The Collapse of Ambac Financial As Moody's Downgrades

Companies / Credit Crisis 2008 Sep 20, 2008 - 07:21 PM GMTBy: Mike_Shedlock

In what would have been major news nearly any other week this year, MarketWatch is reporting Ambac warns downgrade would put unit under pressure .

Ambac Financial said late Friday that a downgrade by ratings agency Moody's Investors Service would leave its guaranteed investment contract business short of collateral to meet liabilities.

The company also said plans to pump $850 million into a new municipal bond insurance business called Connie Lee have been postponed. It also canceled a $50 million share buyback plan that was announced earlier this year.

Moody's warned late Thursday that it may downgrade the main bond insurance units of Ambac (ABK) again because losses on mortgage-related securities they guaranteed are likely to get much worse. Ambac shares slumped 42% on Friday after the warning, while MBIA stock fell 8%. Ambac shares fell another 7% to $3.60 during after-hours trading.

Ambac said late Friday that a downgrade would increase pressure on its financial services business, which includes guaranteed investment contracts, or GICs.

GICs provide institutions a certain rate of return on specific amounts of money. Providers promise to pay an agreed rate and get the money to invest in return. Profits are made on the spread between the rate the provider offers the buyer and the returns it can generate itself.

Municipalities often use GICs when they get large sums of money from a recent bond offering, but don't want to spend the cash straight away. Ambac and MBIA have large GIC businesses.

When GIC providers are downgraded by ratings agencies, they are often required to post more collateral to support the agreements, or come up with collateral when the contracts are terminated.

Ambac estimated late Friday that if it's downgraded there won't be enough assets in its GIC portfolio to cover the projected cumulative collateral requirement and terminations.

Ambac also said its Connie Lee project will be delayed while the company deals with the potential consequences of a possible downgrade by Moody's.

Ambac "Mystified" By Moody's Announcement

Inquiring minds are considering Ambac's press release on the ratings action by Moody's .

We can find no justification for Moody's actions based on our ongoing analysis of Ambac's portfolio, our aggressive remediation efforts and progress toward commuting exposures with certain counterparties.

As you know, after Moody's released its decision with respect to Ambac, the United States government announced its intention to establish the Mortgage and Financial Institutions Trust that will be authorized to acquire up to $750 billion of impaired assets from various financial institutions. While the details of this act are not yet known we believe that an undertaking of this magnitude may change the financial landscape entirely.

Moody's updated mortgage loss assumptions are extreme in our view and appear to be based on limited additional data since their last review. We continue to be mystified by Moody's methodology of applying additional stresses to the current incredibly stressed environment.

Upon a downgrade below the current rating level, Ambac estimates that the GIC asset portfolio is insufficient to cover the projected cumulative collateral requirement and terminations.

Another important consequence of a potential downgrade is a re-evaluation of the plans and the timeline for our Connie Lee effort. Despite Moody's action, we believe that our Connie Lee initiative is still viable and, in fact, needed more than ever. We had hoped to launch this new financial guarantee subsidiary focused on the municipal sector in the fourth quarter and have been working tirelessly to do so. However, the recent market turmoil and Moody's action cause us to decelerate our timeline so as to focus our resources on addressing the concerns raised by Moody's.

Smoke and Mirrors at Ambac

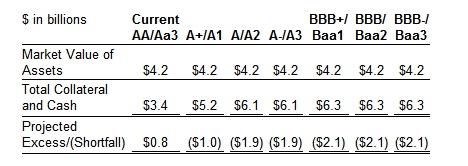

Ambac has a market cap of $1.1 billion. The above table shows that even a tiny one step downgrade means that Ambac would need to raise capital nearly 100% of its market cap. A two or more step downgrade shows that Ambac would need to raise nearly 200% of its market cap.

Ambac is essentially arguing "don't downgrade us because it will wreck our business". To that I say, any company whose business model depends on maintaining a certain debt rating has a fatally flawed business model to begin with. Furthermore, it just might behoove companies operating with such a flawed business model to not get into trouble in the first place. Ambac (ABK) and MBIA (MBI) fail on both counts, and it was greed and excessive risk taking that did them in.

That Moody's is prepared to downgrade Ambac means one of two things: 1) Ambac is no longer relevant or 2) something else is at work such as yet another bailout at taxpayer expense is coming.

Ambac's share price collapsed on a day when every other financial stock was flying. That collapse serves as a fitting anticlimax for the week.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.