Checking in on Gold & Silver Sentiment

Commodities / Gold & Silver 2019 Nov 27, 2019 - 04:59 PM GMTBy: Jordan_Roy_Byrne

The precious metals sector remains in a correction. The miners have shown some positive signs but are not ready to move yet because the metals likely have more correction ahead.

Technical support levels can provide us with low risk buy opportunities but combine that with sentiment data and we increase our odds of success.

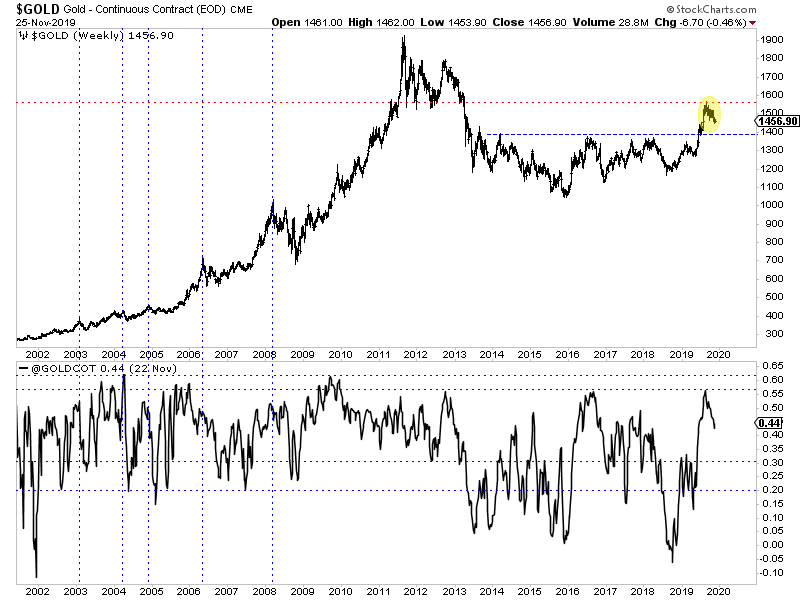

One reason why the sector is stuck in a correction is because the net speculative position in Gold remains stubbornly high at 44% of open interest. Following interim peaks in the 2000s, the net speculative position usually fell to 30% and even 20% at times before Gold began its next impulsive advance.

We anticipate Gold will test $1400 and perhaps lower and that will clear out some of the specs.

Gold Weekly & Gold CoT

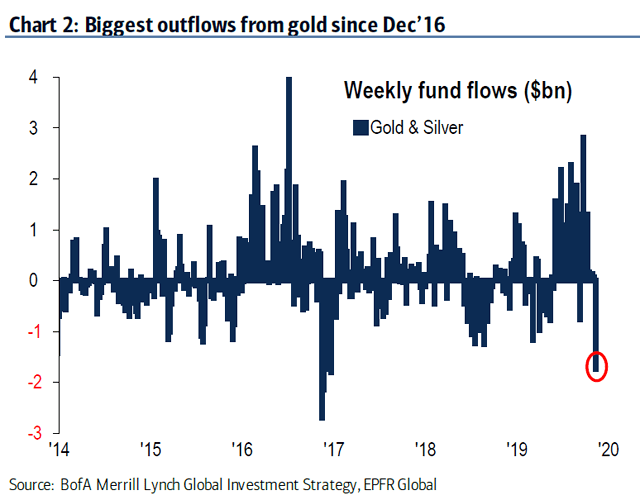

Other sentiment data for Gold is more encouraging.

As of mid November, outflows in GLD reached their highest level since the December 2016 low. Judging from the outflows around the previous lows, Gold likely needs a few more weeks of outflows to signal a bottom.

GLD Weekly Fund Flows

As we noted here over three months ago, the 21-day daily sentiment index (DSI) like the net speculative position often declines to and below 30% during corrections within bull markets. Last I checked, the 21-day DSI was 38.5%. It has decreased from a whopping 84% but still has more room to fall.

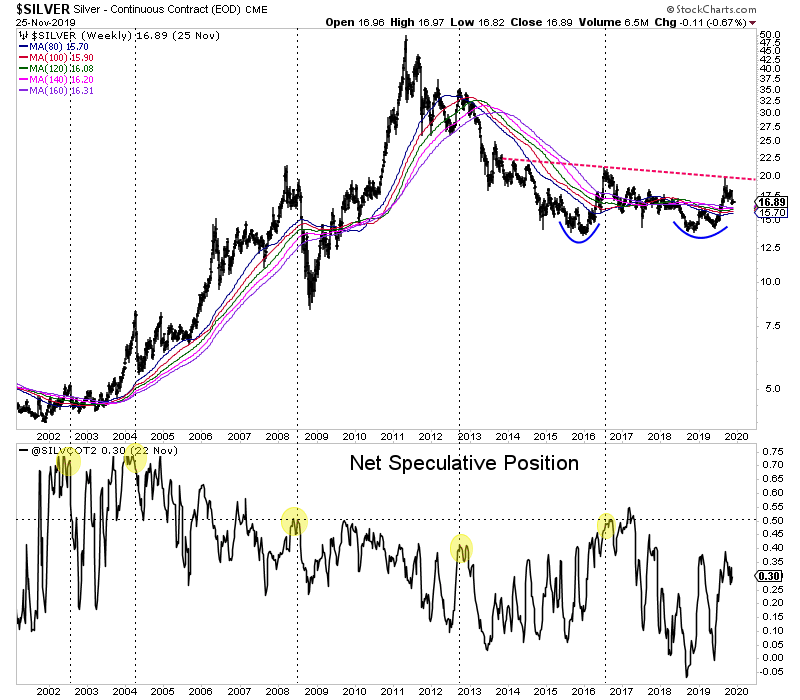

Turning to Silver, we note a current net speculative position of 30% of open interest which is below previous peaks of 40% and 50%. During corrections within the bull market of the 2000s, Silver’s net speculative position often bottomed around 25%.

Silver Weekly & Silver CoT

Elsewhere, the 21-day DSI for Silver is currently 63% which is stubbornly high. While Silver’s net speculative position isn’t extended, its DSI is.

Essentially, both the technicals and sentiment suggest the path of least resistance for Gold and Silver is lower.

We are looking at downside targets of $1400 and lower in Gold and roughly $16.00 for Silver. Should the metals test those levels, then sentiment indicators would reach more encouraging levels that could finally favor the bulls.

If and when that occurs, it could create excellent buying opportunities across the sector. Some juniors could bottom sooner while some could bottom around the end of tax loss selling.

We continue to focus on identifying and accumulating the juniors with significant upside potential in 2020.

To learn the stocks we own and intend to buy during the next correction that have 3x to 5x potential, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.