

VIX futures are down as it may retest the 52-day Moving Average at 17.06

Bloomberg reports, “During Monday’s equity rout, investors were not only back to betting on volatility’s return, they were doing so using a leveraged security from the firm at the nexus of last month’s stock selloff.

As a jump in the VIX spurred activity across volatility-related securities, the exchange-traded product that had the highest volume was the VelocityShares Daily 2x VIX Short Term ETN. Known by its ticker TVIX, it’s a leveraged product issued by Credit Suisse Group AG -- which was forced to redeem a note linked to stock swings in February.”

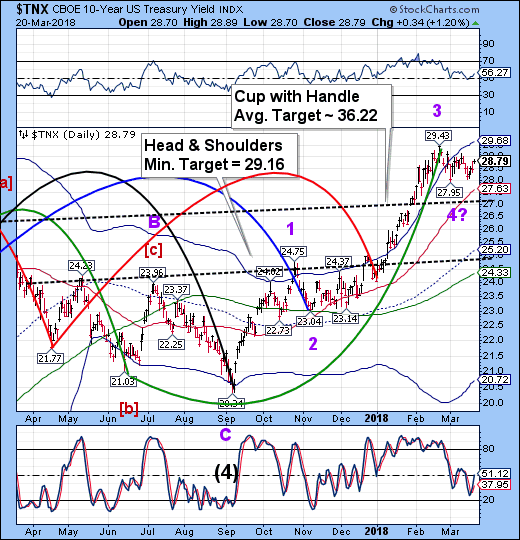

TNX appears to have broken the 29.00 resistance again this morning. That implies another Cyclical inversion (Master Cycle high) in early April. Are stocks and bonds decoupling? That seems to be the question of the day.

ZeroHedge observes, “We previously laid out some of the key expectations and questions ahead of Wednesday's hawkish FOMC decision, when new Fed chair Jay Powell is virtually guaranteed to raise rates by 25bps, with the only question being whether the FOMC "dots" will rise enough to indicate 4 rate hikes in 2018, or stay at 3, and whether the Fed will change the FOMC day format to add a press conference after every meeting.

Here, for those who missed it, or are still unsure what to expect, here is a preview of tomorrow's main event with the help of RanSquawk:

RATE PATH: A 25bps hike to 1.50-1.75% is priced in with over 90% certainty by money markets. More interest will be on how many hikes the FOMC projects in 2018 (currently three), and over its forecast horizon (seven; federal funds futures barely price five over that horizon).”

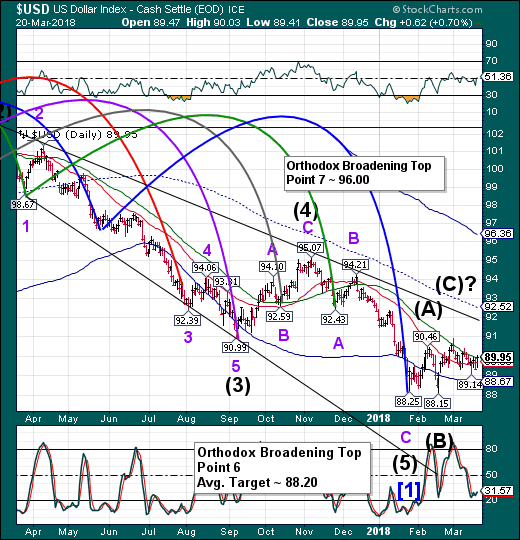

USD futures appear to be backing away from the 52-day Moving Average this morning. The sideways consolidating continues. I am still looking for a breakout to point 7.

USD/JPY took a hit this morning as China announced counter-levies to the Trump tariffs.

I am off on an appointment this morning. Will probably be back for commentary after the open.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.