The Fed Celebrates While Americans Drown in Financial Despair

Economics / Inflation Dec 23, 2019 - 04:19 PM GMTBy: John_Mauldin

The Federal Reserve System is supposed to be independent. But it’s not. And as much as Donald Trump doesn’t like it, the Fed shouldn’t follow the president’s orders.

The Fed operates under a legal mandate from Congress. Its monetary policy role is “to promote maximum employment, stable prices and moderate long-term interest rates.”

So how is it doing?

Long-term rates are certainly moderate. Employment is historically high, though wages and job quality aren’t always great.

As for that “stable prices” part… it depends on what you are buying.

CPI Doesn’t Reflect Real Inflation

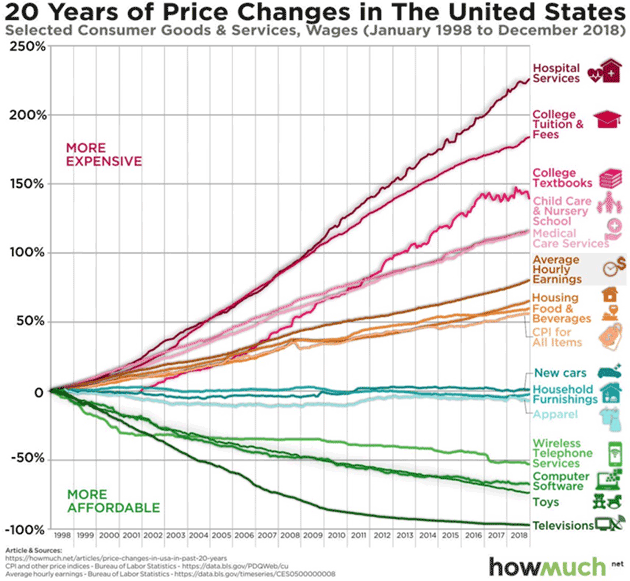

As you see below, for many goods the price is nowhere near “stable.” Unfortunately, if you are in the bottom 60–70% of the income brackets, these are some of the things you buy the most.

Source: Sebastian Sienkiewicz

The Fed believes that 2% annual inflation equals “stable prices.” Yet that small amount adds up over time—to almost 50% in 20 years. Which is about where CPI lands in this 20-year chart, so the Fed is succeeding by that yardstick.

But CPI doesn’t reflect real-life spending for most people. Prices have risen dramatically more than average for some of life’s basic necessities.

While Fed officials may think they have tamed inflation, their ZIRP and QE actually drove real-world prices considerably higher than CPI or PCE show. It showed up mainly in asset valuations, like stocks and real estate.

These, in turn, drove up other prices like housing. Aggregate inflation isn’t higher because technology and globalization reduced manufactured goods costs and the shale revolution kept energy costs low.

Try to look at this like an average worker. Your rent keeps rising, your kids can’t go to college without racking up debt, your health insurance is astronomical, and your wages, while up a bit, aren’t keeping up with your living costs.

Meanwhile, the people who are supposed to be looking out for you keep talking about how the economy is improving thanks to their brilliant policies.

It’s All Relative…

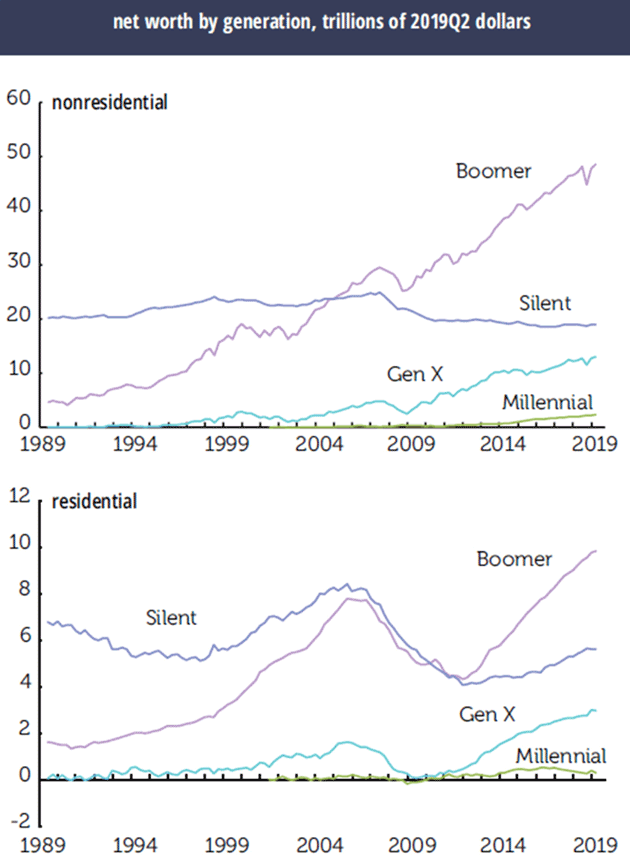

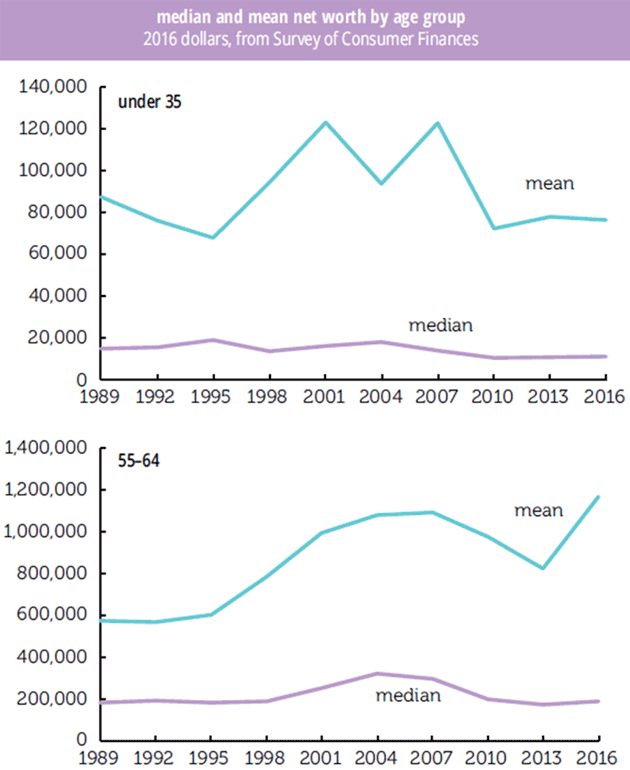

My friend Philippa Dunne at The Liscio Report showed two charts demonstrating older generations (read boomers) are doing much better than Gen Xers and especially millennials.

Source: The Liscio Report

Source: The Liscio Report

I understand the economic theories that GDP growth will eventually spread widely enough to ease the angst. But I am not sure we can wait that long.

People are hurting now and they are increasingly willing to embrace radical solutions. “Just wait for better times” is not cutting it as technology eats into higher-paying jobs and aggravates the stress of lower-income jobs.

That’s doubly true if the economy weakens. Some of the data improved a bit in recent weeks. The November jobs report showed much stronger growth than we’ve seen in a while. That’s good to see and suggests we might postpone recession past 2020.

But merely avoiding recession isn’t enough. Another year of sub-2% growth (which is my base case) will be another year of suffering for the millions whom this weak recovery hasn’t helped.

And it’s not clear that we can avoid a recession. One-third of economists surveyed by The Wall Street Journal think we will see a recession next year and almost two-thirds see a recession by 2021.

Angst-Ridden Voters

No one should be surprised the lower 80% of the income pyramid is anxious and depressed. You would be, too, in their situation. And there’s a good chance you will be in their situation in a few years, because angst-ridden people can still vote.

Economic theories aren’t relevant to them. They look at their own situations and want change.

History suggests that President Trump should win re-election unless recession strikes by next November. But even if we avoid a recession in 2020, what happens if there is one in 2021 or 2022? Democrats could gain power by 2024, if not sooner.

The already-growing annual budget deficit will soar to over $2 trillion. How do we finance that without creating more angst? I can easily imagine a populist Democrat winning the White House, followed by higher taxes and an echo recession.

Then even higher deficits and the national debt spinning out of control. The Fed will give us massive quantitative easing and zero rates, but it may be in fact pushing on a string…

We don’t have much time to get our house in order, either in the US or globally. We can and should take steps to protect our individual families and lives, but that’s not enough.

At the national level, I’m beginning to fear only an enormously stressful Great Reset will deliver the deep but necessary sacrifices. The partisan divide inhibits compromise, so nothing happens and the problems grow.

Think about the late 1930s… Hopefully with just economic turmoil, not kinetic war. It will be hard but without the kind of motivation, I really question whether we will do what it takes.

Sigh.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could be triggered in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.